Revenues up 10.9% and EBITDAR margin down to

18.5%

Regulatory News:

ORPEA (Paris:ORP) :

Activity in the first half of the year and during the summer

months remained sustained by the pace of new bed openings and a

gradual improvement in the level of activity.

At the same time, operating profitability for the first half of

the year, as well as for full-year 2022, has been affected by the

reduction in compensation mechanisms relating to Covid-19, which

the increase in the Group's occupancy rate was not sufficient to

counterbalance, as well as by a sizeable amount of non-recurring

income specific to 2021, an inflationary context in purchases

(particularly energy) and also by a more active recruitment policy,

particularly in France, in a job market under pressure.

Laurent Guillot, Chief Executive Officer, said: "A little over

two months after taking office, I am convinced that ORPEA benefits

from solid assets to be a leading player at the heart of the

societal challenges associated with the care of elderly persons.

Its 72,000 employees caring for residents, patients and their

families are the most important of these. I would like to extend my

warmest thanks to all our teams, both in France and abroad, for

their unwavering commitment, particularly during this very hot

summer.

We have taken a first step with concrete measures that were

decided this summer as part of the implementation of our three

short-term priorities: safety and working conditions for our

employees; quality of care and support for our residents, patients

and their families; and the ethical and responsibility principles

that are attached to our mission.

With the support of a largely renewed Board of Directors, ORPEA

is fully engaged in its transformation plan and into restoring

sustainable practices, in a spirit of dialogue and transparency

with all our stakeholders. I will present the main orientations of

this plan in the autumn.”

* *

*

The Board of Directors meeting on 10 September 2022 reviewed the

preliminary financial indicators for the first half of 2022,

unaudited as of today, and the economic environment for the second

half of 2022.

The indicators for the first half of 2022 are as follows:

(€m)

FY2020

FY2021

H1 2021

H1 2022

(unaudited figures)

Revenue

3,922

4,299

2,070

2,295 (1) + 10.9%

EBITDAR

963

1,070

515

Margin

24.6%

24.9%

24.9%

18.5%

EBITDA

927

1,041

499

Margin

23.6%

24.2%

24.1%

17.9%

Recurring operating profit

423

396

231

Margin

10.8%

9.2%

11.1%

3.6%

Gross financial debt

7,542

8,863

8,264

9,475

Cash

889

952

938

1,130

Net financial debt (2)

6,653

7,910

7,326

8,345

Rental expense (3)

354

382

186

212

(1)

This amount is €17 million lower than the

figure published on 20 July 2022 due to a change in the accounting

approach for an entity that is no longer included in the scope of

consolidation.

(2)

As of June 30, 2022, the Company had a

syndicated facility of 1,729 million euros, of which 900 million

euros had been drawn.

(3)

It should be noted that rental expenses

are not deducted from EBITDA in accordance with IFRS 16

Certain income statement items (financial income and expense,

non-current items and income tax expense) are still the subject of

internal and external works. With regard to the determination of

non-current items, impairment tests are currently being carried

out, mainly on certain intangible assets. Based on the information

in its possession, the Company estimates that the resulting

impairment losses could range between €170 million and €220

million.

Change in EBITDAR margin between H1 2021 and H1 2022 is

explained by:

- the substantial reduction in compensation for Covid-19 received

in the various countries concerned, which the increase in the

Group's occupancy rate between the two periods was not sufficient

to counterbalance, as well as by the recording of sizeable specific

income in the first half of 2021 that did not recur in 2022. These

two items account for about two-thirds of the change in the margin

rate between the two periods;

- the other third comes from an increase in other costs which is

in line with a highly inflationary environment impacting purchases,

while the tariffs charged to patients and residents remained almost

stable in the short term. The most significant inflationary effects

concerned foodstuffs and especially energy. As a result of the

hedging policy decisions made in 2021, the company’s energy

purchases for 2022 are only partially hedged, and there is no

hedging on electricity in France in particular. As a result, the

Group's energy costs as a percentage of revenue in the first half

of 2022 stood at 2.9%, compared with 1.9% in the first half of

2021.

