UBISOFT REPORTS THIRD-QUARTER 2022-23 SALES

UBISOFT REPORTS

THIRD-QUARTER

2022-23

SALES

Download the press release

|

|

In €m9

months2022-23 |

Reported change

vs.2021-22 |

% of total net

bookings |

|

|

9 months

2022-23 |

9 months

2021-22 |

|

IFRS 15 sales |

1,503.7 |

+6.1% |

- |

- |

|

Net bookings |

1,426.3 |

-2.6% |

- |

- |

|

Digital net bookings |

1,209.9 |

+11.2% |

84.8% |

74.3% |

|

PRI net bookings |

841.7 |

+57.1% |

59.0% |

36.6% |

|

Back-catalog net bookings |

754.8 |

-19.4% |

52.9% |

64.0% |

-

Third fiscal quarter: Net

bookings of €726.9 million, in line with the revised target

- Tom

Clancy’s Rainbow Six

Siege®:

delivered more than 30% DARPU year-on-year progression during the

quarter and double-digit PRI growth over the first nine months

- Assassin’s

Creed® brand: active

players up 30% over the first nine months, reaching new engagement

records

2022-23

and 2023-24 targets confirmed

2023-24 line-up: new releases

across big brands with Assassin's Creed® Mirage, Avatar: Frontiers

of Pandora™, Tom Clancy’s Rainbow Six® Mobile, Tom Clancy’s The

Division® Resurgence and another large game as well as across

long-lasting Live games, notably with Skull and Bones™ and The

Crew® Motorfest

Paris, February 16, 2023 –

Today, Ubisoft released its sales figures for the third quarter of

fiscal 2022-23, i.e. the three months ended December 31, 2022.

Yves Guillemot, Co-Founder and Chief Executive

Officer, said “We are committed to boosting our efficiency and

execution through a more agile organization adapted to new market

conditions, with a strong focus on initiatives to enhance

predictability across our productions and through our

cost-reduction efforts.

As we are focused on building on our strengths,

we are prioritizing our efforts on big brands and long-lasting Live

games. While the macro environment impacted the video game market

and our Q3 results, our established franchises and Live games have

performed solidly. In an intensely competitive environment for

shooter games, Rainbow Six Siege has performed remarkably well.

This momentum, seven years after the game’s release, is promising

as we look to launch Rainbow Six Mobile next fiscal year. The

Assassin’s Creed franchise reached new player engagement records

over the past quarter, and we are excited to bring Assassin’s Creed

Mirage to players in 2023-24. Similarly, we are looking to bring

The Division to a larger, global audience, with the release on

mobile of The Division Resurgence, also next fiscal year.”

Frédérick Duguet, Chief Financial Officer, said

“Fueling our expectations for strong revenue growth, next fiscal

year will see the release of a meaningful line-up, including new

titles within the Assassin’s Creed, Avatar, Rainbow Six and The

Division universes. In the coming months, players will have the

opportunity to test and discover several of our upcoming

long-lasting Live Games, including The Crew Motorfest, Skull and

Bones, as well as, starting today, our first cross-platform

technical test for XDefiant.”

Q3 Game

Highlights

In a very competitive backdrop, Tom

Clancy’s Rainbow Six Siege posted a very

strong performance in December and January, following the release

of Operation Solar Raid, the last season of Year 7. It resonated

very well with the community, reflecting the excellent work from

our teams at Ubisoft Montreal and at the associate studios,

building on the game’s positive momentum since Q1 2022-23 which has

led the games’ PRI to grow double-digit on a 9-month basis. As a

result, December posted another record month for DARPU, which grew

more than 30% year-on-year during the quarter, and engagement is

back to double-digit year-on-year growth since the beginning of

calendar year 2023. At the end of the ongoing esports Six

Invitational event, the team will unveil the new season of Rainbow

Six Siege as well as an amazing year of content. Leveraging this

current success and strong engagement, we will release Tom Clancy’s

Rainbow Six Mobile next fiscal year as we look to bring the brand

to a significantly wider audience.

