Decline in operating profitability and net

income at -€269m significantly impacted by asset

impairments

Regulatory News:

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20220928005767/en/

The ORPEA Group (Paris:ORP) reports its consolidated results,

reviewed by the statutory auditors, for the six months ended 30

June 2022, which were approved today by the Board of Directors.

Laurent Guillot, Chief Executive Officer, said: "ORPEA has

strong assets: first and foremost, 71,000 professionals who are as

committed as ever to our residents and patients; its care

protocols, which have always been one of the pillars of the Group;

and its dense network of facilities with leading positions in its

main countries. As a result, turnover for the first half of 2022 is

up by more than 10%.

However, the company has been severely affected by the unethical

behaviour of its former managers and by its rapid international and

real estate development, which have weakened ORPEA's financial

situation. The net result is thus strongly affected by assets

depreciation.

In this context, I took a first series of very concrete measures

this summer. These include the launch of an ambitious recruitment

plan, greater autonomy for facility managers to hire and improve

quality of care, and more dialogue with families, as evidenced by

the results of the “Etats Généraux du Grand Age” held in France.

This is a first step that will be followed by a transformation plan

to be presented in the autumn, paving the way for the definition of

a new model, bringing more trust and more transparency in the

support of the most fragile people.”

* * *

1. Consolidated income

statement

(€m) – including IFRS16 impact

2021

H1 2021

H1 2022

Chg. H1 2022 vs. H1 2021

Revenue

4 299

2,070

2,295

+10.9%

EBITDAR

1 070

515

427

-17.1%

EBITDAR margin

24,9%

24.9%

18.6%

-628 bps

EBITDA

1 041

499

415

-16.9%

EBITDA margin

24,2%

24.1%

18.1%

-605 bps

Recurring Operating Profit

396

231

82

-64.6%

Recurring operating margin

9,2%

11.1%

3.6%

-758 bps

Non current items

-41

12

-251

Operating Profit (Loss)

355

242

-170

Net Finance cost

-249

-109

-96

Result before tax

106

133

-266

Net Result – Group share

65

102

-269

Rental income not deducted from EBITDA

under IFRS16 was €171 million in H1 2021 and €202m in H1 2022 (the

increase being mainly due to the development of the Group). EBITDA

excluding the impact of IFRS16 was €682m for the full year 2021,

€326 million for H1 2021 and €209 million for H1 2022.

Revenue for the first half of 2022 amounted to €2,295m, up

10.9%, of which 6.4% was organic. Activity was characterised by

good overall momentum in clinics both in France and

internationally, and in retirement homes outside France. In France,

the nursing home activity was affected by the crisis faced by the

Company (5-point decrease in occupancy rate between January and

April 2022 followed by a gradual recovery). Revenue for the period

benefited from the contribution of acquisitions made in 2021 and

changes in scope in 2022.

EBITDAR was €426.7m in H1 2022, representing a margin of

18.6%, compared with 24.9% in H1 2022. This decline, totalling

around 628 bps, is mainly attributable:

- for approximately 190 bps, to the substantial reduction in

Covid-related compensations received in its various countries (net

impact: €40m), which the increase in the Group's occupancy rate

between the two periods did not offset;

- for approximately 190 bps, to the recording of sizeable

specific income, totalling €40m (reversal of provisions, reduction

of social security contributions and VAT credits) in the first half

of 2021 that did not recur in 2022;

- for approximately 213 bps, to an increase in other costs in a

highly inflationary environment for purchases, whereas the rates

charged to patients and residents remained virtually stable in the

short term. The most marked inflationary effects were on catering

and especially on energy. As a result of the hedging policy

decisions made in 2021, the company’s energy purchases for 2022 are

only partially hedged, and there is no hedging on electricity in

France in particular. As a result, the Group's energy costs as a

percentage of revenue in the first half of 2022 stood at 2.9%,

compared with 1.9% in the first half of 2021.

EBITDA amounted to €414.9m, representing a margin of

18.1% of sales.

Recurring Operating Profit (after depreciation and

provisions) was €81.8m, which compares to €230.7m in H1 2021.

