Touax: 2022 RESULTS Growth in business volume and in operating

profitability

PRESS

RELEASE Paris, 22

March 2023 – 5.45 p.m.

YOUR OPERATIONAL LEASING SOLUTION FOR

SUSTAINABLE TRANSPORTATION

2022

RESULTS

Growth in business volume and in

operating profitability

- Growth in

business volume of 29%

- EBITDA

growth of 9% to €57.9 million and Operating income up 8% to €31.1

million

- Group share

of net profit: €7.5 million

- Return to a

dividend distribution policy

|

"Touax’s good results for 2022 confirm the

resilience of its business model. Relevant investments in quality

logistics assets for long-term leases have bolstered recurrent

revenues. At its General Meeting of Shareholders in June, Touax

will propose that the group resume distributing dividends, with a

dividend pay-out for 2022 of 10 cents per share.” remarked

Fabrice and Raphael Walewski, Touax SCA’s managing partners.

Despite factors such as the Russian-Ukrainian

war, inflation, and rising interest rates, the Touax Group turned

in a strong operating performance in 2022.

Consolidated EBITDA at end-December 2022

increased by €4.9 million to €57.9 million and Operating income

rose by €2.4 million to €31.1 million. The Group share of net

profit fell by €5.1 million to €7.5 million due to an increase in

financial expenses following the repayment of hybrid capital in the

form of undated deeply subordinated bonds (TSSDI) and a provision

for tax of €3.8 million.

In 2022, the group completed the repayment of

€50.8 million in undated deeply subordinated bonds (TSSDI), 54% of

which in cash and 46% by issuing a new EuroPP enabling Touax SCA to

save €3.0 million in cash each year. As the undated deeply

subordinated bonds were recognized in equity and the coupons as

dividends, the portion financed in EuroPP, i.e., €23.3 million, now

appears under financial liabilities in the balance sheet and the

related interest is shown in the income statement at €1.6 million

per year.

The net book value per share is €12.94, up 11%

compared with December 31, 2021. Based on the market value of the

assets, the revalued NAV1 per share came to €21.95, up 9% versus

last year.

The consolidated financial statements for the

period ended December 31, 2022, were approved by the Management

Board on March 21, 2023 and were submitted to the Supervisory Board

on March 22, 2023. The auditing of these statements is

underway.

KEY ACCOUNTING ITEMS

|

Key figures |

2022 |

2021 |

|

(in € million) |

|

Restated Revenue (*) from

activities |

161.5 |

125.0 |

|

Of which Freight railcars |

56.1 |

50.3 |

|

Of which River barges |

17.5 |

12.8 |

|

Of which Containers |

81.4 |

47.7 |

|

Of which Miscellaneous and eliminations |

6.4 |

14.2 |

|

EBITDA |

57.9 |

53.1 |

|

Operating income |

31.1 |

28.7 |

|

Financial result |

-15.4 |

-11.9 |

|

Profit before taxes |

15.7 |

16.8 |

|

Corporate tax |

-6.3 |

-1.0 |

|

Consolidated net profit (loss) (Group’s

share) |

7.5 |

12.6 |

|

Earnings per share (€) |

1.07 |

1.79 |

|

Total non-current assets |

394.6 |

358.0 |

|

Total assets |

571.7 |

552.4 |

|

Total shareholders’ equity |

153.7 |

165.0 |

|

Net financial debt (a) |

280.8 |

231.6 |

|

Operating cash flow (b) |

-1.5 |

-25.7 |

|

Loan to Value ratio (c) |

59.5% |

52% |

(a) including €232.3m in debt

without recourse at 31 Dec 2022(b) including

€60.0m of net equipment acquisitions (€71.3m end of Dec

2021)(c) Loan to Value ratio: Ratio of

consolidated gross financial debt to total assets less goodwill and

intangible fixed assets

(*) The key indicators in the

Group’s activity report are presented differently from the IFRS

income statement, to enable an understanding of the activities’

performance. As such, no distinction is made in third-party

management, which is presented solely in agent form.This

presentation therefore allows a direct reading of syndication fees,

sales commissions and management fees.This new presentation has no

impact on EBITDA, operating income or net income. The accounting

presentation of revenue from activities is presented in the

appendix to the press release.

STRONG BUSINESS GROWTH IN

2022

Restated revenue from activities over full-year

2022 totaled €161.5 million (€151.8 million at constant scope

and currency), up 29.2% compared with 2021 (+21.5% at constant

scope and currency).

This increase was due to the dynamism of the

owned activity, which came to €150.5 million at the end of 2022, up

€34.1 million. The owned activity benefited in particular from

growth in container trading and an increase in rental turnover.

