SOITEC REPORTS FY’23 THIRD QUARTER REVENUE

SOITEC REPORTS FY’23 THIRD QUARTER

REVENUE

- Q3’23 revenue reached €274m,

up 32% on a reported basis and up 25% at constant exchange rates

and perimeter

- Sharp growth achieved in

both Automotive & Industrial and Smart devices, sustained

growth in Mobile communications

- First nine months of FY’23

revenue reached €745m, up 20% at constant exchange rates and

perimeter compared with the first nine months of

FY’22

- FY’23 guidance confirmed:

revenue growth expected around 20% at constant exchange rates and

perimeter, and EBITDA1

margin2 expected around

36%

Bernin (Grenoble), France,

January 25th, 2023 –

Soitec (Euronext Paris), a world leader in designing and

manufacturing innovative semiconductor materials, today announced

consolidated revenue of 274 million Euros for the third quarter of

FY’23 (ended December 31st, 2022), up 32% on a reported basis

compared with 208 million Euros achieved in the third quarter of

FY’22. This reflects the combination of a 25% growth at constant

exchange rates and perimeter and a positive currency impact of

7%3.

Pierre Barnabé, Soitec’s CEO, commented:

Thanks to another strong quarter, we are in line to achieve

our guidance for the fiscal year ending in March 2023, with an

organic revenue growth around

20%. In mobile

communications, we continue to benefit from the increase in RF

content in the new generations of 5G smartphones as well as from

long term agreements with our clients. We are also

very pleased with the adoption of FD-SOI across our three end

markets, particularly in automotive and smart devices. Lastly, we

are confident in the prospects of our

SmartSiC™ technology, as evidenced by the

new cooperation agreement we signed last month with

STMicroelectronics.”

Third quarter FY’23 consolidated revenue

(unaudited)

| |

Q3’22 |

Q3’23 |

Q3’23/Q3’22 |

| |

|

|

|

|

| (Euros

millions) |

|

|

change reported |

chg. at const. exch. rates & perimeter |

| |

|

|

|

|

| Mobile

communications |

146 |

170 |

+17% |

+11% |

| Automotive

& Industrial |

19 |

37 |

+96% |

+84% |

| Smart

devices |

43 |

67 |

+57% |

+50% |

| |

|

|

|

|

| Total

revenue |

208 |

274 |

+32% |

+25% |

Soitec recorded a 25% total revenue growth at

constant exchange rates and perimeter in the third quarter of FY’23

compared to the third quarter of FY’22. This reflects sustained

growth in Mobile communications and sharp growth in both Automotive

& Industrial and Smart devices.

Mobile communications

Growth in Mobile communications continues to be

supported by further adoption of 5G smartphones and Wi-Fi 6, as

well as the deployment of 5G infrastructure.

In the third quarter of FY’23, Mobile

communications revenue reached 170 million Euros, an 11%

growth at constant exchange rates and perimeter compared to the

third quarter of FY’22, reflecting both an increase in volumes as

well as a positive price/mix effect.

RF-SOI wafer sales continue to be

supported by significantly higher RF content in every 5G smartphone

compared to 4G smartphones. RF-SOI wafer sales also benefited from

a higher penetration of high-end mobile handsets. Despite an

increasing level of inventories at some customers during the third

quarter of FY’23, Soitec delivered further growth in both RF-SOI

200-mm and RF-SOI 300-mm.

Additionally, FD-SOI continues its

momentum in front end modules.

POI (Piezoelectric-on-Insulator)

wafers dedicated to RF filters for 5G smartphones are

still in an adoption phase, as Soitec continues to work with

several customers on qualifying different design architectures, a

process which should last another few quarters.

Automotive & Industrial

Demand from the automotive industry continues to be

driven by the rise in semiconductor content embedded in new

vehicles. Semiconductors are increasingly used for the needs of

multimedia and infotainment, for functional safety, for autonomous

and assisted driving, as well as to power vehicles equipped with

electric and hybrid engines.

Automotive & Industrial revenue reached 37

million Euros in the third quarter of FY’23, an 84% growth at

constant exchange rates and perimeter compared to the third quarter

of FY’22. Growth essentially reflects a sharp increase in

volumes.