Mario +

Rabbids: Sparks of Hope, led by

Ubisoft Paris and Ubisoft Milan, was awarded the best

Simulation/Strategy game at the Game Awards 2022. Thanks to

positive player reception, upcoming high-quality post-launch

content and word of mouth, we expect the game to be a long-term

seller.

Game Pipeline Highlights

The reveal of The Crew

Motorfest, developed by the seasoned car racing and Live

Services team at Ubisoft Ivory Tower, was very well received by

players and critics alike. Subsequently, the registrations to the

Insider Program, that enables players to test the game and submit

feedback, generated very strong demand. To date, feedback has been

very positive on the gameplay and the core experience. As players

race through the island of O’ahu, The Crew Motorfest will leverage

the franchise strong and profitable success with a community of

more than 40 million unique players as well as ongoing solid player

engagement in The Crew® 2, more than four years after its

release.

The Tom Clancy’s

The Division®

franchise is getting ready for a big year.

With its 4th anniversary on the horizon, Tom

Clancy’s The Division®

2 will keep improving the player experience

and receive new updates, including a full year of fresh new

seasonal content to keep new and veteran players engaged. Next

fiscal year we will also be launching Tom Clancy’s

The Division Resurgence, the

first high-end AAA mobile looter shooter experience for Android and

iOS devices. As we look to bring The Division to a larger, global

audience, we are also working on Tom Clancy’s

The Division®

Heartland, a PvEvP-focused Free-to-Play

action survival shooter for console and PC.

XDefiant, from our Ubisoft

San-Francisco studio, is Ubisoft’s upcoming Free-to-Play fast paced

arena shooter for consoles and PC. In October 2022 we concluded our

weekly test sessions with players and received positive feedback

thus far. Starting today, through Sunday, we are conducting our

first cross platform technical test with tens of thousands of

players.

Organization Highlights

Boosting

Predictability

Across our Brands

Over the past five years, through three fan

favorite, highly successful and profitable titles (Assassin’s

Creed® Origins, Assassin’s Creed® Odyssey and Assassin’s Creed®

Valhalla), Ubisoft teams in Montreal and Quebec City as well as the

associate teams from our network of worldwide studios, have

reliably delivered very high-quality innovative experiences. This

reflects maturity in terms of production tools, best practices and

processes that we have built over the past 15 years on this beloved

brand. Over the past 18 months, we have been implementing this

best-in-class production framework to our other brands’ production

pipelines to drive stronger predictability in quality, innovation

and timely execution. We believe this will have a meaningful impact

on production across our brands in the future.

Reinforcing our Commitment to Social

Experience

The Group appointed Bernd Diemer as VP of

Editorial - Social Experience within the Global Creative Office.

With more than two decades of experience in the video game

industry, including leading the creative direction of Crysis,

Horizon: Zero Dawn, Battlefield and Star Wars: Battlefront, he will

be responsible for driving Ubisoft's efforts to enhance in-game

social interactions for players.

A Continued Commitment to Diversity

& InclusionAs part of Ubisoft’s ongoing efforts to

foster inclusion both in its workplace and among its communities,

the company has embarked on a three-year plan to advance inclusion

for LGBTQIA+ team members worldwide, which kicked off with the

signature of the Autre Cercle Charter. The first video game company

to sign this Charter, Ubisoft commits to ensuring the inclusion of

LGBTQIA+ people in the workplace, to supporting equal treatment and

rights for all, regardless of sexual orientation or gender

identity, and to combatting discrimination.

Note The Group presents

indicators which are not prepared strictly in accordance with IFRS

as it considers that they are the best reflection of its operating

and financial performance. The definitions of the non-IFRS

indicators are appended to this press release.

