NZ Dollar Falls Amid RBNZ Rate Cut Prospects

22 November 2024 - 3:19AM

RTTF2

The New Zealand dollar weakened against other major currencies

in the Asian session on Friday, as traders expect the Reserve Bank

of New Zealand (RBNZ) to cut its interest rates at the next week's

monetary policy meeting.

The RBNZ is expected to its key rates by 50 basis points from

4.75% to 4.25% at Tuesday's monetary policy meeting.

"The economy is growing sluggishly at best, and the labor market

is pretty weak. So that sets up the RBNZ next week to deliver

another 50-basis point cut, the same as we saw in October," said

Shannon Nicoll, associate economist at Moody's Analytics.

Escalating geopolitical tensions due to the ongoing war between

Russia and Ukraine continued to weigh on market sentiment.

In the Asian trading today, the NZ dollar slid to nearly a

2-month low of 90.03 against the yen, from yesterday's closing

value of 90.53. The kiwi may test support near the 86.00

region.

In economic news, overall consumer prices in Japan were up 2.3

percent on year in October, the Ministry of Internal Affairs and

Communications said on Friday. That was in line with expectations

and down from 2.5 percent in September.

On a seasonally adjusted monthly basis, overall inflation was up

0.4 percent, exceeding forecasts for 0.2 percent following the 0.3

percent decline in the previous month. Core CPI, which excludes the

volatile prices of foods, rose 2.3 percent on year, above forecasts

for 2.2 percent but down from 2.3 percent a month earlier.

The latest survey from Jibun Bank revealed that the

manufacturing sector in Japan continued to contract in November,

and at a faster pace, with a manufacturing PMI score of 49.0.

That's down from 49.2 in October, although it moves further beneath

the boom-or-bust line of 50 that separates expansion from

contraction. The survey also showed that the services PMI improved

to 50.2 from 49.7 in the previous month. The composite PMI rose to

49.8 in November from 49.6 on October.

Against the Australia and the U.S. dollars, the kiwi plunged to

more than a 2-yr low of 1.1180 and a 1-yr low of 0.5829 from

Thursday's closing quotes of 1.1109 and 0.5859, respectively. If

the kiwi extends its downtrend, it is likely to find support around

1.12 against the aussie and 0.57 against the greenback.

The kiwi edged down to 1.7961 against the euro, from yesterday's

closing value of 1.7869. On the downside, 1.84 is seen as the next

support level for the kiwi.

Looking ahead, PMI reports from various European economies and

U.K. for November are slated for release in the European

session.

In the New York session, Canada new housing price index for

October, retail sales for September, U.S. PMI data for November,

U.S. University of Michigan consumer sentiment for November and

U.S. Baker Hughes weekly oil rig count data are slated for

release.

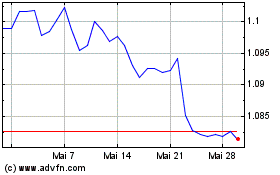

AUD vs NZD (FX:AUDNZD)

Forex Chart

Von Okt 2024 bis Nov 2024

AUD vs NZD (FX:AUDNZD)

Forex Chart

Von Nov 2023 bis Nov 2024