Unilever Sells Ekaterra Tea Business to CVC Capital for EUR4.5 Billion

18 November 2021 - 6:07PM

Dow Jones News

By Joe Hoppe

Unilever PLC said Thursday that it will sell its global tea

business ekaterra to CVC Capital Partners Fund VIII for 4.5 billion

euros ($5.09 billion) on a cash-free, debt-free basis.

The Anglo-Dutch consumer-goods group said that ekaterra--which

has a portfolio of 34 brands, including Lipton, PG tips, Pukka, T2

and TAZO--generated revenue of around EUR2 billion in 2020.

The transaction is expected to be completed in the second half

of 2022, subject to completion of works council consultation

processes and the receipt of certain regulatory approvals.

The deal also excludes Unilever's tea business in India, Nepal

and Indonesia, as well as its interests in the Pepsi Lipton

ready-to-drink tea joint ventures and associated distribution

businesses.

"The evolution of our portfolio into higher growth spaces is an

important part of our growth strategy for Unilever. Our decision to

sell ekaterra demonstrates further progress in delivering against

our plans," Chief Executive Alan Jope said.

Write to Joe Hoppe at joseph.hoppe@wsj.com

(END) Dow Jones Newswires

November 18, 2021 11:52 ET (16:52 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

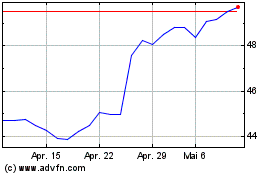

Unilever (EU:UNA)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

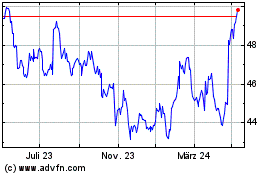

Unilever (EU:UNA)

Historical Stock Chart

Von Apr 2023 bis Apr 2024