Opening of an Amicable Conciliation

Procedure Towards ORPEA S.A Aiming at Renegociating Its Debt With

Its Financial Creditors

Anticipated Asset Impairments at 31 December

2022 Associated With the Ongoing Strategic Review and Currently

Estimated at Between €2.1 and €2.5 Billion Before Tax1

Presentation on 15 November of the

Transformation Plan, Benefitting Patients, Residents, Their

Families, and Employees

Regulatory News:

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20221025006174/en/

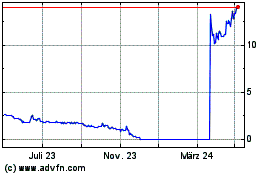

Appendix 1 – Gross financial debt

maturity profile (Graphic: Business Wire)

ORPEA S.A (Paris:ORP):

The highly inflationary economic environment and the

consequences of the strategic and financial review conducted,

currently being finalized by the new management team since the

Company’s last publications, have led the Company in a situation

requiring to renegotiate its debt, including the covenants

contained in many of its financing lines, which may not be met as

they stand at 31 December 2022. In addition, the current context

also impacts the asset disposal program as envisaged in the

financing plan agreed with the main banking partners in May of this

year, which aimed at ensuring the Group's liquidity. The amount of

gross debt due as of 31 December 2023 (as calculated as of 30 June

2022, pro forma for drawings made as of 27 September 2022) is

€2.439 billion.

ORPEA S.A therefore received yesterday approval regarding the

opening of an amicable conciliation procedure2 by the President of

the Nanterre specialized Commercial Court. The purpose of this

procedure is to enable ORPEA S.A to engage in discussions with its

financial creditors on the restructuring of its financial debt, to

obtain new financial resources and to adjust its covenants, within

a stable and legally secure framework. The conciliation procedure

only concerns the financial debt of ORPEA S.A as legal entity and

will not involve operational creditors (such as suppliers). It will

have no impact on operations, employees, patients, residents and

their families.

This new step, which has the Board of Directors’ unanimous

approval and support, is a prerequisite for the implementation of

ORPEA's transformation plan that will be presented on 15

November.

Following the suspension on 24 October 2022, the trading of

all financial instruments (shares, debt securities and related

securities) issued by ORPEA will resume on this Wednesday 26

October 2022, at the market opening.

Laurent Guillot, Chief Executive

Officer, said:

“The new management team and all the ORPEA teams are fully

mobilized on our main priorities: safety and working conditions for

our employees; quality of care and support for our residents,

patients and their families; ethical and responsibility principles

inherent to our mission.

We have taken many decisions to restore good practices

throughout the Company, in a spirit of 'zero tolerance'. This has

already led us to dismiss managers and employees who have behaved

unethically, to implement reinforced control measures and to take

an active approach to transparency, particularly financial

transparency, in order to provide an accurate and sincere picture

of ORPEA's situation.

The malfeasance and ethical misconduct, combined with the

excessive real estate and international development undertaken by

the previous management team, have seriously affected ORPEA's

financial situation. All the elements relating to these acts have

been and will continue to be brought to the attention of the Public

Prosecutor, further to the complaint already filed by the Company

in April 2022, and in a nominative manner when appropriate.

In order to ensure the implementation of the transformation plan

that I will present on 15 November, in a challenging macroeconomic

context that has impacted operating performance as well as the

asset disposal program, and in view of the risk of depreciation on

certain assets, I have requested the opening of an amicable

conciliation procedure benefitting the ORPEA SA legal entity. This

procedure allows us to better manage discussions with our financial

creditors in the context of a restructuring of the Group’s

financial debt and to obtain new financial resources, while

ensuring the Company can operate normally.”

Guillaume Pepy, Chairman of the Board

of Directors stated on his part:

“The Board of Directors unanimously supports the Chief Executive

Officer’s decision to request the opening of an amicable

conciliation procedure and expresses full confidence in ORPEA's

ability to transform itself and ensure the best support and quality

of care for the most vulnerable.”

Unaudited financial information

concerning the Group's debt structure as of 30 September

2022:

Gross Debt

€9 527 M

Cash position

€854 M

Secured Debt

€4 477 M

Unsecured Debt

€5 050 M

Unsecured Debt incurred by ORPEA S.A

€4 403 M

Debt subject R1/R2 covenants

€3 342 M

The gross financial debt maturity profile, as published on 28

September 2022, is set forth in Appendix

1 of this press release.

