Trending: Schneider Electric's $10.8 Billion Acquisition of Aveva

21 September 2022 - 3:24PM

Dow Jones News

1253 GMT - Schneider Electric is among the most mentioned

companies across news items over the past 12 hours, according to

Factiva data, after the French energy management and automation

company confirmed its intention to purchase the rest of Aveva's

shares that it doesn't already own. Schneider agreed to pay 9.48

billion pounds ($10.8 billion). Schneider says that together they

will enable the faster execution of its software growth strategy

and combine energy and processes. As part of the deal Aveva will

retain its business autonomy, Schneider said. Berenberg analysts in

a research note say that the deal has questionable merits. If Aveva

is to remain truly independent, the analysts say they struggle to

see how the deal contributes more than 2% to 3% to Schneider's

earnings per share. But Bryan Garnier analysts Gregory Ramirez and

Paul Charpentier say in a note that the rationale for the deal is

also to accelerate Aveva's transition into a hybrid cloud-based

subscription model. The acquisition is expected to close in the

first quarter of 2023. Dow Jones & Co. owns

Factiva.(pierre.bertrand@wsj.com)

(END) Dow Jones Newswires

September 21, 2022 09:09 ET (13:09 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

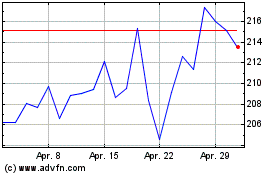

Schneider Electric (EU:SU)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Schneider Electric (EU:SU)

Historical Stock Chart

Von Apr 2023 bis Apr 2024