SOITEC REPORTS FY’22 FOURTH QUARTER REVENUE

SOITEC REPORTS FY’22 FOURTH QUARTER

REVENUE

- FY’22 revenue

reached for the first time $1

billion, at €863m, up 50% at

constant exchange rates, slightly

above the guidance of around 45%

- Q4’22 revenue also reached

the record level of €282m, up 53% at constant

exchange rates versus Q4’21

- FY’22

EBITDA1

margin2 is now expected

around 35.5%

- FY’23 revenue expected up

around 20% at constant exchange rates and perimeter and

EBITDA1

margin2 at least at the

level of FY’22 EBITDA1

margin2

- Soitec managing its business

to reach by FY’26 a revenue target of

around $2.3 billion and an

EBITDA1

margin2 target

of around 40% (at a 1.20 Euro/ US

Dollar exchange rate)

Bernin (Grenoble),

France, April 27th, 2022

– Soitec (Euronext Paris), a world leader in designing and

manufacturing innovative semiconductor materials, today announced

consolidated revenue of 282 million Euros for the fourth quarter of

FY’22 (ended March 31st, 2022), up 56% compared with 181 million

Euros achieved in the fourth quarter of FY’21. This reflects the

combination of a 53% growth at constant exchange rates and a

positive currency impact of 3%3.

On a sequential basis, fourth quarter revenue

was up 35% at constant exchange rates compared with the third

quarter of FY’22, representing a seventh consecutive

quarter-over-quarter organic revenue growth since the first quarter

of FY’21.

Paul Boudre, Soitec’s CEO, commented:

“Thanks to another record quarter, we completed our fiscal

year with a 50% annual organic growth, an even higher level than

initially anticipated allowing us to pass the one billion US

dollars revenue mark for the first time. We are very proud of such

a strong performance and particularly pleased that significant

growth was achieved by all our products, demonstrating the value

that we bring to our customers on our

three end markets: mobile communications,

automotive and industrial, and smart devices.

“Among the key events of the quarter, in

line with our FY’26 strategic

roadmap, we announced the expansion of our manufacturing footprint

in Bernin to ramp up overall

production and manufacture innovative

SmartSiC™ wafers.

SmartSiC™ will primarily address the key

challenges of the electric vehicle and industrial

markets,” added Paul Boudre.

Fourth quarter FY’22 consolidated

revenue (unaudited)

| |

Q4’21 |

Q4’22 |

Q4’22/Q4’21 |

| |

|

|

|

|

| (Euros

millions) |

|

|

change reported |

chg. at const. exch. rates |

| |

|

|

|

|

|

150/200-mm |

74 |

94 |

+27% |

+25% |

|

300-mm |

95 |

175 |

+85% |

+81% |

| Royalties and

other revenue |

12 |

13 |

+10% |

+9% |

| |

|

|

|

|

|

Total revenue |

181 |

282 |

+56% |

+53% |

Soitec recorded a 53% total revenue increase at

constant exchange rates in the fourth quarter of FY’22 compared to

the fourth quarter of FY’21, with a solid performance across all

types of products in each end market.

Soitec achieved another strong growth in

Mobile communications, its largest end market,

which continues to be supported by the deployment of 5G, whether in

sub-6 GHz or in mmWave. The expansion of 5G is translating into

much higher sales of RF-SOI wafers dedicated to radiofrequency

applications, POI wafers dedicated to RF filters, and also FD-SOI

wafers for 5G mmWave modules. Growth was enabled by the ramp-up in

production following the capacity increase in our Singapore

facility dedicated to 300-mm SOI products and in Bernin III,

dedicated to 150-mm POI products.

Soitec enjoyed further growth in

Automotive & Industrial as evidenced by the

sustained sales of Power-SOI and FD-SOI, which continue to benefit

from the recovery of the automotive market.

Soitec also achieved a sharp increase in revenue

from Smart devices thanks to much higher sales of

FD-SOI wafers for Internet of Things and edge computing

applications as well as of Photonics-SOI wafers for data

centers.

