WENDEL: 2021 Full-Year Results

Press release - March 18, 2022

2021 Full-Year Results

Strong performance and profitability of

portfolio companies in 2021

Net income Group share of €1.05

billion

NAV €188.1 per share, close to historical

highs1 and

up +20.1% year-on-year2

c.€640 million in capital deployed or

committed over the last 12 months

Close to historically high Net Asset Value as

of December 31, 2021, at €8,419 million, up +18.3% since December

31, 2020

Consolidated net sales for 2021 at

€7,503.9 million, up 9.8% overall and up 10.2%

organically year-on-year. All companies’ sales above 2019 on an

organic basis

- Strong growth generated by Bureau Veritas (+8.3%) and Stahl

(+24.2%)

- Strong rebound continued at Crisis Prevention Institute

(+63.6%) with total sales passing the $100 million mark for the

first time and record high margins

- Constantia Flexibles resumed external growth and showed solid

organic growth (+6.5%)

- FX headwinds experienced across the portfolio (-1.2%

consolidated sales)

Net income Group share of €1,046.9 million,

up +496.4% primarily due to the accounting impact of IHS

deconsolidation

- Net income from operations of €765 million up +77.6%,

reflecting increased profitability of portfolio companies. Bureau

Veritas was the largest contributor, in absolute value.

- Non-recurring income of €846.3 million, up +900.7% year on

year, boosted by the accounting gain from the deconsolidation of

IHS from Wendel’s group accounts under norm IAS 28. The disposal of

Cromology occurred in 2022 and will only impact annual accounts in

2022

- The reduction in impairments and goodwill allocation at

portfolio companies and at Wendel levels is due to the low base of

comparison versus 2020 which was mainly impacted by the full

impairment of Tsebo and exceptional impairments related to the

COVID-19 pandemic

- Consolidated net income of €1,376.4 million, as compared to a

€-231.0 million loss in 2020, and net income Group share of

€1,046.9 million

Deployment and commitment of c. €640 million

since the beginning of 2021

- €222 million invested by Wendel in partnership with the

Deconinck Family, via Tarkett Participation, to acquire Tarkett’s

shares

- Wendel Lab: €49 million committed in 2021, already additional

€21 million in 2022

- €42.4 million of Wendel shares bought back in 2021 and early

2022. Share buybacks will continue in 2022

- c.€3043 million equity invested to acquire ACAMS on March 10,

2022

Disposal of Cromology closed on January 21,

2022, generating €896 million in proceeds for Wendel

- The transaction generated net proceeds of €896 million or €358

million above Cromology’s valuation in the latest Wendel’s net

asset value published before the transaction announcement, i.e., as

of June 30, 2021.

Group companies: other noteworthy

developments since January 1, 2021

- IPO of IHS Towers on the NYSE

- Maarten Heijbroek started as CEO of Stahl on July 1, 2021.

Stahl’s sustainability efforts were recognized in July with a Gold

rating from EcoVadis, placing it within the top 5% of their rating

universe

- Bureau Veritas acquired six companies in strategic areas

(infrastructure, renewables, sustainability certification,

cybersecurity and consumer products in China) representing total

bolt-on revenues of c.€48.0 million. This revenue includes the

latest acquisition of PreScience, a U.S.-based leader of Project

Management/Construction management services for Transportation

Infrastructure projects

- Didier Michaud-Daniel was renewed as the CEO of Bureau Veritas

and a succession plan led to the recruitment of Hinda Gharbi as

Chief Operating Officer

Strong financial structure

- LTV ratio at 10.3% as of December 31, 2021. Proforma the

disposal of Cromology and for the ACAMS acquisition, LTV would

stand at 4.3% as of December 31, 2021

- Wendel today announced it is exercising the make-whole

redemption of the bonds maturing in October 2024 with outstanding

principal of €500 million (ISIN FR0012199156) and bearing interest

at 2.750% at a price determined in accordance with the terms and

conditions of the bonds. This initiative will further optimize the

cost and the maturity of Wendel’s debt. Pro forma the issuance of

€300 million in January 2022 and of this repurchase, Wendel average

maturity would be extended to 7.24 years and its average weighted

cost of debt lowered to 1.7%.

- Total liquidity of €1.4 billion as of December 31, 2021,

including €650 million of cash and a €750 million committed credit

facility (fully undrawn). Proforma the issuance of €300 million in

January 2022, the disposal of Cromology, the ACAMS acquisition and

the early repayment in whole of the bond maturing in October 2024,

total liquidity would stand at c.€1.8 billion5

- Investment grade corporate ratings: Moody’s Baa2 with stable

outlook / S&P BBB with stable outlook.

- ESG targets now embedded in the financial terms of the undrawn

€750 million syndicated credit

- Improvement of debt maturity and cost following two bond issues

benefiting from favorable market conditions:

- Successful placement of €300 million 10-year bonds at 1.0%

coupon on May 26, 2021. Proceeds from this offering have been used

for the early and full repayment, on July 1, 2021, of bonds

otherwise maturing in April 2023.

- Successful issue of €300 million 12-year bonds at 1.375% coupon

on January 16, 2022

ESG achievements

- Wendel is included in the Dow Jones Sustainability World and

Europe indices (DJSI) and is now also included in Sustainalytics’

ESG Global 50 top-rated companies’ list.

- 54%6 of Wendel’s consolidated sales are generated from products

and services with social and environmental added-value

2021 Dividend

·Ordinary dividend of €3.0 per share for

2021, up 3.4%, to be proposed at the Annual Shareholders’ Meeting

on June 16, 2022, representing a yield of 2.85%7

|

André François-Poncet, Wendel Group CEO, commented: “In

2021, we grew our Net Asset Value by 18% and its increase would

have exceeded 27% without the disappointing aftermarket trading of

IHS Towers following its IPO. First and foremost, Bureau Veritas,

our largest investment, performed very well on the back of its

unique Green Line offering. We generated an outsized capital gain

from the turnaround and sale of Cromology to be recognized in 2022.

Prior to its sale, Cromology reached record profitability. Crisis

Prevention Institute also had an outstanding year, demonstrating

the attractiveness of this growth investment which we made in 2019.

Under new CEOs, Constantia achieved modest but profitable growth,

and Stahl a strong rebound, in the face of significant pressure

from rising input costs. We have pursued our objective of

capital redeployment in line with our roadmap through the

acquisition of ACAMS which further enhances the growth profile of

our portfolio after the acquisition of CPI. Additionally, we have

entered into a partnership with the Deconinck family in Tarkett, a

world leader in flooring and sports surfaces. The transactions

themselves were creative, illustrating our team’s ability to carry

out complex projects as the buyer of choice. We also laid the

groundwork for the significant acceleration of the Wendel Lab for

both its fund and direct compartments by onboarding experienced

professionals with strong experience and credentials. As we

look forward, our robust balance sheet with relatively little

corporate and portfolio company leverage overall and our long-term

perspective should allow us to continue to execute our roadmap

capitalizing on acquisition opportunities which will likely result

from current unprecedented circumstances. |

2021 net sales

2021 consolidated sales

| (in

millions of euros) |

2020 |

2021 |

Δ |

Organic Δ |

|

Bureau Veritas |

4,601.0 |

4,981.1 |

+8.3% |

+9.4% |

|

Constantia Flexibles |

1,505.3 |

1,603.4 |

+6.5% |

+4.2% |

|

Stahl |

669.4 |

831.3 |

+24.2% |

+25.4% |

|

CPI (1) |

56.0 |

88.2 |

+57.6% |

+58.8% |

|

Consolidated net sales (2) |

6,831.7 |

7,503.9 |

+9.8% |

+10.2% |

- The PPA effect corresponds to the PPA restatement impact of

$-1.9 million booked in Q4 2020.

