2022 H1 financial results: Renault Group upgrades its 2022

financial outlook

|

PRESS RELEASE July 29, 2022 |

2022 first half

results

Renault Group

upgrades its 2022 financial

outlook and accelerates its

transformation

-

2022 H1

results,

a new step in the

Group's turnaround:

- Significant improvement in

profitability: 4.7% operating margin

- Strong free cash flow generation:

€956 million

- Strengthening of the financial

structure: net debt reduced by €1.2 billion to -€426 million

-

Acceleration of

the strategy focused on

value and success of new vehicles

-

2022 FY

financial

outlook upgraded

- Capital

Market Day in the fall

to present the

2nd step of

the Renaulution strategy

and the update of the Group's

mid-term financial

outlook

"Renault Group is resolutely pursuing

its in-depth transformation and turnaround of its

activities. These first

half results are

a proof of this: despite all the headwinds

related to the stop of

the activity in

Russia, the semiconductor crisis and cost inflation, the

Group continues to improve its operating performance and is

beginning to benefit from the success of new launches.

Having more than compensated for the

loss of its

Russian activities and continuing

its

high-speed

transformation, Renault Group is

upgrading its

2022 full-year financial

outlook. In the

fall, new

mid-term financial

outlook and the accelerated roll-out

of Renaulution will be

presented during

its Capital Market Day.

All our energies are mobilized to transform Renault Group

into a competitive, tech and sustainable

player."

said Luca de

Meo, CEO of Renault Group

-

2022 H11

results,

a new step in the Group's

turnaround:

significant improvement

in

profitability,

strong free cash

flow generation and

strengthening of the financial structure

- Group revenue at

€21.1 billion, stable compared to 2021 H1, despite 11.9% decline in

the Group's global sales over the period, in a still disrupted

market

- Group operating

margin at €988 million (4.7% of revenue): up €556 million and +2.6

points compared to 2021 H1

- Automotive

operating margin at €420 million (2.1% of Automotive revenue):

+€565 million (+2.8 points) despite a decrease of 136,000 vehicles

compared to 2021 H1

- Net income from

continuing operations at €657 million, up €458 million compared to

2021 H1

- Net income from

discontinued operations at -€2.3 billion due to the non-cash

adjustment related to the disposal of the Russian industrial

activities announced on May 16, 2022

- Automotive

operational free cash flow at +€956 million (including a €800

million dividend from Mobilize Financial Services) up €1,470

million compared to 2021 H1

- Automotive net debt

reduced by €1.2 billion versus December 31, 2021, of which €522

million related to the sale of activities in Russia: -€426

million

- Success of

new vehicles and acceleration of

the strategy focused on

value

- Group order book in

Europe at 4.1 months of sales, supported by the success of new

launches:

- Renault Arkana

recorded more than 100,000 orders since its launch, 60% of which

are in E-TECH version and 60% on the retail channel

- Renault Megane

E-TECH Electric is experiencing a promising launch with already

more than 25,000 orders, 75% of which are on the highest versions

and 80% on the most powerful engines. The first vehicles arrived in

French dealerships mid-May; its launch in European countries is

underway and will continue until September

- Dacia Sandero

remains the best-selling vehicle to retail customers in Europe

- With more than

30,000 orders recorded in 2022 H1, Dacia Spring 100% electric is

number 1 electric vehicle sold to retail customers in France

- Dacia Jogger

promises to be a new success with more than 50,000 orders in 6

months and a mix of more than 60% on high-end versions in

Europe

- Alpine doubled its

orders versus 2021 H1 thanks to the success of its new A110

range

- Product mix effect

of +3.3 points on the Automotive revenue versus 2021 H1 thanks to

new launches (Arkana, Jogger and Megane E-TECH Electric)

- Performance of

E-TECH sales2 that continue to grow, representing 36% of the

registrations of Renault brand passenger cars in Europe (vs. 26% in

2021 H1)

- Acceleration of the

pricing effect, which reached +7.4 points of the Automotive revenue

versus 2021 H1. This effect will continue in H2 thanks to the

Renaulution commercial policy

- Impact of raw

materials price increases and cost inflation more than offset by

the benefits of this new commercial policy coupled with the Group's

productivity

-

2022 FY

financial outlook

upgraded

Renault Group is upgrading its 2022 FY financial

outlook with:

- a Group operating margin superior to 5%

versus around 3% previously

- an Automotive operational free cash flow superior to €1.5

billion

versus positive previously

The Group confirms an impact of the semiconductor crisis

estimated at 300,000 vehicles in 2022.

