UBISOFT REPORTS FULL-YEAR 2021-22 EARNINGS FIGURES

UBISOFT REPORTS

FULL-YEAR

2021-22

EARNINGS FIGURES

Significant progress on key strategic

priorities

Ubisoft’s three largest brands each

generated well over 300 M€ of net bookings this

year, a first in Ubisoft’s history

Focused on delivering Ubisoft’s richest

ever pipeline and significant growth

Continued transformation of the

organization

Download the press release

Download the slideshow

|

|

FY 2021-22(In €m) |

Reported change vs. 2020-21

|

In % of total net bookings |

|

|

12 months 2021-22 |

12 months 2020-21 |

|

IFRS 15 sales |

2,125.2 |

-4.4% |

NA |

NA |

|

Net bookings |

2,128.5 |

-5.0% |

NA |

NA |

|

Digital net bookings |

1,665.7 |

+3.5% |

78.3% |

71.8% |

|

PRI net bookings |

812.8 |

+4.2% |

38.2% |

34.8% |

|

Back-catalog net bookings |

1,426.5 |

+11.1% |

67.0% |

57.3% |

|

IFRS operating income |

241.5 |

-16,6% |

NA |

NA |

|

Non-IFRS operating income |

407.6 |

-13.9% |

19.1% |

21.1% |

DELIVERING ON KEY STRATEGIC PRIORITIES

- Building major

franchises: In 2021-22, Ubisoft’s three largest brands

each generated well over 300 M€ of net bookings

- Assassin’s

Creed®: Brand’s net bookings nearly

doubling vs 2019-20, the prior release-free year. Stellar

performance of Assassin’s Creed Valhalla, with more unique players

in 2021-22 than in 2020-21

- Far

Cry®: Best year ever for the brand

- Tom Clancy’s

Rainbow Six®: Net bookings growth

on the back of the brand’s expansion with Rainbow Six Extraction.

Very positive reception for Rainbow Six Siege Year 7 roadmap

- Growing the recurring

profile of our business: Back-catalog up 11.1%, and

represented more than 50% of total net bookings for the fourth

consecutive year

- Continued transformation of

the organization

- Expansion of the Executive

Committee and new independent board member

- Evolved capital allocation

decision-making process with new brand, editorial, production and

technology leaderships and framework

- Attracted numerous top-tier talents

and welcomed back more than 600 talents1

- Continuous progress in Diversity

and Inclusion: 25% of Ubisoft’s workforce is women vs. 22% two

years ago. Strong representation of women at leadership levels:

respectively 42% and 45% for the Executive Committee and the

Board2

2022-23

TARGET: Significant top-line

growth and non-IFRS operating income of around 400

M€Paris, May

11,

2022 – Today, Ubisoft released

its earnings figures for fiscal 2021-22.

Yves Guillemot, Co-Founder and Chief Executive

Officer, said “My first thoughts today go to our more than 1,000

Ukrainian team members. I want to reiterate our unwavering

solidarity and we will keep on doing everything in our power to

support our colleagues as they go through those extremely difficult

times.

The past two years have been intense. We

delivered the biggest line-up of quality content of the industry

despite many challenges, including the adaptation to new hybrid

production models. At the same time, we have been thoroughly

transforming our organization as we prepare to capture the many

great opportunities our fast-evolving industry has to offer and

continue to deliver amazing experiences to players. We appointed

new leaders across the company, expanded our Executive Committee,

and continued building best-in-class governance. Last year, we

welcomed back more than 600 talents who had previously worked at

Ubisoft, reflecting our reputation as a great place to work. We

also made significant additions to our teams, from industry leading

producers and creators to highly recognized experts in artificial

intelligence and programming. Women now represent 25% of our total

workforce, and represented one third of total recruitment in the

past 12 months. Furthermore, we have a strong representation of

women at leadership levels with respectively 42% and 45% for the

Executive Committee and the Board3. We have ambitious plans to

continue building a more diverse and inclusive organization.”

Frédérick Duguet, CFO commented “Our full-year

performance was built on many brands and content, across new

releases and back-catalog, as well as our capacity to increasingly

leverage the competition among platforms through high-value

partnerships. Our three biggest brands, Assassin’s Creed, Far Cry

and Rainbow Six, each delivered well over 300 M€ of net bookings, a

first in Ubisoft’s history, reflecting Assassin’s Creed Valhalla’s

stellar performance, Far Cry’s best year ever and the expansion of

the Rainbow Six universe.

For 2022-23 we look to return to significant

topline growth. It will be mostly driven by a diverse line-up of

premium games, including Avatar: Frontiers of Pandora™, Mario +

Rabbids®: Sparks of Hope and Skull &

Bones®, as well as other exciting titles. This

growth will also benefit from our Free-to-Play releases, especially

those based on our biggest IPs.”

Yves Guillemot concluded “Over the past year,

despite meaningful challenges we have progressed on key strategic

priorities, including growing our major brands, building an

increasingly recurring business, and implementing profound

transformation of our organization. During demanding times, our

teams have showcased great resilience. As an organization, we have

demonstrated that we can rely on dependable brands, production and

technology assets which are stronger than ever at a time when the

value of assets has never been so high.