- Comparable sales for 12 months 2020 represent €6,831.6m vs.

2020 published sales of €7,459.2 million. The difference of €627.6

million corresponds to sales of Cromology group, classified as

asset held for sale in accordance with IFRS 5. The contribution of

this portfolio company has been reclassified in "Net income from

discontinued operations and operations held for sale”.

2021 sales of equity-accounted

companies

| (in

millions of euros) |

2020 |

2021 |

Δ |

Organic Δ |

|

Tarkett (1) |

n.a. |

1,530.9 |

+9.7% |

+6.5% |

(1) Tarkett accounts have been consolidated

since July 7, 2021. The published figures correspond to sales of

the second half of 2021.

2021 consolidated results

| (in

millions of euros) |

2020 |

2021 |

|

Consolidated subsidiaries |

430.7 |

765.0 |

|

Financing, operating expenses and taxes |

-114.2 |

-111.3 |

|

Net income from operations(1) |

316.4 |

653.7 |

|

Net income from operations,(1) Group share |

77.3 |

256.2 |

|

Non-recurring net income |

-376.5 |

834 |

| Impact of

goodwill allocation |

-171.0 |

-111.2 |

|

Total net income |

-231.0 |

1,376.4 |

|

Net income, Group share |

-264.1 |

1,046.9 |

(1) Net income before goodwill allocation

entries and non-recurring items.

2021 net income from operations

| (in

millions of euros) |

2020 |

2021 |

Change |

|

Bureau Veritas |

302.8 |

509.2 |

+68.2% |

|

Stahl |

78.3 |

113.9 |

+45.5% |

|

Constantia Flexibles |

49.5 |

50.9 |

+2.9% |

|

Cromology |

15.6 |

52.4 |

+236.1% |

|

Tsebo |

-7.6 |

- |

+100% |

|

CPI |

-2.6 |

7.8 |

+398.2% |

|

Tarkett (equity accounted) |

0.0 |

3.0 |

n/a |

| IHS

(equity accounted) |

-5.3 |

27.7 |

+622.5% |

|

Total contribution from Group companies |

430.7 |

765.0 |

+77.6% |

| of

which Group share |

191.5 |

367.4 |

+91.9% |

|

Total operating expenses |

-64.8 |

-73.8 |

+13.8% |

|

Total financial expense |

-49.4 |

-37.5 |

24.0% |

|

Net income from operations |

316.4 |

653.7 |

+106.5% |

| of

which Group share |

77.3 |

256.2 |

+231.4% |

On March 17, 2022, Wendel Supervisory Board met

under the chairmanship of Nicolas ver Hulst and reviewed Wendel’s

consolidated financial statements, as approved by the Executive

Board on March 9, 2022. Financial statements have been audited by

the Statutory Auditors prior to their publication.

Wendel Group’s consolidated sales totaled

€7,504 million8, up 9.8% overall and up 10.2% organically,

thanks to the strong rebound following COVID-19 which affected the

Group in 2020.

The overall contribution of Group companies to

net income from operations amounted to €653.7 million and has more

than doubled compared to 2020 (+106.5%), as all portfolio companies

have registered strong increases in their earnings, with Bureau

Veritas being the largest contributor, as it benefitted from a very

strong recovery after the COVID-19 lockdowns in 2020.

Financial expenses, operating expenses and taxes

totaled €111.3 million, down 2.5% from the €114.2 million reported

in 2020. As in the previous year, financial expenses have continued

to decrease, and were down 24.0% in 2021 as a result of the

unwinding of cross currency swaps in March 2021 which generated

savings of €25 million of yearly financial expenses to Wendel over

2021 and 2022, partially offset by the increase in operating

expenses under the effect of a strong bidding activity.

Non-recurring income came in at €846.3 million,

compared to a loss of €105.7 million in 2020. This change is

largely due to the accounting treatment of the deconsolidation of

IHS Towers following its IPO. Post listing, Wendel does not have

any significant influence over IHS, as no Wendel employee sits on

the Supervisory Board and the shareholders’ agreement has been

updated for the public status of IHS. As per IFRS, from an

accounting perspective, the listing of IHS has been treated as an

“exit” from the equity method investment, generating a

€913 million capital gain (corresponding to the difference

between the IPO value and the net book value in Wendel’s financial

statements), despite Wendel not having sold any share of IHS. As a

result, IHS Towers has been accounted for as a financial asset at

fair value since the IPO, with changes in value being booked in

equity. Following the share price drop between the IPO and December

31, 2021, a loss of €357 million has been booked in equity.

As a result of the above, consolidated net

income reached €1,376.4 million (€-231.0 million loss in 2020) and

net income Group share €1,046.9 million (€-264.1 million

loss in 2020).

Group companies’ results

Figures include IFRS 16 unless

otherwise specified.

Bureau Veritas: strong operating and

excellent financial performance in 2021; solid 2022 outlook

(full consolidation)

Revenue in 2021 amounted to €4,981.1 million, an

8.3% increase compared with 2020. Organic revenue was up 9.4%. In

the fourth quarter, organic growth was limited to 2.5%, impacted by

the cyber-attack which occurred in November 2021. Adjusted for the

cyber-attack, organic growth would have reached 4.5% in the last

quarter and 9.9% for the full year 2021.

All six divisions posted organic growth, with

more than half of the portfolio (including Consumer Products,

Certification, and Buildings & Infrastructure) posting a strong

recovery, reaching +13.3% organically on average. Consumer Products

was the best performing division, up 15.7% over the year, fueled by

Asia, the resumption of product launches, and helped by a favorable

comparison base. Certification (up 15.4%) benefited from the

catch-up of audits and strong momentum in Corporate Responsibility

and Sustainability Certification services. Buildings &

Infrastructure outperformed Bureau Veritas’s average growth, with

an increase of 11.8% during the year as it benefited from strong

momentum across its three platforms (Americas, Asia and

Europe).

External growth contributed a positive 0.1% (of

which 0.4% in the last quarter), reflecting the impact from

prior-year disposals offset by the six bolt-on acquisitions

realized in 2021. Currency fluctuations had a negative impact of

1.2% (including a positive impact of 2.3% in Q4), mainly due to the

depreciation of some emerging countries’ currencies, as well as the

USD and pegged currencies against the euro.

During the year 2021, Bureau Veritas completed

six M&A transactions in strategic areas, representing around

€48.0 million in annualized revenue (or 1.0% of 2021 Bureau

Veritas revenue). The pipeline of opportunities is healthy, and

Bureau Veritas will continue to deploy a selective bolt-on

acquisitions strategy in targeted strategic areas (notably

Buildings & Infrastructure, Renewable Energy, Consumer

Products, Technologies and Cybersecurity).

Consolidated adjusted operating profit increased

by 30.4% to €801.8 million whilst the 2021 adjusted operating

margin increased by 273 basis points to 16.1%, including a 7 basis

points negative foreign exchange impact and a 2 basis points

positive scope impact. On an organic basis, adjusted operating

profit margin jumped by 278 basis points to 16.2%. All business

activities experienced higher organic margins thanks to improved

operational leverage in a context of revenue recovery and the

benefit of the cost containment measures taken in the prior

year.