Depreciation, amortisation and provisions amounted to

€333.2m, compared with €268.7m in the first half of 2021. This

change includes the increase in depreciation and amortisation

linked to the increase in the number of facilities operated, as

well as an additional allocation to the provisions of €83.2m that

had been booked at 31 December 2021 following the joint IGF-IGAS

(France’s Inspectorate General for Finance and Inspectorate General

for Social Affairs) mission’s report. The latter was increased to

€100.8 million at 30 June 2022, an increase of €17.6m. This change

includes the estimated surplus of €14.3m for the first half of 2022

(compared to €41m for the whole of 2021) and an additional €3.3m

following the notification received from the CNSA (“Caisse

Nationale de Solidarité pour l'Autonomie”).

Indeed, on 29 July 2022, the CNSA notified ORPEA S.A. that it

intended, following the report of the joint IGF-IGAS audit dated

March 2022, to request the return of unduly received funding in the

amount of €55.8m.

In its reply dated 29 August 2022, ORPEA undertook to reimburse

a sum of €25.6m, corresponding to: - the territorial economic

contribution (CET) and the social solidarity contribution (C3S),

for €19.6m. For the record, these amounts had not been provisioned

at the close of the 2021 accounts; - amounts corresponding to

end-of-year discounts that would have been received from our

suppliers for purchases financed by the "care" section, for €5.6m;

- expenses related to the cost of taking out civil liability

insurance policies, for €0.5m.

The Company has reallocated its provision lines to be consistent

with the amounts requested and has made additional provisions of

€3.3 million. On the other hand, ORPEA has not made any provision

for the staff costs demanded with regard to the life auxiliaries

“filling in” as assistant nurses, corresponding to an amount of

€30.2m.

The table below summarises the evolution of the provisions

mentioned above:

in €m Provisions as of 31

December 2021 Charges to provisions H1 2022 Reversal

of provisions H1 2022 Provisions as of 30 June 2022

2017-2020 surpluses (*)

19.8

19.8

2021 surpluses (before validation of statement of income and

expenditure (**))

41.1

41.1

H1 2022 surpluses (estimate)

14.3

14.3

Total provisions related to surpluses

60.9

14.3

-

75.2

Provisions for repayment of charges linked to Care and Dependancy

22.3

3.3

25.6

Total provisions

83.2

17.6

-

100.8

(*) The surpluses correspond to the unused part of the public

subsidies for activities related to care and dependency (**) "ERRD"

(Etats Réalisés des Recettes et des Dépenses / statement of

provisional income and expenses) are made annually by all

dependancy care operators and validated by Authorities

The net finance cost was -€96.1m, including a positive

effect of €24m provision on interest rate hedging instruments, with

no impact on the Company's cash position.

Non-current items amounted to -€251.4m. They include €20m

of costs related to the management of the crisis and €186m of asset

depreciations. These impairments, unrelated to the crisis faced by

the Group in France, concern intangible assets, €79m to goodwill in

Brazil (on Brazil Senior Living and on the Group's historical

activities whose development prospects are slower than expected)

and €49m to the valuation of operating licences. In addition, an

impairment of €58m was recognised on receivables from related

parties, mainly in Belgium.

The net result for the first half of 2022 was a loss of

€269.4m.

It is specified that the accounts at 30/06/2022 do not

include the potential accounting implications of the ongoing

strategic review, nor the outcome of negotiations currently being

conducted with the Group's historical partners:

- For the June 2022 financial statements, asset impairments have

been made for specific assets partially impaired at the end of 2021

or for assets for which an indication of potential impairment has

been identified for subsequent years. The other "Cash Generating

Units" (CGUs) were not tested for the June closing as the Group has

initiated the preparation of a strategic review of the CGUs and its

property assets. This strategic plan will form the basis for

updating the annual impairment of goodwill and intangible assets

across all CGUs as of 31 December 2022, the annual valuation of

property assets and the monitoring of the Group's compliance with

the commitments made under the financing obtained in June

2022.

- Advances granted by the ORPEA Group to associates and joint

ventures amounted to €478m at 30 June 2022. Advances granted by the

ORPEA Group to other companies amounted to €220m. A significant

part of these receivables concerns a single partner. ORPEA has

entered into negotiations with this partner to unwind the

partnerships and recover the real estate assets in exchange for the

receivables. To date, and without prejudging the outcome of these

negotiations in the second half of the year, the Group does not

anticipate significant future losses on these receivables given the

value of the underlying real estate assets.