In the third quarter of FY’23, the increase in

Automotive & Industrial revenue mostly came from FD-SOI

wafers dedicated to automotive applications, as well as

from the sales of Power-SOI

wafers which recorded a sustained level of

growth.

Smart devices

The demand from the smart devices market is driven

by the need for more complex sensors, higher connectivity

functionalities and embedded intelligence, leading to more powerful

and efficient edge artificial intelligence chips.

Smart devices revenue reached 67 million Euros in

the third quarter of FY’23, a 50% increase at constant exchange

rates and perimeter compared to the third quarter of FY’22. This

performance mostly reflects a highly positive price/mix effect as

well as higher volumes.

Growth achieved in FD-SOI wafer

sales confirms structural demand for Edge Computing devices across

consumer and industrial sectors.

Sales of Photonics-SOI wafers for

data transceivers, recorded a solid growth compared to the third

quarter of FY’22, while sales of Imager-SOI wafers

for 3D imaging applications remained at a sustained level.

First nine months FY’23 consolidated

revenue (unaudited)

| |

9m’22 |

9m’23 |

9m’23/9m’22 |

| |

|

|

|

|

| (Euros

millions) |

|

|

change reported |

chg. at const. exch. rates & perimeter |

| |

|

|

|

|

| Mobile

communications |

423 |

510 |

+21% |

+13% |

| Automotive

& Industrial |

52 |

94 |

+81% |

+68% |

| Smart

devices |

106 |

140 |

+33% |

+26% |

| |

|

|

|

|

| Total

revenue |

581 |

745 |

+28% |

+20% |

Overall, consolidated revenue reached 745 million

Euros in the first nine months of FY’23, up 28% on a reported basis

compared to 581 million Euros in the first nine months of FY’22.

This reflects an 20% growth at constant exchange rates and

perimeter combined with a positive currency impact of 8%3.

Confirmed FY’23 outlook

Soitec continues to anticipate FY’23 revenue to

grow around 20% at constant exchange rates and perimeter, and FY’23

EBITDA1 margin2 to reach around 36%.

Key events of the quarter

STMicroelectronics and Soitec cooperate

on SiC substrate manufacturing

technology

On December 1st, 2022, STMicroelectronics and

Soitec announced the next stage of their cooperation on Silicon

Carbide (SiC) substrates, with the qualification of Soitec’s SiC

substrate technology by STMicroelectronics planned over the next 18

months. The goal of this cooperation is the adoption by

STMicroelectronics of Soitec’s SmartSiC™ technology for its future

200mm substrate manufacturing, feeding its devices and modules

manufacturing business, with volume production expected in the

medium term. The combination of Soitec’s SmartSiC™ substrates with

STMicroelectronics’ industry-leading silicon carbide technology and

expertise is a game-changer for automotive chip manufacturing. As

the automotive industry is facing major disruption with the advent

of electric vehicles, the transition from 150mm to 200mm SiC wafers

will bring substantial advantages to automotive and industrial

customers as they accelerate the transition towards the

electrification of their systems and products.

Soitec breaks ground on Singapore fab

extension to grow its global semiconductor wafer production

capacity

On December 9th, 2022, Soitec formally broke ground

on the construction of its wafer fab extension at Singapore’s Pasir

Ris Wafer Fab Park. The ceremony was held in the presence of Low

Yen Ling, Singapore’s Minister of State for Trade and Industry, and

Her Excellency, Minh-di Tang, Ambassador of France to Singapore.

The fab extension will enable Soitec to double the annual

production capacity at its Pasir Ris site, in Singapore, to around

two million 300mm SOI (Silicon-on-Insulators) wafers. The capacity

ramp-up is part of Soitec's strategic growth plan to address the

increasing global demand for engineered wafers and complements its

investments at its main hub in France. The extension in Singapore

will add 45,000 square meters of fab space and double Soitec’s

Singapore workforce to more than 600 by 2026.

# # #

Analysts conference call to be held in

English on Thursday 26th January

at 8:00 am CET.

To listen this conference call, the audiocast is

available live and in replay at the following

address: https://channel.royalcast.com/soitec/#!/soitec/20230126_1

# # #

Agenda

Q4’23 revenue is due to be published on April 26th,

2023 after market close.

