UBISOFT REPORTS FIRST-QUARTER 2022-23 SALES

UBISOFT REPORTS

FIRST-QUARTER

2022-23

SALES

Q1 performance

slightly ahead of target New

high-value licensing

partnership on mobileRelease schedule

updated2022-23 non-IFRS operating

income target confirmed

Download the press release

- Net

bookings of €293.3 million, slightly ahead of target of

around €280.0 million

|

|

In

€mQ12022-23 |

Reported change vs.Q1

2021-22 |

% of total net

bookings |

|

|

Q1 2022-23 |

Q1 2021-22 |

|

IFRS 15 sales |

318.2 |

-9.8% |

NA |

NA |

|

Net bookings |

293.3 |

-10.0% |

NA |

NA |

|

Digital net bookings |

262.3 |

-6.1% |

89.4% |

85.7% |

|

PRI net bookings |

153.5 |

-11.6% |

52.3% |

53.2% |

|

Back-catalog net bookings |

256.3 |

-16.5% |

87.4% |

94.1% |

-

Better than

expected Q1 performance

from the Assassin’s

Creed® brand and

Tom Clancy’s Rainbow

Six® Siege

-

Gameplay reveals of Mario +

Rabbids®: Sparks of Hope and

Skull and Bones™, to be released on

October 20 and November 8, 2022, respectively

-

Reveal of Tom Clancy’s

The Division® Resurgence for

mobile, in line with stated strategy of expanding the

brand’s universe to a significantly larger audience

-

Signature of a new high-value

licensing partnership on mobile

for one of our AAA brands

-

Avatar:

Frontiers of

Pandora™ will now release in

2023-24

-

Ubisoft will reveal the future of the

Assassin’s Creed brand in September

- 2022-23

non-IFRS operating income target

of approximately

€400 million

confirmed

- Strong

support of Ubisoft’s

shareholders at the Annual

General Meeting: all resolutions were

approved with a minimum of 95%. The Board is now composed of an

absolute majority of independent directors, 45% women and three

employee-representatives

-

Play Green: In

line with its environmental commitment, Ubisoft is the first

pure-player video game company to get its official Target

Validation by the Science Based Target initiative

Paris, July

21,

2022 – Today, Ubisoft released its sales

figures for the first quarter of fiscal 2022-23, i.e., the three

months ended June 30, 2022.

Frédérick Duguet, Chief Financial Officer, said

"We delivered a slightly better than expected performance in the

quarter, with notably outperformances from Rainbow Six Siege and

the Assassin’s Creed brand. The past months have been very active,

with the gameplay reveals of Mario Rabbids: Sparks of Hope and

Skull and Bones. Players’ feedback for the reveal of The Division

Resurgence and for the ongoing tests of Rainbow Six Mobile, The

Division Heartland and XDefiant have been supportive.”

Yves Guillemot, Co-Founder and Chief Executive

Officer, said "As our teams are intensely focused on delivering

memorable experiences to players across platforms, business models

and geographies, we continue to work on the richest pipeline in the

Company’s history. We have an unprecedented opportunity to leverage

the strength of our IPs to a significantly wider audience. The new

high-value mobile partnership for one of our brands reflects the

powerful appeal of our brands for the fast-growing AAA mobile

segment. It also provides our teams with more time to fully realize

their creative vision and deliver high-quality experiences for our

fans, while at the same time increasing our visibility for both

2022-23 and 2023-24.”

Yves Guillemot concluded “As we concentrate on

unlocking the value of these initiatives, we are simultaneously

adapting our organization to current economic uncertainties through

cost optimization. We are also working hard to design the most

efficient working conditions to ensure both flexibility for our

teams as well as strong productivity and high-quality content. We

are confident that we are entering a multi-year cycle of

significant topline and operating income growth.”

Q1 ACTIVITY

Tom Clancy’s Rainbow

Six Siege performed ahead of expectations. The team has

been hard at work to deliver very ambitious Year 7 content,

translating into a stabilization of PRI thanks to a very strong

DARPU and Battle Pass conversion.

The Assassin’s Creed brand also

performed ahead of expectations on the back of a strong quarter

from Odyssey, Origins and Valhalla. We saw a significant uptick in

overall engagement, with double-digit active player growth versus

last year as players were excited by the beginning of the campaign

for the 15th Anniversary of the brand. This campaign will be marked

by a series of celebrations for the community throughout the summer

that will lead to the unveiling of the future of Assassin’s Creed

in September during a very special event.

Roller

Champions™ has been well received by

players for its fun and dynamic gameplay. On both retention and

revenues KPIs, Roller Champions is tracking ahead of Hyper

Scape™.

