Tetragon Financial Group Limited Edison issues review on Tetragon Financial Group

30 August 2022 - 9:37AM

RNS Non-Regulatory

TIDMTFG

Tetragon Financial Group Limited

30 August 2022

London, UK, 30 August 2022

Edison issues review on Tetragon Financial Group (TFG)

Tetragon Financial Group's (Tetragon's) NAV declined 3.5% in

H122 in total return terms, compared to a 20% fall in the MSCI ACWI

Index (based on Refinitiv). The portfolio revaluation contributed

4.1pp to the decline, which was mostly due to a Q122 loss on

Tetragon's direct exposure to a publicly quoted biotech company and

the downward revaluation of Equitix on the back of public multiples

contraction. The best-performing assets in the portfolio were

collateralised loan obligations (CLOs, which also assisted the

valuation of the CLO manager LCM). Tetragon's NAV total return was

also supported by a NAV-accretive share repurchase (+3pp on NAV).

Tetragon's one-year NAV performance to end-June 2022 stands at 10%,

compared to a 15% decrease in the MSCI ACWI (based on

Refinitiv).

At end-June 2022, Tetragon had cash commitments of US$96.5m,

which are fully covered by the undrawn part of its credit facility

(US$150m). The facility has been enlarged recently to US$400m from

US$250m, with the drawn part translating into net gearing at 3.7%

of NAV at end-June 2022. We also note that Tetragon receives

recurring cash inflows from bank loan investments and TFG Asset

Management, with a five-year average of US$115m and US$69m pa,

respectively. Tetragon's average costs excluding incentive fees

stood at US$49m pa over the last five years. In H122, Tetragon used

US$42m for share repurchases close to market price and paid

US$19.2m in dividends and we calculate that the latest dividend per

share (DPS) of US$0.11 (up 10% y-o-y) implies a 4.3% yield,

according to our calculations.

Click here to view the full report or here to sign up to receive

research as it is published.

All reports published by Edison are available to download free

of charge from its website

www.edisongroup.com

About Edison: E dison is a leading research and investor

relations consultancy, connecting listed companies to the widest

pool of global investors. By focusing on the volume and quality of

investors reached - across institutions, family offices, wealth

managers and retail investors - Edison can create and gauge intent

to purchase, even in the darkest pools of capital, and then make

introductions via non-deal roadshows, events or virtual

meetings.

Having been the first in-market 17 years ago, Edison now has

more than 100 analysts covering every economic sector.

Headquartered in London, Edison also has offices in New York,

Frankfurt, Amsterdam and Tel Aviv and a presence in Athens,

Johannesburg and Sydney.

Edison is authorised and regulated by the Financial Conduct

Authority .

Edison is not an adviser or broker-dealer and does not provide

investment advice. Edison's reports are not solicitations to buy or

sell any securities.

For more information, please contact Edison:

Milosz Papst +44 (0)20 3077 5700

investmenttrusts@edisongroup.com

Michal Mordel +44 (0)20 3077 5700

investmenttrusts@edisongroup.com

Learn more at www.edisongroup.com and connect with Edison

on:

LinkedIn www.linkedin.com/company/edison-group-/

Twitter www.twitter.com/Edison_Inv_Res

YouTube www.youtube.com/edisonitv

This information is provided by Reach, the non-regulatory press

release distribution service of RNS, part of the London Stock

Exchange. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

Reach is a non-regulatory news service. By using this service an

issuer is confirming that the information contained within this

announcement is of a non-regulatory nature. Reach announcements are

identified with an orange label and the word "Reach" in the source

column of the News Explorer pages of London Stock Exchange's

website so that they are distinguished from the RNS UK regulatory

service. Other vendors subscribing for Reach press releases may use

a different method to distinguish Reach announcements from UK

regulatory news.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NRAGRGDISXXDGDG

(END) Dow Jones Newswires

August 30, 2022 03:37 ET (07:37 GMT)

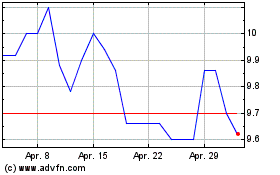

Tetragon Financial (EU:TFG)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

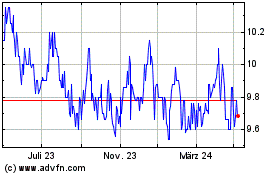

Tetragon Financial (EU:TFG)

Historical Stock Chart

Von Apr 2023 bis Apr 2024