Worldline announces the closing of its major strategic commercial acquiring alliance with ANZ Bank in Australia

01 April 2022 - 8:00AM

Worldline announces the closing of its major strategic commercial

acquiring alliance with ANZ Bank in Australia

Worldline announces the

closing of its major strategic commercial

acquiring alliance with ANZ Bank in Australia

Paris La Défense, April

1st, 2022 –

Worldline [Euronext: WLN], a global leader in the

payments industry, today

announces

the completion of the

acquisition of a controlling stake in the commercial acquiring

business of ANZ and the creation

of a 51%-49% joint-venture controlled by Worldline to operate and

develop commercial acquiring services in Australia with ANZ

Bank, one of the largest banks in Asia-Pacific and

Australia’s 3rd largest acquirer

with a

c. 20%

share of transaction volumes processed in

Australia1.

Australia is a highly attractive and strategic

market for Worldline with favorable dynamics, a sizable and growing

addressable market and a high level of readiness and receptiveness

towards cashless payment methods. Furthermore, with a cash

penetration still high, the Australian market offers an attractive

growth opportunity driven by the shift from cash to card.

Similar to Europe in terms of market structure,

payment standards and technology, the Australian payment market is

large and dynamic. It has a high level adoption of electronic

payments and is ranked #4 globally for payment terminals per

capita, with consumer use of contactless cards and digital wallets

amongst the highest in the world.

The new joint-venture is a unique opportunity

for Worldline to significantly expand its merchant acquiring

business outside of Europe, with direct access to an existing and

high quality merchants’ portfolio, and at the same time to generate

significant synergies due to enhanced scale by leveraging the

Group’s payment technologies.

The combination of ANZ’s strong market position

and Worldline’s global scale, best-in-class technologies and

payment expertise will allow the alliance to grow revenue at a

double-digit rate in the coming years. This accelerated growth rate

will be delivered through cross and up-sell opportunities based on

innovative solutions such as digital onboarding, Alternative

Payment Methods (APM), fraud detection, online and omnichannel

capabilities, while leveraging the existing merchant portfolio.

With annual revenue of c. € 180 million with

expected double-digit organic growth CAGR over the next 5 years and

an OMDA margin of c. 20% expected at closing, a robust integration

and platform development program will be implemented at closing

with the objective to reach € 25 million additional OMDA by 2025.

The synergy plan is mainly based on the re-use approach of

Worldline’s proven payment modules with the implementation of a

targeted platform bringing innovative European market standard

payment applications in Australia.

Forthcoming events

- April 27,

2022 Q1

2022 revenue

- June 9,

2022 Annual

General Shareholders’ Meeting

- July 27,

2022 H1

2022 results

- October 25,

2022 Q3 2022

revenue

Contacts

Investor Relations

Laurent Marie+33 7 84 50 18

90laurent.marie@worldline.com

Benoit d’Amécourt+33 6 75 51 41

47benoit.damecourt@worldline.com

Communication

Sandrine van der Ghinst+32 499 585

380sandrine.vanderghinst@worldline.com

Hélène Carlander+33 7 72 25 96

04helene.carlander@worldline.com

About

Worldline

Worldline [Euronext: WLN] is a global leader in

the payments industry and the technology partner of choice for

merchants, banks and acquirers. Powered by 20,000 employees in more

than 50 countries, Worldline provides its clients with sustainable,

trusted and innovative solutions fostering their growth. Services

offered by Worldline include instore and online commercial

acquiring, highly secure payment transaction processing and

numerous digital services. In 2021 Worldline generated a proforma

revenue close to 4 billion euros. worldline.com

Worldline’s corporate purpose (“raison d’être”)

is to design and operate leading digital payment and transactional

solutions that enable sustainable economic growth and reinforce

trust and security in our societies. Worldline makes them

environmentally friendly, widely accessible, and supports social

transformation.

Disclaimer

This document contains forward-looking

statements that involve risks and uncertainties, including

references, concerning the Group's expected growth and

profitability in the future which may significantly impact the

expected performance indicated in the forward-looking statements.

These risks and uncertainties are linked to factors out of the

control of the Company and not precisely estimated, such as market

conditions or competitors’ behaviours. Any forward-looking

statements made in this document are statements about Worldline’s

beliefs and expectations and should be evaluated as such.

Forward-looking statements include statements that may relate to

Worldline’s plans, objectives, strategies, goals, future events,

future revenues or synergies, or performance, and other information

that is not historical information. Actual events or results may

differ from those described in this document due to a number of

risks and uncertainties that are described within the 2020

Universal Registration Document filed with the French Autorité des

marchés financiers (AMF) on April 13, 2021 under the filling

number: D.21-0303 and its Amendment filed on July 29, 2021 under

the filling number: D. 21-0303-A01.

Worldline does not undertake, and specifically

disclaims, any obligation or responsibility to update or amend any

of the information above except as otherwise required by law.

This document is disseminated for information

purposes only and does not constitute an offer to purchase, or a

solicitation of an offer to sell, any securities in the United

States or any other jurisdiction. Securities may not be offered or

sold in the United States unless they have been registered under

the U.S. Securities Act of 1933, as amended (the “U.S. Securities

Act”) or the securities laws of any U.S. state, or are exempt from

registration. The securities that may be offered in any transaction

have not been and will not be registered under the U.S. Securities

Act or the securities laws of any U.S. state and Worldline does not

intend to make a public offering of any such securities in the

United States.

1 Credit, Debit and Chargecard turnover, ANZ

internal and RBA data

- Worldline complete its major strategic commercial acquiring

alliance with ANZ Bank

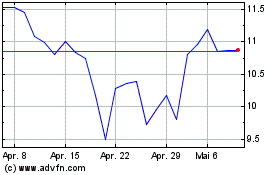

Worldline (EU:WLN)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Worldline (EU:WLN)

Historical Stock Chart

Von Apr 2023 bis Apr 2024