PIPELINE OF GAMES

Ubisoft showcased Mario + Rabbids:

Sparks of Hope, set to release on October 20th, with a

first glimpse into its gameplay. The community applauded the

tactical aspect of the game, and Gamespot described the upcoming

game as “primed to surprise players all over again, with a greater

degree of flexibility and more Mario like mechanics”. The community

is eagerly awaiting its launch which is one of the most anticipated

Nintendo Switch releases this year.

Skull and

Bones also made its comeback with an extended

gameplay walkthrough. The core strength of the game revolves around

its unique combination of a gritty pirate fantasy, dynamic and

action-packed naval combat as well as multiplayer features, based

on both co-op and PvP, that will allow players to have memorable

moments with friends. The game will release on November 8th.

On free-to-play, we revealed Tom

Clancy’s The Division: Resurgence the

upcoming mobile title in the brand’s universe. Built from the

ground up on mobile, the game will be based on an independent

storyline and stay true to the brand DNA with a vast open world in

a very detailed urban environment with stunning graphics for the

platform. With this title, we are bringing The Division franchise

to a significantly larger audience. Initial player reception has

been very positive.

The quarter was also very active on the other

Free-to-Play initiatives as different testing phases for

XDefiant, Tom Clancy’s

Rainbow Six Mobile and The Division

Heartland took place around the world. Player feedback was

supportive throughout these respective tests which will continue

over the coming months.

Avatar:

Frontiers of Pandora

will now release in 2023-24. We are committed to delivering a

cutting-edge immersive experience that takes full advantage of

next-gen technology, as this amazing global entertainment brand

represents a major multi-year opportunity for Ubisoft.

We also decided to release in 2023-24 a smaller

unannounced premium game, originally slated for 2022-23.

While this additional development time is a

reflection of the current ongoing constraints on productions across

the industry, we are hard at work to design the most efficient

working conditions to ensure both flexibility for our teams as well

as strong productivity while delivering the best experiences to

players.

Ubisoft Forward will return on

September 10th, with updates and news on multiple games and

projects from our teams around the world.

PLAY GREEN: PROGRESS ON UBISOFT’S

ENVIRONMENTAL COMMITMENTS

Ubisoft has received the official Target

Validation from the Science Based Target initiative (SBTi),

confirming that Ubisoft’s 2030 carbon reduction objective is in

line the goal to limit global warming to 1.5°C. Ubisoft is the

first pure-player video game company to receive its official Target

Validation by the SBTi.

APPROVAL OF ALL RESOLUTIONS AT UBISOFT’S

ANNUAL GENERAL MEETING

Ubisoft’s shareholders approved all the

resolutions on the agenda for its Annual General Meeting early July

with approval rates above 95%. The vote notably led to the

appointment of Claude France as independent director, who brings

her expertise in technology, both in cloud and online services, as

well as her experience working in international multi-cultural

environments. With this appointment, the Board returns to an

absolute majority of independent directors, reaches 45% women, and

includes three employee-representatives.

Note The Group

presents indicators which are not prepared strictly in accordance

with IFRS as it considers that they are the best reflection of its

operating and financial performance. The definitions of the

non-IFRS indicators are appended to this press release.

Sales and net bookings

|

In € millions |

Q1 2022-23 |

Q1 2021-22 |

|

|

Sales (IFRS 15) |

318.2 |

352.8 |

|

|

Deferred revenues related to IFRS 15 |

(24.9) |

(26,8) |

|

|

Net bookings |

293.3 |

326.0 |

|

IFRS 15 sales for the first quarter of 2022-23

came to €318.2 million, down 9.8% (13.9% at constant exchange

rates1) compared with the €352.8 million generated in first-quarter

2021-22.

First-quarter 2022-23 net bookings totaled

€293.3 million, exceeding the target of around €280.0 million

and down 10.0% (14.2% at constant exchange rates) on the €326.0

million figure for the first quarter of 2021-22.

Outlook

Second-quarter 2022-23

Net bookings for the second quarter of 2021-22

are expected to come in at around €270 million.

Full-year 2022-23

The Company continues to expect significant net

bookings growth and confirms its non-IFRS operating income target

of approximately €400 million for full-year 2022-23.

Conference call

Ubisoft will hold a conference call today,

Thursday July 21, 2022, at 6:15 p.m. Paris time/5:15 p.m. London

time/12:15 p.m. New York time. The conference call will take

place in English and can be accessed live and via replay by

clicking on the following link:

https://edge.media-server.com/mmc/p/i7nx7k77

Contacts

Investor RelationsJean-Benoît

RoquetteSVP Investor Relations+ 33 1 48 18 52

39Jean-benoit.roquette@ubisoft.com

| Alexandre Enjalbert

Senior Investor Relations Manager +33 1 48 18 50 78

Alexandre.enjalbert@ubisoft.com |

Press Relations Michael Burk

Senior Director of Corporate Public Relations + 33 1 48 18 24 03

Michael.burk@ubisoft.com

DisclaimerThis press release

may contain estimated financial data, information on future

projects and transactions and future financial results/performance.