- During its

Capital Market Day in the

fall, the Group will present an

update of its Renaulution mid-term financial outlook and its

strategy positioning itself as a competitive, tech and sustainable

reference player

Boulogne-Billancourt, July 29, 2022 –

On May 16, 2022, the Board of Directors of

Renault Group unanimously approved the signing of agreements to

sell 100% of Renault Group's shares in Renault Russia to the City

of Moscow and its 67.69% stake in AVTOVAZ to NAMI (the Central

Institute for Research and Development of Automobiles and Engines).

In addition, the agreement provides for a call option for Renault

Group to buy back its stake in AVTOVAZ, exercisable at certain

periods over the next 6 years.

As a result of these agreements:

- The Russian

activities were deconsolidated in Renault Group's 2022 H1 financial

statements and treated as discontinued operations under IFRS 5 with

retroactive effect from January 1st, 2022.

- The financial

aggregates of continuing operations for 2022 H1 therefore no longer

include the Russian industrial activities and the year 2021 has

been adjusted in line with this new scope of activity.

- The result of

discontinued operations represents a loss of -€2.3 billion in 2022

H1, mainly due to the impairment of the property, plant and

equipment, intangible assets and goodwill of AVTOVAZ and Renault

Russia as well as the impairment of specific assets held by the

other entities of the Group and the result of disposals on the

Russian entities sold.

- The Automotive

net debt was reduced by €0.5 billion from -€1.6 billion to -€1.1

billion at December 31, 2021.

Group revenue

reached €21,121 million, up 0.3% compared to 2021 H1. At constant

exchange rates3, it increased by 1.1% (negative exchange rate

effect mainly related to the Turkish lira devaluation).

Automotive revenue stood at

€19,574 million, up 0.3% compared to 2021 H1.

The price effect, positive by +7.4 points,

reflected the continuation of our commercial policy, launched in

2020 Q3, focused on value over volume as well as price increases to

offset cost inflation, and an optimization of commercial discounts.

It amounted to +8.4 points in 2022 Q2 after +5.6 points in Q1.

The success of Arkana, launched in 2021 Q2, as

well as those of Jogger and Megane E-TECH Electric in H1,

emphasized the renewal of Renault brand in the C segment and

contributed to generate a positive product mix effect of +3.3

points.

These two effects make it possible to compensate

for the loss of volume of -5.2 points, which is mainly explained by

the decline of the European automotive market in connection with

the shortage of semiconductors.

The impact of sales to partners, negative by

-1.8 points, is mainly due to the decrease in production of diesel

engines and vehicles for our partners (end of contracts of Master

for Opel and Traffic for Fiat at the end of 2021).

The "Other" effect, of -2.1 points, is due to a

decrease in the contribution of sales from the Renault Retail Group

(RRG) network following the disposals of branches and partially

offset by the aftersales performance.

The Group recorded a positive

operating margin of €988 million (4.7% of revenue)

versus €432 million in 2021 H1(+2.6 points).

Automotive operating

margin improved by €565 million to €420 million (2.1% of

Automotive revenue, or +2.8 points versus 2021 H1).

The positive mix/price/enrichment effect of

+€1,548 million illustrates the success of the commercial policy

focused on value over volume. This policy more than offset the

negative volume effect of -€270 million and the increase in costs

(raw materials, purchasing, warranty and manufacturing &

logistics costs) which amounted to -€647 million. The latter is

mainly explained by the sharp increase in raw materials prices

(-€797 million), partially offset by the performance of purchasing

(+€167 million).

The contribution of Sales Financing of

Mobilize Financial Services

(formerly RCI Bank and Services) to the Group's operating margin

reached €582 million, down €11 million compared to 2021 H1, mainly

due to the normalization of the level of risk and an average

performing assets (€43.7 billion) decreasing in line with the

Group's strategy to optimize vehicle stocks in the network.

The retail business recorded a 2.3% increase in

new financings. The 14.8% increase in the average amount financed

for new contracts offset the 10.9% decrease of the number of new

financing contracts due to the decline of the Group's

registrations.

In 2022 H1, Mobilize Financial Services

successfully completed its first green bond issue for an amount of

€500 million with a 5-year maturity. The proceeds of this issue

will be used to finance electric vehicles and charging

infrastructure. This issue was cashed in early July and is

therefore not included in the financial liabilities as at June 30,

2022.

Other operating income and

expenses were negative at -€49 million (versus -€70

million in 2021 H1) and were notably explained by restructuring

provisions of -€134 million and asset disposals (+€56 million)

mainly related to the sale of several commercial subsidiaries of

the Group and branches of RRG.

