UBISOFT REPORTS THIRD-QUARTER 2021-22 SALES

UBISOFT REPORTS

THIRD-QUARTER

2021-22 SALESRecent

industry news cast a positive light on Ubisoft’s

organic model and asset strengths

Q3 performance in line with

expectations Robust

back-catalog trends

Ubisoft FY22 Q3 Sales

Net bookings for the first nine months

of fiscal 2021-22

|

|

In €m9

months2021-22 |

Reported change

vs.2020-21 |

% of total net bookings |

|

|

9 months

2021-22 |

9 months 2020-21 |

|

IFRS 15 sales |

1,417.2 |

-17.7% |

NA |

NA |

|

Net bookings |

1,464.3 |

-16.6% |

NA |

NA |

|

Digital net bookings |

1,087.6 |

-12.6% |

74.3% |

70.8% |

|

PRI net bookings |

535.7 |

-9.2% |

36.6% |

33.6% |

|

Back-catalog net bookings |

937.0 |

-7.7% |

64.0% |

57.8% |

-

Third fiscal quarter: Net

bookings of €746.1 million, in line with the target range

-

Back-Catalog up 10% YoY and up 37% vs. Q3 FY20,

together with back-catalog PRI growth, highlighting the strength of

Ubisoft’s recurring business

- Assassin’s

Creed® Valhalla life-to-date net bookings

and PRI were up respectively over 70% and over 80% vs. Assassin’s

Creed Odyssey

- Tom

Clancy’s Rainbow® Six

Siege reached 80 million unique active players

life-to-date, adding 10 million players over the past twelve

months

- Far

Cry® 6 ranked in

the Top

51 of

2021 calendar year new releases and saw playtime per

player and PRI per player

increase respectively

45% and 30% vs. Far Cry

5

- Strong

player reception for Riders

Republic® with playtime per player

and PRI up respectively 60%

and 4x vs.

Steep™

Tom Clancy’s Rainbow

Six Extraction reached 5

million unique active

players, expanding the Rainbow Six

franchise

2021-22 targets

confirmed

Paris,

February 17,

2022 – Today, Ubisoft released

its sales figures for the third quarter of fiscal 2021-22, i.e. the

three months ended December 31, 2021.

Yves Guillemot, Co-Founder and Chief Executive

Officer, said “The beginning of the year offered a striking

confirmation of both the great appeal of the videogame industry and

of the scarcity of high-quality assets. The multiplication of

platforms offers great opportunities for IP creators like Ubisoft.

With our long-term approach and appetite for taking creative risks,

we have developed internally some of the industry’s strongest

proprietary brands as well as the industry’s deepest and most

diversified portfolio. Along the way, we have also built the most

significant production and creative capabilities, cutting-edge

technologies and a strong community of engaged players. This makes

us exceedingly confident about Ubisoft’s future and our capacity to

take full advantage of the industry’s powerful momentum.”

Frédérick Duguet, Chief Financial Officer, said

“Our Q3 performance is once again a demonstration of the robustness

of our model. It is based both on new releases continuously feeding

the deep and diversified stream of revenues from our back-catalog

and on our capacity to leverage the strength of our brands. Q4 will

see very strong growth with very dynamic back-catalog trends,

high-quality new releases, partnerships and significant post-launch

content delivery throughout our brands.”

Yves Guillemot concluded “Looking forward, we

have unmatched production scale and creative firepower. We are

investing in promising new technologies, and we have increasing

access to all distribution venues, platforms, geographies and

business models leveraging the strength of our brands. We could not

be prouder of our teams’ work on what is the richest pipeline of

games in Ubisoft’s history."

An asset-based

model

Value of Ubisoft’s organic model

In a fast-moving IP-based industry with regular

technology, platform and business model breakthroughs, companies

can build a powerful portfolio of assets and strong value by

relying on a range of strategies from organic investments,

partnerships, M&A and licensing to outsourcing. Each approach

requires very large investments. Against this backdrop, the

beginning of the year offered a striking confirmation of both the

great appeal of the videogame industry and of the scarcity of

high-quality assets. It is now very clear that, while the organic

model requires time and iterations, M&A requires unprecedented

levels of investments.