# # #

Disclaimer

This document is provided by Soitec (the “Company”)

for information purposes only.

The Company’s business operations and financial

position are described in the Company’s 2021-2022 Universal

Registration Document (which notably includes the 2021-2022 Annual

Financial Report) which was filed on June 20, 2022 with the French

stock market authority (Autorité des Marchés Financiers, or AMF)

under number D.22-0523, as well as in the Company’s 2022-2023

half-year report released on November 23, 2022. The French versions

of the 2021-2022 Universal Registration Document and of the

2022-2023 half-year report, together with English courtesy

translations for information purposes of both documents, are

available for consultation on the Company’s website

(www.soitec.com), in the section Company - Investors - Financial

Reports.

Your attention is drawn to the risk factors

described in Chapter 2.1 of the Company’s 2021-2022 Universal

Registration Document.

This document contains summary information and

should be read in conjunction with the 2021-2022 Universal

Registration Document and the 2022-2023 half-year report.

This document contains certain forward-looking

statements. These forward-looking statements relate to the

Company’s future prospects, developments and strategy and are based

on analyses of earnings forecasts and estimates of amounts not yet

determinable. By their nature, forward-looking statements are

subject to a variety of risks and uncertainties as they relate to

future events and are dependent on circumstances that may or may

not materialize in the future. Forward-looking statements are not a

guarantee of the Company’s future performance. The occurrence of

any of the risks described in Chapter 2.1 of the Universal

Registration Document may have an impact on these forward-looking

statements. In addition, the future consequences of geopolitical

conflicts, in particular the Ukraine / Russia situation, as well as

rising inflation, may result in greater impacts than currently

anticipated in these forward-looking statements.

The Company’s actual financial position, results

and cash flows, as well as the trends in the sector in which the

Company operates may differ materially from those contained in this

document. Furthermore, even if the Company’s financial position,

results, cash-flows and the developments in the sector in which the

Company operates were to conform to the forward-looking statements

contained in this document, such elements cannot be construed as a

reliable indication of the Company’s future results or

developments.

The Company does not undertake any obligation to

update or make any correction to any forward-looking statement in

order to reflect an event or circumstance that may occur after the

date of this document. In addition, the occurrence of any of the

risks described in Chapter 2.1 of the Universal Registration

Document may have an impact on these forward-looking

statements.

This document does not constitute or form part of

an offer or a solicitation to purchase, subscribe for, or sell the

Company’s securities in any country whatsoever. This document, or

any part thereof, shall not form the basis of, or be relied upon in

connection with, any contract, commitment or investment

decision.

Notably, this document does not constitute an offer

or solicitation to purchase, subscribe for or to sell securities in

the United States. Securities may not be offered or sold in the

United States absent registration or an exemption from the

registration under the U.S. Securities Act of 1933, as amended (the

“Securities Act”). The Company’s shares have not been and will not

be registered under the Securities Act. Neither the Company nor any

other person intends to conduct a public offering of the Company’s

securities in the United States.

# # #

About Soitec

Soitec (Euronext, Tech 40 Paris) is a world leader

in designing and manufacturing innovative semiconductor materials.

The company uses its unique technologies to serve the electronics

markets. With more than 3,700 patents worldwide, Soitec’s strategy

is based on disruptive innovation to meet its customers’ needs for

high performance, energy efficiency and cost competitiveness.

Soitec has manufacturing facilities, R&D centers and offices in

Europe, the United States and Asia. Fully committed to sustainable

development, Soitec adopted in 2021 its corporate purpose to

reflect its engagements: “We are the innovative soil from which

smart and energy efficient electronics grow into amazing and

sustainable life experiences.”

Soitec, SmartSiC™ and SmartCut™ are registered

trademarks of Soitec.

