Agreement in Principle With the Main Banking Partners of ORPEA S.A. Relating to an Additional Financing and the Adjustment of the Financing Documentation of June 2022

08 März 2023 - 8:00AM

Business Wire

Regulatory News:

Further to the press release of 6 March 2023 of ORPEA S.A.

(Paris:ORP), the Company continued its discussions with its main

banking partners, which has enabled to set the terms of the

agreement in principle, detailed below.

This agreement in principle is a major step in the

implementation of the group's financial restructuring in view of

the opening of an accelerated safeguard procedure in the course of

March.

It will allow, subject to obtaining the agreement of the credit

committees of the institutions concerned and the finalization of

the contractual documentation, to satisfy one of the conditions

precedent of the lock-up agreement relating to the financial

restructuring of the Company concluded on 14 February 2023 with, on

the one hand, the group of long-term investors led by the Caisse

des Dépôts et Consignations, including CNP Assurances, MAIF and

MACSF, and on the other hand, five institutions holding unsecured

debt of ORPEA S.A.

This agreement in principle is exclusively part of the

restructuring plan proposed by the Company, intended for the group

of investors led by the Caisse des Dépôts et Consignations to

become the controlling shareholder of the Company.

1. Additional financing via a secured syndicated loan of 600

million euros

Pursuant to the agreement in principle, an additional financing

via a secured syndicated loan in the amount of 600 million euros

will be made available by lenders including the main banking

partners with whom the Company had implemented the June 2022

financing.

This additional secured financing will be made available to

Niort 94 and Niort 95, which will hold part of the group's real

estate assets.

The implementation of this additional financing should notably

enable the group to cover its liquidity needs until the completion

of the capital increases.

This additional financing will include the provision of the

following credit facilities:

(i) A revolving credit facility, in the amount of 400 million

euros, maturing on 30 June 2026;

(ii) Two credit facilities, for a total amount of 200 million

euros, maturing on the earliest of the following dates: 31 December

2023 or 5 business days following the completion of all the capital

increases.

These credit facilities will bear interest at a rate equal to

EURIBOR, plus a margin of 2.00%.

The drawing of these credits will be subject to usual conditions

precedent for this type of financing and will also be conditional

on the completion of certain stages of the financial restructuring

of the Company (including approvals of competent authorities).

The other characteristics of this additional financing will be

communicated to the market once the contractual documentation will

have been finalised.

2. Adjustment of the documentation of the existing

financing

The main changes will be as follows:

- Margin reduced to 2.00% per year;

- Final maturity date extended to 31 December 2027;

- Contractual instalments as follows:

- 31 December 2023: 200 million euros

instalment

- 31 October 2024: 200 million euros

instalment

- 31 October 2025: 200 million euros

instalment (increased by the amount of the net proceeds of any

asset sale, up to 100 million euros)

- 31 October 2026: 200 million euros

instalment

- Commitment to dispose of real estate assets for €1.25 billion

(gross value, excluding duties) by 31 December 2025;

- 75% of the net proceeds from asset disposals, allocated to

mandatory prepayment, net of contractual instalments, subject to

maintaining a minimum liquidity of 300 million euros.

About ORPEA

ORPEA is a leading global player, expert in the care of all

types of frailty. The Group operates in 22 countries and covers

three core businesses: care for the elderly (nursing homes,

assisted living, home care), post-acute and rehabilitation care and

mental health care (specialized clinics). It has more than 72,000

employees and welcomes more than 255,000 patients and residents

each year.

https://www.orpea-group.com/

ORPEA is listed on Euronext Paris (ISIN: FR0000184798) and is a

member of the SBF 120, STOXX 600 Europe, MSCI Small Cap Europe and

CAC Mid 60 indices.

Warning - Forward-looking information

This press release contains forward-looking information that

involve risks and uncertainties, concerning the Group's expected

growth and profitability in the future which may significantly

impact the expected performance indicated in the forward-looking

statements. These risks and uncertainties are linked to factors out

of the control of the Company and not precisely estimated, such as

future market conditions. Any forward-looking statements made in

this press release are statements about the Company’s expectations

about a future situation and should be evaluated as such. Further

events or actual results may differ from those described in this

press release due to a number of risks and uncertainties that are

described in the 2021 Company’s Universal Registration Document

available on the Company’s website and on the Autorité des Marchés

Financiers website (www.amf-france.org), and in the Half-Year 2022

financial report which is available on the Company’s website.

This press release is for information purposes only and does not

constitute an offer to sell or a solicitation of an offer to buy

any securities in any jurisdiction

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230307006095/en/

Investor Relations ORPEA Benoit Lesieur Investor

Relations Director b.lesieur@orpea.net

Toll free tel. nb. for shareholders: +33 (0) 805 480

480

Investor Relations NewCap Dusan Oresansky Tel.:

+33 (0)1 44 71 94 94 ORPEA@newcap.eu

Media Relations ORPEA Isabelle Herrier-Naufle

Media Relations Director Tel.: +33 (0)7 70 29 53 74

i.herrier-naufle@orpea.net

Image 7

Charlotte Le Barbier Tel.: +33 (0)6 78 37 27 60

clebarbier@image7.fr

Laurence Heilbronn Tel.: +33 (0)6 89 87 61 37 lheilbronn@image7.fr

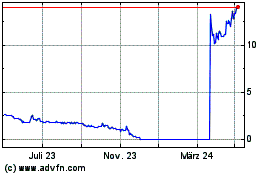

Orpea (EU:ORP)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

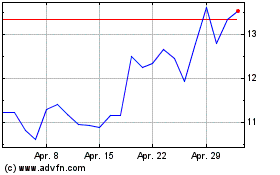

Orpea (EU:ORP)

Historical Stock Chart

Von Apr 2023 bis Apr 2024