Cyber-attack

On November 22, 2021, Bureau Veritas announced

that its cybersecurity system had detected a cyber-attack on

Saturday, November 20, 2021.

In response, all Bureau Veritas’s cybersecurity

procedures were immediately activated. A preventive decision was

made to temporarily take servers and data offline to protect

clients and the company while further investigations and corrective

measures were in progress. This decision generated a partial

unavailability or slowdown of services and client interfaces.

Bureau Veritas’s teams, supported by leading

third-party IT experts, deployed all efforts to ensure business

continuity and minimize disruption to its clients, employees and

partners. Bureau Veritas also actioned the relevant authorities and

its cybersecurity insurance policies.

Bureau Veritas considers that all its operations

have been running at normal level since the beginning of the year

2022. Nevertheless, there are still incident response costs to be

incurred through 2022.

Overall, Bureau Veritas estimates the impact of

the cyber-attack (fully accounted for in Q4 2021) to be

approximately €25 million on Bureau Veritas’s revenue (around 50

basis points impact on the Bureau Veritas’s full-year organic

growth).

Launch of an ESG solution: with Clarity,

Bureau Veritas enables companies to bring transparency and

credibility to their ESG commitments

On December 8, 2021, Bureau Veritas announced

the launch of Clarity, a suite of solutions that enables companies

to manage their ESG roadmaps and monitor the progress of their

sustainability strategies. With Clarity, Bureau Veritas supports

its clients across a wide spectrum of topics, from Social, Health

& Safety, Environment, Biodiversity, Climate Change, Business

Ethics and Responsible Sourcing to Animal Welfare, Energy

Efficiency and Waste Management.

Clarity helps organizations put their

sustainability strategies in motion. Through systematic maturity

evaluations, the approach helps clients clearly define where they

should focus their efforts across complex value chains.

In 2021, Bureau Veritas also defined a clear

roadmap laying out its Strategic Direction for 2025 and its growth

opportunities, notably as regards Sustainability services which

already represent today more than 50% of Bureau Veritas sales.

Strong financial position

At the end of December 2021, Bureau Veritas

adjusted net financial debt decreased compared to the level at

December 31, 2020. Bureau Veritas had €1.4 billion in available

cash and cash equivalents, complemented by €600 million in undrawn

committed credit lines. At December 31, 2021, the adjusted net

financial debt/EBITDA ratio has been further reduced to 1.10x (from

1.80x last year). The average maturity of Bureau Veritas’s

financial debt was 4.3 years with a blended average cost over the

year of 2.3% excluding the impact of IFRS 16 (to be compared with

2.6% in 2020 excluding the impact of IFRS 16).

Strong free cash flow at €603.0 million

driven by operating performance

Free cash flow (operating cash flow after tax,

interest expenses and capex) was €603.0 million, compared to €634.2

million in 2020, down 4.9% year on year (against a record level

achieved in 2020) attributed to increased capex. On an organic

basis, free cash flow reached €605.9 million, down 4.5% year on

year.

Proposed dividend

Bureau Veritas is proposing a dividend of €0.53

per share for 2021, up 47.2% compared to prior year. The proposed

dividend will be paid in cash. Going forward, Bureau Veritas

expects to propose a dividend of around 50% of its adjusted net

profit.

This is subject to the approval of the

Shareholders’ Meeting to be held on June 24, 2022. The dividend

will be paid in cash on July 7, 2022, (shareholders on the register

on July 6, 2022 will be entitled to the dividend and the share will

trade ex-dividend on July 5, 2022).

2022 Outlook

Based on a healthy sales pipeline and the

significant growth opportunities related to Sustainability, and

assuming there are no severe lockdowns in its main countries of

operation due to Covid-19, for the full year 2022 Bureau Veritas

expects to:

• Achieve mid-single-digit organic revenue

growth;

• Improve the adjusted operating margin;

• Generate sustained strong cash flow, with a

cash conversion rate above 90%.

2025 strategy aims to take Bureau Veritas’

value creation to the next level

On December 3, 2021, Bureau Veritas hosted its

Investor Day to present Bureau Veritas’ 2025 strategy and financial

ambitions. Bureau Veritas is capitalizing on the successful

delivery of the previous strategic plan and relies upon the key

fundamentals of the Testing Inspection and Certification market,

which offer solid growth prospects:

Below are the financial ambitions and

assumptions as well as sustainability ambitions for 2025:

2025 Financial ambitions and

assumptions:

|

2025 AMBITION |

|

|

GROWTH |

Resilient enhanced organic growth: mid-single-digit |

|

MARGIN |

No compromise on margin: above 16%9 |

|

CASH |

Strong Cash Conversion10: superior to 90% |

The use of Free Cash Flow generated from

operations will be balanced between Capital Expenditure (Capex),

Mergers & Acquisitions (M&A) and shareholder returns

(Dividend):

|

2025 ASSUMPTIONS |

|

|

CAPEX |

Between 2.5% and 3.0% of Group revenue |

|

M&A |

Disciplined and selective bolt-on M&A strategy |

|

DIVIDEND |

Pay-out of around 50% of Adjusted Net Profit |

2025 Sustainability

ambitions

|

|

UN SDGS |

2025 TARGET |

|

SOCIAL & HUMAN CAPITAL |

|

|

|

Total Accident Rate (TAR)11 |

#3 |

0.26 |

|

Proportion of women in leadership positions12 |

#5 |

35% |

|

Number of training hours per employee (per year) |

#8 |

35.0 |

|

NATURAL CAPITAL |

|

|

|

CO2 emissions per employee (tons per year)13 |

#13 |

2.00 |

|

GOVERNANCE |

|

|

|

Proportion of employees trained to the Code of Ethics |

#16 |

99% |

Please refer to Bureau Veritas financial

communication for further details: group.bureauveritas.com

Renewal of the term of office of the

Chief Executive Officer of Bureau Veritas and appointment of a

Chief Operating Officer

On February 24, 2022, the Board of Directors of

Bureau Veritas announced the renewal of the term of office of the

Chief Executive Officer, Didier Michaud-Daniel, until the Annual

General Meeting of June 2023, which will be called to approve the

financial statements for the year 2022.

As of May 1st, 2022, Hinda Gharbi will join

Bureau Veritas as Chief Operating Officer and member of the

Executive Committee. The Board of Directors’ decision is the result

of a rigorous selection and recruitment process, as part of the

succession planning for the Chief Executive Officer, led jointly by

the Nomination & Compensation Committee and Didier

Michaud-Daniel.

On January 1st, 2023, Hinda Gharbi will assume

the position of Deputy CEO of Bureau Veritas. The Board of

Directors will appoint her as Chief Executive Officer at the end of

the 2023 Annual General Meeting.

Hinda Gharbi will join Bureau Veritas from

Schlumberger, a global technology leader in the energy sector,

where she is currently Executive Vice President, Services and

Equipment. In this role, which she has held since July 2020, she

oversees products and services for Schlumberger as well as digital

topics.

With a degree in Electrical Engineering from the

Ecole Nationale Supérieure d’Ingénieurs Electriciens de Grenoble,

and a Master of Science in signal processing from the Institut

Polytechnique de Grenoble, Hinda joined Schlumberger in 1996,

choosing to start her career in the field in the Nigerian offshore

oil fields.

