Ubisoft Strengthens Strategic Focus on Biggest Brands and Live

Services With a New Set of Measures, Cementing Long-Term Growth and

Value Creation Prospects

UBISOFT STRENGTHENS

STRATEGIC FOCUSON BIGGEST BRANDS

AND LIVE SERVICES WITH A

NEW SET OF MEASURES, CEMENTING LONG-TERM GROWTH

AND VALUE CREATION PROSPECTS

2022-23 financial targets

updated, introduction of

targets for 2023-24

Download the press release

Paris, January

11, 2023 – Ubisoft strengthens

strategic focus on biggest brands with a new set of measures,

cementing long-term growth and value creation prospects. The

Company updates today its 2022-23 financial targets and introduces

2023-24 targets.

Over the past 10 years, Ubisoft teams have

organically created one of the deepest and most diversified

portfolios of owned IPs in the industry. This has resulted in a

significant transformation of the Group, the development of

multiple major brands and much stronger recurring revenues thanks

to highly successful Live Service games.

Despite these achievements, the Company is

facing major challenges as the industry continues to shift towards

mega-brands and long-lasting titles than can reach players across

the globe, across platforms and business models. Our strategy over

the past 4 years has been about building long-lasting live games

and adapting our strongest franchises, mainly Assassin’s Creed®,

Far Cry®, Tom Clancy’s Ghost Recon®, Tom Clancy’s Rainbow Six® and

Tom Clancy’s The Division®, to these converging trends to make them

truly global brands. However, the games from this investment phase

have yet to be released, while our recent launches have not

performed as well as expected. Compounding this effect, in the

context of worsening macroeconomic conditions, the trends over the

Holiday season, in particular the last weeks of December and

beginning of January, have been markedly and surprisingly slower

than expected.

This overall context has triggered a full review

of our revenue prospects leading to increased cautiousness over the

coming years. Considering this, combined with the significant

additional investments that resulted from lockdown and new working

patterns that have had a profound impact on productions across the

industry over the past 3 years, Ubisoft is announcing today a set

of measures dedicated to strengthening its long-term growth and

value-creation prospects:

- Ensure all our

energy is focused on building our brands and live services into

some of the most powerful within the industry. As a consequence, we

have decided to cancel three unannounced projects, on top of the

four already announced in July 2022.

- Depreciate

around €500m of capitalized R&D, concerning upcoming premium

and Free-to-Play games and the newly cancelled titles. This notably

reflects the increased cautiousness related to the current

challenging videogame market and macroeconomic environment as well

as the necessary increased focus on fewer titles.

- As part of our

increased strategic focus, adapt our organization to a more

challenging market, with an expected net reduction of our

non-variable costs base of more than €200m over the next 2 years.

This will be achieved through targeted restructuring, divesting

some non-core assets and usual natural attrition. Ubisoft will

continue to look at hiring highly talented people for its biggest

brands and live services.

Yves Guillemot, Co-Founder and Chief Executive

Officer, said “We are clearly disappointed by our recent

performance. We are facing contrasted market dynamics as the

industry continues to shift towards mega-brands and everlasting

live games, in the context of worsening economic conditions

affecting consumer spending. Despite excellent ratings and players’

reception as well as an ambitious marketing plan, we were surprised

by Mario + Rabbids®: Sparks of Hope underperformance in the final

weeks of 2022 and early January. Just Dance® 2023 underperformed as

well. Therefore, with the approval of the Board of Directors, we

are taking additional important strategic and operational decisions

today. It is key to continue adapting our organization, to further

strengthen our execution and to ensure we both deliver amazing

games to players as well as great value creation.

The industry’s long-term prospects remain

promising, and I am convinced Ubisoft is well positioned to benefit

from this momentum thanks to the strength of our teams, brands,

production capacity, technology and balance-sheet. Our

back-catalogue remains very healthy with notably robust activity on

Rainbow Six Siege, great momentum for our Assassin’s Creed games,

and generally solid performance from our live games. We expect our

strategy to build long-lasting live games and transform our biggest

brands into truly global phenomenon with multiple offerings across

platforms and business models, to ultimately generate significant

value creation, with strong topline and operating income growth

over the coming years."

Updated Financial

TargetsToday, Ubisoft is revising its Q3 2022-23 net

bookings target, now expected at approximately €725m versus the

prior target of approximately €830m. This reflects the more

challenging environment mentioned previously, which notably

resulted in the lower-than-expected performance of Mario + Rabbids:

Sparks of Hope and Just Dance 2023.

