Intermediate declaration by the Board of Directors

Regulatory News:

Highlights Q2 2022:

› Revenue was USD 188.8 million, at the upper

end of the guided USD 180-190 million, up 17% year-on-year (YoY)

and up 6% quarter-on-quarter (QoQ)

› Strong growth and continuously strong

demand across all key end markets

› EBITDA margin of 22.5%, within the 20-24%

guidance

› EBITDA was USD 42.5 million, down 2% YoY

and up 3% QoQ

› EBIT was USD 24.0 million, down 2% YoY and

up 8% QoQ

Outlook:

› Q3 2022 revenue is expected to be in the

range of USD 182-192 million with an EBITDA margin in the range of

20-24%. This guidance is based on an average exchange rate of 1.02

USD/Euro.

› Management adjusts the full-year guidance

to revenues in the range of USD 750-790 million and an EBITDA

margin in the range of 22-25%. The full-year guidance is based on

an average exchange rate of 1.06 USD/Euro.

Revenue breakdown per quarter:

in millions of USD

Q3 2020

Q4 2020

Q1 2021

Q2 2021

Q3 2021

Q4 2021

Q1 2022

Q2 2022

Q2 y-o-y growth

Automotive

40.8

65.4

83.5

82.8

81.5

83.8

89.7

98.3

19%

Industrial

23.9

27.3

32.4

35.2

38.3

39.7

41.4

42.5

21%

Medical

7.7

12.0

8.7

10.4

14.3

14.5

13.7

13.9

34%

Subtotal core business

72.3

104.7

124.6

128.4

134.1

138.0

144.9

154.7

20%

75.2%

77.1%

80.1%

79.8%

79.3%

80.1%

81.1%

81.9%

CCC1

23.7

30.9

30.6

32.4

34.7

34.0

32.5

33.6

4%

Others

0.1

0.3

0.3

0.1

0.3

0.3

1.2

0.6

Total revenues

96.1

135.9

155.4

161.0

169.1

172.3

178.7

188.8

17%

1 Consumer, Communications & Computer

in millions of USD

Q3 2020

Q4 2020

Q1 2021

Q2 2021

Q3 2021

Q4 2021

Q1 2022

Q2 2022

Q2 y-o-y growth

CMOS

81.1

115.0

134.9

137.5

141.8

144.2

148.6

156.3

14%

MEMS

9.8

14.6

14.4

16.2

17.4

17.5

17.9

19.8

22%

Silicon carbide

5.2

6.3

6.1

7.2

9.9

10.6

12.1

12.8

78%

Total revenues

96.1

135.9

155.4

161.0

169.1

172.3

178.7

188.8

17%

Business development

In the second quarter, X-FAB generated revenues amounting to USD

188.8 million, at the upper end of the guided USD 180-190 million,

up 17% year-on-year and 6% quarter-on-quarter.

Revenues in X-FAB’s core markets – automotive, industrial, and

medical – reached USD 154.7 million, up 20% year-on-year and 7%

quarter-on-quarter. Their share in the Group’s total revenues

further increased to 82%.

X-FAB recorded strong double-digit growth in the second quarter

across all its key end markets and achieved record revenues in the

automotive as well as industrial business. Revenues were supported

by a favorable product mix, price increases as well as growth in

quantities produced, reflecting the focus on increasing wafer

output amidst the persisting chip shortage, but also the

accelerating demand driven by the transition to electric vehicles

and green energy. Silicon carbide (SiC) revenues continued to grow

strongly in the second quarter amounting to USD 12.8 million, up

78% year-on-year and 5% quarter-on-quarter. In addition, the

successful ramp up in volume production of X-FAB’s automotive 180nm

technology at X-FAB France contributed to the automotive growth of

the second quarter. This brought the share of the French site’s

revenues based on X-FAB technologies up to 52% while the legacy

business further decreased, in line with targets.

In the second quarter, X-FAB’s CCC business (Consumer,

Communication & Computer) recorded revenues of USD 33.6

million, up 4% year-on-year and 3% quarter-on-quarter.