Ubisoft’s assets have never been so

strong at a time when the value of assets has never been so

highOver our 35 years of existence, Ubisoft has developed

the culture, the skills and the organization to create value

organically for our players, talents and shareholders. We believe

the recent industry news has cast a very positive light on what

makes them so valuable. With our long-term approach and appetite

for taking creative risks, we have built some of the strongest

assets in the industry:

- A production

powerhouse, strong of 17,000 talents, structured around the

seasoned Lead & Associate organization of Ubisoft’s global

network of more than 45 studios, which bring together high AAA

production standards with world class creative and engineering

talents.

- The deepest and

most diverse portfolio of proprietary brands in the industry,

including some of the most beloved franchises in videogames:

Assassin’s Creed, Beyond Good & Evil™, Brawlhalla®, The Crew®,

Tom Clancy’s The Division®, Far Cry, For Honor®, Tom Clancy’s Ghost

Recon®, Hungry Shark®, Idle Miner Tycoon™, Immortals Fenyx Rising,

Just Dance®, Mario + Rabbids®, Might & Magic®, Rainbow Six,

Riders Republic and Watch Dogs®.

- Robust proprietary

technologies, from cutting-edge engines (Anvil and Snowdrop) and a

comprehensive online services and distribution platform (Ubisoft

Connect) to i3D.net, Ubisoft’s thriving video game hosting

business. This is in addition to investments in promising new

technologies, including cloud computing, artificial intelligence,

Web3, UGC, voxel and VR.

Benefits of the vertically

integrated organization

Growing in an organic manner requires not only a

different mindset but also a dependable organization, unique in its

structure and strategically vertically integrated. While other

models rely heavily on outsourcing that proves to be increasingly

expensive, we internalize most of our tasks and the several

thousands of jobs that come with them. This offers better control

of the production process and editorial direction at a time when

projects are enormously complex. It also allows for control and

ownership of technological investments and innovations. Finally,

this model leverages our diverse portfolio through synergies and

economies of scale. This is how Ubisoft has been able to deliver

more high-quality content than any other developer in the context

of major challenges related to the global pandemic.

The richest pipeline of games in Ubisoft’s

history

Additionally, our organic investments – to

expand our premium portfolio and bring our established franchises

to a significantly wider audience through free-to-play – require

several thousand talents to work on new technology and game

projects for several years before generating revenues. While it

takes time, this is how, over its history, Ubisoft has delivered

major topline growth and massive shareholder value. As we develop

our own capabilities across platforms for free-to-play, we are also

partnering with Tencent, one of the most prolific developers of

mobile games for core audiences. This partnership is getting closer

to bear meaningful fruits. Equally, our ambitious roadmaps for our

biggest franchises, combined with our investments in Avatar:

Frontiers of Pandora™, Beyond Good and Evil 2, Skull & Bones™,

the Star Wars game and unannounced new IPs are expected to expand

our premium portfolio in a significant way.

The

multiplication

of platforms benefits IP

creators

Looking ahead, the multiplication of platforms

offers great opportunities for IP creators like Ubisoft. As

demonstrated by our recent partnerships, there is a growing need to

bring high-quality content and engaged communities to all

platforms. We have therefore been increasingly valuing the

strengths of our IPs and the depth and diversity of our

portfolio.

Q3 & FY22

commentary

New releases

Players continue to have a great time in Far Cry

6 – which ranked in the top 52 biggest new releases in calendar

2021 – and its post-launch content released over the quarter that

included the Vaas: Insanity DLC, Far Cry 3 Blood Dragon and the

Danny Trejo live event. Playtime per player is now up 45% when

compared with Far Cry 5, with PRI per player up 30%. Far Cry 6 will

continue to deliver exciting new content, including the recent

Rambo live event and upcoming Stranger Things crossover mission.

Riders Republic launched on October 28th with a positive reception

from press and the community, with playtime per player and PRI up

60% and 4x respectively versus Ubisoft Annecy’s previous game

Steep. The launch of the Winter Bash mid-December and the

introduction of the season progression, new sponsors, new gear, and

live events drove acquisition and engagement throughout December.

Just Dance 2022 continues to leverage Switch momentum and delivered

a third consecutive year of strong performance.

Back-catalog

With third quarter back-catalog bookings up 10%

year-on-year and 37% vs. 2 years ago, Ubisoft’s deep portfolio of

games continues to deliver a solid performance, highlighting its

recurrence and resilience. The main drivers were Assassin’s Creed

Valhalla and Odyssey, Brawlhalla, The Crew 2, Far Cry 5, Ghost

Recon Breakpoint, For Honor, Immortals Fenyx Rising, Mario +

Rabbids Kingdom Battle, Rainbow Six Siege and Watch Dogs

Legion.