During her 26 years with Schlumberger, Hinda has

held a variety of general management positions in operations for

Schlumberger’s core business activities at a global and regional

level. She has also assumed cross-functional responsibilities

including Human Resources, Technology Development, and Health,

Safety and Environment.

Hinda Gharbi has worked and lived on multiple

continents: in Nigeria, France, Thailand, Malaysia, the United

Kingdom and the United States.

For more information:

group.bureauveritas.com

Constantia Flexibles – Led by a revamped

leadership team, encouraging 2021 topline performance with +6.5%

growth driven by an organic growth of +4.2%, representing a

reversal of previous trends, and the successful integration of the

Propak acquisition. Very resilient EBITDA margin despite increasing

pressure on raw material prices. Cash generation profile

structurally improved, above historical average.

(full consolidation)

FY 2021 Constantia sales increased by +6.5%

reaching €1,603.4 million, up +4.2% on an organic basis driven by

the Consumer markets (+6.1% organic growth) with a focus on some

key growing segments such as coffee. The Pharma market was affected

in the first part of the year by lockdown-induced reduced mild flu

and cold season severity and destocking from customers leading to

-1.3% YTD organic decline in sales compared to an extraordinarily

high activity beginning of 2020. However, this demand has since

significantly improved and the orderbook for the Pharma market is

currently at record levels.

For the record, in 2020, Consumer sales were

negatively impacted with lower activity levels particularly in

India, Mexico and South Africa, partially offset by (i) an

increased demand in European Consumer markets due to so-called

‘pantry loading’, and (ii) particularly high pharma sales due to

increased demand in the early part of the COVID-19 pandemic. In

India, the market has remained very challenging this year in the

light of a second lockdown and a very competitive environment with

significant price pressure.

2021 benefited from the integration of Propak in

June (+3.2%), but was negatively impacted (-0.9%) by unfavorable

FX, mainly from U.S. dollar, Russian ruble and Indian rupee.

Despite the inflationary environment in raw

material, freight, and energy costs, EBITDA was up +6.1% to €201.0

million14, i.e., a 12.5% EBITDA margin, only 10 bps below last

year. This is the result of (i) Constantia’s renewed management

team efforts towards profitability measures to mitigate the impact

of raw material cost increases and (ii) a continuous cost reduction

program, iii) acquisition of Propak.

On June 9, 2021, Constantia closed the

acquisition of Propak, a packaging producer located in Düzce in

Turkey. The purchase price is based on an enterprise value of €120

million, representing a 6.4x multiple of 2020 actual EBITDA. Propak

is a leading player in the European packaging industry for the

snacks market operating out of a well-invested plant with

approximately 360 employees and complements Constantia Flexibles’

packaging solutions portfolio. This significant acquisition

elevates Constantia Flexibles to one of the leading packaging

players in the European snacks market. Performance since the

acquisition has been in line with expectations with good commercial

and cost synergies identified for the future.

In spite of the Propak acquisition in June 2021,

leverage has remained stable year on year at 1.8x LTM EBITDA,

leaving significant headroom to its covenant level of 3.75x, with

ample liquidity as of end of December 2021. Net debt stood at

€400.315 million at the end of December (€362.2 million on December

31, 2020) thanks to strong cash flow generation. This year,

significant improvements were made in terms of cash generation

thanks to contained capex from a more focused investment policy,

improved working capital position and the acquisition of the

cash-generative Propak business. As a result, Constantia Flexibles

improved its operating cash flow profile above its historical track

record of c. 45% on average.

Good progress has been made by the company in

line with its Vision 2025 strategy with a return to organic growth

and an improvement of operational efficiency (targets of achieving

an EBITDA margin of at least 14% of sales by 2025). With the

mentioned Propak acquisition, Constantia has resumed acquisitions

in the fragmented and consolidating flexible packaging market.

Outside of Europe, profitability of operations has been

significantly enhanced in North America and South Africa.

Constantia is carefully managing raw material price’ increases as

well as the availability of raw materials, particularly the

aluminum, focusing its efforts on preserving the profitability of

the company to the extent possible. In addition, Constantia

reaffirmed its standing with its customer base with a very positive

customer feedback survey for the second year in a row.

In 2021, Constantia Flexibles continued its

efforts to improve the performance of its processes and products

relating to sustainable challenges. The EcoLutions initiative

(development of new recyclable packaging solutions with aim to

support the ongoing market transformation) has experienced a

positive momentum, with the commercialization of its products by

more than 10 various large Fast-Moving Consumer Goods players in

Europe and India and a strong acceleration in the pipeline with

more than 320 projects. In 2021, Constantia Flexibles has been

recognized for leadership in corporate sustainability by global

environmental non-profit CDP (Carbon Disclosure Project), securing

a spot on its ‘A List’. In addition, for the fourth time in a row,

Constantia Flexibles as a group has been awarded the EcoVadis Gold

Medal in recognition of its CSR achievement. This result places

Constantia Flexibles among the top 1% of companies assessed by

EcoVadis in its industry.

Crisis Prevention Institute – 2021 total

sales passed the $100 million mark for the first time, thanks

to a total growth of +63.6% compared to 2020

and +18.9% versus 2019. EBITDA up +97.3% and margin

stands at a record high of 49.4%

(Full consolidation)

In 2021, Crisis Prevention Institute recorded

revenue of $104.3 million, up +63.6% in total compared to the

same period in 2020 and +18.9% versus 2019. CPI passed for the

first time in its history the $100M sales mark thanks to:

- Recoveries in attendance aided by CPI’s adaptation to virtual

training;

- Overall new Certified Instructors (CI) and renewal volumes

above 2019 levels;

- Successful new program launches including specialty topics such

as Trauma, Autism, and Advanced Physical Skills;

- Continued mix shift toward digital solutions for both new and

existing Cis, with programs retaining the required in-person

components. Virtual Learner Material sales (c.46% of learner

material sales) continued to expand in share, with year-to-date,

e-learning delivery representing 35% of total Learner Material

volumes, above the 30% and 11% levels in 2020 and 2019.

Of the +63.6% sales increase versus the same

period in 2020, + 58.8% was organic growth, +3.0% was related to a

purchase accounting adjustment to deferred revenue (impact of -$1.9

million in 2020), and +1.8% was due to FX movements.

CPI’s activity has benefited from the improved

ability to gather in person as customers, notably in hospitals and

schools, to move towards an increasingly normalized work

environment. As a result, CPI has leveraged an improved sales force

strategy to continue further penetrating these core US markets as

well as expanding into new markets.

This strong revenue growth was accompanied by an

overall EBITDA increase of +97.3% year on year

to $51.5 million16 or a 49.4% EBITDA margin in 2021.

Compared to 2019, EBITDA is up by c.30%17 and EBITDA margin

improved by +435 basis points.

This strong growth of profitability was

primarily induced from the flow-through of higher sales to

earnings, as well as effective cost management. In 2022, CPI has

resumed in-person training, which will include higher travel and

operating costs than those incurred during the hybrid training

provided during 2020 and 2021.

The overall heightened level of activity,

combined with effective cost management, has led to continued

deleveraging over the past few months, driving CPI’s leverage level

at 6.0x, well below the 10.5x FY21 covenant, and below the leverage

at acquisition by Wendel in 2019.