Prototyping revenues in the second quarter came in at USD 20.5

million, flat year-on-year and down 17% quarter-on-quarter. This is

mainly due to several customer-specific projects having reached

production milestone, and thus, now being accounted as volume

production revenues.

Demand continued to be strong throughout the past quarter. This

is however not reflected in second quarter bookings, which totaled

at USD 162.6 million compared to USD 239.3 million in the previous

quarter. In light of ongoing negotiations relating to price

increases as well as long-term agreements with customers, X-FAB had

paused accepting firm orders for 2023 until commercial conditions

are fixed. Progress is being made to achieve the target to cover

about 70% of X-FAB’s business with long-term agreements.

Due to persistently high demand, the allocation of capacity had

to be continued throughout the quarter and X-FAB remains in close

contact with its customers to agree on minimum quantities required

to ensure supply chain stability on the customers’ side.

Prototyping and production revenue per quarter and end

market:

in millions

of USD

Revenue

Q2 2021

Q3 2021

Q4 2021

Q1 2022

Q2 2022

Q2 y-o-y growth

Automotive

Prototyping

3.0

3.5

3.6

5.0

4.1

38%

Production

79.8

78.0

80.2

84.8

94.2

18%

Industrial

Prototyping

10.3

12.9

11.5

11.0

9.2

-11%

Production

24.9

25.4

28.2

30.4

33.3

34%

Medical

Prototyping

2.9

4.1

4.0

3.1

1.6

-45%

Production

7.5

10.2

10.6

10.7

12.4

64%

CCC

Prototyping

4.1

4.8

4.5

4.3

5.0

21%

Production

28.3

29.9

29.5

28.2

28.6

1%

Operations update

Operational excellence and productivity improvements continued

to be a primary focus at all manufacturing sites to meet the

customers’ demand. The delivery of new equipment as well as the

ongoing activities to have them installed and qualified were key to

eliminate production bottlenecks and increase wafer output.

X-FAB proceeded with its capacity expansion program across all

sites to prepare for the expected long-term growth and kicked off a

major expansion project at X-FAB Sarawak, Malaysia. In line with

the high demand for the automotive 180nm technology, X-FAB plans to

invest more than USD 500 million over the next three years to

significantly increase manufacturing capacity of this technology

platform. Once the investment is completed, the site’s processing

capacity will increase by about 50%.

Full-year capital expenditures are expected to come in at around

USD 200 million. In the second quarter, they totaled USD 36.8

million, down 25% from the previous quarter. This is partially due

to the longer than expected delivery schedules for equipment due to

current tight supply chains. Thanks to the risk mitigation measures

that X-FAB has put in place to ensure a reliable supply of raw

materials, there were no supply bottlenecks impacting X-FAB’s

production in the second quarter.

X-FAB also continued to expand capacities for SiC processing as

well as SiC epitaxy, thus responding to the accelerating demand.

Quarterly SiC bookings came in at USD 14.8 million, up 21%

year-on-year and down 31% quarter-on-quarter following an

extraordinarily strong previous quarter. The development of

standard SiC process blocks, which allow customers to benefit from

faster technology releases and a reduced time-to-market, keeps

drawing interest from new customers, resulting in a marked increase

of X-FAB’s SiC customer base.

Financial update

Second quarter EBITDA was USD 42.5 million with an EBITDA margin

of 22.5%, within the guided 20-24%. Despite strong revenue growth,

the EBITDA margin went down 0.5 percentage points compared to the

previous quarter. Rising costs continued to put some pressure on

margins. Additionally, there was an exceptional item concerning the

award of an arbitration between X-FAB and a supplier. X-FAB made a

provision for a portion of the award. This relates to interest

payments in the amount of USD 12.4 million in the finance result as

well as legal fees of USD 1.4 million in the general &

administrative expenses.

In absolute terms, EBITDA was up 3% quarter-on-quarter and down

2% year-on-year due to a favorable one-off effect in the second

quarter last year related to USD 6.5 million received in the

context of a Covid-19-related government support scheme. Excluding

this, the EBITDA increased 15% year-on-year.