On the technology side, we have been developing

cutting-edge capabilities at the service of players’ experience,

from our leading engines Anvil and Snowdrop, to i3D.net our

fast-growing video-game hosting provider, to promising investments

in cloud computing with Scalar, as well as in Voxels and Web3.

We are now entering a new multi-year phase of

significant topline growth, spurred by the major progression of our

investments over the past years. We have ambitious plans to grow

our biggest franchises with notably four promising mobile games

under development, and to expand our overall portfolio with new IPs

and massive entertainment licensed brands. We are diversifying our

operations through more business models, more platforms and we are

continuing to grow our recurring profile. As a consequence, we

expect a significant progression of our operating income, starting

in 2023-24.”

A DEPENDABLE ORGANIZATION DURING

CHALLENGING TIMES

The past two years have been challenging for the

industry. Prospects are as promising as ever, with an

ever-expanding total addressable market, falling platform, business

model and geographical barriers, as well as exciting new

technological breakthroughs. However, these come alongside great

competition, with growing player expectations and an abundance of

high-quality content.

To adapt to the industry’s continued evolution

and position Ubisoft for major growth opportunities, during the

past two years we have implemented a thorough transformation of our

organization and focused on creating a more inclusive culture (see

next section).

Simultaneously, the Covid crisis has led to

major production challenges across the industry that have caused

more than 30 premium titles being delayed in calendar year 2021

alone and, while clear productivity improvements are being made,

every month continues to see major content postponed. These

production challenges have been exacerbated over the past 12 months

by The Great Reshuffle trend that has been impacting all industries

across the world.

In this context, Ubisoft has been able to

deliver the biggest line-up of quality content of the industry over

the past two years. Players have been enjoying amazing experiences

with recent titles including Assassin’s Creed Valhalla, Far Cry 6,

Immortals® Fenyx Rising, Just

Dance® or Riders Republic™ as

well as an exciting array of live content and services across our

portfolio. In 2021-22, for the first time in Ubisoft’s history, our

three biggest brands, Assassin’s Creed, Tom Clancy’s Rainbow Six

and Far Cry, each generated well above 300 M€ of net bookings. This

is a testament to our teams’ passion and hard work as well as to

the resilience of our organization.

In the short term, we will develop and build on

the already significant progress we have made on the transformation

of our organization. While we expect the external challenges to

continue, we have been hard at work to mitigate them. With an

increasingly robust hybrid working arrangement, we are gradually

getting closer to the levels of productivity we had before the

pandemic.

THE THOROUGH

TRANSFORMATION OF OUR ORGANIZATION IS

STARTING TO BEAR FRUIT

Best-in-Class GovernanceWe have

appointed Claude France as a new independent board member. She

brings her expertise in technology, notably in cloud and online

services as well as her experience working in international

multi-cultural environments. With this appointment, that is subject

to shareholder approval, the Board will once again have an absolute

majority of independent directors and 45% women representation, in

line with our commitment. As a reminder, in addition to the

presence of a Lead Independent Director and 3 employees on the

Board, our Audit committee and Compensation, Nomination &

Governance committee are fully independent, and the CSR committee

is headed by an independent Board member.

Expansion of our Executive

Committee to accelerate

the Group’s

transformation and strategyOur thorough

transformation is notably reflected in the expansion of our

Executive Committee, announced today, with a broader scope,

including new managers and new roles. We now have 42% women

representation, in line with our commitment to create a more

diverse company.

Appointment of

Marie-Sophie de Waubert as SVP

Studio OperationsMarie-Sophie de Waubert, a Ubisoft

veteran with more than 20 years’ experience in the video game

industry, was appointed as Ubisoft’s SVP Studio Operations.

Marie-Sophie will be responsible for defining and implementing the

strategy for Ubisoft’s production studios around the world,

empowering teams to create exciting and innovative games,

technologies, and services.

Evolved

decision-making process

for our productions’ capital

allocationWe have evolved our decision-making

process for managing our productions’ capital allocation, with a

close collaboration between the Brand Portfolio Management team

(created under the management of Sandrine Caloiaro), the Editorial

team (under the management of Igor Manceau) and the Production

Project Management team (under the management of Martin Schelling).

They will work in close cooperation with Marie-Sophie de Waubert’s

team. This new framework is destined to:

- Define each brand’s DNA and market

opportunities

- Create

long-lasting meaningful experiences that will fulfil players rising

expectations for self-expression and social experiences

- Define a new

global set of KPIs and processes to deliver even more

predictability in Ubisoft’s productions

Alignment of technology

developmentsIn parallel, one year ago we created the role

of VP Production Technology, with the recruitment of Guillemette

Picard. This was designed to ensure alignment of our technologies

across Ubisoft, and maximize the focus on both our biggest existing

opportunities and the most promising technological breakthroughs.

As part of this process, we took the decision to focus our engine

efforts on the development of our industry-leading Anvil and

Snowdrop proprietary tools - and as a consequence to progressively

sunset the Dunia engine - as well as on the development of our

cloud-native technology, Scalar.