After taking into account other operating income

and expenses, the Group's operating income stood

at €939 million versus €362 million in 2021 H1.

Net financial income and

expenses amounted to -€236 million compared to -€138

million in 2021 H1. This deterioration can be explained by the

impact of hyperinflation in Argentina, the cost of debt remaining

stable.

The contribution of associated

companies amounted to €214 million, up by €54 million

compared with the first half of 2021. This includes €325 million

related to Nissan's contribution, which more than offset €111

million negative contribution from other associates, notably in

connection with the impairment of Renault Nissan Bank shares in

Russia.

Current and deferred taxes

represented a charge of -€260 million compared to a charge of -€185

million in 2021 H1 in relation with the improvement in profit.

Net income from

continuing operations was €657 million, up by €458 million

compared to 2021 H1.

Net income

from discontinued operations amounted to

-€2.3 billion due to the non-cash adjustment related to the

disposals of the Russian industrial activities.

Thus, net income was -€1,666

million and net income, Group share, was -€1,357

million (or -€4.98 per share).

The cash flow

of the Automotive business, excluding

restructuring expenses, included €800 million of Mobilize Financial

Services dividend and reached €2.6 billion, up €0.9 billion

compared to 2021 H1. This cash flow largely covered the tangible

and intangible investments before asset disposals which amounted to

€1.2 billion (€1.1 billion net of disposals).

Excluding the impact of asset disposals, the

Group's net CAPEX and R&D rate was 8.0% of revenue compared to

9.1% in 2021 H1. It amounted to 7.5% including asset disposals.

Automotive

operational free cash

flow4 was positive at +€956

million taking into account -€278 million of restructuring expenses

and a negative change in working capital requirement of -€275

million.

Automotive net debt amounted to

-€426 million at June 30, 2022 compared to -€1.6 billion at

December 31, 2021 (-€1.1 billion adjusted from the operations of

AVTOVAZ and Renault Russia), or a decrease of €1.2 billion.

In 2022 H1, Renault Group made an early

repayment of €1 billion of the loan of a banking pool benefiting

from the guarantee of the French State (PGE) and will reimbursed,

in H2, €1 billion for the mandatory annual repayment. As announced,

the entire loan will be reimbursed by the end of 2023 at the

latest.

As part of its Shelf Registration program,

Renault SA launched on June 24, 2022 a bond issue on the Japanese

market for a total amount of 80.7 billion yen (or €561 million)

with a rate of 3.5% and a 3-year maturity. This issue was cashed in

on July 1st , 2022 and is therefore not included in the financial

liabilities as at June 30, 2022.

As of June 30, 2022, total

inventories of new vehicles (including the

independent dealer network) represented 348,000 vehicles compared

to 427,000 (including c. 12,000 vehicles in Russia) at the end of

June 2021, or 60 days of sales.

Outlook & Strategy

Renault Group is upgrading its 2022 FY financial

outlook with:

- a Group

operating margin superior to

5%, versus around 3% previously

- an

Automotive

operational free

cash flow superior to

€1.5 billion, versus positive previously

The Group confirms an impact of the

semiconductor crisis estimated at 300,000 vehicles in 2022.

During its

Capital Market Day in the

fall, Renault Group will

present an update of its

Renaulution

mid-term

financial

outlook and its

strategy positioning

itself as a competitive, tech

and sustainable reference

player.

