VGP and Allianz Joint Venture Completes €364 Million Logistics Portfolio Purchase

16 März 2022 - 7:00AM

VGP and Allianz Joint Venture Completes €364 Million Logistics

Portfolio Purchase

Antwerp, Belgium, 16 March 2022 (7.00 a.m. CET)

VGP NV ('VGP' or 'the Company') and Allianz Real

Estate, acting on behalf of several Allianz Group companies, today

announced a successful third closing with its 50:50 joint venture,

VGP European Logistics II (‘Second Joint Venture’)1. The

transaction comprised of 13 logistic buildings, including 9

buildings in 5 new VGP parks and another 4 newly completed logistic

buildings which were developed in parks previously transferred to

the Joint Venture.

The 13 buildings are located in Spain (7), Italy

(4), the Netherlands (1) and in Romania (1).

The transaction value is € 364 million2. The

gross proceeds from this transaction amounts to circa € 233

million3.

The proceeds will be applied towards the further

expansion of the development pipeline i.e. acquisition of new

development land and financing of existing projects under

construction and new projects which will start shortly.

Following the completion of this third closing

of the Second Joint Venture, the Second’s Joint Venture’s

property portfolio consist of 32 completed buildings

representing around 642,000 m² of lettable area, with a 99.8%

occupancy rate.

For Allianz Real Estate, this transaction adds

to its € 11.6 billion global logistics AuM, an asset class in which

the firm has materially increased its exposure over the last few

years with a focus on grade A logistics portfolios in prime

locations.

For VGP the increase in the joint ventures’

portfolio should have a further positive impact on the fee income

generated by the asset-, property-, and development management

services rendered by VGP to the Joint Ventures.

CONTACT DETAILS FOR INVESTORS AND MEDIA

ENQUIRIES

|

Investor Relations |

Tel: +32 (0)3 289 1433 investor.relations@vgpparks.eu |

|

Petra Vanclova (External Communications)| |

Tel: +42 0 602 262 107 |

|

Anette NachbarBrunswick Group |

Tel: +49 152 288 10363 |

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking

statements. Such statements reflect the current views of management

regarding future events, and involve known and unknown risks,

uncertainties and other factors that may cause actual results to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements. VGP is providing the information in this press release

as of this date and does not undertake any obligation to update any

forward-looking statements contained in this press release in light

of new information, future events or otherwise. The information in

this announcement does not constitute an offer to sell or an

invitation to buy securities in VGP or an invitation or inducement

to engage in any other investment activities. VGP disclaims

any liability for statements made or published by third parties and

does not undertake any obligation to correct inaccurate data,

information, conclusions or opinions published by third parties in

relation to this or any other press release issued by VGP.

ABOUT VGP

VGP is a pan-European developer, manager and

owner of high-quality logistics and semi-industrial real estate.

VGP operates a fully integrated business model with capabilities

and longstanding expertise across the value chain. The company has

a development land bank (owned or committed) of 10.94 million m²

and the strategic focus is on the development of business parks.

Founded in 1998 as a Belgian family-owned real estate developer in

the Czech Republic, VGP with a staff of circa 350 employees today

owns and operates assets in 14 European countries directly and

through several 50:50 joint ventures. As of December 2021, the

Gross Asset Value of VGP, including the joint ventures at 100%,

amounted to € 5.75 billion and the company had a Net Asset Value

(EPRA NTA) of € 2.33 billion. VGP is listed on Euronext Brussels

(ISIN: BE0003878957).

For more information, please

visit: http://www.vgpparks.eu

1 VGP has entered into

four 50:50 joint ventures with Allianz Real Estate: (i) the First

Joint Venture i.e. VGP European Logistics S.à.r.l., (ii) the Second

Joint Venture i.e. VGP European Logistics 2 S.à.r.l., (iii) the

Third Joint Venture i.e. VGP Park München GmbH and (iv) the Fourth

Joint Venture i.e. VGP European Logistics 3 S.à.r.l. which will

become effective at the moment of its first closing, currently

expected to occur during the second half of 2022.

2 The transaction value is

composed of the purchase price for the completed income generating

buildings and the net book value of the development pipeline which

is transferred as part of a closing but not yet paid for by the

Second Joint Venture.

3 Total cash obtained after

transaction, including a simultaneous € 5.5 million equity

distribution.

- Third closing VGP European Logistics II JV - EN

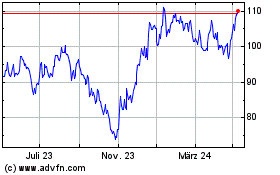

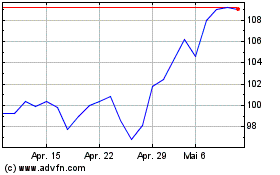

VGP NV (EU:VGP)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

VGP NV (EU:VGP)

Historical Stock Chart

Von Apr 2023 bis Apr 2024