Evolution of financial

covenants

Given the highly inflationary economic environment and the

consequences of the strategic review currently being finalized,

ORPEA must amend the "R1" and "R2" covenants (see definition

recalled in Appendix 2) contained in

many of the Group's financing lines (representing, together and to

date, an outstanding amount of €3.3 billion).

Indeed:

- With regard to the R1 ratio: the downward trend in the

activities’ financial performance observed in the first half of

2022 is continuing in the second half of the year, in particular

due to the significant increase in the Group's purchasing costs,

particularly for energy and catering; and

- With regard to the R2 ratio: the new business plans drawn up by

the operational teams at facility level as part of the strategic

review suggest, to date and on the basis of unaudited internal

works carried out, significant impairments of certain assets

recorded in the Company's balance sheet, with a decrease estimated

at:

- Between €0.8 and €1.0 billion before tax, of the value of the

revalued real estate assets subject to an independent annual

appraisal, and estimated at €5.8 billion at 31 December 2021. The

total value of the real estate assets reported, including the part

not revalued by independent experts, amounted to €8.1 billion on

the same date; this decrease in the value of the real estate assets

is solely the result of the evolution of the business plans,

excluding any other parameter (real estate yields, etc.)3 and will

be recorded mainly as a reduction in equity;

- Between €1.3 and €1.5 billion before tax, of the value of

intangible assets corresponding to goodwill and operating licenses

that represented €4.7 billion on the balance sheet at 31 December

2021. This decrease in the value of intangible assets results both

from the evolution of business plans and from the upward revision

of the risk-free rate to 2.5% (compared to 0.2% previously).

- These figures are unaudited and will be reviewed by the

statutory auditors as part of their audit of the accounts to 31

December 2022.

Furthermore, in the context of the preparation of its financial

statements for the year to 31 December 2022, the Company may be led

to recognize impairments in addition to those mentioned above. The

latter could result from changes in certain calculation parameters

not considered as of today in the approach used for the valuation

of real estate and intangible assets (e.g. cost of capital, yield

on real estate assets, etc.). As an indication, an increase of

0.25% in the yield on real estate assets would result in a decrease

of approximately €240 million in the value of the real estate

assets revalued by the independent experts. These additional

impairments could also result from future work that the Company

will carry out on the unappraised portion of the real estate assets

held and on the value of financial receivables relating to

partnerships, depending on the progress of negotiations undertaken

with a view to their settlement. As a reminder, the amount of these

financial receivables was €697 million at 30 June 2022.

Failure to comply with the "R1" and "R2" covenants could result

in the acceleration of repayment of the relevant financing

lines.

Financing plan and real estate

disposals

The financing plan, agreed with the main banking partners in May

this year and formalized in June 2022 by the approval of a

conciliation protocol (protocole de conciliation), included the

achievement of a property disposals program. A first transaction

involving assets in the Netherlands was announced in July 2022 for

an amount of €126 million and resulted in an initial receipt of €94

million in September.

Meanwhile, the recent context and the resulting wait-and-see

attitude in the real estate transaction market are jeopardizing the

continuation of this program within the specified timeframe and

necessarily impact the liquidity conditions of such assets.

In this respect, the Company's main commitments, made in June

2022, are set forth in Appendix 3.

Conciliation procedure and contemplated

financial restructuring

ORPEA has obtained yesterday the opening by the President of the

Nanterre specialized Commercial Court of an amicable conciliation

procedure. The purpose of this preventive procedure is to reach

amicable solutions with ORPEA S.A's main financial creditors, under

the aegis of a conciliator, in order to achieve a sustainable

financial structure by drastically reducing its debt and securing

the liquidity necessary to continue its activity.

At this stage, options under consideration include equity

conversion of ORPEA S.A's unsecured debt, amounting €4.3 billion,

amendment of the "R1" and "R2" financial covenants contained in

multiple financing agreements not impacted by the conversion of

debt into equity, and certain modifications to existing secured

debt to facilitate the injection of new sources of financing,

notably in the form of new secured debt on assets of the group free

of any security interests and capital increase.