150/200-mm wafer revenue

150/200-mm wafers are mostly dedicated to

radiofrequency applications, including filters, and, for a smaller

part, to power applications. In the fourth quarter of FY’22,

150/200-mm wafer revenue reached 94 million Euros, a 25%

growth at constant exchange rates compared to the fourth quarter of

FY’21. This growth mostly reflects a strong increase in volumes of

150-mm POI wafers produced in Bernin III, as well as a higher

output of 200-mm SOI wafers in Bernin I thanks to the industrial

performance and at Simgui, Soitec’s partner based in Shanghai. It

also reflects a positive price/mix effect.

150/200-mm wafer revenue growth was mainly

supported by:

- Higher

RF-SOI 200-mm wafer sales compared to the fourth

quarter of FY’21,

- An increase in POI

(Piezoelectric-on-Insulator) wafer sales compared to the

fourth quarter of FY21.

On a sequential basis, 150/200-mm wafer revenue

was up 9% at constant exchange rates compared to the third quarter

of FY’22, with higher RF-SOI 200-mm and Power SOI wafer sales.

300-mm wafer revenue

In the fourth quarter of FY’22, 300-mm wafer

sales reached 175 million Euros, an 81% increase at constant

exchange rates, compared with the fourth quarter of FY’21. Sales

growth essentially results from a strong demand on Soitec’s three

end markets and the Group’s capacity to deliver more volumes from

Bernin II (thanks to the very good industrial performance) and from

Singapore (thanks to the capacity increase), and to a small extent

from a positive price/mix effect.

RF-SOI 300-mm wafer sales

significantly increased compared with the fourth quarter of FY’21.

Sales continue to be supported by the ongoing deployment of 5G

smartphones and by the increase in RF content in every 5G

smartphone.

FD-SOI wafer sales

continued to enjoy a strong growth and were significantly higher

than in the fourth quarter of FY’21, as FD-SOI is increasingly

benefitting applications across Soitec’s three end markets, i.e.

Smart devices, Automotive and Industrial, and Mobile

communications, especially 5G mmWave modules.

Sales of Imager-SOI wafers,

which allow 3D image sensing for facial recognition in smartphones,

also reached a higher level than in the fourth quarter of

FY’21.

Finally, sales of Photonics-SOI

wafers for data centers were much higher than in the fourth quarter

of FY’21, confirming the positive trend experienced since the

fourth quarter of FY’21.

On a sequential basis, 300-mm wafer revenue

increased 50% at constant exchange rates compared to the third

quarter of FY’22, with strong growth achieved in every product

line.

Royalties and other revenue

Total Royalties and other revenue reached 13

million Euros in the fourth quarter of FY’22 compared to 12 million

Euros in the fourth quarter of FY’21, up 9% at constant exchange

rates.

FY’22 annual consolidated revenue

(unaudited)

| |

FY’21 |

FY’22 |

FY’22/FY’21 |

| |

|

|

|

|

| (Euros

millions) |

|

|

change reported |

chg. at const. exch. rates |

| |

|

|

|

|

|

150/200-mm |

277 |

344 |

+24% |

+26% |

|

300-mm |

277 |

488 |

+77% |

+79% |

| Royalties and

other revenues |

30 |

30 |

+1% |

+2% |

| |

|

|

|

|

|

Total revenue |

584 |

863 |

+48% |

+50% |

Annual consolidated revenue reached 863 million

Euros in FY’22, an all-time high record. Revenue was up 48% from

584 million Euros in FY’21. This reflects the combination of a 50%

growth at constant exchange rates and a negative currency impact of

2%.

150/200-mm wafer sales were up 26% at constant

exchange rates compared to FY’21 while 300-mm wafer sales were up

79% at constant exchange rates.

FY’22 Outlook

Thanks in particular to the higher revenue level

in Q4’22, FY’22 EBITDA1 margin2 is now expected around 35.5%,

Soitec having previously guided around 34% with a potential upside

to reach around 35%.

FY’23 outlook

Soitec anticipates FY’23 revenue up around 20%

at constant exchange rates and perimeter and EBITDA margin at least

at the level of FY’22 EBITDA1 margin2.

FY’26 Financial model

Soitec is anticipating significant growth on

each of its end markets and is managing its business to reach by

FY’26 a revenue target of around 2.3 billion US Dollar and an

EBITDA1 margin2 target of around 40% (at a 1.20 Euro/US Dollar

exchange rate), as compared to a revenue of 2 billion US Dollar

(with a high case around 2.4 billion US Dollar) and a 35% EBITDA1

margin2 communicated during its Capital Markets Day in June

2021.