2. Main balances of the consolidated

balance sheet

(€m)

31 Dec. 2021

30 June 2022

Net tangible assets

8,069

8,475

Net intangible assets

3,076

3,065

Shareholder’s equity

3,811

3,703

Gross financial debt

8,863

9,476

Including financial liabilities maturing

within one year

1,856

1,842

Cash

952

1,133

Net financial debt

7,910

8,343

Lease commitments (IFRS16)

3,265

3,557

At 30 June 2022, the value of tangible assets amounted to

€8,475m, an increase of €406m, mainly as a result of construction

projects.

Intangible assets amounted to €3,065m.

Net debt amounted to €8,343m, up €433m.

Cash amounted to €1,133m, an increase of €181m compared

with the end of 2021. This increase was due to drawdowns undertaken

within the framework of the financing agreement.

3. Covenants as of 30 June

2022

The Company reminds readers that bilateral bank loans as well as

borrowings made under German law, Schuldschein, for a total amount

of c. €4.1bn as of 30 June 2022, are subject to the following

contractually agreed covenants, tested on a half-yearly basis:

R1 =

consolidated net financial debt (excluding net real

estate debt) , and

(consolidated EBITDA excluding

IFRS161 – 6 % x net real estate debt)

R2 =

consolidated net financial debt

Equity + quasi equity2

As of 30 June 2022, these two ratios stood at 3,58 and 1,87

respectively, within the required limits of 5.5x for R1 and 2.0x

for R2 at 30 June 2022. The components of the calculation are shown

in the table below:

(€m)

31 December 2021

30 June 2022

Consolidated net financial debt (1)

7,910

8,343

o.w debt allocated to real estate (*)

87.7%

96.5%

Net real estate debt (2) (**)

6,937

8,047

EBITDA excluding IFRS16 (3) [last twelve

months]

682

565

Equity + quasi equity (4)

4,574

4,470

R1 ratio = [(1)-(2) / [(3)-6% x (2)]

3.66

3.58

R2 ratio = (1) / (4)

1.73

1.87

(*) Starting from the calculation made in

June 2022, the approach has been redefined to better reflect the

allocation of debt to real estate. This allocation is now carried

out in detail on a line-by-line basis. (**) This figure is used

only for the calculation of R1 ratio

Update on the Financing Agreement

announced on 13 June 2022

The Group has started to overhaul its financing strategy, with a

first step based on the Financing Agreement announced on 13 June

2022, which was the subject of a conciliation protocol approved by

the Nanterre Commercial Court on 10 June 2022.

This syndicated loan of €1.729 billion (comprising several A1,

A2, A3, A4 and B loans) is to be made available progressively until

31 December 2022, subject to conditions precedent. It is associated

with an optional refinancing facility of up to €1.5 billion (C1 and

C2 loans), which is intended to refinance any existing financing

(excluding any bonds, Euro PP or Schuldschein) of the ORPEA Group

that is not secured. Details of the Terms and Conditions of these

credit facilities are available in the presentation attached to

this Press Release.

The status of the drawdowns on these various financing lines is

summarized in the table below:

Under the terms of the Financing Agreement, the Company has made

a number of commitments, including a commitment to maintain a

consolidated cash level of €300m at the end of each quarter,

starting on 30 June 2023 (only financial ratio commitment to comply

with), commitments to dispose of property assets3 for an amount of

€1bn by 31 December 2023, increased to €1,5bn by December 2024 and

to €2bn before the end of 2025, of which, and commitments to

allocate net proceeds from the disposal of operating assets4 for a

cumulative amount of €1.2bn. As at 27 September 2022, a gross value

of €94m of property assets had been sold as part of the transaction

in the Netherlands announced on 28 July 2022. ORPEA remains fully

committed to implementing the commitments made in the framework of

this financing but remains exposed to the risk of not being able to

respect the terms of this Agreement. As security for the repayment

of the amounts due under the syndicated loan agreement, ORPEA has

granted first ranking pledges on certain of its assets representing

25% and 32% of the Group's revenues respectively. The collateral

will be enforceable in the event of certain events of default under

these agreements (in particular in the event of a breach of

covenants or cross default on other debts in excess of €100m).

The repayment schedule of the gross financial debt as of 30 June

2022, pro forma of the drawdowns made until 27 September 2022, is

presented in Appendix 2 of this press release. In addition, a

description of the main terms and conditions of these credit

facilities is set out in Appendix 3.

Outlook

As indicated in the press release published on 12 September

2022, the downward trend in the financial performance of the

business observed in the first half of 2022 could be amplified in

the second half of the year due to the additional volatility

observed in energy prices.