Assassin’s Creed

Assassin’s Creed Valhalla posted a remarkable

performance in Q3 with overall engagement now up more than 30% when

compared to Assassin’s Creed Odyssey life-to-date. This solid

performance coupled with a stronger post-launch program delivered

impressive life-to-date net bookings and PRI growth of respectively

over 70% and over 80%. On March 10, Ubisoft Sofia, the team behind

Assassin’s Creed Rogue, will be bringing the Dawn of Ragnarök

expansion, Ubisoft’s biggest ever expansion.

Elsewhere in the Assassin’s Creed universe, the

introduction of the Crossover stories in December, bringing new

free content to both Valhalla and Odyssey, drove Odyssey’s

strongest month of the year in terms of engagement. Ubisoft is

bringing today The Ezio Collection to Switch, allowing fans to step

into the legendary footsteps of Master Assassin, Ezio.

Altogether, the Assassin’s Creed brand confirms

its status as a powerful evergreen franchise.

Tom Clancy’s Rainbow Six

Despite intense competition, Rainbow Six Siege

recently passed the 80 million player mark, adding 10 million

players over the past twelve months, and continues to be one of the

biggest multiplayer shooters on the market. In esports, the Six

Invitational, the game’s biggest competition of the year, is in

full swing this week, with the Grand Final scheduled on February 20

and with exciting reveals for Year 7 of the game. Players will have

a lot to look forward with the most ambitious year of new features

and content to date.

Rainbow Six Extraction was released on January

20 and expands the Rainbow Six franchise with a co-op focused

experience IGN calls “one of the boldest games in recent Ubisoft

history.” Extraction has already exceeded 5 million unique players

to date, bringing in new players to the franchise and Siege’s

engaged fans, as well as a significant number of reactivated lapsed

franchise players. An innovative Buddy Pass system that allows

players to let their friends play free for up to two weeks will

continue to fuel the game’s growth along with the title’s inclusion

in Game Pass. There is more to come for Extraction players

post-launch, which will be revealed during the Six Invitational

broadcast tomorrow.

Building the future of

Ubisoft

FY23 game pipeline

In line with Ubisoft’s commitment to

significantly expand its offering, the next fiscal year will

notably include the releases of Avatar: Frontiers of Pandora, Mario

+ Rabbids: Sparks of Hope, Skull & Bones as well as more

exciting games.

Ubisoft continues to progress towards its

ambition to extend its brands’ reach to a significantly larger

audience through free-to-play across all geographies and

platforms.

Splinter Cell remake development

underwayUbisoft announced that the development of a

Splinter Cell® remake is underway. The project is led by the team

at Ubisoft Toronto and will leverage the power of Ubisoft’s

Snowdrop engine. This once again highlights the value that lies

within Ubisoft’s portfolio of iconic brands.

Building a more inclusive and welcoming

workplace

A recent interview with Anika Grant, Ubisoft’s

Chief People Officer, posted on Ubisoft News, outlines the recent

changes implemented at Ubisoft.

Bringing new,

experienced talent to the Editorial department

Ubisoft appointed Fawzi Mesmar as the newest VP

of Editorial, a veteran game designer with more than 18 years of

experience. Most recently the Head of Design at DICE, Fawzi will

work closely with Ubisoft’s worldwide production teams to help

shape the creative vision of Ubisoft’s vast portfolio of games and

franchises. He will also partner with teams across Ubisoft to

ensure they are including diverse perspectives throughout the

production process.

TAFEP concludes

investigation into Ubisoft Singapore

The Tripartite Alliance for Fair and Progressive

Employment Practices (TAFEP) in Singapore completed its

investigation into the Ubisoft Singapore studio and concluded that

the studio has a structured system in place to handle any workplace

misconduct reports, that past reports were handled appropriately

and that salaries are performance-based.

New studio in Sherbrooke

and extension of the

partnership with Québec to 2030

25 years after its first steps in Québec,

Ubisoft announced in November the opening of a fourth video game

development studio in the province, in the city of Sherbrooke, as

well as an extension of its partnership with the province to 2030.

This new studio reaffirms Ubisoft’s commitment as a major economic

player serving the province’s workforce, communities and ecosystems

and it will leverage the city’s hotbed of talent and high-tech

expertise as well as its burgeoning digital ecosystem. This

partnership is yet another example of the virtues of Ubisoft’s Lead

& Associate organization, enabling a regional and international

footprint to attract the best talents all over the world in order

to deliver its organic growth opportunities.