Key events of the quarter

Dolphin Design opens a processing center

in Singapore

On January 5th, 2022, Dolphin Design,

specialized in advanced chip design, announced that it will open

its new dedicated Edge Computing and AI branch in Soitec’s fab in

Singapore. Dolphin Design's vision is to enable the largest

possible AIoT/EDGE IoT semiconductor community to deliver products

with ultimate energy efficiency and performance. Soitec holds an

80% stake in Dolphin Design.

A*STAR's Institute of Microelectronics

and Soitec to develop next-generation silicon carbide

semiconductors

On January 10th, 2022, Singapore-based Institute

of Microelectronics (IME) at the Agency for Science, Technology and

Research (A*STAR) and Soitec have announced a research

collaboration to develop next-generation silicon carbide (SiC)

semiconductor devices to power electric vehicles and advanced

high-voltage electronic devices.

Chief Executive Officer succession

plan

On January 19th, 2022, Soitec’s Board of

Directors announced that Pierre Barnabé will succeed Paul Boudre as

Group CEO at the close of the July 2022 shareholders’ meeting.

Pierre Barnabé will join the company on May 1st, 2022 to work

closely with Paul Boudre on an effective leadership transition. The

Board will also propose the nomination of Pierre Barnabé as a

Director at the ordinary shareholders’ meeting scheduled for July

26th, 2022.

Soitec to expand its manufacturing

footprint in Bernin to produce

innovative silicon carbide semiconductor wafers and increase its

SOI capabilities

On March 11th, 2022, Soitec announced a new

fabrication facility at its headquarters in Bernin, France,

primarily to manufacture new silicon carbide wafers, which address

key challenges of the electric vehicle and industrial markets. The

extension will also support Soitec’s 300-mm Silicon-on-Insulator

(SOI) activities. The factory is to produce innovative SmartSiC™

engineered wafers developed by Soitec at the Substrate Innovation

Center located at CEA-Leti in Grenoble, using Soitec’s proprietary

SmartCut™ technology. The electronic chips built on this type of

wafers offer compelling performance and energy efficiency gains to

power supply systems. The groundbreaking ceremony took place on

March 31st. The new facility will lead to the creation of up to 400

direct new jobs. Soitec targets to generate first revenues in the

second half of calendar year 2023.

Grenoble INP –

Phelma, UGA and Soitec sign a first

partnership agreement

On March 14th, 2022, Grenoble INP - Phelma,

Engineering school in Physics, Electronics and Materials Science of

Université Grenoble Alpes and Soitec announced the signing of a

three-year partnership agreement that will enhance collaboration

between the two organizations, with a focus on growing

microelectronics as a field of study. It will also provide support

for Phelma’s students as they transition to working life and

promote recruitment initiatives.

Post-closing events

Power outage of production in

Bernin

At around 2:00 am on Tuesday April 5th, 2022, a

fire broke out at an electricity supply facility outside Soitec's

site in Bernin which led to the power outage of its production

plants. Safety protocols were activated to protect equipment while

waiting for the restoration of the power supply. Soitec's plants

were progressively back in operation as from April 5th at 8:30 pm

and production went fully back to normal on April 9th. Soitec

expects this power outage to have only a very limited impact on

FY’23 operational and financial performance.

CEA, Soitec, GlobalFoundries and

STMicroelectronics to advance next generation FD-SOI roadmap for

automotive, IoT and mobile applications

On April 8th, 2022, leading semiconductor

players CEA, Soitec, GlobalFoundries and STMicroelectronics

announced a new collaboration in which they intend to jointly

define the industry’s next generation roadmap for FD-SOI

technology. Semiconductors and FD-SOI innovation are of strategic

value to France and the EU as well as to customers globally. FD-SOI

offers substantial benefits for designers and customer systems,

including lower power consumption as well as easier integration of

additional features such as connectivity and security, a key

feature for automotive, IoT and mobile applications.

# # #

Analysts conference call to be held in

English on Thursday 28th April at

8:00 am CET.