The freight railcar (89.4%), river barge (100%)

and container (96.1%) utilization rates were at a high level at the

end of December 2022.

The management business also saw growth of €2.9

million (+36.4%), with investor fleet management fees of €4.7

million and commissions on the sale of investor equipment of €3.5

million.

ANALYSIS OF CONTRIBUTIONS BY

DIVISION

Restated revenue from the Freight

Railcars division reached €56.1 million in 2022, an

increase of 11.6%.

Rental income rose by 12.4% to €52.2 million

over the period, with new assets acquired generating additional

revenue. Sales of owned equipment were stable at €1.6 million.

Restated revenue from the River

Barges division was up 36.2% to €17.5 million in 2022,

driven by the leasing activity (revenue linked to the increase in

chartering in the Rhine basin).

Restated revenue from the

Containers division came to €81.4 million at the

end of December 2022, an increase of €33.8 million (+71%).

Sales of owned equipment more than doubled over

the year to €50.8 million, thanks to the development of the trading

activity for new containers.

Benefiting from a high average utilization rate

in 2022 (97.7%), the leasing activity grew by 22.5% (+€4.1

million). The increase in commissions linked to the sale of

investor equipment also contributed +€2.1 million to these very

good results.

Revenue from the Modular Construction

business in Africa, presented under the "Miscellaneous”

line, decreased in 2022 to €6.4 million. However, the business

outlook for 2023 is promising given the order book.

HIGHER OPERATING

PROFITABILITY

EBITDA came to

€57.9 million, an increase of 9%.

EBITDA in the Freight Railcars

division rose to €30.6 million (+16%) compared with €26.2 million

in 2021, against a backdrop of higher rental revenue and effective

control of operating expenses.

The River Barges division

posted EBITDA of €5.0 million over the year, giving a slight

increase of €0.1 million.

EBITDA in the Containers

division grew by a substantial €5.0 million to €22.8 million

(+28%). The trading activity turned in high margins together with

higher volumes.

Operating income reached €31.1

million, up 8% on 2021.

Financial income came to

-€15.4 million, compared with -€11.9 million in 2021. The

€3.0 million increase in net interest expense can partly be

explained by a volume effect (refinancing as debt of the undated

deeply subordinated bonds previously recognized as capital, and an

increase in the debt of the Container division to support growth)

and partly by the impact of the rise in interest rates mainly

linked to the refinancing of the Containers division.

Corporate income tax amounted to €6.3 million,

up €5.2 million due to an exceptional tax provision of €3.8 million

(no cash impact) in the Containers division following the loss of a

tax dispute in the court of first instance in Hong Kong.

Net income Group share amounted

to €7.5 million (compared with €12.6 million in 2021), after taking

into account the increase in financial expenses and the exceptional

tax provision.

A BALANCED FINANCIAL

STRUCTURE

The balance sheet showed a total of

€572 million at December 31, 2022, compared with

€552 million at December 31, 2021.

Tangible fixed assets and inventories amounted

to €450 million, compared with €418 million at the end of

2021, mainly due to investments within the Freight Railcars and

Containers divisions.

Group shareholders' equity decreased to €154

million compared with €165 million in 2021, due to the redemption

of the hybrid capital (undated deeply subordinated bonds) for €26.6

million.

Gross debt came to €337 million, 69% of

which was non-recourse debt to Touax SCA. The Group’s net debt

amounted to €281 million, with a comfortable cash position of €56

million.

The loan-to-value ratio stood at 59.5% at

December 31, 2022.

OUTLOOK

The Touax Group confirms its strategy of regular

investments in quality assets for long-term leasing while remaining

cautious given the market outlook.

Touax's activities are well oriented at a time

of growing awareness of the need to decarbonize the economy and

transportation.

Activity in the Freight

Railcars business is being driven in Europe by the

intermodal segment, in which Touax is a market leader, and by

efforts from large industrial players and logistics operators to

reduce their carbon footprint. The Indian market is growing due to

considerable infrastructure needs.

Concerning the River Barges

business, this sector in Europe is set to receive new public and

institutional investments that will help to speed up the

development of river transport. In North and South America, Touax

will look selectively at any new investment opportunities.

The Containers business has had

two exceptional years. The market is set to return to normal in

2023, in terms of the global volume of containerized traffic as

well as asset prices and maritime freight rates. Touax intends to

take advantage of this trend towards normalization with a more

attractive entry price, by enhancing its range of services

(leasing, trading, and new types of containers) and expanding its

geographical scope to meet the expectations of and increase its

customer base.