Cash and cash equivalents at the end of the second quarter

amounted to USD 250.8 million, down 3% compared to the previous

quarter end.

With a share of Euro-denominated sales amounting to 42% during

the second quarter, the current weakness of the Euro had a negative

impact on revenues. At a constant US-Dollar/Euro exchange rate of

1.20 as experienced in the previous year’s quarter, revenues of the

second quarter would have been USD 10.5 million higher and EBITDA

margin would have been 22.5%.

Management comments

Rudi De Winter, CEO of X-FAB Group, said: “In the current

economic environment that is marked by a high level of uncertainty,

I am very glad about the business X-FAB is in. We continue to see

an unprecedented strong demand for our technologies, which is

mainly driven by the accelerating electrification. This holds

particularly true for the automotive market, where X-FAB has a

strong presence. I would like to thank all X-FAB employees for

being strongly engaged to maintain production lines running at full

steam despite the challenges arising from Covid-19-related higher

absence rates as well as increased logistical challenges.”

Procedures of the independent auditor

The statutory auditor, KPMG Bedrijfsrevisoren – Réviseurs

d’Entreprises BV/SRL, represented by Jos Briers, has confirmed that

the audit procedures, which have been substantially completed, have

not revealed any material misstatement in the accounting

information included in this press release as of and for the six

months ended June 30, 2022.

X-FAB Quarterly Conference Call

X-FAB’s second quarter results will be discussed in a live

conference call on Thursday, July 28, 2022, at 6.30 p.m. CEST. The

conference call will be in English. Please register in advance of

the conference using the following link:

https://cossprereg.btci.com/prereg/key.process?key=PYG6B3TET.

The conference call will be available for replay for ten days

following the event. Please call +1 617 801 6888 and enter the

following passcode: 79065081.

The third quarter 2022 results will be communicated on October

27, 2022.

About X-FAB

X-FAB is the leading analog/mixed-signal and MEMS foundry group

manufacturing silicon wafers for automotive, industrial, consumer,

medical and other applications. Its customers worldwide benefit

from the highest quality standards, manufacturing excellence and

innovative solutions by using X-FAB’s modular CMOS processes in

geometries ranging from 1.0 to 0.13 µm, and its special silicon

carbide and MEMS long-lifetime processes. X-FAB’s analog-digital

integrated circuits (mixed-signal ICs), sensors and

micro-electro-mechanical systems (MEMS) are manufactured at six

production facilities in Germany, France, Malaysia and the U.S.

X-FAB employs approx. 4,000 people worldwide. For more information,

please visit www.xfab.com.

Forward-looking information

This press release may include forward-looking statements.

Forward-looking statements are statements regarding or based upon

our management’s current intentions, beliefs or expectations

relating to, among other things, X-FAB’s future results of

operations, financial condition, liquidity, prospects, growth,

strategies or developments in the industry in which we operate. By

their nature, forward-looking statements are subject to risks,

uncertainties and assumptions that could cause actual results or

future events to differ materially from those expressed or implied

thereby. These risks, uncertainties and assumptions could adversely

affect the outcome and financial effects of the plans and events

described herein.

Forward-looking statements contained in this press release

regarding trends or current activities should not be taken as a

report that such trends or activities will continue in the future.

We undertake no obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, unless legally required. You should not place undue

reliance on any such forward-looking statements, which speak only

as of the date of this press release.

The information contained in this press release is subject to

change without notice. No re-report or warranty, express or

implied, is made as to the fairness, accuracy, reasonableness, or

completeness of the information contained herein and no reliance

should be placed on it.