Early 2022, CPI has managed well through the

Omicron COVID surge with a minimal number of onsite programs being

pushed out to Q2. CPI is confident to revert training back to

predominately in-person given customer feedback supporting the

decision. Investment made in 2021 should also support 2022

performance, notably the continuous pursuit of market share gains,

and geographical expansion as well as program diversification to

expand offering beyond high-trauma areas.

IHS - Delivering continued, strong

financial and operational performance while accomplishing many

actions that further strengthen its position

(Deconsolidated following its IPO)

In 2021, revenue was $1,579.7 million compared

to $1,403.1 million in 2020, thus an increase of $176.6 million, or

+12.6%. Organic growth was $226.6 million, or +16.1%. Organic

growth was driven primarily by escalations, lease amendments and

foreign exchange resets, as well as new sites and new colocations.

Aggregate inorganic revenue was $34.0 million, or +2.4%. The

increases in organic revenue in the period were partially offset by

a negative 6.0% movement in foreign exchange rates of $84.0

million.

Adjusted EBITDA18 was $926.4 million in 2021,

compared to $819.0 million in 2020. Adjusted EBITDA margin was

58.6%, compared to 58.4% in 2020. The increase in Adjusted EBITDA

primarily reflects the increase in revenue offset with year-on-year

increase in cost of sales mainly due to higher power generation

costs. The increase was also due to a decrease in administrative

costs mainly due to a reversal of allowance for trade

receivables.

As of December 2021, IHS recorded $2,985.2

million of total debt. As of December 31, 2021 IHS totaled $916.5

million of cash and cash equivalents and its leverage stands at

2.2x19.

In January 2021, March 2021 and April 2021 IHS

closed and integrated the Skysites Acquisition, Centennial Colombia

acquisition and the Centennial Brazil acquisition, respectively. In

April 2021 and October 2021, IHS closed the third and fourth phase

of the Kuwait Acquisition, respectively. In October IHS entered the

Egyptian market through a licensed partnership. In November 2021,

IHS closed its previously announced transaction with TIM S.A.

(“TIM”) to acquire a controlling interest in FiberCo Soluções de

Infraestrutura S.A. (“I-Systems”) and signed agreements to purchase

5,709 towers from MTN in South Africa. As of end 2021 IHS is

the fourth largest independent multinational tower company with

over 31,000 towers spanning nine countries on three continents. In

January 2022, IHS announced the acquisition of the GTS SP5

portfolio of 2,115 towers in Brazil, after which IHS will become

the third largest towerco in Brazil. IHS has deepened its

commitment to Africa while also pursuing its diversification

strategy, building upon its entrance into Latam and the Middle

East, and continuing its strong investment in organic growth,

including in ancillary technologies such as small cells, DAS and

fiber.

In October 2021 IHS was listed on the NYSE.

IHS Full Year 2022 Outlook

Guidance

The following full year 2022 guidance is based

on a number of assumptions that IHS management believes to be

reasonable and reflect the Company’s expectations as of March 15,

2022. Please refer to IHS financial communication for the

assumptions considered by the company on

https://www.ihstowers.com/investors

|

Metric |

Range |

|

Revenue |

$1,795M – $1,815M |

|

Adjusted EBITDA20 |

$960M – $980M |

|

Recurring Levered FCF 1 |

$310M – $330M |

|

Total Capex |

$500M – $540M |

For more information:

https://www.ihstowers.com

Stahl – A strong +25.4% organic sales

rebound was the major driver for significant EBITDA growth (+18%).

EBITDA margins remained solid, thanks to tight fixed costs

management and despite strong raw material cost increases,

particularly in the second half of the year. Cash generation

remains excellent, which led to significant further net debt

reduction.

(Full consolidation)

Stahl, the world leader in coating layers and

surface treatments for flexible materials, posted total sales of

€831.3 million in FY 2021, representing an increase of +24.2% over

FY 2020 and above 2019 pre-pandemic sales level. Organic growth was

+25.4% while foreign exchange rate fluctuations had a negative

impact (-1.2%).

After a challenging 2020, Stahl continued its

recovery that started in Q3 2020, and accelerated at the end of

2020, despite disruptions in the automotive end market. This was

driven by a strong order book and broad-based volume growth across

almost all regions and end markets, in part due to a restocking

effect observed across several industries. Growth was particularly

strong in Asia Pacific. Stahl’s automotive business rebounded

significantly vs. FY2020, although it was impacted in the second

half by disruptions in the automotive supply chain.

FY2021 EBITDA21 amounted to €179.9 million,

translating into an EBITDA margin of 21.6%. While Stahl was able to

largely maintain a low level of fixed costs in FY2021 (below

FY2019) thanks to management’s focus and a resilient business

model, variable costs suffered from the unprecedented increase in

raw material prices, especially from H2 onwards, which led to a

deterioration of EBITDA margin. Price increase measures have been

implemented, across the Leather Chemicals and Performance Coatings

divisions, although the full effect of these is not yet reflected

in FY2021 numbers. In addition, the Company will continue to

monitor closely the continuous rise of input costs (raw materials,

freight services and energy) and take appropriate measures, if

required, to preserve its profitability.

Stahl remained highly cash generative, notably

thanks to the good EBITDA level. As a result, as of December 31,

2021, Stahl’s net debt22 was €176.2 million, thus a €68.8 million

reduction year-to-date. Leverage23 was reported at 0.8x EBITDA as

of December 31, 2021.

On March 11, 2021, Stahl announced the

appointment of Maarten Heijbroek as new Chief Executive Officer of

Stahl. Maarten Heijbroek joined Stahl on July 1st, 2021 and took

over the CEO responsibilities from Huub van Beijeren, who retired

from Stahl at the end of June 2021 after 14 years at the helm of

the company.

Stahl’s sustainability efforts have been

rewarded in July with a Gold rating from EcoVadis, placing it

within the top 5% of companies assessed by EcoVadis. In 2020, Stahl

had been awarded a Silver award. Stahl’s 2030 target is to maintain

the EcoVadis Gold rating through continual improvement.

In November 2021, Stahl announced that it will

extend its GHG reduction targets to cover Scope 3 emissions. This

step underlines Stahl’s commitment to aligning its strategy with

the 2015 Paris Climate Agreement goals, updated at the recent COP26

in Glasgow.

Tarkett - Sustained sales growth, in

particular in the fourth quarter. Profitability negatively impacted

by inflation – continued increases in sale prices

(Equity method since 07/07/2021)

In 2021 Tarkett totaled €2,792 million in net

sales, an increase of +6.0% as compared with 2020. Organic growth

was 6.4%, or 8.0% including price increases in the CIS region

(Commonwealth of Independent States) implemented to counter

inflation in procurement costs (in the CIS, price adjustments have

historically been excluded from the calculation of organic growth,

because they are implemented to offset currency fluctuations). The

effect of price increases implemented in all segments averaged

+3.5% in 2021 as compared with the prior year.

Adjusted EBITDA totaled €229.0 million in 2021,

or 8.2% of revenues, as compared with €277.9 million in 2020, or

10.6% of revenues. Growth in sales volumes aided EBITDA,

contributing €20 million. However, the effect of inflation on

purchases of raw materials, energy, and freight accelerated in the

second half and led to an unprecedented increase in procurement

costs of €178 million, in an environment of limited supply and very

strong demand, which added to the increases in the prices of oil

and other energy sources. The selling price increases of €93

million have mitigated the impact of inflation.