Sales and net bookings

|

In € millions |

Q3 |

9 months |

|

2022-23 |

2021-22 |

2022-23 |

2021-22 |

|

IFRS 15 sales |

772.5 |

665.9 |

1,503.7 |

1,417.2 |

|

Deferred revenues related to IFRS 15 |

45.6 |

80.2 |

77.3 |

47.1 |

|

Net bookings |

726.9 |

746.1 |

1,426.3 |

1,464.3 |

|

Digital net bookings |

568.4 |

530.2 |

1,209.9 |

1,087.6 |

|

PRI net bookings |

419.3 |

187.1 |

841.7 |

535.7 |

|

Back-catalog net bookings |

249.4 |

340.8 |

754.8 |

937.0 |

IFRS 15 sales for the third quarter of 2022-23

came to €772.5 million, up 16.0% (12.8% at constant exchange

rates1).For the first nine months of 2022-23, IFRS 15 sales

amounted to €1,503.7 million, up 6.1% (2.3% at constant exchange

rates).

Net bookings for third-quarter 2022-23 totaled

€726.9 million, in line with the Group’s revised target of around

725.0 million and representing a decrease of 2.6% (-5.4% at

constant exchange rates).For the first nine months of 2022-23, net

bookings stood at €1,426.3 million, down 2.6% (-6.2% at constant

exchange rates).

Outlook

Full-year 2022-23

The company confirms its financial targets of

full year net bookings down more than 10% year-on-year and full

year non-IFRS operating income of approximately -€500m.

Full-year 2023-24

The Company confirms it expects a strong topline

growth and a non-IFRS operating income target of approximately €400

million.

Conference call

Ubisoft will hold a conference call today, Thursday February 16,

2023, at 6:15 p.m. Paris time/5:15 p.m. London time/12:15 p.m.

New York time. The conference call can be accessed live and via

replay by clicking on the following link:

https://edge.media-server.com/mmc/p/3qsf57od

Contacts

Investor RelationsJean-Benoît

RoquetteSVP Investor Relations+ 33 1 48 18 52

39jean-benoit.roquette@ubisoft.comPress Relations

Fabien DarriguesDirector of Global

Communicationsfabien.darrigues@ubisoft.com

|

Alexandre Enjalbert Senior Investor Relations Manager + 33 1 48 18

50 78 alexandre.enjalbert@ubisoft.com |

DisclaimerThis press release

may contain estimated financial data, information on future

projects and transactions and future financial results/performance.

Such forward-looking data are provided for information purposes

only. They are subject to market risks and uncertainties and may

vary significantly compared with the actual results that will be

published. The estimated financial data have been approved by the

Board of Directors, and have not been audited by the Statutory

Auditors. (Additional information is provided in the most recent

Ubisoft Registration Document filed on June 14, 2022 with the

French Financial Markets Authority (l’Autorité des Marchés

Financiers)).

About UbisoftUbisoft is a

creator of worlds, committed to enriching players’ lives with

original and memorable entertainment experiences. Ubisoft’s global

teams create and develop a deep and diverse portfolio of games,

featuring brands such as Assassin’s Creed®, Brawlhalla®, For

Honor®, Far Cry®, Tom Clancy’s Ghost Recon®, Just Dance®, Rabbids®,

Tom Clancy’s Rainbow Six®, The Crew® and Tom Clancy’s The

Division®. Through Ubisoft Connect, players can enjoy an ecosystem

of services to enhance their gaming experience, get rewards and

connect with friends across platforms. With Ubisoft+, the

subscription service, they can access a growing catalog of more

than 100 Ubisoft games and DLC. For the 2021–22 fiscal year,

Ubisoft generated net bookings of €2,129 million. To learn more,

please visit: www.ubisoftgroup.com.

© 2023 Ubisoft Entertainment. All Rights

Reserved. Ubisoft and the Ubisoft logo are registered trademarks in

the US and/or other countries.