During the first half of 2022, despite the crisis, the Group

continued its development with the opening of 1,547 additional

beds, corresponding to new facilities and extensions in all its

geographical areas. These achievements respond to the need to

develop a care offer in line with the expectations of families,

residents and authorities in the different countries.

Expected operational performance in the

second half of the year

The Group's average occupancy rate since the beginning of 2022

remains above the average level for the same period in 2021. This

trend was confirmed in July and August. As a result, ORPEA confirms

its confidence in its ability to maintain robust revenue growth

momentum throughout 2022.

ORPEA expects the decline in the financial performance of its

activities experienced in H1 2022 compared with H1 2021 to continue

into the second half of the year and considers it may be amplified

by additional volatility observed recently in energy markets. In

this context, and depending on the recovery of the occupancy rate,

EBITDAR margin in H2 2022 could be lower than the level seen in H1

2022.

Transformation has started, for the

benefit of residents, patients, families and

employees

Three priorities have already been set for the short term:

safety and working conditions, quality of care and support, and

unconditional respect for ethical principles. Immediate steps in

this direction were taken during the summer. For example, in

France, payment of an attendance bonus for those who completed 10

weeks of work out of the 13 weeks that constitute the critical

summer period. Reporting of undesirable events is now

systematically escalated to Executive Management in order to speed

up the implementation of action plans designed to improve the

quality of care. Greater autonomy has been given to facility

Directors to recruit or decide on improvements to their

facilities.

These priorities will enhance the transformation plan currently

being drawn up, which will be presented in the autumn.

==============

Financial calendar

ORPEA will announce its consolidated financial results for the

first half of 2022 on 28 September 2022 after market close.

About ORPEA

ORPEA is a leading global player, expert in the care of all

types of frailty. The Group operates in 22 countries and covers

three core businesses: care for the elderly (nursing homes,

assisted living, home care), post-acute and rehabilitation care and

mental health care (specialized clinics). It has more than 72,000

employees and welcomes more than 255,000 patients and residents

each year.

https://www.orpea-group.com/

ORPEA is listed on Euronext Paris (ISIN: FR0000184798) and is a

member of the SBF 120, STOXX 600 Europe, MSCI Small Cap Europe and

CAC Mid 60 indices.

DISCLAIMER

This document contains forward-looking statements that involve

risks and uncertainties, including references, concerning the

Group's expected growth and profitability in the future which may

significantly impact the expected performance indicated in the

forward-looking statements. These risks and uncertainties are

linked to factors out of the control of the Company and not

precisely estimated, such as market conditions. Any forward-looking

statements made in this document are statements about the Company’s

beliefs and expectations and should be evaluated as such. Actual

events or results may differ from those described in this document

due to a number of risks and uncertainties that are described

within the Company’s Universal Registration Document.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220911005079/en/

Investor Relations ORPEA Benoit Lesieur Investor

Relations Director b.lesieur@orpea.net

Investor Relations NewCap Dusan Oresansky Tel.:

+33 (0)1 44 71 94 94 ORPEA@newcap.eu

Media Relations ORPEA Isabelle Herrier-Naufle

Media Relations Director Tel.: +33 (0)7 70 29 53 74

i.herrier-naufle@orpea.net

Image 7 Laurence Heilbronn Tel.: +33 (0)6 89 87 61 37

lheilbronn@image7.fr

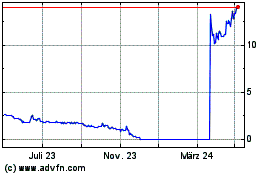

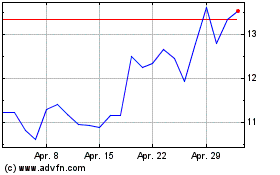

Orpea (EU:ORP)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Orpea (EU:ORP)

Historical Stock Chart

Von Apr 2023 bis Apr 2024