Condensed Consolidated Statement of Profit and Loss

in thousands of USD

Quarter

ended 30 Jun 2022

unaudited

Quarter

ended 30 Jun 2021

unaudited

Quarter

ended 31 Mar 2022

unaudited

Half-year

ended 30 Jun 2022

unaudited

Half-year

ended 30 Jun 2021

unaudited

Revenue

188,832

160,955

178,664

367,495

316,375

Revenues in USD in %

58

66

59

59

67

Revenues in EUR in %

42

33

40

41

33

Cost of sales

-142,870

-119,230

-135,422

-278,292

-239,649

Gross Profit

45,962

41,725

43,241

89,203

76,726

Gross Profit margin in %

24.3

25.9

24.2

24.3

24.3

Research and development expenses

-9,920

-8,692

-10,759

-20,679

-17,174

Selling expenses

-1,968

-2,008

-2,149

-4,117

-4,127

General and administrative expenses

-10,495

-7,649

-8,732

-19,226

-15,800

Rental income and expenses from investment

properties

187

668

292

478

1,295

Other income and other expenses

257

559

331

588

714

Operating profit

24,023

24,602

22,223

46,247

41,635

Finance income

8,585

3,470

7,092

15,677

7,753

Finance costs

-24,153

-3,104

-8,490

-32,643

-10,271

Net financial result

-15,567

366

-1,398

-16,966

-2,518

Profit before tax

8,456

24,968

20,825

29,281

39,117

Income tax

-1,539

1,769

-1,450

-2,988

395

Profit for the period

6,917

26,737

19,375

26,293

39,512

Operating profit (EBIT)

24,023

24,602

22,223

46,247

41,635

Depreciation

18,442

18,718

18,808

37,250

37,269

EBITDA

42,465

43,320

41,031

83,496

78,903

EBITDA margin in %

22.5

26.9

23.0

22.7

24.9

Earnings per share at the end of

period

0.05

0.20

0.15

0.20

0.30

Weighted average number of shares

130,631,921

130,631,921

130,631,921

130,631,921

130,631,921

EUR/USD average exchange rate

1.06719

1.20429

1.12305

1.09491

1.20528

Amounts in the financial tables provided in this press release

are rounded to the nearest thousand except when otherwise

indicated, rounding differences may occur.

Condensed Consolidated Statement of Financial

Position

in thousands of USD

Quarter ended 30 Jun 2022

unaudited

Quarter ended 30 Jun 2021

unaudited

Year ended 31 Dec 2021

audited

ASSETS

Non-current assets

Property, plant, and equipment

397,012

325,812

340,670

Investment properties

8,070

8,265

8,310

Intangible assets

6,227

4,807

4,034

Other non-current assets

8

48

28

Deferred tax assets

45,143

33,223

45,645

Total non-current assets

456,459

372,156

398,687

Current assets

Inventories

198,427

162,235

181,014

Trade and other receivables

90,472

66,994

73,689

Other assets

49,473

48,641

43,354

Cash and cash equivalents

250,828

205,109

290,187

Total current assets

589,200

482,979

588,244

TOTAL ASSETS

1,045,659

855,135

986,931

EQUITY AND LIABILITIES

Equity

Share capital

432,745

432,745

432,745

Share premium

348,709

348,709

348,709

Retained earnings

-9,598

-80,465

-36,154

Cumulative translation adjustment

123

-594

-559

Treasury shares

-770

-770

-770

Total equity attributable to equity

holders of the parent

771,209

699,626

743,971

Non-controlling interests

368

341

365

Total equity

771,576

699,967

744,335

Non-current liabilities

Non-current loans and borrowings

33,697

34,899

39,916

Other non-current liabilities and

provisions

3,996

4,241

5,686

Total non-current liabilities

37,693

39,140

45,602

Current liabilities

Trade payables

43,157

26,809

41,364

Current loans and borrowings

105,040

24,321

87,114

Other current liabilities and

provisions

88,192

64,898

68,515

Total current liabilities

236,389

116,029

196,993

TOTAL EQUITY AND LIABILITIES

1,045,659

855,135

986,931

Condensed Consolidated Statement of Cash Flow

in thousands of USD

Quarter

ended 30 Jun 2022

unaudited

Quarter

ended 30 Jun 2021

unaudited

Quarter

ended 31 Mar 2022

unaudited

Half-year

ended 30 Jun 2022

unaudited

Half-year

ended 30 Jun 2021

unaudited

Income before taxes

8,456

24,968

20,825

29,281

39,117

Reconciliation of net income to cash

flow arising from operating activities:

36,295

12,079

20,944

57,239

33,670

Depreciation and amortization, before

effect of grants and subsidies

18,442

18,718

18,808

37,250

37,269

Recognized investment grants and subsidies

netted with depreciation and amortization

-841

-848

-874

-1,715

-1,689

Interest income and expenses (net)

13,015

-117

183

13,198

-240

Loss/(gain) on the sale of plant,

property, and equipment (net)

-19

-280

-158

-177

-392

Other non-cash transactions (net)

5,698

-5,393

2,985

8,683

-1,277

Changes in working capital:

-21,335

-12,864

-32,183

-53,518

-33,059

Decrease/(increase) of trade

receivables

-15,479

-943

-8,637

-24,115

-12,236

Decrease/(increase) of other receivables

& prepaid expenses

-918

-6,055

-5,799

-6,717

-11,554

Decrease/(increase) of inventories

-3,062

-6,055

-14,349

-17,411

-8,524

(Decrease)/increase of trade payables

-3,341

-126

-2,014

-5,356

400

(Decrease)/increase of other

liabilities

1,466

316

-1,384

82

-1,144

Income taxes (paid)/received

-108

-14

-107

-215

-1,747

Cash Flow from operating

activities

23,308

24,169

9,479

32,787

37,981

Cash Flow from investing

activities:

Payments for property, plant, equipment

& intangible assets

-36,760

-14,216

-48,847

-85,606

-23,917

Payments for loan investments to related

parties

-35

-38

-114

-148

-129

Proceeds from loan investments related

parties

62

45

98

160

125

Proceeds from sale of property, plant, and

equipment

64

285

164

228

402

Interest received

275

468

237

512

938

Cash Flow used in investing

activities

-36,393

-13,456

-48,462

-84,855

-22,582

Condensed Consolidated Statement of Cash Flow – con’t

in thousands of USD

Quarter

ended 30 Jun 2022

unaudited

Quarter

ended 30 Jun 2021

unaudited

Quarter

ended 31 Mar 2022

unaudited

Half-year

ended 30 Jun 2022

unaudited

Half-year

ended 30 Jun 2021

unaudited

Cash Flow from (used in) financing

activities:

Proceeds from loans and borrowings

15,281

4,479

7,261

22,542

4,479

Repayment of loans and borrowings

-1,367

-4,231

-2,803

-4,170

-11,850

Receipts of sale & leaseback

arrangements

0

0

7,723

7,723

0

Payments of lease installments

-1,258

-1,529

-1,759

-3,017

-2,702

Interest paid

-432

-350

-139

-571

-698

Distribution to non-controlling

interests

0

0

-11

-11

-12

Cash Flow from (used in) financing

activities

12,224

-1,630

10,271

22,495

-10,783

Effect of changes in foreign currency

exchange rates on cash

-7,581

217

-2,205

-9,786

-5,374

Increase/(decrease) of cash and cash

equivalents

-861

9,083

-28,712

-29,573

4,617

Cash and cash equivalents at the beginning

of the period

259,271

195,810

290,187

290,187

205,867

Cash and cash equivalents at the end

of

the period

250,828

205,109

259,271

250,828

205,109

###

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220728005712/en/

X-FAB Press Contact Uta Steinbrecher Investor Relations

X-FAB Silicon Foundries +49-361-427-6489

uta.steinbrecher@xfab.com

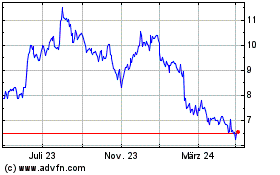

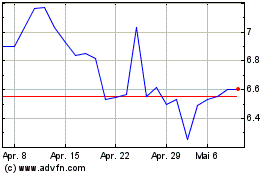

X-FAB Silicon Foundries (EU:XFAB)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

X-FAB Silicon Foundries (EU:XFAB)

Historical Stock Chart

Von Apr 2023 bis Apr 2024