Renault Group's consolidated results

|

In €

million |

2021 H1

5 |

2022 H1 |

Change |

|

Group revenue |

21,057 |

21,121 |

+0.3% |

|

Operating margin % of revenue |

432

2.1% |

988 4.7

% |

+556 +2.6 pts |

|

Other operating income and expenses |

-70 |

-49 |

+21 |

|

Operating income |

362 |

939 |

+577 |

|

Net financial income and expenses |

-138 |

-236 |

-98 |

|

Contribution from

associated companies |

160 |

214 |

+54 |

|

of which Nissan |

100 |

325 |

+225 |

|

Current and deferred taxes |

-185 |

-260 |

-75 |

|

Net income |

368 |

-1,666 |

-2,034 |

|

of which continuing operations |

199 |

657 |

+458 |

|

of which

discontinued operations |

169 |

-2,323 |

-2,492 |

|

Net income, Group share |

354 |

-1,357 |

-1,711 |

|

Automotive

operational

free

cash

flow |

-514 |

956 |

+1,470 |

Adjustments of AVTOVAZ and Renault Russia activities in 2021

|

In € million |

2021 H1 |

2021 H1 |

Change |

2021 FY |

2021 FY |

Change |

|

published |

adjusted |

|

Published |

adjusted |

|

|

Group revenue |

23,357 |

21,057 |

-2,300 |

46,213 |

41,659 |

-4,554 |

|

Operating margin |

654 |

432 |

-222 |

1,663 |

1,153 |

-510 |

|

% of revenue |

2.8% |

2.1% |

-0.7 pt |

3.6% |

2.8% |

-0.8 pt |

|

Other operating income and expenses |

-83 |

-70 |

+13 |

-265 |

-253 |

+12 |

|

Operating income |

571 |

362 |

-209 |

1,398 |

900 |

-498 |

|

Net financial income and expenses |

-163 |

-138 |

+25 |

-350 |

-295 |

+55 |

|

Contribution from

associated companies |

160 |

160 |

- |

515 |

515 |

- |

|

Current and deferred taxes |

-200 |

-185 |

+15 |

-596 |

-571 |

+25 |

|

Net income |

368 |

368 |

- |

967 |

967 |

- |

|

of which continuing operations |

368 |

199 |

-169 |

967 |

549 |

-418 |

|

of which discontinued

operations |

- |

169 |

+169 |

|

418 |

+418 |

|

Automotive

operational

free

cash

flow |

-70 |

-514 |

-444 |

1,272 |

889 |

-383 |

|

Automotive Net Debt |

|

|

|

-1,622 |

-1,100 |

+522 |

|

|

at 2021-12-31 |

at 2021-12-31 |

at 2021-12-31 |

Additional information

The condensed half-year consolidated financial

statements of Renault Group at June 30, 2022 were reviewed by the

Board of Directors on July 28, 2022. The Group’s statutory auditors

have conducted a limited review of these financial statements and

their half-year report will be issued shortly. The financial

report, with a complete analysis of the financial results in the

first half of 2022, is available at www.renaultgroup.com in the

“Finance” section.

2022 H1 Financial Results Conference

Link to follow the conference at 8am today and available in

replay: events.renaultgroup.com/en/

About Renault

Group Renault Group is at the forefront of a mobility that

is reinventing itself. Strengthened by its alliance with Nissan and

Mitsubishi Motors, and its unique expertise in electrification,

Renault Group comprises 4 complementary brands - Renault, Dacia,

Alpine and Mobilize - offering sustainable and innovative mobility

solutions to its customers. Established in more than 130 countries,

the Group has sold 2.7 million vehicles in 2021. It employs nearly

111,000 people who embody its Purpose every day, so that mobility

brings people closer. Ready to pursue challenges both on the road

and in competition, Renault Group is committed to an ambitious

transformation that will generate value. This is centred on the

development of new technologies and services, and a new range of

even more competitive, balanced and electrified vehicles. In line

with environmental challenges, the Group’s ambition is to achieve

carbon neutrality in Europe by 2040.

https://www.renaultgroup.com/en/

| RENAULT

GROUP INVESTOR RELATIONS |

|

Philippine de

Schonen+33 6 13 45 68 39philippine.de-schonen@renault.com

|

|

|

|

RENAULT GROUP PRESS

RELATIONS |

|

Frederic Texier+33 6 10 78 49 20frederic.texier@renault.com

Astrid de Latude+33 6 25 63 22 08astrid.de-latude@renault.com

|

|

|

1 The results presented relate to continuing operations

(excluding Avtovaz and Renault Russia whose disposals were

announced on May 16, 2022)

2 The E-TECH range consists of electric and hybrid vehicles 3 In

order to analyze the variation in consolidated revenue at constant

exchange rates, Renault Group recalculates the revenue for the

current period by applying average exchange rates of the previous

period.

4 Automotive operating free cash flow: cash flow after interest

and taxes (excluding dividends received from listed companies) less

tangible and intangible investments net of disposals +/- change in

working capital requirement5 The results presented relate to

continuing operations (excluding Avtovaz and Renault Russia whose

disposals were announced on May 16, 2022)

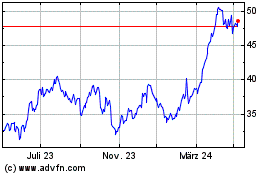

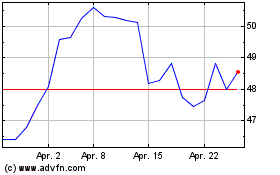

Renault (EU:RNO)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Renault (EU:RNO)

Historical Stock Chart

Von Apr 2023 bis Apr 2024