Note The Group presents

indicators which are not prepared strictly in accordance with IFRS

as it considers that they are the best reflection of its operating

and financial performance. The definitions of the non-IFRS

indicators are appended to this press release.

Sales and net bookings

|

In € millions |

Q3 |

9 months |

|

2021-22 |

2020-21 |

2021-22 |

2020-21 |

|

IFRS 15 sales |

665.9 |

965.1 |

1,417.2 |

1,722.1 |

|

Deferred revenues related to IFRS 15 |

80.2 |

35.9 |

47.1 |

33.6 |

|

Net bookings |

746.1 |

1,001.0 |

1,464.3 |

1,755.7 |

|

Digital net bookings |

530.2 |

588.4 |

1,087.6 |

1,243.8 |

|

PRI net bookings |

187.1 |

218.4 |

535.7 |

589.9 |

|

Back-catalog net bookings |

340.8 |

308.5 |

937.0 |

1,015.2 |

IFRS 15 sales for the third quarter of 2021-22

came to €665.9 million, down 31.0% (31.8% at constant exchange

rates3) compared with the €965.1 million generated in third-quarter

2020-21.For the first nine months of 2021-22, IFRS 15 sales

amounted to €1,417.2 million, down 17.7% (17.3% at constant

exchange rates) compared with the €1,722.1 million figure for the

first nine months of 2020-21.

Net bookings for third-quarter 2021-22 totaled

€746.1 million, in line with the Group’s target of between €725.0

million and €780.0 million and representing a decrease of 25.5%

(26.1% at constant exchange rates) compared with the €1,001.0

million recorded for the third quarter of 2020-21.For the first

nine months of 2021-22, net bookings stood at €1,464.3 million,

down 16.6% (16.2% at constant exchange rates) on the €1,755.7

million generated in the first nine months of 2020-21.

Outlook

Full-year 2021-22

The Company confirms its Net bookings target of

between flat to slightly down and its non-IFRS operating income

target of between €420 million and €500 million.

Conference call

Ubisoft will hold a conference call today, Thursday February 17,

2021, at 6:15 p.m. Paris time/5:15 p.m. London time/12:15 p.m.

New York time. The conference call can be accessed live and via

replay by clicking on the following link:

https://edge.media-server.com/mmc/p/a3wsxdhw

Contacts

Investor RelationsJean-Benoît

RoquetteSVP Investor Relations+ 33 1 48 18 52

39Jean-benoit.roquette@ubisoft.com

| Alexandre Enjalbert

Senior Investor Relations Manager +33 1 48 18 50 78

Alexandre.enjalbert@ubisoft.com |

Press Relations Michael Burk

Senior Director of Corporate Public Relations + 33 1 48 18 24 03

Michael.burk@ubisoft.com

DisclaimerThis press release

may contain estimated financial data, information on future

projects and transactions and future financial results/performance.

Such forward-looking data are provided for information purposes

only. They are subject to market risks and uncertainties and may

vary significantly compared with the actual results that will be

published. The estimated financial data have not been reviewed by

the Statutory Auditors. (Additional information is provided in the

most recent Ubisoft Registration Document filed on June 10, 2021,

with the French Financial Markets Authority (l’Autorité des Marchés

Financiers)).

About UbisoftUbisoft is a

creator of worlds, committed to enriching players’ lives with

original and memorable entertainment experiences. Ubisoft’s global

teams create and develop a deep and diverse portfolio of games,

featuring brands such as Assassin’s Creed®, Brawlhalla®, For

Honor®, Far Cry®, Tom Clancy’s Ghost Recon®, Just Dance®, Rabbids®,

Tom Clancy’s Rainbow Six®, The Crew®, Tom Clancy’s The Division®,

and Watch Dogs®. Through Ubisoft Connect, players can enjoy an

ecosystem of services to enhance their gaming experience, get

rewards and connect with friends across platforms. With Ubisoft+,

the subscription service, they can access a growing catalog of more

than 100 Ubisoft games and DLC. For the 2020–21 fiscal year,

Ubisoft generated net bookings of €2,241 million. To learn more,

please visit: www.ubisoftgroup.com.

© 2022 Ubisoft Entertainment. All Rights

Reserved. Ubisoft and the Ubisoft logo are registered trademarks in

the US and/or other countries.

APPENDICES

Definition of non-IFRS financial

indicators

Net bookings corresponds to sales restated for

the services component and including unconditional amounts related

to license or distribution agreements recognized independently of

the achievement of performance obligations.