Overhaul of our HR

organizationAt the human resources level, Anika Grant, our

Chief People Officer, and her team have been hard at work on the

evolution of the HR organization and on helping build a safe,

respectful, and inclusive workplace for everyone at Ubisoft. In

parallel, Raashi Sikka, Vice President of Global Diversity &

Inclusion, and her team have been focused on embedding diversity

and inclusion frameworks into Ubisoft’s policies and processes, as

well as implementing an effective structure for the Group’s

ERGs.

As with other industries and with our peers,

attrition has been a challenge this year. Despite this, we have

continued to benefit from strong talent attraction. We have made

significant additions to our teams in the recent months, from

industry leading producers and creators like Fawzy Mesmar and

Cameron Lee to recognized experts in artificial intelligence and

programming. Also, we were happy to welcome back more than 600

talents last year4. Additionally, the actions we have implemented

on talent retention are starting to pay-off.

Creation of new Global

Publishing and Direct-to-Player groupsWith falling

platform, business model and geographical barriers, Ubisoft has

profoundly transformed its publishing organization, moving from a

region-based to an efficient and agile global organization. A

dedicated team overseeing Ubisoft’s Direct-to-Player initiatives

has also been created with very ambitious development goals for

Ubisoft Connect and Ubisoft+, leveraging our large community of

engaged players and our deep and diversified portfolio of

proprietary franchises.

DELIVERING ON OUR STRATEGY

STARTING IN

2022-23 WITH EXCITING PREMIUM AND F2P

TITLES ACROSS ALL PLATFORMS

Over the past five years we have meaningfully

grown our talent force with ambitious roadmaps for our biggest

brands to bring them to new heights, to expand meaningfully our

portfolio and to continue building an increasingly recurring

business. We have been working on the biggest pipeline in Ubisoft’s

history through a mix of highly ambitious premium games,

multiplatform Free-to-Play experiences to reach significantly wider

audiences, new internally developed brands as well as titles based

on massive entertainment brands licenses.

2022-23 will see the first benefits from this

strategy as we look to significantly grow our topline. The biggest

driver of our topline growth will be our diverse line-up of premium

games, including Avatar: Frontiers of Pandora, Mario + Rabbids:

Sparks of Hope and Skull & Bones, as well as other exciting

titles. Our growth will also benefit from our Free-to-Play

releases, based notably on our biggest IPs. Some of these titles

have been undergoing internal and external test phases and are in

final stages of development. We expect they will be a meaningful

driver of PRI progression in FY23.

Note The Group presents

indicators which are not prepared strictly in accordance with IFRS

as it considers that they are the best reflection of its operating

and financial performance. The definitions of the non-IFRS

indicators as well as a reconciliation table between the IFRS

consolidated income statement and the non-IFRS consolidated income

statement are provided in an appendix to this press release.

Income statement and key financial data

|

In € millions |

2021-22 |

% |

2020-21 |

% |

|

|

IFRS 15 sales |

2,125.2 |

|

2,223.8 |

|

|

|

Deferred revenues related to IFRS 15 |

3.3 |

|

16.7 |

|

|

|

Net bookings |

2,128.5 |

|

2,240.6 |

|

|

|

Gross margin based on net bookings |

1,858.8 |

87.3% |

1,914.8 |

85.5% |

|

|

Non-IFRS R&D expenses |

(782.7) |

-36.8% |

(784.9) |

-35.0% |

|

|

Non-IFRS selling expenses |

(408.6) |

-19.2% |

(438.1) |

-19.6% |

|

|

Non-IFRS G&A expenses |

(259.9) |

-12.2% |

(218.4) |

-9.7% |

|

|

Total non-IFRS SG&A expenses |

(668.6) |

-31.4% |

(656.6) |

-29.3% |

|

|

Non-IFRS operating income |

407.6 |

19.1% |

473.3 |

21.1% |

|

|

IFRS operating income |

241.5 |

|

289.4 |

|

|

|

Non-IFRS diluted EPS (in €) |

2.11 |

|

2.48 |

|

|

|

IFRS diluted EPS (in €) |

0.65 |

|

0.85 |

|

|

|

Non-IFRS cash flows from operating

activities(1) |

(191.6) |

|

169.0 |

|

|

|

R&D investment expenditure |

1,195.6 |

|

1,104.2 |

|

|

|

Non-IFRS net cash/(debt) position |

(282.7) |

|

79.2 |

|

|

(1) Based on the consolidated cash flow

statement for comparison with other industry players (not audited

by the Statutory Auditors).

Sales and net bookings

IFRS 15 sales for the fourth quarter of 2021-22

came to €708.0 million, up 41.1% (or 38.0% at constant exchange

rates5) on the €501.8 million generated in fourth-quarter 2020-21.

IFRS 15 sales for full-year 2021-22 totaled €2,125.2 million, down

4.4% (or 4.8% at constant exchange rates) versus the 2020-21 figure

of €2,223.8 million.

