Schneider Electric 2022 Earnings Rose on Strong Demand - Update

16 Februar 2023 - 11:14AM

Dow Jones News

By Pierre Bertrand

Schneider Electric SE reported an increase in full-year earnings

Thursday amid easing of supply-chain constraints and strong demand

for electrification and decarbonization.

The French energy-management company achieved 3.48 billion euros

($3.72 billion) in 2022 net profit compared with EUR3.20 billion in

2021 on revenue that grew 12% organically to EUR34.18 billion.

The result compares with expectations of net profit of EUR3.52

billion and revenue of EUR33.63 billion, according to a

company-provided consensus.

Adjusted earnings before interest, taxes and amortization

exceeded analysts' expectations, amounting to EUR6.02 billion, a

14% organic rise compared to 2021.

Analysts had expected Schneider Electric to post EUR5.95 billion

in adjusted Ebita, according to the consensus.

The Paris-based company said its result was driven by dynamic

demand in all of its four end-markets, which were supported by

customers focusing on electrification, digitization and

sustainability. That said, consumer-linked segments including

residential buildings and distributed IT remained weak as softening

demand trends seen in the third quarter carried over.

That weakness is expected to continue and normalize to more

usual levels in 2023 compared with the pandemic-related highs

registered in 2020 and 2021, Chief Executive Jean-Pascal Tricoire

said.

"On the other hand, what we see is a continuous traction for

everything we do, electrification and digitization, on the vast

majority of our business where all the plans of retrofit, energy

transition [and] energy efficiency are really being developed and

executed as we go forward," Mr. Tricoire said.

The company noted it saw a degree of destocking in the fourth

quarter in its industry end-market, though demand stayed high.

The progressive easing of supply-chains constraints supported

growth at the company's energy-management, industrial-automation

and discreet-automation segments, Schneider said.

Schneider Electric said currency effects in 2023 are estimated

to drag revenue by a range of EUR600 million to EUR700 million,

while scope impact is estimated to hit revenue by around EUR750

million.

The company said it would propose a dividend of EUR3.15 a share

compared with EUR2.90 for 2021.

Schneider Electric said it is targeting organic adjusted Ebita

growth of between 12% and 16% in 2023 and expects organic revenue

growth of 9% to 11%, with an Ebita margin of around 17.4% to

17.7%.

Write to Pierre Bertrand at pierre.bertrand@wsj.com

(END) Dow Jones Newswires

February 16, 2023 04:59 ET (09:59 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

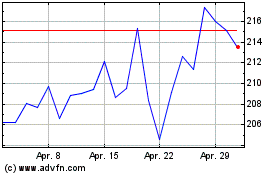

Schneider Electric (EU:SU)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Schneider Electric (EU:SU)

Historical Stock Chart

Von Apr 2023 bis Apr 2024