Player Recurring Investment (PRI) corresponds to

sales of digital items, DLC, season passes, subscriptions and

advertising.

Non-IFRS operating income calculated based on

net bookings corresponds to operating income less the following

items:

- Stock-based compensation expense

arising on free share plans, group savings plans and/or stock

options.

- Depreciation of acquired intangible

assets with indefinite useful lives.

- Non-operating income and expenses

resulting from restructuring operations within the Group.

Breakdown of net bookings by geographic

region

|

|

Q32021-22 |

Q32020-21 |

9 months

2021-22 |

9 months

2020-21 |

|

Europe |

39% |

39% |

35% |

36% |

| Northern

America |

48% |

48% |

49% |

49% |

|

Rest of the world |

13% |

13% |

16% |

15% |

|

TOTAL |

100% |

100% |

100% |

100% |

Breakdown of net bookings by

platform

|

|

Q32021-22 |

Q32020-21 |

9 months

2021-22 |

9 months

2020-21 |

|

PLAYSTATION®4 &PLAYSTATION®5* |

29% |

36% |

31% |

34% |

| XBOX One™

&XBOX Series X/S™* |

16% |

23% |

18% |

21% |

| PC |

29% |

21% |

25% |

23% |

| NINTENDO

SWITCH™ |

14% |

13% |

11% |

11% |

| MOBILE |

7% |

5% |

9% |

8% |

|

Others** |

5% |

2% |

6% |

3% |

|

TOTAL |

100% |

100% |

100% |

100% |

* Backwards compatibility allows users of new-generation

consoles to continue playing games previously purchased on the

older generation of consoles. **Ancillaries, etc.

Title release

schedule4th

quarter (January

– March

2022)

|

PACKAGED & DIGITAL |

|

|

|

|

TOM CLANCY’S RAINBOW SIX® EXTRACTION |

AMAZON LUNA, PC, PLAYSTATION®4, PLAYSTATION®5, STADIA, XBOX

ONE, XBOX SERIES X/S |

|

| |

|

|

|

|

|

|

ASSASSIN'S CREED®

VALHALLA: DAWN OF RAGNARÖK |

|

|

|

AMAZON LUNA, PC, PLAYSTATION®4, PLAYSTATION®5, STADIA, XBOX ONE,

XBOX SERIES X/S |

|

|

THE SETTLERS® |

|

|

|

PC |

|

| |

|

|

|

|

|

|

|

DIGITAL

ONLY |

|

|

|

ASSASSIN’S CREED®: THE EZIO COLLECTION |

NINTENDO SWITCHTM |

|

CLASH OF BEASTS™ |

IOS, ANDROID |

|

FAR CRY® 6: DLC – EPISODE 2: CONTROL |

AMAZON LUNA, PC, PLAYSTATION®4, PLAYSTATION®5, STADIA, XBOX

ONE, XBOX SERIES X/S |

|

FAR CRY® 6: DLC - EPISODE 3: COLLAPSE |

AMAZON LUNA, PC, PLAYSTATION®4, PLAYSTATION®5, STADIA, XBOX

ONE, XBOX SERIES X/S |

|

FOR HONOR®: YEAR 6 – SEASON 1 |

PC, PLAYSTATION®4, XBOX ONE |

|

ODDBALLERS™ |

AMAZON LUNA, PC, PLAYSTATION®4, PLAYSTATION®5, STADIA, XBOX

ONE, XBOX SERIES X/S |

|

TOM CLANCY’S RAINBOW SIX® SIEGE: YEAR 7 – SEASON 1 |

AMAZON LUNA, PC, PLAYSTATION®4, PLAYSTATION®5, STADIA, XBOX

ONE, XBOX SERIES X/S |

1 Premium new releases on PlayStation and Xbox based on NPD, GSD

and Company estimates2 Premium new releases on PlayStation and Xbox

based on NPD, GSD and Company estimates

3 Sales at constant exchange rates are

calculated by applying to the data for the period under review the

average exchange rates used for the same period of the previous

year.

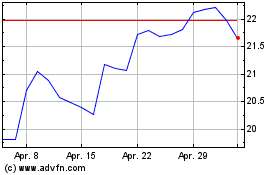

UBISoft Entertainment (EU:UBI)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

UBISoft Entertainment (EU:UBI)

Historical Stock Chart

Von Apr 2023 bis Apr 2024