To listen this conference call, the audiocast is

available live and in replay at the following

address: https://channel.royalcast.com/soitec/#!/soitec/20220428_1

# # #

Agenda

FY’22 annual results are due to be published on

June 8th, 2022 after market close.

# # #

Disclaimer

This document is provided by Soitec (the

“Company”) for information purposes only.

The Company’s business operations and financial

position are described in the Company’s 2020-2021 Universal

Registration Document (which notably includes the 2020-2021 Annual

Financial Report) which was filed on July 5, 2021 with the French

stock market authority (Autorité des Marchés Financiers, or AMF)

under number D.21-0681 as well as in the Company’s FY’22 half-year

report released on December 2nd, 2021. The French versions of the

2020-2021 Universal Registration Document and of the half-year

report, together with English courtesy translations for information

purposes of both documents are available for consultation on the

Company’s website (www.soitec.com), in the section Company -

Investors - Financial Reports.

Your attention is drawn to the risk factors

described in Chapter 2.1 of the Company’s 2020-2021 Universal

Registration Document.

This document contains summary information and

should be read in conjunction with the 2020-2021 Universal

Registration Document and the FY’22 half-year report.

This document contains certain forward-looking

statements. These forward-looking statements relate to the

Company’s future prospects, developments and strategy and are based

on analyses of earnings forecasts and estimates of amounts not yet

determinable. By their nature, forward-looking statements are

subject to a variety of risks and uncertainties as they relate to

future events and are dependent on circumstances that may or may

not materialize in the future. Forward-looking statements are not a

guarantee of the Company’s future performance. The occurrence of

any of the risks described in Chapter 2.1 of the Universal

Registration Document may have an impact on these forward-looking

statements. In addition, the future consequences of geopolitical

conflicts, in particular the Ukraine / Russia situation, as well as

rising inflation, may result in greater impacts than currently

anticipated in these forward looking statements.

The Company’s actual financial position, results

and cash flows, as well as the trends in the sector in which the

Company operates may differ materially from those contained in this

document. Furthermore, even if the Company’s financial position,

results, cash-flows and the developments in the sector in which the

Company operates were to conform to the forward-looking statements

contained in this document, such elements cannot be construed as a

reliable indication of the Company’s future results or

developments.

The Company does not undertake any obligation to

update or make any correction to any forward-looking statement in

order to reflect an event or circumstance that may occur after the

date of this document. In addition, the occurrence of any of the

risks described in Chapter 2.1 of the Universal Registration

Document may have an impact on these forward-looking

statements.

This document does not constitute or form part

of an offer or a solicitation to purchase, subscribe for, or sell

the Company’s securities in any country whatsoever. This document,

or any part thereof, shall not form the basis of, or be relied upon

in connection with, any contract, commitment or investment

decision.

Notably, this document does not constitute an

offer or solicitation to purchase, subscribe for or to sell

securities in the United States. Securities may not be offered or

sold in the United States absent registration or an exemption from

the registration under the U.S. Securities Act of 1933, as amended

(the “Securities Act”). The Company’s shares have not been and will

not be registered under the Securities Act. Neither the Company nor

any other person intends to conduct a public offering of the

Company’s securities in the United States.

# # #

About Soitec

Soitec (Euronext, Tech 40 Paris) is a world

leader in designing and manufacturing innovative semiconductor

materials. The company uses its unique technologies to serve the

electronics markets. With more than 3,500 patents worldwide,

Soitec’s strategy is based on disruptive innovation to meet its

customers’ needs for high performance, energy efficiency and cost

competitiveness. Soitec has manufacturing facilities, R&D

centers and offices in Europe, the United States and Asia.Soitec

and Smart Cut are registered trademarks of Soitec.

For more information, please

visit www.soitec.com and follow

us on Twitter: @Soitec_EN

| Investor

Relations: investors@soitec.com |

Media

contacts: Isabelle Laurent+33 1 53 32 61 51

isabelle.laurent@oprgfinancial.fr Fabrice Baron+33 1 53 32 61

27fabrice.baron@oprgfinancial.fr |

# # #

Soitec is a French joint-stock corporation with

a Board of Directors (Société Anonyme à Conseil d’administration)

with a share capital of €70,301,160, having its registered office

located at Parc Technologique des Fontaines - Chemin des Franques -

38190 Bernin (France), and registered with the Grenoble Trade and

Companies Register under number 384 711 909.