APPENDICES

Definition of non-IFRS financial

indicators

Net bookings corresponds to sales restated for

the services component and including unconditional amounts related

tolicense or distribution agreements recognized independently of

the achievement of performance obligations.

Player Recurring Investment (PRI) corresponds to

sales of digital items, DLC, season passes, subscriptions and

advertising.

Non-IFRS operating income calculated based on

net bookings corresponds to operating income less the following

items:

- Stock-based compensation expense

arising on free share plans, group savings plans and/or stock

options.

- Depreciation of acquired intangible

assets with indefinite useful lives.

- Non-operating income and expenses

resulting from restructuring operations within the Group.

Breakdown of net bookings by geographic

region

|

|

Q32022-23 |

Q32021-22 |

9 months

2022-23 |

9 months

2021-22 |

|

Europe |

31% |

39% |

30% |

35% |

| Northern

America |

53% |

48% |

52% |

49% |

|

Rest of the world |

16% |

13% |

18% |

16% |

|

TOTAL |

100% |

100% |

100% |

100% |

Breakdown of net bookings by

platform

|

|

Q32022-23 |

Q32021-22 |

9 months

2022-23 |

9 months

2021-22 |

|

CONSOLES |

36% |

59% |

39% |

60% |

| PC |

11% |

29% |

16% |

25% |

| MOBILE |

43% |

7% |

35% |

9% |

|

Others* |

10% |

5% |

10% |

6% |

|

TOTAL |

100% |

100% |

100% |

100% |

*Ancillaries, etc.

Title release

schedule4th

quarter (January

– March

2023)

|

PACKAGED & DIGITAL |

|

|

|

|

ANNO 1800 CONSOLES |

PLAYSTATION®5, XBOX SERIES X/S |

|

| |

|

|

|

|

|

|

ODDBALLERS |

|

|

|

PC, PLAYSTATION®4, XBOX ONENINTENDO SWITCH™ |

|

| |

|

|

|

|

|

|

|

DIGITAL

ONLY |

|

|

|

FOR HONOR®: Year 7 – Season 1 |

PC, PLAYSTATION®4, XBOX ONE |

|

MARIO + RABBIDS™: SPARKS OF HOPE DLC1 The Tower of Doooom |

NINTENDO SWITCH™ |

|

RIDERS REPUBLIC™: Season 6 – Cutting Edge |

AMAZON LUNA, PC, PLAYSTATION®4, PLAYSTATION®5, XBOX ONE, XBOX

SERIES X/S |

|

TOM CLANCY’S RAINBOW SIX® SIEGE: Year 8 – Season 1 |

AMAZON LUNA, PC, PLAYSTATION®4, PLAYSTATION®5, XBOX ONE, XBOX

SERIES X/S |

|

TOM CLANCY’S THE DIVISION® 2: Season 11 |

AMAZON LUNA, PC, PLAYSTATION®4, XBOX ONE |

|

THE CREW ® 2: Season 7 – Episode 2 / Season 8 – Episode 1 |

AMAZON LUNA, PC, PLAYSTATION®4, PLAYSTATION®5, XBOX ONE, XBOX

SERIES X/S |

|

THE SETTLERS®: NEW ALLIES |

AMAZON LUNA, PC, PLAYSTATION®4, XBOX ONENINTENDO SWITCH™ |

|

VALIANT HEARTS: COMING HOME |

NETFLIX GAMES |

1 Sales at constant exchange rates are

calculated by applying to the data for the period under review the

average exchange rates used for the same period of the previous

year.

- Download the press release

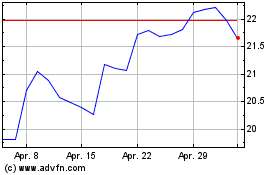

UBISoft Entertainment (EU:UBI)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

UBISoft Entertainment (EU:UBI)

Historical Stock Chart

Von Apr 2023 bis Apr 2024