Fourth-quarter 2021-22 net bookings totaled

€664.2 million, up 37.0% (or 33.7% at constant exchange rates) on

the €484.9 million recorded for fourth-quarter 2020-21. Net

bookings for full-year 2021-22 amounted to €2,128.5 million, down

5.0% (or 5.4% at constant exchange rates) on the €2,240.6 million

figure for 2020-21.

Main income statement

items6

Non-IFRS operating income came in at €407.6

million, versus €473.3 million in 2020-21.

Non-IFRS attributable net income amounted to

€269.0 million, representing non-IFRS diluted earnings per share

(EPS) of €2.11, compared with non-IFRS attributable net income of

€313.5 million and non-IFRS diluted earnings per share of €2.48 for

2020-21.

IFRS attributable net income totaled €79.1

million, representing IFRS diluted EPS of €0.65 (compared with IFRS

attributable net income of €103.1 million and IFRS diluted earnings

per share of €0.85 for 2020-21).

Main cash flow

statement7 items

Non-IFRS cash flows from operating activities

represented a net cash outflow of €191.6 million in 2021-22 (versus

a net cash inflow of €169.0 million in 2020-21). It reflects a

negative €55.0 million in non-IFRS cash flow from operations

(versus a positive €64.6 million in 2020-21) and an €136.6 million

increase in non-IFRS working capital requirement (compared with an

€104.5 million decrease in 2020-21).

Main balance sheet items and

liquidity

At March 31, 2022, the Group’s equity was €1,807

million and its non-IFRS net debt was €283 million versus non-IFRS

net cash of €79 million at end of March 31, 2021. IFRS net debt

totaled €618 million at March 31, 2022, of which €335 million

related to the IFRS16 accounting restatement.

Outlook

First-quarter 2022-23

Net bookings for the first quarter of 2022-23

are expected to come in at around €280 million.

Full-year 2022-23

The Company is introducing its targets for

2022-23:

- Significant net bookings

growth

- Non-IFRS operating income of

approximately 400 M€

Conference call

Ubisoft will hold a conference call today,

Wednesday May 11, 2022, at 6:15 p.m. Paris time/12:15 p.m. New York

time. The conference call can be accessed live and via replay by

clicking on the following link:

https://edge.media-server.com/mmc/p/z2sb2zob

Contacts

|

Investor Relations Jean-Benoît RoquetteSVP

Investor Relations+ 33 1 48 18 52

39Jean-benoit.roquette@ubisoft.com |

Press Relations Michael Burk Senior

Director of Corporate Public Relations + 33 1 48 18 24 03

Michael.burk@ubisoft.com |

| Alexandre

Enjalbert Senior Investor Relations Manager + 33 1 48 18 50 78

Alexandre.enjalbert@ubisoft.com |

|

DisclaimerThis press release

may contain estimated financial data, information on future

projects and transactions and future financial results/performance.

Such forward-looking data are provided for information purposes

only. They are subject to market risks and uncertainties and may

vary significantly compared with the actual results that will be

published. The estimated financial data have been approved by the

Supervisory Board on May 11, 2022, and have not been audited by the

Statutory Auditors. (Additional information is provided in the most

recent Ubisoft Registration Document filed on June 10, 2021 with

the French Financial Markets Authority (l’Autorité des Marchés

Financiers)).

About UbisoftUbisoft is a

creator of worlds, committed to enriching players’ lives with

original and memorable entertainment experiences. Ubisoft’s global

teams create and develop a deep and diverse portfolio of games,

featuring brands such as Assassin’s Creed®, Brawlhalla®, For

Honor®, Far Cry®, Tom Clancy’s Ghost Recon®, Just Dance®, Rabbids®,

Tom Clancy’s Rainbow Six®, The Crew®, Tom Clancy’s The Division®,

and Watch Dogs®. Through Ubisoft Connect, players can enjoy an

ecosystem of services to enhance their gaming experience, get

rewards and connect with friends across platforms. With Ubisoft+,

the subscription service, they can access a growing catalog of more

than 100 Ubisoft games and DLC. For the 2021–22 fiscal year,

Ubisoft generated net bookings of €2,129 million. To learn more,

please visit: www.ubisoftgroup.com.

© 2022 Ubisoft Entertainment. All Rights

Reserved. Ubisoft and the Ubisoft logo are registered trademarks in

the US and/or other countries.

APPENDICES

Definition of non-IFRS financial

indicators

Net bookings corresponds to the sales excluding

the services component and integrating the unconditional amounts

related to license contracts recognized independently of the

performance obligation realization.

Player Recurring Investment (PRI) corresponds to

sales of digital items, DLC, season passes, subscriptions and

advertising.

Non-IFRS operating income calculated based on

net bookings corresponds to operating income less the following

items:

- Stock-based compensation expense

arising on free share plans, group savings plans and/or stock

options.

- Depreciation of acquired intangible

assets with indefinite useful lives.

- Non-operating income and expenses

resulting from restructuring operations within the Group.

Non-IFRS operating margin corresponds to

non-IFRS operating income expressed as a percentage of net

bookings. This ratio is an indicator of the Group’s financial

performance.