In this context, and depending on the recovery of the occupancy

rate, the Group's EBITDAR margin in the second half of 2022 could

be lower than in the first half of 2022, which would require ORPEA

to approach the relevant creditors in order to renegotiate these

financial covenants (for a description of the Group's financing,

see slides 19 to 21 of the presentation attached to this Press

release). Such a step would only be taken in the event of a proven

risk of non-compliance with a ratio, with a view to preserving the

Group's financial structure.

Web Conference

ORPEA invites you to a conference call in English on Wednesday

28 September 2022 at 7:00 pm (CEST – Paris time) hosted by Laurent

Guillot, Chief Executive Officer and Laurent Lemaire, Chief

Financial Officer.

The conference call will be accessible via webcast. Participants

can register by clicking on the following link:

https://channel.royalcast.com/landingpage/orpeaeng/20220928_1/

Communication

The half year results are also described in the presentation

material which forms part of this press release and is available on

the company's website.

Financial calendar

ORPEA will announce its Q3 2022 revenues on 8 November 2022

after market close.

About ORPEA

ORPEA is a leading global player, expert in the care of all

types of frailty. The Group operates in 22 countries and covers

three core businesses: care for the elderly (nursing homes,

assisted living, home care), post-acute and rehabilitation care and

mental health care (specialised clinics). It has more than 71,000

employees and welcomes more than 255,000 patients and residents

each year.

https://www.orpea-group.com/

ORPEA is listed on Euronext Paris (ISIN: FR0000184798) and is a

member of the SBF 120, STOXX 600 Europe, MSCI Small Cap Europe and

CAC Mid 60 indices.

DISCLAIMER

This document contains forward-looking statements that involve

risks and uncertainties, including references, concerning the

Group's expected growth and profitability in the future which may

significantly impact the expected performance indicated in the

forward-looking statements. These risks and uncertainties are

linked to factors out of the control of the Company and not

precisely estimated, such as market conditions. Any forward-looking

statements made in this document are statements about the Company’s

beliefs and expectations and should be evaluated as such. Actual

events or results may differ from those described in this document

due to a number of risks and uncertainties that are described

within the Company’s Universal Registration Document available on

the company’s website and on the French financial markets

regulator, AMF’s website (www.amf-france.org), and in the

Half-Year 2022 financial report which will be published in French

version on 30 September 2022.

___________________________ 1 At the end of June, calculation

based on last twelve months 2 Deferred tax liabilities linked to

the valuation of intangible operating assets under IFRS in the

consolidated financial statements 3 Real estate assets disposal

commitments do not prevent the group from becoming tenant for these

assets 4 Operating asset means any member of the Group or goodwill

(whether taken alone or together with other members of the Group

and goodwill subject to the same disposal) that is not a property

asset (as defined below). Property Asset means any property asset

or any member of the Group (if applicable, together with the other

assets and members of the Group subject to the same disposal) more

than 50% of whose assets consist of property assets or property

rights, provided that such property assets are not operated by such

member of the Group (or any member of the Group subject to the same

disposal).

Appendix 1 – Consolidated accounts at

June 2022

Consolidated income statementin €m 1st half 2021

1st half 2022 REVENUE

2,070

2,295

Staff costs

(1,276)

(1,439)

Purchases used and other external expenses

(347)

(438)

Taxes and duties

(27)

(44)

Depreciation, amortisation and charges to provision

(269)

(333)

Other recurring operating income and expenses

80

41

Recurring operating profit

231

82

Other non-recurring operating income and expenses

12

(251)

OPERATING PROFIT

242

(170)

Net financial expense

(109)

(96)

PROFIT BEFORE TAX

133

(266)

Income tax expense

(31)

(6)

Share in profit (loss) of associates and JV

(0)

3

Profit (loss) attributable to non-controlling interest

0

(1)

NET PROFIT ATTRIBUTABLE TO SHAREHOLDERS

102

(269)

Consolidated balance sheet - in €m 31-Dec-21

30-Jun-22 Non-current assets

16,181

16,830

Goodwill

1,669

1,679

Net intangible assets

3,076

3,065

Net tangible assets and real estate under development

8,069

8,475

Right of use assets

3,073

3,342

Other non-current assets

294

269

Current assets

2,415

2,670

Cash and short-term investments

952

1,133

Assets held for sale

388

280

TOTAL ASSETS

18,984

19,780

Equity and indefinitely deferred taxes (*)