# # #Appendix

Consolidated revenue (Q3’22 and Q4’22

unaudited)

| Quarterly

revenue |

Q4 |

Q1 |

Q2 |

Q3 |

Q4 |

| (Euros

thousands) |

‘20 |

‘21 |

‘21 |

‘22 |

‘21 |

‘22 |

‘21 |

‘22 |

‘21 |

‘22 |

| |

|

|

|

|

|

|

|

|

|

|

|

150/200-mm |

91,623 |

74,193 |

67,392 |

79,090 |

71,029 |

85,071 |

64,762 |

85,934 |

74,193 |

94,085 |

|

300-mm |

103,895 |

94,850 |

41,269 |

95,914 |

63,877 |

101,615 |

76,655 |

115,662 |

94,850 |

175,201 |

| Royalties and other

revenue |

8,299 |

11,666 |

4,961 |

5,422 |

5,848 |

5,983 |

7,260 |

5,973 |

11,666 |

12,793 |

| |

|

|

|

|

|

|

|

|

|

|

|

Total revenue |

203,817 |

180,708 |

113,622 |

180,427 |

140,754 |

192,668 |

148,678 |

207,569 |

180,708 |

282,079 |

| Quarterly

revenue |

Q4’21 |

Q1’22 |

Q2’22 |

Q3’22 |

Q4’22 |

| (vs. previous

year) |

change reported |

chg. at const. exch. rates and

perimeter1 |

change reported |

chg. at const. exch. rates and

perimeter1 |

change reported |

chg. at const. exch. rates and

perimeter1 |

change reported |

chg. at const. exch. rates and

perimeter1 |

change reported |

chg. at const. exch. rates and

perimeter1 |

| |

|

|

|

|

|

|

|

|

|

|

|

150/200-mm |

-19.0% |

-14.4% |

+17.4% |

+24.2% |

+19.8% |

+22.3% |

+32.7% |

+32.8% |

+26.8% |

+24.7% |

|

300-mm |

-8.7% |

-2.9% |

+132.4% |

+148.9% |

+59.1% |

+63.1% |

+50.9% |

+51.0% |

+84.7% |

+81.1% |

| Royalties and

other revenue |

+40.6% |

+42.3% |

+9.3% |

+12.0% |

+2.3% |

+3.2% |

-17.7% |

-17.7% |

+9.7% |

+9.1% |

| |

|

|

|

|

|

|

|

|

|

|

|

Total revenue |

-11.3% |

-6.2% |

+58.8% |

+69.0% |

+36.9% |

+40.0% |

+39.6% |

+39.7% |

+56.1% |

+53.3% |

1 At constant exchange rates and comparable scope of

consolidation:

- There is no scope effect in Q4’21, Q1’22, Q2’22, Q3’22.

- In Q4’22, the scope effect relating to the acquisition of

NOVASiC, finalized on December 29, 2021, had no material impact on

Soitec's revenue.

# # #

[1] The EBITDA represents the operating income

(EBIT) before depreciation, amortization, non-monetary items

related to share-based payments, and changes in provisions on

current assets and provisions for risks and contingencies,

excluding income on asset disposals. This alternative indicator of

performance is a non-IFRS quantitative measure used to measure the

company’s ability to generate cash from its operating activities.

EBITDA is not defined by an IFRS standard and must not be

considered as an alternative to any other financial indicator.

[2] EBITDA margin = EBITDA from continuing operations /

Revenue.

[3] The scope effect related to the acquisition of NOVASiC, the

closing of which took place on December 29, 2021, had no material

impact on Soitec’s revenue.

- SOITEC PR Sales Q4'22 VUK

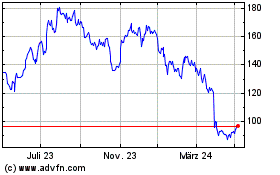

SOITEC (EU:SOI)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

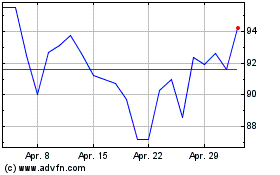

SOITEC (EU:SOI)

Historical Stock Chart

Von Apr 2023 bis Apr 2024