Non-IFRS net income corresponds to net income

less the following items:

- The above-described deductions used

to calculate non-IFRS operating income.

- Income and expenses arising on

revaluations, carried out after the measurement period, of the

potential variable consideration granted in relation to business

combinations.

- OCEANE bonds’ interest expense

recognized in accordance with IFRS9.

- The tax impacts on these

adjustments.

Non-IFRS attributable net income corresponds to

non-IFRS net income attributable to owners of the parent.

Non-IFRS diluted EPS corresponds to non-IFRS

attributable net income divided by the weighted average number of

shares after exercise of the rights attached to dilutive

instruments.

The adjusted cash flow statement includes:

- Non-IFRS cash flow from operations

which comprises:

- The costs of internally developed

software and external developments (presented under cash flows from

investing activities in the IFRS cash flow statement) as these

costs are an integral part of the Group's operations.

- The restatement of impacts (after

tax) related to the application of IFRS 15.

- The restatement of commitments

related to leases due to the application of IFRS 16.

- Current and deferred taxes.

- Non-IFRS change in working capital

requirement which includes movements in deferred taxes and restates

the impacts (after tax) related to the application of IFRS 15, thus

cancelling out the income or expenses presented in non-IFRS cash

flow from operations.

- Non-IFRS cash flows from operating

activities which includes:

- the costs of internal and external

licenses development (presented under cash flows from investing

activities in the IFRS cash flow statement and included in non-IFRS

cash flow from operations in the adjusted cash flow

statement);

- the restatement of lease

commitments relating to the application of IFRS 16 presented under

IFRS in cash flow from financing activities.

- Non-IFRS cash flows from investing

activities which excludes the costs of internal and external

licenses development that are presented under non-IFRS cash flow

from operations.

Free cash flow corresponds to cash flows from

non-IFRS operating activities after cash inflows/outflows arising

on the disposal/acquisition of other intangible assets and

property, plant and equipment.

Free cash flow before working capital

requirement corresponds to cash flow from operations after cash

inflows/outflows arising on (i) the disposal/acquisition of other

intangible assets and property, plant and equipment and (ii)

commitments related to leases recognized on the application of IFRS

16.

Cash flow from non-IFRS financing activities,

which excludes lease commitments relating to the application of

IFRS16 presented in non-IFRS cash flow from operation.

IFRS net cash/(debt) position corresponds to

cash and cash equivalents and cash management financial assets less

financial liabilities excluding derivatives.

Non-IFRS net cash/(debt) position corresponds to

the net cash/(debt) position as adjusted for commitments related to

leases (IFRS 16).

Breakdown of net bookings by geographic

region

|

|

Q4

2021-22

|

Q4 2020-21 |

12 months

2021-22

|

12 months 2020-21 |

|

Europe |

38% |

36% |

36% |

36% |

| Northern

America |

46% |

48% |

48% |

49% |

|

Rest of the world |

16% |

16% |

16% |

15% |

|

TOTAL |

100% |

100% |

100% |

100% |

Breakdown of net bookings by

platform

|

|

Q4 2021-22 |

Q4 2020-21 |

12 months 2021-22 |

12 months 2020-21 |

|

CONSOLES |

59% |

63% |

60% |

65% |

| PC |

27% |

21% |

26% |

23% |

| MOBILE |

9% |

9% |

9% |

8% |

|

Others* |

5% |

7% |

5% |

4% |

|

TOTAL |

100% |

100% |

100% |

100% |

*Ancillaries, etc.

Title release

schedule 1st

quarter (April - June 2022)

|

PACKED &

DIGITAL

|

|

|

|

RABBIDS®: PARTY OF LEGENDS (global release) |

NINTENDO SWITCH™, PLAYSTATION®4, STADIA, XBOX

ONE |

|

DIGITAL

ONLY

|

|

|

|

ANNO® 1800: SEEDS OF CHANGE |

PC |

|

ASSASSIN’S CREED® VALHALLA: Discovery Tour Viking Age |

AMAZON LUNA, PC, PLAYSTATION®4, PLAYSTATION®5,

STADIA, XBOX ONE, XBOX SERIES X/S |

|

FOR HONOR®: Year 6 – Season 2 |

AMAZON LUNA, PC, PLAYSTATION®4, STADIA, XBOX

ONE |

|

RIDERS REPUBLIC™: Season 2 – Showdown |

AMAZON LUNA, PC, PLAYSTATION®4, PLAYSTATION®5,

STADIA, XBOX ONE, XBOX SERIES

X/S |

|

ROLLER CHAMPIONS™ |

AMAZON LUNA, PC, PLAYSTATION®4, PLAYSTATION®5,

STADIA, XBOX ONE, XBOX SERIES

X/S |

|

TOM CLANCY’S THE DIVISION® 2: Season 9 |

AMAZON LUNA, PC, PLAYSTATION®4, STADIA, XBOX ONE

|

|

TOM CLANCY’S RAINBOW SIX® SIEGE: Year 7 – Season 2 |

AMAZON LUNA, PC, PLAYSTATION®4, PLAYSTATION®5,

STADIA, XBOX ONE, XBOX SERIES X/S |

|

UNO®: Valhalla DLC |

NINTENDO SWITCH™, PC, PLAYSTATION®4,

STADIA, XBOX ONE |

Extracts from the Consolidated Financial

Statements at

March 31, 2022

The audit procedures have been carried out and

the audit report is in preparation.