# # #

For more information, please visit

www.soitec.com and follow us on Twitter:

@Soitec_EN

| Investor

Relations: investors@soitec.com

|

Media

contacts: Isabelle Laurent+33 6 42 37 54

17

isabelle.laurent@oprgfinancial.fr Fabrice Baron+33 6 14 08

29

81 fabrice.baron@oprgfinancial.fr |

# # #

Soitec is a French joint-stock corporation with a

Board of Directors (Société Anonyme à Conseil d’administration)

with a share capital of €71,178,834 having its registered office

located at Parc Technologique des Fontaines - Chemin des Franques -

38190 Bernin (France), and registered with the Grenoble Trade and

Companies Register under number 384 711 909.

# # #Appendix

Consolidated revenue (Q3’23

unaudited)

|

Revenue |

Q1’22 |

Q2’22 |

Q3’22 |

Q4’22 |

Q1’23 |

Q2’23 |

Q3’23 |

|

9m’22 |

9m’23 |

| (Euros

thousands) |

|

|

|

|

|

|

|

|

|

|

| Mobile

communications |

135,121 |

142,282 |

145,709 |

200,031 |

152,105 |

188,503 |

169,838 |

|

423,112 |

510,446 |

| Automotive &

Industrial |

15,917 |

17,212 |

18,815 |

22,461 |

23,160 |

33,785 |

36,947 |

|

51,944 |

93,892 |

| Smart

devices |

29,390 |

33,174 |

43,045 |

59,587 |

27,604 |

45,424 |

67,395 |

|

105,609 |

140,423 |

|

|

|

|

|

|

|

|

|

|

|

|

| Total

revenue |

180,427 |

192,668 |

207,569 |

282,079 |

202,869 |

267,712 |

274,180 |

|

580,665 |

744,761 |

| Change in

revenue |

Q1’23/Q1’22 |

Q2’23/Q2’22 |

Q3’23/Q3’22 |

|

9m’23/9m’22 |

| (vs. previous

year) |

change reported |

chg. at const. exch. rates and

perimeter1 |

change reported |

chg. at const. exch. rates and

perimeter1 |

change reported |

chg. at const. exch. rates and

perimeter1 |

|

change reported |

chg. at const. exch. rates and

perimeter1 |

| Mobile

communications |

+12.6% |

+6.2% |

+32.5% |

+22.1% |

+16.6% |

+10.5% |

|

+20.6% |

+13.0% |

| Automotive &

Industrial |

+45.5% |

+36.7% |

+96.3% |

+79.7% |

+96.4% |

+84.5% |

|

+80.8% |

+68.2% |

| Smart devices |

-6.1% |

-10.9% |

+36.9% |

+27.9% |

+56.6% |

+50.3% |

|

+33.0% |

+26.1% |

|

|

|

|

|

|

|

|

|

|

|

| Total

revenue |

+12.4% |

+6.1% |

+38.9% |

+28.3% |

+32.1% |

+25.5% |

|

+28.3% |

+20.3% |

1 At constant exchange rates and comparable scope

of consolidation:

- There was no scope effect in Q1’22,

Q2’22, Q3’22.

- In Q4’22, Q1’23, Q2’23 and Q3’23 the

scope effect relating to the acquisition of NOVASiC, finalized on

December 29, 2021, had no material impact on Soitec's

revenue.

# # #

1 The EBITDA represents operating income (EBIT)

before depreciation, amortization, impairment of non-current

assets, non-cash items relating to share-based payments, provisions

for impairment of current assets and for contingencies and

expenses, and disposals gains and losses. This alternative

indicator of performance is a non-IFRS quantitative measure used to

measure the company’s ability to generate cash from its operating

activities. EBITDA is not defined by an IFRS standard and must not

be considered an alternative to any other financial indicator

2 EBITDA margin = EBITDA from continuing operations

/ Revenue

3 The scope effect related to the acquisition of

NOVASiC, the closing of which took place on December 29, 2021, had

no material impact on Soitec’s revenue.

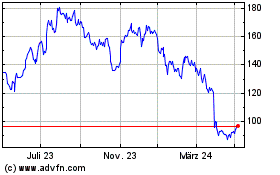

SOITEC (EU:SOI)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

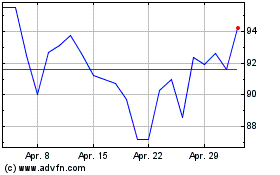

SOITEC (EU:SOI)

Historical Stock Chart

Von Apr 2023 bis Apr 2024