Net financial debt was stable at €475.7 million

at the end of December 2021 (as compared with €473.8 million at the

end of December 2020), including an increase due to an exchange

rate effect on Tarkett’s dollar-denominated debt. Financial

leverage was 2.1x adjusted EBITDA at the end of December 2021. In

addition to this solid financial structure, at the end of the year

Tarkett had a significant amount of liquidity, €628.7 million,

including undrawn Revolving Credit Facilities for €350.0 million

and other confirmed and unconfirmed credit facilities for €73.3

million and cash equivalents of €205.4 million.

2022 Outlook:

At the beginning of the year, Tarkett expected

continued volume growth and further inflation in purchasing costs

(€220 million) to be fully offset by additional selling price

increases.

The situation in Russia and Ukraine has

implications for the activities of the Group in the CIS region and

its overall performance, although it is too early to assess the

impact. Russia represents c.10% of Tarkett’s combined net sales in

2021. Safety of employees who can be exposed to the conflict is a

key priority.

Tarkett represented c.1.9% of Wendel’s Gross

Asset Value as of December 31, 2021.

For more information:

https://www.tarkett-group.com/en/investors/

Wendel Lab: accelerating the development

through new capital commitments and new hirings

The purpose of the Wendel Lab is to increase the

Group’s exposure to future growth. Since it was launched in 2013,

the Wendel Lab has principally made commitments to several

high-quality funds specialized in investment in technology. As part

of its 2021-24 roadmap, Wendel announced that this asset category

would ultimately account for 5-10% of its net asset value.

The Wendel Lab has a dual objective:

- Diversify Wendel’s portfolio, by gaining exposure to

fast-growing companies, generally with a high digital component or

with a disruptive business model;

- Develop the expertise of Wendel’s team and those of its

portfolio companies in terms of technological innovation that could

impact or improve the Group’s value-creation profile.

In 2021, €49m of new capital has been committed.

Since the start of 2022, an additional €21m has been committed to

technology-focused funds raised by Andreessen Horowitz (A16Z),

Insight Partners and Kleiner Perkins. Each of these firms is

managed by highly respected and experienced technology investors.

Total commitments at the end of 2021 amounted to €115 million, of

which c.70% have been already called.

Early 2022, Wendel announced its decision to

strengthen its activities dedicated to financing fast-growing

companies, via two complementary initiatives headed by Jérôme

Michiels, who will remain Executive Vice-President and Chief

Financial Officer.

In addition to its investments in funds and

funds of funds, the Wendel Lab will also seek, as announced, direct

investment and co-investment opportunities through start-ups. To

carry out these direct investments, similar to the one made in 2019

in AlphaSense, the Wendel Lab will rely on a new team made up of

two professionals experienced in this asset class, including

Antoine Izsak, who joined Wendel in early February as Head of

Growth Equity. Mr. Izsak was previously Investment Director at BPI

france.

Wendel’s net asset value: €188.1 per share as

of December 31, 2021

Wendel’s Net Asset Value as of December 31, 2021

was prepared by Wendel to the best of its knowledge and on the

basis of market data available at this date and in compliance with

its methodology24.

Net Asset Value was €8,419 million or €188.1 per

share as of December 31, 2021 (see detail in Appendix 1 below), as

compared to €159.1 on December 31, 2020, representing an increase

of +18.3%. Compared to the last 20-day average share price as of

December 31, the discount to the December 31, 2021 NAV per share

was of 45.6%.

Renewal of term and new Supervisory Board

member to be submitted to the 2022 Shareholders’ Meeting

It will be proposed to shareholders to renew for

a further four-year term Franca Bertagnin Benetton as an

independent member of the Supervisory Board and of the Audit, Risks

and Compliance Committee.

Guylaine Saucier, whose term will expire at the

close of the Shareholders’ Meeting of June 16, 2022 has expressed

her intent not to renew her term. The Supervisory Board would like

to express its sincere thanks for her remarkable contribution to

the work of the Supervisory Board over 12 years, of which 11 years

as a Chairwoman of the Audit, Risks and Compliance Committee.

Shareholders will be asked to vote on the

appointment of a new independent Supervisory Board member, William

D. Torchiana, a US citizen, who would bring to the Board his US

business culture, his experience in complex transactions and his

knowledge in governance-related matters. Subject to his

appointment, he would join both the Audit, Risk and Compliance

Committee and the Governance and Sustainability Committee.

Other significant events of 2021

Integration of ESG targets into the financial

terms of the undrawn €750 million syndicated credit

facility

Wendel has signed an amendment to its undrawn

€750 million syndicated credit facility maturing in October 2024 in

order to integrate Environmental, Social and Governance (ESG)

criteria. Measurable aspects of the non-financial performance of

Wendel and the companies in its portfolio will henceforth be taken

into account in the calculation of the financing cost of this

syndicated credit. They are in line with certain quantitative ESG

targets the Group has set in its ESG 2023 roadmap.

The three non-financial criteria selected to be

integrated into the calculation of the syndicated credit’s

financing cost are as follows:

- ESG due diligence must systematically be carried out on new

investments directly made by Wendel, and the controlled companies

in its portfolio must implement an ESG roadmap;

- the main climate risks and carbon footprint associated with

each controlled portfolio company must be evaluated and action

plans developed;

- at least 30% of Wendel Group representatives on the boards of

directors of portfolio companies and of certain Group holdings must

be women, by the end of 2023.

These criteria will be evaluated annually by an

independent third party and will, if the case may be,give rise to

adjustments to the margin of the facility.

Wendel partners with the Deconinck family to

acquire shares of Tarkett and to support the growth of the

company

As part of its 2021-24 investment strategy,

Wendel has teamed up with the Deconinck family to form Tarkett

Participation, which will support Tarkett’s growth. This investment

was accompanied by an offer to acquire Tarkett shares. According to

the partnership, Wendel will hold up to 30% of Tarkett

Participation, alongside the Deconinck family. The Deconinck family

will maintain a controlling stake in the company.

On October 26, 2021, Tarkett Participation

announced that it held, directly or indirectly, 90.41% of Tarkett’s

share capital (compared with 86.27% following the close of the

simplified tender offer on July 9, 2021). Minority shareholders of

Tarkett now hold less than 10% of share capital and voting

rights.

Tarkett Participation could contemplate a

potential squeeze-out procedure, in accordance with the regulation,

but this is not on the table at this time. Tarkett Participation is

a company controlled by the Deconinck family, alongside Wendel.

As a result, Wendel has invested a total of €222

million for a total stake of 25.9% of Tarkett Participation’s

capital, representing a 23.4% ownership of Tarkett.

Josselin de Roquemaurel, Wendel’s Executive

Vice-President and Managing Director of Wendel, joined Tarkett

S.A.’s Supervisory Board as an Observer on July 29, 2021.

Wendel further improves its debt profile and

structure

Gross debt as of the end of December stood at

€1,619 million, with, net cash position of €650 million resulting

in a net debt of €969 million. LTV ratio was 10.3%. Pro forma the

disposal of Cromology and the ACAMS transaction, net debt would

stand at €378 million and LTV would have stood at 4.3%, as of

December 2021.