Consolidated income statement (IFRS,

extract from the accounts which have undergone an audit by the

Statutory Auditors).

|

(in € millions) |

03.31.2022 |

03.31.2021 |

|

|

|

|

|

Sales |

2,125.2 |

2,223.8 |

| Cost of sales |

(269.7) |

(325.7) |

| Gross

margin |

1,855.5 |

1,898.1 |

| Research and

Development costs |

(822.5) |

(827.1) |

| Marketing costs |

(412.6) |

(442.8) |

| General and

Administrative costs |

(270.2) |

(228.4) |

| Current

operating income |

350.2 |

399.8 |

| Other non-current

operating income & expense |

(108.7) |

(110.4) |

| Operating

income |

241.5 |

289.4 |

| Net borrowing

costs |

(23.0) |

(17.4) |

| Net foreign exchange

gains/losses |

(1.2) |

(8.2) |

| Other financial

expenses |

(25.4) |

(27.0) |

| Other financial

income |

1.2 |

1.0 |

| Net

financial income |

(48.4) |

(51.6) |

| Share of profit of

associates |

— |

— |

| Income tax |

(113.6) |

(132.6) |

|

Consolidated net income |

79.5 |

105.2 |

|

Net income attributable to owners of the parent company |

79.1 |

103.1 |

|

Net income attributable to non-controlling interests |

0.4 |

2.1 |

|

Earnings per share attributable to owners of the parent

company |

|

|

|

Basic earnings per share (in €) |

0.66 |

0.87 |

|

Diluted earnings per share (in €) |

0.65 |

0.85 |

|

Weighted average number of shares in issue |

119,608,218 |

118,980,402 |

|

Diluted weighted average number of shares |

127,320,735 |

126,286,728 |

Reconciliation of IFRS Net income and

non-IFRS Net income

|

In millions of euros, except for per share

data |

2021-22 |

2020-21 |

|

IFRS |

Adjustment |

Non-IFRS |

IFRS |

Adjustment |

Non-IFRS |

|

IFRS15 Sales |

2,125.2 |

|

2,125.2 |

2,223.8 |

|

2,223.8 |

|

Deferred revenues related to IFRS 15 |

|

3.3 |

3.3 |

|

16.7 |

16.7 |

|

Net bookings |

|

|

2,128.5 |

|

|

2,240.6 |

|

Total Operating expenses |

(1,883.7) |

162.8 |

(1,720.9) |

(1,934.5) |

167.2 |

(1,767.2) |

|

Stock-based compensation |

(54.1) |

54.1 |

0.0 |

(56.8) |

56.8 |

0.0 |

|

Non-current operating income & expense |

(108.7) |

108.7 |

0.0 |

(110.4) |

110.4 |

0.0 |

|

Operating Income |

241.5 |

166.1 |

407.6 |

289.4 |

184.0 |

473.3 |

|

Net Financial income |

(48.4) |

30.7 |

(17.7) |

(51.6) |

32.4 |

(19.1) |

|

Income tax |

(113.6) |

(6.8) |

(120.4) |

(132.6) |

(5.9) |

(138.6) |

|

Consolidated Net Income |

79.5 |

190.0 |

269.5 |

105.2 |

210.4 |

315.6 |

|

Net income attributable to owners of the parent

company |

79.1 |

|

269.0 |

103.1 |

|

313.5 |

|

Net income attributable to non-controlling

interests |

0.4 |

|

0.4 |

2.1 |

|

2.1 |

|

Diluted weighted average number of shares |

127,320,735 |

|

127,320,735 |

126,286,728 |

|

126,286,728 |

|

Diluted earnings per share attributable to parent

company |

0.65 |

1.46 |

2.11 |

0.85 |

1.64 |

2.48 |

Consolidated balance sheet (IFRS,

extract from the accounts which have undergone an audit by

Statutory Auditors)