The Modular Construction

business in Africa also provides its customers with turnkey

eco-responsible buildings and tailored solutions. The level of

orders recorded in Q1 2023 suggests a good year ahead and a higher

valuation of Touax’s stake in this business.

Through its unique position in sustainable

transport, Touax is increasingly committed to an environmentally

friendly approach and best practices around social and governance

criteria. After obtaining its first ESG non-financial rating in Q4

2022 from EcoVadis, which ranked Touax as one of the best in its

industry, the group wants to capitalize on this and is working on a

continuous improvement plan.

Touax is reflecting this new paradigm in its

financial strategy by proactively indexing its financing costs to

ESG performance criteria. This already concerns 65% of its

financing.

Touax's goal is to strive to constantly improve

how it serves its customers through services supporting sustainable

transport. Our various asset classes are benefiting from

developments in infrastructures, e-commerce, and intermodal

logistics as they keep pace with the expectations of consumers,

industrial groups, public authorities, lenders and investors around

green transport.

UPCOMING EVENTS

- March 22, 2023:

Presentation of the annual results at Hotel des Arts & Métiers,

Paris 75016

- March 23, 2023:

Video conference call to present the annual results in English

- May 15,

2023: Q1 2023

revenue from activities

- June 14, 2023:

Annual General

Meeting

TOUAX Group leases out

tangible assets (freight railcars, river barges and containers) on

a daily basis worldwide, both on its own account and for investors.

With €1.3 billion of assets under management, TOUAX is one of the

leading European players in the leasing of such equipment.

TOUAX is listed on the

EURONEXT stock market in Paris - Euronext Paris Compartment C (ISIN

code: FR0000033003) - and is listed on the CAC® Small, CAC® Mid

& Small and EnterNext©PEA-PME 150 indices.

For further

information please visit: www.touax.com

Contacts:

TOUAX ACTIFIN

Fabrice & Raphaël

Walewski Ghislaine

Gasparetto

touax@touax.com ggasparetto@actifin.fr

www.touax.com Tel:

+33 1 56 88 11 11

Tel:

+33 1 46 96 18 00

APPENDICES

1 – Analysis of revenue

from activities

|

Restated Revenue from activities |

Q1 2022 |

Q2 2022 |

Q3 2022 |

Q4 2022 |

TOTAL 2022 |

Q1 2021 |

Q2 2021 |

Q3 2021 |

Q4 2021 |

TOTAL 2021 |

|

(in € thousand) |

|

Leasing revenue on owned equipment |

15,509 |

16,909 |

17,178 |

17,530 |

67,126 |

13,229 |

13,633 |

14,480 |

15,351 |

56,693 |

|

Ancillary services |

5,732 |

4,884 |

7,390 |

6,607 |

24,613 |

2,745 |

3,747 |

5,530 |

7,357 |

19,379 |

|

Total leasing activity |

21,241 |

21,793 |

24,568 |

24,137 |

91,739 |

15,974 |

17,380 |

20,010 |

22,708 |

76,072 |

|

Sales of owned equipment |

14,862 |

14,249 |

15,392 |

14,282 |

58,785 |

7,085 |

8,328 |

9,132 |

15,781 |

40,326 |

|

Total sales of equipment |

14,862 |

14,249 |

15,392 |

14,282 |

58,785 |

7,085 |

8,328 |

9,132 |

15,781 |

40,326 |

|

Total of owned activity |

36,103 |

36,042 |

39,960 |

38,419 |

150,524 |

23,059 |

25,708 |

29,142 |

38,489 |

116,398 |

|

Syndication fees |

0 |

2,522 |

65 |

150 |

2,737 |

17 |

946 |

48 |

1,992 |

3,003 |

|

Management fees |

978 |

986 |

1,083 |

1,655 |

4,702 |

897 |

891 |

895 |

958 |

3,641 |

|

Sales fees |

336 |

1,349 |

801 |

999 |

3,485 |

591 |

358 |

181 |

236 |

1,366 |

|

Total of management activity |

1,314 |

4,857 |

1,949 |

2,804 |

10,924 |

1,505 |

2,195 |

1,124 |

3,186 |

8,010 |

|

Other capital gains on disposals |

0 |

0 |

6 |

2 |

8 |

0 |

6 |

0 |

552 |

558 |

|

Total Others |

0 |

0 |

6 |

2 |

8 |

0 |

6 |

0 |

552 |

558 |

|

Total Revenue from activities |

37,417 |

40,899 |

41,915 |

41,225 |

161,456 |

24,564 |

27,909 |

30,266 |

42,227 |

124,966 |

2 - Table showing the transition from

summary accounting presentation to restated

presentation

|

Revenue from activities |

2022 |

Restatement |

Restated 2022 |

2021 |

Restatement |

Restated 2021 |

|

(in € thousand) |

| Leasing revenue

on owned equipment |

67,126 |

|

67,126 |

56,693 |

|

56,693 |

|

Ancillary services |

32,729 |

-8,116 |

24,613 |

20,879 |

-1,500 |

19,379 |

|

Total leasing activity |

99,855 |

-8,116 |

91,739 |

77,572 |

-1,500 |

76,072 |

|

Sales of owned equipment |

58,785 |

|

58,785 |

40,326 |

|

40,326 |

| Total

sales of equipment |

58,785 |

|

58,785 |

40,326 |

|

40,326 |

|

Total of owned activity |

158,640 |

-8,116 |

150,524 |

117,898 |

-1,500 |

116,398 |

| Leasing revenue

on managed equipment |

44,399 |

-44,399 |

0 |

44,328 |

-44,328 |

0 |

| Syndication

fees |

2,737 |

|

2,737 |

3,003 |

|

3,003 |

| Management

fees |

1,285 |

3,417 |

4,702 |

721 |

2,920 |

3,641 |

| Sales fees |

3,485 |

|

3,485 |

1,366 |

|

1,366 |

|

Total of management activity |

51,906 |

-40,982 |

10,924 |

49,418 |

-41,408 |

8,010 |

| Other capital

gains on disposals |

8 |

|

8 |

558 |

|

558 |

|

Total Others |

8 |

0 |

8 |

558 |

0 |

558 |

|

Total Revenue from activities |

210,554 |

-49,098 |

161,456 |

167,874 |

-42,908 |

124,966 |

3 - Breakdown of

restated revenue from activities by division

|

Restated revenue from activities |

Q1 2022 |

Q2 2022 |

Q3 2022 |

Q4 2022 |

TOTAL 2022 |

Q1 2021 |

Q2 2021 |

Q3 2021 |

Q4 2021 |

TOTAL 2021 |

|

(in € thousand) |

| Leasing

revenue on owned equipment |

10,544 |

11,142 |

11,292 |

11,768 |

44,746 |

9,152 |

9,223 |

10,123 |

10,779 |

39,277 |

|

Ancillary services |

1,858 |

1,177 |

1,820 |

2,564 |

7,419 |

1,873 |

1,724 |

1,951 |

1,584 |

7,132 |

|

Total leasing activity |

12,402 |

12,319 |

13,112 |

14,332 |

52,165 |

11,025 |

10,947 |

12,074 |

12,363 |

46,409 |

|

Sales of owned equipment |

110 |

238 |

369 |

833 |

1,550 |

320 |

403 |

162 |

641 |

1,526 |

| Total

sales of equipment |

110 |

238 |

369 |

833 |

1,550 |

320 |

403 |

162 |

641 |

1,526 |

|

Total of owned activity |

12,512 |

12,557 |

13,481 |

15,165 |

53,715 |

11,345 |

11,350 |

12,236 |

13,004 |

47,935 |

| Syndication

fees |

0 |

446 |

1 |

0 |

447 |

0 |

0 |

0 |

570 |

570 |

|

Management fees |

466 |

451 |

507 |

557 |

1,981 |

463 |

470 |

451 |

440 |

1,824 |

|