- Wendel announces today exercising the make-whole redemption of

the bonds maturing in October 2024 with outstanding principal of

€500 million (ISIN FR0012199156) and bearing interest at 2.750% at

a price determined in accordance with the terms and conditions of

the bonds. This operation will further optimize the cost and the

maturity of Wendel’s debt. Pro forma the issuance of €300 million

in January 2022 and of this repurchase, Wendel average maturity

would be extended to 7.2 years25 and its average weighted cost of

debt lowered to 1.7%.

- Total liquidity of €1.4 billion as of December 31, 2021,

including €650 million of cash and a €750 million committed credit

facility (fully undrawn). Proforma the issuance of €300 million in

January 2022, the disposal of Cromology, the ACAMS acquisition and

the early repayment in whole of the bond maturing in October 2024,

total liquidity would stand at c.€1.8 billion26

S&P reaffirms Wendel BBB rating with a

stable outlook and says Wendel has ample financial flexibility to

absorb new investments

In February 2021, S&P concluded its

analytical review by reaffirming the ‘BBB’ rating on Wendel issuer.

Over the course of 2021 and early 2022, S&P highlighted in its

publications that Wendel has ample financial flexibility to absorb

new investments.

Moody’s reaffirms Wendel Baa2 rating with a

stable outlook

Moody’s also updated its credit analysis in

August 2021 and reaffirmed Wendel’s Baa2 rating incorporating the

company’s consistent and prudent investment strategy, and

conservative financial policy reflected by its very low

point-in-time market value leverage and Moody’s expectation that

Wendel will maintain low MVL through market cycles.

Moody’s and S&P’s ratings, respectively

’Baa2’ and ‘BBB’ are one notch above the investment grade

threshold.

Extra financial ratings: Wendel continues to

benefit from excellent rankings in 2021

Wendel improves score in the Dow Jones

Sustainability (DJSI) World and Europe indices

Wendel is once again included in the Dow Jones

Sustainability World and Europe indices (DJSI) and improves its

score on the Corporate Sustainability Assessment (CSA) of S&P

Global.

Following the results release of the 2021

Corporate Sustainability Assessment (CSA) questionnaire published

on November 12, 2021, Wendel scored 76/100 in the Diversified

Financials category. This score is up 5 points compared to the 2020

assessment (71/100) and positions Wendel very well above the

average for its sector (27/100).

This improvement is notably linked to the

progress of scores on the topics of cybersecurity, protection of

human rights and the fight against climate change.

In addition, Wendel is ranked AA by MSCI,

Negligible Risk by Sustainalytics, B- by CDP and 75/100 by Gaïa

Rating.

2022 significant events:

Wendel acquires ACAMS, the world’s largest

membership organization dedicated to fighting financial

crime

Announced on January 24, 2022, Wendel has

completed the acquisition of the Association of Certified

Anti-Money Laundering Specialists (“ACAMS” or the “Company”) from

Adtalem Global Education (NYSE: ATGE) on March 10, 2022. Wendel

invested $338 million of equity for a c. 98% interest in

the Company, alongside ACAMS’ management and a minority

investor.

ACAMS is the global leader in training and

certifications for anti-money laundering (“AML”) and financial

crime prevention professionals. ACAMS has a large, global

membership base with more than 90,000 members in 175 jurisdictions,

including over 50,000 professionals who have obtained their CAMS

certification-an industry-recognized AML qualification- that

promotes ongoing education through participation in conferences,

webinars, and other training opportunities.

The Company has approximately 275 employees

primarily located in the U.S., London and Hong Kong that serve its

global customers.

Sale of Cromology completed

After obtaining the necessary authorizations,

Wendel announced on January 21, 2022, the completion of the sale of

Cromology to DuluxGroup, a subsidiary of Nippon Paint Holdings Co.,

Ltd. For Wendel, the transaction generated net proceeds of €896

million or €358 million above Cromology’s valuation in Wendel’s net

asset value published before the transaction announcement, i.e., as

of June 30, 2021.

This transaction is a milestone in Wendel’s

2021-24 roadmap, and its target to accelerate the redeployment of

its capital toward growth companies.

Wendel’s portfolio direct exposure to current

uncertain environment

Wendel is paying close attention to the

evolution of the situation in Ukraine and its potential

consequences, as the most material financial impact, among other

things, could come from an increase of our companies' cost

structures, raw materials prices, supply chain and wages inflation,

if these are not passed on sufficiently quickly in sales prices, as

our companies were able to do in 2021. Wendel is also monitoring

the evolution of the Covid pandemic in Asia, and particularly in

China.

Wendel direct economical exposure to Russia and

Ukraine is limited at c.1%27 and security of local employees who

can be exposed to the conflict is a key priority.

Please find below the Group direct exposure to

Russia and Ukraine through its companies:

|

|

2021 Russia & Ukraine sales (% total

sales) |

|

Listed assets |

|

|

Bureau Veritas (46% of GAV28) |

<1% |

|

IHS Towers (7.5% of GAV) |

0% |

|

Tarkett (1.9% of GAV) |

c.10% |

|

Unlisted assets (37% of GAV) |

|

|

Constantia Flexibles |

<5% |

|

Stahl |

c.1% |

|

CPI |

c. 0% |

|

|

|

|

Net cash position & financial assets (6.5% of

GAV) |

0% |

|

ACAMS |

c.

0% |

Return to shareholders and

Dividend

An ordinary dividend of €3.0 per share for

2021, up 3.4%, will be proposed at the Annual Shareholders’ Meeting

on June 16, 2022, representing a yield of 2.85%29

€42.4 million of Wendel shares were repurchased

in 2021 and early 2022. Wendel announces that share buybacks will

continue in 2022.

Appendix 1: NAV as of December 31, 2021:

€188.1 per share

|

(in millions of euros) |

|

|

12/31/2021 |

12/31/2020 |

|

Listed equity investments |

Number of shares |

Share price (1) |

5,559 |

3,599 |

|

Bureau Veritas |

160.8/160.8 m |

€28.7/€22.4 |

4,616 |

3,599 |

|

IHS |

63.0m |

$13.5 |

748 |

n/a |

|

Tarkett |

|

€18.6 |

195 |

n/a |

|

Investment in unlisted assets (2) |

3,732 |

3,910 |

|

Other assets and liabilities of Wendel and holding

companies(3) |

|

97 |

74 |

|

Net cash position & financial assets (4) |

|

|

650 |

1,079 |

|

Gross asset value |

|

|

10,038 |

8,662 |

|

Wendel bond debt |

|

|

-1,619 |

-1,548 |

|

Net Asset Value |

|

|

8,419 |

7,114 |

|

Of which net debt |

|

|

-969 |

-468 |

|

Number of shares |

|

|

44,747,943 |

44,719,119 |

|

Net Asset Value per share |

|

|

€188.1 |

€159.1 |

|

Wendel’s 20 days share price average |

|

€102.3 |

€97.9 |

|

Premium (discount) on NAV |

|

|

-45.6% |

-38.5% |

| |

|

|

|

|

|

- Last 20 trading days average as of December 31, 2021 and

December 31, 2020

- Investments in non-publicly traded companies (Cromology, Stahl,

IHS as of December 2020, Constantia Flexibles, Crisis Prevention

Institute, indirect investments). Aggregates retained for the

calculation exclude the impact of IFRS 16.

- Of which 1,116,456 treasury shares as of December 31, 2021, and

900,665 treasury shares as of December 31, 2020

- Cash position and financial assets of Wendel & holdings. As

of December 31, 2021, this comprises €0.4 bn of cash and cash

equivalents and €0.3 bn short term financial investment.