|

Assets |

|

Net |

Net |

|

(in € millions) |

|

03.31.2022 |

03.31.2021 |

|

Goodwill |

|

132.1 |

220.7 |

|

Other intangible assets |

|

1,882.0 |

1,453.2 |

|

Property, plant and equipment |

|

207.4 |

199.8 |

|

Right of use assets |

|

302.3 |

282.1 |

|

Non-current financial assets |

|

52.3 |

16.1 |

|

Deferred tax assets |

|

180.4 |

173.1 |

|

Non-current assets |

|

2,756.5 |

2,345.0 |

|

Inventory |

|

22.2 |

23.1 |

|

Trade receivables |

|

471.0 |

342.7 |

|

Other receivables |

|

208.1 |

260.6 |

|

Other current financial assets |

|

0.8 |

— |

|

Current tax assets |

|

48.0 |

45.7 |

|

Cash management financial assets* |

|

— |

239.9 |

|

Cash and cash equivalents |

|

1,452.5 |

1,627.7 |

|

Current assets |

|

2,202.7 |

2,539.8 |

|

TOTAL ASSETS |

|

4,959.2 |

4,884.8 |

|

|

|

|

|

|

Liabilities and equity |

|

Net |

Net |

|

(in € millions) |

|

03.31.2022 |

03.31.2021 |

|

Capital |

|

9.7 |

9.6 |

|

Premiums |

|

630.2 |

556.0 |

|

Consolidated reserves |

|

1,088.0 |

987.1 |

|

Consolidated earnings |

|

79.1 |

103.1 |

|

Equity attributable to owners of the parent

company |

|

1,807.1 |

1,655.7 |

|

Non-controlling interests |

|

2.0 |

9.3 |

|

Total equity |

|

1,809.0 |

1,665.0 |

|

Provisions |

|

10.0 |

5.0 |

|

Employee benefit |

|

20.2 |

21.6 |

|

Long-term borrowings and other financial liabilities |

|

1,420.3 |

1,894.9 |

|

Deferred tax liabilities |

|

183.1 |

158.5 |

|

Other non-current liabilities |

|

37.0 |

34.4 |

|

Non-current liabilities |

|

1,670.6 |

2,114.3 |

|

Short-term borrowings and other financial liabilities |

|

649.9 |

200.0 |

|

Trade payables |

|

156.6 |

152.0 |

|

Other liabilities |

|

644.9 |

737.8 |

|

Current tax liabilities |

|

28.1 |

15.8 |

|

Current liabilities |

|

1,479.6 |

1,105.5 |

|

Total liabilities |

|

3,150.2 |

3,219.8 |

|

TOTAL LIABILITIES AND EQUITY |

|

4,959.2 |

4,884.8 |

* Shares of UCITS invested in short-term

maturity securities, which do not meet the criteria for

qualification as cash equivalents defined by IAS 7.

Consolidated cash flow statement (IFRS, extract from the

accounts which have undergone an audit by Statutory

Auditors)

|

In millions of euros |

03.31.2022 |

03.31.2021 |

|

Cash flows from operating activities |

|

|

| Consolidated

earnings |

79.5 |

105.2 |

| +/- Share in profit

of associates |

— |

— |

| +/- Net amortization

and depreciation on property, plant and equipment and intangible

assets |

672.3 |

658.7 |

| +/- Net

Provisions |

6.4 |

(16.1) |

| +/- Cost of

share-based compensation |

54.1 |

56.8 |

| +/- Gains / losses

on disposals |

0.2 |

0.9 |

| +/- Other income and

expenses calculated |

26.4 |

32.6 |

| +/- Income Tax

Expense |

113.3 |

132.6 |

|

TOTAL CASH FLOW FROM OPERATING ACTIVITIES |

952.3 |

970.7 |

|

Inventory |

2.5 |

10.9 |

| Trade

receivables |

(118.2) |

(45.7) |

| Other assets |

59.8 |

(131.4) |

| Trade payables |

1.1 |

1.2 |

| Other

liabilities |

(149.6) |

316.8 |

| Deferred income and

prepaid expenses |

48.8 |

(81.1) |

| +/- Change

in working capital |

(155.6) |

70.7 |

| +/- Current Income

tax expense |

(91.0) |

(83.4) |

|

TOTAL CASH FLOW GENERATED BY OPERATING

ACTIVITIES |

705.7 |

958.0 |

|

Cash flows from investing activities |

|

|

| - Payments for the

acquisition of internal & external developments |

(855.9) |

(753.2) |

| - Payments for the

acquisition of intangible assets and property, plant and

equipment |

(90.6) |

(96.8) |

| + Proceeds from the

disposal of intangible assets and property, plant and

equipment |

0.2 |

0.1 |

| +/- Payments for the

acquisition of financial assets |

(113.4) |

(200.4) |

| + Refund of loans

and other financial assets |

78.3 |

198.1 |

| +/- Changes in scope

(1) |

(26.5) |

(16.0) |

|

CASH GENERATED BY INVESTING ACTIVITIES |

(1,007.9) |

(868.2) |

|

Cash flows from financing activities |

|

|

| + New

borrowings |

158.3 |

1,139.6 |

| - Refund of

leases |

(41.4) |

(35.7) |

| - Refund of

borrowings |

(215.6) |

(506.8) |

| + Funds received

from shareholders in capital increases |

74.4 |

80.7 |

| +/- Change in cash

management assets |

239.9 |

(239.9) |

| +/- Sales /

purchases of own shares |

(117.0) |

25.8 |

|

CASH GENERATED BY FINANCING ACTIVITIES |

98.6 |

463.8 |

|

Net change in cash and cash equivalents |

(203.7) |

553.7 |

| Cash and cash

equivalents at the beginning of the fiscal year |

1,565.2 |

986.9 |

| Foreign exchange

losses/gains |

29.8 |

24.7 |

|

Cash and cash equivalents at the end of the

period |

1,391.4 |

1,565.2 |

|

(1) Including cash in companies acquired and disposed of |

— |

— |

RECONCILIATION OF NET CASH POSITION

|

Cash and cash equivalents at the end of the

period |

1,391.4 |

1,565.2 |

| Bank borrowings

and from the restatement of leases |

(1,972.0) |

(1,938.8) |

| Commercial

papers |

(37.0) |

(93.5) |

| Cash management

financial assets |

— |

239.9 |

|

IFRS NET CASH POSITION |

(617.6) |

(227.2) |

Consolidated cash flow statement for comparison with

other industry players

(non-audited)