Total of management activity |

466 |

897 |

508 |

557 |

2,428 |

463 |

470 |

451 |

1,010 |

2,394 |

|

Total Freight railcars |

12,978 |

13,454 |

13,989 |

15,722 |

56,143 |

11,808 |

11,820 |

12,687 |

14,014 |

50,329 |

| Leasing

revenue on owned equipment |

1,619 |

1,789 |

1,869 |

1,821 |

7,098 |

1,688 |

1,745 |

1,770 |

1,626 |

6,829 |

|

Ancillary services |

1,807 |

2,385 |

3,788 |

2,319 |

10,299 |

683 |

972 |

1,286 |

2,272 |

5,213 |

|

Total leasing activity |

3,426 |

4,174 |

5,657 |

4,140 |

17,397 |

2,371 |

2,717 |

3,056 |

3,898 |

12,042 |

|

Sales of owned equipment |

0 |

0 |

0 |

16 |

16 |

41 |

0 |

0 |

0 |

41 |

| Total

sales of equipment |

0 |

0 |

0 |

16 |

16 |

41 |

0 |

0 |

0 |

41 |

|

Total of owned activity |

3,426 |

4,174 |

5,657 |

4,156 |

17,413 |

2,412 |

2,717 |

3,056 |

3,898 |

12,083 |

| Syndication

fees |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

710 |

710 |

| Management

fees |

14 |

5 |

11 |

11 |

41 |

6 |

6 |

5 |

6 |

23 |

|

Total of management activity |

14 |

5 |

11 |

11 |

41 |

6 |

6 |

5 |

716 |

733 |

|

Total River Barges |

3,440 |

4,179 |

5,668 |

4,167 |

17,454 |

2,418 |

2,723 |

3,061 |

4,614 |

12,816 |

| Leasing

revenue on owned equipment |

3,342 |

3,973 |

4,013 |

3,935 |

15,263 |

2,384 |

2,654 |

2,572 |

2,937 |

10,547 |

|

Ancillary services |

2,070 |

1,325 |

1,779 |

1,722 |

6,896 |

191 |

1,054 |

2,297 |

3,995 |

7,537 |

|

Total leasing activity |

5,412 |

5,298 |

5,792 |

5,657 |

22,159 |

2,575 |

3,708 |

4,869 |

6,932 |

18,084 |

|

Sales of owned equipment |

13,205 |

12,575 |

12,967 |

12,085 |

50,832 |

3,480 |

3,524 |

5,991 |

11,696 |

24,691 |

| Total

sales of equipment |

13,205 |

12,575 |

12,967 |

12,085 |

50,832 |

3,480 |

3,524 |

5,991 |

11,696 |

24,691 |

|

Total of owned activity |

18,617 |

17,873 |

18,759 |

17,742 |

72,991 |

6,055 |

7,232 |

10,860 |

18,628 |

42,775 |

| Syndication

fees |

0 |

2,076 |

64 |

150 |

2,290 |

17 |

946 |

48 |

712 |

1,723 |

| Management

fees |

498 |

530 |

565 |

1,087 |

2,680 |

428 |

415 |

439 |

512 |

1,794 |

| Sales

fees |

336 |

1,349 |

801 |

999 |

3,485 |

591 |

358 |

181 |

236 |

1,366 |

|

Total of management activity |

834 |

3,955 |

1,430 |

2,236 |

8,455 |

1,036 |

1,719 |

668 |

1,460 |

4,883 |

|

Total Containers |

19,451 |

21,828 |

20,189 |

19,978 |

81,446 |

7,091 |

8,951 |

11,528 |

20,088 |

47,658 |

| Leasing

revenue on owned equipment |

4 |

5 |

4 |

6 |

19 |

5 |

11 |

15 |

9 |

40 |

|

Ancillary services |

-3 |

-3 |

3 |

2 |

-1 |

-2 |

-3 |

-4 |

-494 |

-503 |

|

Total leasing activity |

1 |

2 |

7 |

8 |

18 |

3 |

8 |

11 |

-485 |

-463 |

|

Sales of owned equipment |

1,547 |

1,436 |

2,056 |

1,348 |

6,387 |

3,244 |

4,401 |

2,979 |

3,444 |

14,068 |

| Total

sales of equipment |

1,547 |

1,436 |

2,056 |

1,348 |

6,387 |

3,244 |

4,401 |

2,979 |

3,444 |

14,068 |

|

Total of owned activity |

1,548 |

1,438 |

2,063 |

1,356 |

6,405 |

3,247 |

4,409 |

2,990 |

2,959 |

13,605 |

| Other capital

gains on disposals |

0 |

0 |

6 |

2 |

8 |

0 |

6 |

0 |

552 |

558 |

|

Total Others |

0 |

0 |

6 |

2 |

8 |

0 |

6 |

0 |

552 |

558 |

|

Total Miscellaneous &

eliminations |

1,548 |

1,438 |

2,069 |

1,358 |

6,413 |

3,247 |

4,415 |

2,990 |

3,511 |

14,163 |

|

Total Restated revenue from activities |

37,417 |

40,899 |

41,915 |

41,225 |

161,456 |

24,564 |

27,909 |

30,266 |

42,227 |

124,966 |

1 The market value is calculated by independent experts, based

50% on the replacement value and 50% on the value-in-use for

railcars, the value-in-use for containers and the replacement value

for river barges with the exception of a long-term contract in

South America for which the value-in-use was used. This market

value is substituted for the net book value when calculating the

net asset value.

- EN TOUAX PR - FY 2022 Results

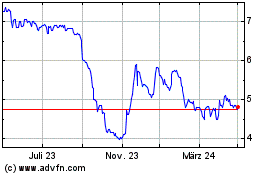

Touax (EU:TOUP)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Touax (EU:TOUP)

Historical Stock Chart

Von Apr 2023 bis Apr 2024