Such forward-looking data are provided for information purposes

only. They are subject to market risks and uncertainties and may

vary significantly compared with the actual results that will be

published. The estimated financial data have not been audited by

the Statutory Auditors. (Additional information is provided in the

most recent Ubisoft Registration Document filed on June 14, 2022

with the French Financial Markets Authority (l’Autorité des Marchés

Financiers)).

About UbisoftUbisoft is a

creator of worlds, committed to enriching players’ lives with

original and memorable entertainment experiences. Ubisoft’s global

teams create and develop a deep and diverse portfolio of games,

featuring brands such as Assassin’s Creed®, Brawlhalla®, For

Honor®, Far Cry®, Tom Clancy’s Ghost Recon®, Just Dance®, Rabbids®,

Tom Clancy’s Rainbow Six®, The Crew®, Tom Clancy’s The Division®,

and Watch Dogs®. Through Ubisoft Connect, players can enjoy an

ecosystem of services to enhance their gaming experience, get

rewards and connect with friends across platforms. With Ubisoft+,

the subscription service, they can access a growing catalog of more

than 100 Ubisoft games and DLC. For the 2021–22 fiscal year,

Ubisoft generated net bookings of €2,129 million. To learn more,

please visit: www.ubisoftgroup.com.

© 2022 Ubisoft Entertainment. All Rights

Reserved. Ubisoft and the Ubisoft logo are registered trademarks in

the US and/or other countries.

APPENDICES

Definition of non-IFRS financial

indicators

Net bookings corresponds to sales restated for

the services component and including unconditional amounts related

tolicense or distribution agreements recognized independently of

the achievement of performance obligations.

Player Recurring Investment (PRI) corresponds to

sales of digital items, DLC, season passes, subscriptions and

advertising.

Non-IFRS operating income calculated based on

net bookings corresponds to operating income less the following

items:

- Stock-based compensation expense

arising on free share plans, group savings plans and/or stock

options.

- Depreciation of acquired intangible

assets with indefinite useful lives.

- Non-operating income and expenses

resulting from restructuring operations within the Group.

Breakdown of net bookings by geographic

region

|

|

Q1

2022-23 |

Q1 2021-22 |

|

Europe |

29% |

33% |

| North America |

51% |

50% |

|

Rest of the world |

20% |

17% |

|

TOTAL |

100% |

100% |

Breakdown of net bookings by

platform

|

|

Q1 2022-23 |

Q1 2021-22 |

|

|

CONSOLES |

47% |

57% |

| PC |

27% |

24% |

| MOBILE |

12% |

13% |

|

Others* |

14% |

6% |

|

TOTAL |

100% |

100% |

*Ancillaries, etc.

Title release

schedule2nd

quarter (July

– September

2022)

|

DIGITAL

ONLY |

|

|

|

ANNO® 1800: Empire of the Skies |

PC |

|

FOR HONOR®: Year 6 – Season 3 |

PC, PLAYSTATION®4, XBOX ONE |

|

RIDERS REPUBLIC™: Season 3 - Summer break |

AMAZON LUNA, PC, PLAYSTATION®4, PLAYSTATION®5, STADIA, XBOX

ONE, XBOX SERIES X/S |

|

RIDERS REPUBLIC™: Season 4 – Freestylin' |

AMAZON LUNA, PC, PLAYSTATION®4, PLAYSTATION®5, STADIA, XBOX

ONE, XBOX SERIES X/S |

|

ROCKSMITH®+ |

PC |

|

ROLLER CHAMPIONS™: Season 2 |

NINTENDO SWITCH™, PC, PLAYSTATION®4, STADIA, XBOX

ONE |

|

THE CREW® 2: Season 6 – Episode 2 |

PC, PLAYSTATION®4, STADIA, XBOX ONE |

|

TOM CLANCY’S RAINBOW SIX® SIEGE: Year 7 – Season 3 |

AMAZON LUNA, PC, PLAYSTATION®4, PLAYSTATION®5, STADIA, XBOX

ONE, XBOX SERIES X/S |

|

TOM CLANCY’S THE DIVISION® 2: Season 10 |

AMAZON LUNA, PC, PLAYSTATION®4, PLAYSTATION®5,STADIA, XBOX

ONE, XBOX SERIES X/S |

1 Sales at constant exchange rates are

calculated by applying to the data for the period under review the

average exchange rates used for the same period of the previous

fiscal year.

- Download the press release

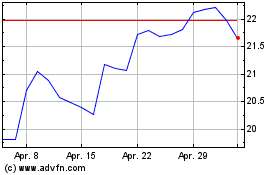

UBISoft Entertainment (EU:UBI)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

UBISoft Entertainment (EU:UBI)

Historical Stock Chart

Von Apr 2023 bis Apr 2024