Players will be able to discover the beauty of

Skull and Bones in the upcoming beta phase. The additional time has

already paid off and brought impressive improvements to its

quality, which has been confirmed by recent playtests. We believe

players will be positively surprised by its evolution. We have

decided to postpone its release in order to have more time to

showcase a much more polished and balanced experience and to build

awareness. Skull and Bones will now be released early 2023-24.

All this considered, Ubisoft is revising its

full year targets with net bookings expected to be down more than

10% year-on-year versus a prior expectation of up more than 10%.

Non-IFRS operating income, reflecting lower net bookings, the

postponement of Skull and Bones and the depreciation of capitalized

R&D for around €500m, is now expected at -€500m versus €400m

previously.

Ubisoft is introducing today its 2023-24

non-IFRS operating income target at around €400m reflecting

necessary prudence in the current challenging environment, while

still expecting an overall strong topline growth thanks to a

materially stronger line-up.

Ubisoft balance sheet is strong with around €1.5

billion in cash and cash equivalents after reimbursing the €500m

bond expiring at the end of this month.

Frédéric Duguet, Chief Financial Officer, said

“Our decisive reaction and our additional cost optimization

measures should help us navigate the current challenging economic

environment and ensure a leaner organization for the years to come.

Leveraging the biggest pipeline of games in the Ubisoft’s history,

2023-24 will see the releases of Assassin’s Creed® Mirage, Avatar:

Frontiers of PandoraTM, Skull and BonesTM and other

yet-to-be-announced premium games, including a large one, as well

as promising Free-to-Play titles for some of our biggest

brands.”

Conference call

Ubisoft will hold a conference call today,

Wednesday January 11, 2023, at 6:30 p.m. Paris time/12:30 p.m. New

York time. The conference call can be accessed live and via replay

by clicking on the following link:

https://edge.media-server.com/mmc/p/akataybp

Forthcoming publication

Ubisoft’s Q3 2022-23 sales will be reported on

February 16, 2023, after market close.

Contacts

|

Investor RelationsJean-Benoît RoquetteSVP Investor

Relations+ 33 1 48 18 52 39Jean-benoit.roquette@ubisoft.com |

Press Relations Fabien DarriguesDirector of Global

CommunicationsFabien.Darrigues@ubisoft.com |

| Alexandre

Enjalbert Senior Investor Relations Manager + 33 1 48 18 50 78

Alexandre.enjalbert@ubisoft.com |

|

DisclaimerThis press release

may contain estimated financial data, information on future

projects and transactions and future financial results/performance.

Such forward-looking data are provided for information purposes

only. They are subject to market risks and uncertainties and may

vary significantly compared with the actual results that will be

published. The estimated financial data have been approved by the

Supervisory Board on May 11, 2022, and have not been audited by the

Statutory Auditors. (Additional information is provided in the most

recent Ubisoft Registration Document filed on June 14, 2022 with

the French Financial Markets Authority (l’Autorité des Marchés

Financiers)).

About UbisoftUbisoft is a

creator of worlds, committed to enriching players’ lives with

original and memorable entertainment experiences. Ubisoft’s global

teams create and develop a deep and diverse portfolio of games,

featuring brands such as Assassin’s Creed®, Brawlhalla®, For

Honor®, Far Cry®, Tom Clancy’s Ghost Recon®, Just Dance®, Rabbids®,

Tom Clancy’s Rainbow Six®, The Crew®, Tom Clancy’s The Division®,

and Watch Dogs®. Through Ubisoft Connect, players can enjoy an

ecosystem of services to enhance their gaming experience, get

rewards and connect with friends across platforms. With Ubisoft+,

the subscription service, they can access a growing catalog of more

than 100 Ubisoft games and DLC. For the 2021–22 fiscal year,

Ubisoft generated net bookings of €2,129 million. To learn more,

please visit: www.ubisoftgroup.com.

© 2023 Ubisoft Entertainment. All Rights

Reserved. Ubisoft and the Ubisoft logo are registered trademarks in

the US and/or other countries.

- Download the press release

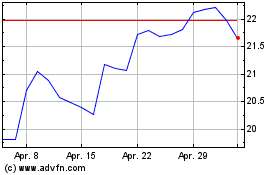

UBISoft Entertainment (EU:UBI)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

UBISoft Entertainment (EU:UBI)

Historical Stock Chart

Von Apr 2023 bis Apr 2024