4,417

4,296

Non-current liabilities

11,026

11,905

Non-current financial liabilities excluding bridging loans

7,007

7,565

Long-term bridging loans

0

68

Long-term lease commitments

2,968

3,232

Provisions for liabilities and charges

223

239

Deferred tax liabilities and other non-current liabilities

828

800

Current liabilities

3,541

3,579

Current financial liabilities excluding bridging loans

1,305

1,182

Short-term bridging loans

551

660

Short-term lease commitments

297

325

Provisions

22

23

Trade payables

335

372

Tax and payroll liabilities

329

380

Current income tax liabilities

69

43

Other payables, accruals and prepayments

633

594

TOTAL LIABILITIES

18,984

19,780

(*) incl. indefinitely deffered taxes on intangibles assets, of

€606m at December 2021 and €594m at June 2022

Cash Flows - in €m

(including IFRS16) H1 2021 H1 2022 Cash-flow from

operations

445

338

Change in working capital

(51)

14

Net cash from operating activities

394

352

Capex (including construction)

(296)

(473)

Acquisition of real estate

(158)

(2)

Disposals of real estate

29

5

Net investments in operating assets and equity investments

(378)

(48)

Net cash from financing activities

470

347

Change in cash over the period

60

181

Cash at the end of the period

949

1,133

In accordance with IFRS16, lease payments made under long-term

leases (€171m in H1 2021 and €202m in H1 2022) are not deducted

from EBITDA and EBITDA and therefore from operating cash flow but

are classified as financing flows.

Appendix 2 – Gross financial debt

maturity profile

Maturity profile of gross debt (€m) as of 30/06/2022

H2 2022

2023

2024

2025

2026

2027

Post2027 Financial Leases &

Mortgage

126

249

233

194

165

141

906

Bank Loans

679

1,113

755

270

340

50

78

Private Placements

228

385

502

345

551

230

452

Bonds

-

-

-

400

-

500

500

Total

1,032

1,747

1,490

1,210

1,056

922

1,937

Maturity profile of gross debt (€m) as of

30/06/2022 PF of drawings made up to 27/09/2022

H2 2022

2023

2024

2025

2026

2027

Post2027 Financial Leases &

Mortgage

126

249

233

194

165

141

906

Bank Loans

522

929

427

681

1,035

26

78

Private Placements

228

385

502

345

551

230

452

Bonds

-

-

-

400

-

500

500

Total

876

1,563

1,162

1,620

1,750

898

1,936

(*) excluding factoring program with €128m drawn as

at 30 June 2022 and issuance costs for €46m. Repayment of the RCF

considered as the final maturity dates of the committed facilities.

Appendix 3 – Summary Terms and

Conditions of the Financing Agreement dated June

2022

Notes to the table of Appendix 3:

(1)

In the event of receiving one or more

indicative offers for the sale of operating assets for aggregate

net proceeds of €1bn

(2)

Drawing conditional on the delivery of

memorandum of understanding relating to the sale of real estate

assets for €200m (the « MoU ».

(3)

In the event of signature of a MOU to sell

real estate assets for net proceeds of €200m

(4)

As of September, 27th 2022, €94m of gross

asset value disposals have been achieved

(5)

Real estate assets disposal commitments do

not prevent the group from becoming tenant for these assets

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220928005767/en/

Investor Relations ORPEA Benoit Lesieur Investor

Relations Director b.lesieur@orpea.net

Investor Relations NewCap Dusan Oresansky Tel.:

+33 (0)1 44 71 94 94 ORPEA@newcap.eu

Media Relations ORPEA Isabelle Herrier-Naufle

Media Relations Director Tel.: +33 (0)7 70 29 53 74

i.herrier-naufle@orpea.net

Image 7 Laurence Heilbronn Tel.: +33 (0)6 89 87 61 37

lheilbronn@image7.fr

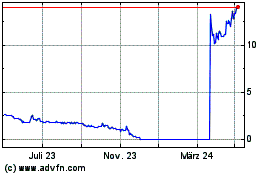

Orpea (EU:ORP)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

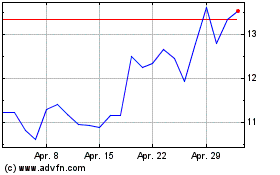

Orpea (EU:ORP)

Historical Stock Chart

Von Apr 2023 bis Apr 2024