|

in € millions |

03.31.2022 |

03.31.2021 |

|

Non-IFRS Cash flows from operating activities |

|

|

| Consolidated

earnings |

79.5 |

105.2 |

| +/- Share in profit

of associates |

— |

— |

| +/- Net Depreciation

on internal & external games & movies |

444.9 |

433.4 |

| +/- Other

depreciation on fixed assets |

227.4 |

225.3 |

| +/- Net

Provisions |

6.4 |

(16.1) |

| +/- Cost of

share-based compensation |

54.1 |

56.8 |

| +/- Gains / losses

on disposals |

0.2 |

0.9 |

| +/- Other income and

expenses calculated |

26.4 |

32.6 |

| +/- Cost of internal

development and license development |

(855.9) |

(753.2) |

| +/- IFRS 15

Impact |

3.4 |

15.4 |

| +/- IFRS 16

Impact |

(41.4) |

(35.7) |

|

Non-IFRS cash flow from operation |

(55.0) |

64.6 |

|

Inventory |

2.5 |

10.9 |

| Trade

receivables |

(118.2) |

(45.7) |

| Other assets |

61.0 |

(126.7) |

| Trade payables |

1.1 |

1.2 |

| Other

liabilities |

(83.0) |

264.8 |

| +/- Non-IFRS

Change in working capital |

(136.6) |

104.5 |

|

Non-IFRS cash flow generated by operating

activities |

(191.6) |

169.0 |

|

Cash flows from investing activities |

|

|

| - Payments for the

acquisition of intangible assets and property, plant and

equipment |

(90.6) |

(96.8) |

|

+ Proceeds from the disposal of intangible assets and property,

plant and equipment |

0.2 |

0.1 |

|

Free Cash-Flow |

(282.0) |

72.3 |

|

+/- Payments for the acquisition of financial assets |

(113.4) |

(200.4) |

| + Refund of loans

and other financial assets |

78.3 |

198.1 |

| +/- Changes in scope

(1) |

(26.5) |

(16.0) |

|

Non-IFRS cash generated by investing

activities |

(152.0) |

(114.9) |

|

Cash flows from financing activities |

|

|

| + New

borrowings |

158.3 |

1,139.6 |

| - Refund of

borrowings |

(215.6) |

(506.8) |

| + Funds received

from shareholders in capital increases |

74.4 |

80.7 |

| +/- Change in

cash management assets |

239.9 |

(239.9) |

| +/- Sales /

purchases of own shares |

(117.0) |

25.8 |

|

Cash generated by financing activities |

139.9 |

499.5 |

|

NET CHANGE IN CASH AND CASH EQUIVALENTS |

(203.7) |

553.6 |

| Cash and cash

equivalents at the beginning of the fiscal year |

1,565.2 |

986.9 |

| Foreign exchange

losses/gains |

29.8 |

24.7 |

|

CASH AND CASH EQUIVALENTS AT THE END OF THE

PERIOD |

1,391.4 |

1,565.2 |

|

(1)Including cash in companies acquired and disposed of |

— |

— |

RECONCILIATION OF NET CASH POSITION

|

CASH AND CASH EQUIVALENTS AT THE END OF THE

PERIOD |

1,391.4 |

1,565.2 |

| Bank borrowings and

from the restatement of leases |

(1,972.0) |

(1,938.8) |

| Commercial

papers |

(37.0) |

(93.5) |

| IFRS 16 |

334.9 |

306.4 |

| Cash management

financial assets |

— |

239.9 |

|

NON-IFRS NET CASH POSITION |

(282.7) |

79.2 |

1 Talents who had left Ubisoft and were rehired in 2021-222

Subject to shareholder approval on the appointment of Claude

France3 Subject to shareholder approval on the appointment of

Claude France4 Talents who had left Ubisoft and we rehired in

2021-225 Sales at constant exchange rates are calculated by

applying to the data for the period under review the average

exchange rates used for the same period of the previous fiscal

year6 See the presentation published on Ubisoft’s website for

further information on movements in the income and cash flow

statement. 7 Based on the consolidated cash flow statement for

comparison with other industry players (non-audited)

- Download the press release

- Download the slideshow

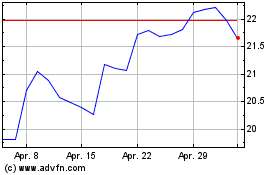

UBISoft Entertainment (EU:UBI)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

UBISoft Entertainment (EU:UBI)

Historical Stock Chart

Von Apr 2023 bis Apr 2024