Creditors holding unsecured financial debt of ORPEA S.A are

invited to organize themselves in order to facilitate future

discussions with the Company. The appointed conciliator, Maître

Hélène Bourbouloux (FHB), invites the financial creditors concerned

to come forward at the following e-mail address

(orpea@aetherfs.com). They are requested to provide, among

others proof of debt holding at that time and sign a non-disclosure

agreement in order to participate in a meeting scheduled for 15

November 2022, the logistical details of which will be communicated

later.

The Company has appointed Rothschild & Co and Perella

Weinberg Partners as financial advisors and White & Case LLP

and Bredin Prat as legal advisors.

The Company will continue to keep the market informed of

progress of the ongoing discussions through its corporate

communication, in compliance with its legal and regulatory

obligations.

Presentation of the transformation plan

and financial calendar

The presentation of ORPEA's transformation plan by the new

management team will take place on Tuesday 15 November 2022.

Details on how to participate will be communicated at a later

stage.

Third quarter 2022 revenue will be announced on 8 November 2022

after market close.

Following the suspension on 24 October 2022, the trading of all

financial instruments (shares, debt securities and related

securities) issued by ORPEA S.A will resume on this Wednesday 26

October 2022 at the market opening.

Appendix 2 – Reminder

of the methods for calculating covenants “R1” and

“R2”

The Company reminds readers that bilateral bank loans as well as

borrowings made under German law, Schuldschein, as well as certain

bond issues are subject to the following contractually agreed

covenants, tested on a half-yearly basis:

R1 =

consolidated net financial debt

(excluding net real estate debt)

, and

(EBITDA excluding IFRS164 – 6 % x

net real estate debt)

R2 =

consolidated net financial

debt

Equity + quasi equity5

As of 30 June 2022, these two ratios amounted to 3.58 and 1.87,

respectively. The applicable contractual limits are 5.5 for R1 and

2.0 for R2.

Notes to the table of Appendix 3: (4) As of September,

27th 2022, €94m of gross asset value disposals have been achieved

(5) Real estate assets disposal commitments do not prevent the

group from becoming tenant for these assets

About ORPEA ORPEA is a leading global player, expert in

the care of all types of frailty. The Group operates in 22

countries and covers three core businesses: care for the elderly

(nursing homes, assisted living, home care), post-acute and

rehabilitation care and mental health care (specialized clinics).

It has more than 71,000 employees and welcomes more than 255,000

patients and residents each year.

https://www.orpea-group.com/

ORPEA is listed on Euronext Paris (ISIN: FR0000184798) and is a

member of the SBF 120, STOXX 600 Europe, MSCI Small Cap Europe and

CAC Mid 60 indices.

___________________________ 1 Unaudited figures 2 The

conciliation is a procedure, so-called amicable or preventive, for

dealing with business difficulties. It is provided for in the

Commercial Code. The negotiations, which take place under the aegis

of a conciliator appointed by the President of the Commercial

Court, are confidential. The conciliator's mission is to encourage

the conclusion of an amicable agreement between the debtor and its

creditors, who are called upon to do so, aimed at putting an end to

the company's difficulties and ensuring its continuity. 3 The

breakdown of this decline in value between the impact on profit or

loss and the impact on equity is currently being determined in

accordance with the accounting rules in force. 4 Calculation based

on last twelve months. 5 Deferred tax liabilities linked to the

valuation of intangible operating assets under IFRS in the

consolidated financial statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221025006174/en/

Investor Relations ORPEA Benoit Lesieur Investor

Relations Director b.lesieur@orpea.net

Investor Relations NewCap Dusan Oresansky +33 (0)1

44 71 94 94 ORPEA@newcap.eu

Media Relations ORPEA Isabelle Herrier-Naufle

Media Relations Director +33 (0)7 70 29 53 74

i.herrier-naufle@orpea.net

Image 7 Charlotte Le Barbier +33 (0)6 78 37 27 60

clebarbier@image7.fr

Toll free tel. nb for shareholders: +33 (0) 805 480 480

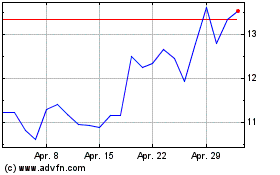

Orpea (EU:ORP)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Orpea (EU:ORP)

Historical Stock Chart

Von Apr 2023 bis Apr 2024