Assets and liabilities denominated in currencies

other than the euro have been converted at exchange rates

prevailing on the date of the NAV calculation.

If co-investment and managements LTIP conditions

are realized, subsequent dilutive effects on Wendel’s economic

ownership are accounted for in NAV calculations. See page 360 of

the 2020 Registration Document.

Appendix 2: Conversion from accounting

presentation to economic presentation

|

2021 |

|

|

|

|

|

Equity-method investments |

|

Total Group |

|

(in millions of euros) |

Bureau Veritas |

Constantia Flexibles |

Cromology |

Stahl |

CPI |

IHS |

Tarkett |

Wendel and holding companies |

|

Net income from operations |

|

|

|

|

|

|

|

|

|

|

|

Net sales |

4,981.1 |

1,603.4 |

- |

831.3 |

88.2 |

|

|

|

7,503.9 |

|

|

|

EBITDA (1) |

N/A |

201.0 |

- |

179.9 |

43.6 |

|

|

|

|

|

|

|

Adjusted operating income (1) |

801.8 |

82.1 |

- |

153.2 |

35.7 |

|

|

|

1072.8 |

|

|

|

Other

recurring operating items |

|

2.0 |

- |

1.5 |

0.4 |

|

|

|

|

|

|

|

Operating income |

801.8 |

84.1 |

- |

154.7 |

36.1 |

|

|

-73.8 |

1002.9 |

|

|

|

Finance

costs, net |

-73.6 |

-14.0 |

- |

-14.6 |

-24.4 |

|

|

-33.7 |

-160.4 |

|

|

|

Other

financial income and expense |

0.4 |

-1.7 |

- |

14.3 |

-0.2 |

|

|

-3.9 |

8.9 |

|

|

|

Tax

expense |

-219.3 |

-17.5 |

- |

-40.4 |

-3.8 |

|

|

- |

-281.0 |

|

|

|

Share

in net income of equity-method investments |

- |

- |

- |

- |

- |

27.7 |

3.0 |

- |

30.7 |

|

|

|

Net

income from discontinued operations and operations held for

sale |

- |

- |

52.4 |

- |

- |

- |

|

- |

52.4 |

|

|

|

Recurring net income from operations |

509.2 |

50.9 |

52.4 |

113.9 |

7.8 |

27.7 |

3.0 |

-111.3 |

653.7 |

|

|

|

Recurring net income from operations – non-controlling

interests |

337.9 |

20.2 |

2.7 |

36.5 |

0.3 |

- |

- |

- |

397.5 |

|

|

|

Recurring net income from operations – Group

share |

171.4 |

30.8 |

49.7 |

77.4 |

7.5 |

27.7 |

3.0 |

-111.3 |

256.2 |

|

|

|

Non-recurring net income |

|

|

|

|

|

|

|

|

- |

|

|

|

Operating income |

-83 |

-50.7 |

- |

-23.2 |

-18.4 |

|

|

-18.0 (2) |

-193.2 |

|

|

|

Net

financial income (expense) |

- |

-2.5 |

- |

-30.6 (5) |

- |

|

|

24.5 (3) |

-8.6 |

|

|

|

Tax

expense |

20.0 |

12.9 |

- |

13.7 |

6.0 |

|

|

- |

52.6 |

|

|

|

Share

in net income of equity-method investments |

- |

- |

- |

- |

- |

-18.8 |

-5.9 |

913.5 (4) |

888.9 |

|

|

|

Net

income from discontinued operations and operations held for

sale |

- |

- |

-17.5 |

0.6 |

- |

- |

|

|

-16.9 |

|

|

|

Non-recurring net income |

-63.0 |

-40.3 |

-17.5 |

-39.5 |

-12.3 |

-18.8 |

-5.9 |

920.0 |

722.6 |

|

|

|

of

which: |

|

|

|

|

|

|

|

|

|

|

|

|

-

Non-recurring items |

-12 |

-8.6 |

-17.5 |

-24.2 |

-0.1 |

-10.9 |

-0.5 |

920.0 |

846.3 |

|

|

|

–

Impact of goodwill allocation |

-47.3 |

-31 |

- |

-15.3 |

-12.3 |

- |

-5.4 |

- |

-111.2 |

|

|

|

- Asset

impairment |

-3.8 |

-0.7 |

- |

- |

- |

-7.9 |

- |

- |

-12.4 |

|

|

|

Non-recurring net income – non-controlling interests |

-41.7 |

-15.8 |

-0.9 |

-12.7 |

-0.5 |

|

- |

3.5 |

-68.0 |

|

|

|

Non-recurring net income – Group share |

-21.3 |

-24.5 |

-16.6 |

-26.9 |

-11.9 |

-18.8 |

-5.9 |

916.4 |

790.6 |

|

|

|

Consolidated net income |

446.2 |

10.6 |

34.9 |

74.4 |

-4.6 |

8.9 |

-2.9 |

808.8 |

1376.4 |

|

|

|

Consolidated net income – non-controlling interests |

296.1 |

4.4 |

1.8 |

23.8 |

-0.2 |

- |

- |

3.5 |

329.5 |

|

|

|

Consolidated net income – Group share |

150.1 |

6.3 |

33.1 |

50.6 |

-4.4 |

8.9 |

-2.9 |

805.2 |

1046.9 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

(1) Before the impact of

goodwill allocation, non-recurring items and management fees.

This item includes the impact of liquidity linked to IHS

co-investment mechanisms for an amount of -€8.8 million

This item includes the impact of the positive change in fair

value and the disposal of Wendel Lab’s financial assets net of tax

for €44.5 million. It also includes the early redemption premium of

the 2023 bond for -€8 million as well as the change in fair value

related to foreign exchange hedges implemented by Wendel for -€6

million.

This item includes the impact of the deconsolidation result of

IHS

This item includes the foreign exchange impact for the period of

-€32 million.

Appendix 3: Summary table of main aggregates

before and after the application of IFRS 16

| (in

millions) |

Sales |

EBITDA (EBIT for IHS) |

Net debt |

|

|

FY

2020 |

FY

2021 |

FY

2020 excluding IFRS 16 |

FY

2020 including IFRS 16 |

FY

2021 excluding IFRS 16 |

FY

2021 including IFRS 16 |

FY

2021 excludingIFRS 16 |

FY

2021 includingIFRS 16 |

|

Stahl |

€669.4 |

€831.3 |

€149.1 |

€152.3 |

€176.8 |

€179.9 |

€161.3 |

€176.2 |

|

Constantia Flexibles |

€1,505.3 |

€1,603.4 |

€174.8 |

€189.4 |

€191.4 |

€201.0 |

€363.2 |

€400.3 |

|

CPI |

$63.8 |

$104.3 |

$25.1 |

$26.1 |

$50.4 |

$51.5 |

$318.6 |

$322.6 |

1 Historical high Net Asset Value per share of

€189.1 as of June 30, 2021

2 Up +20.1% reintegrating dividend of €2.9 per

share paid in 2021, up +18.3% including dividend payment and up

+27% excluding the IHS share price decrease

3 c. $338 million at 1.112 EURUSD

4 As of March 18, 2022

5 including c.€1bn of cash and a €750 million

committed credit facility (fully undrawn)

6 This ratio is based either on the turnover

taxonomy eligibility ratio (for Stahl), or on other ratios

measuring the contribution to environmental or social objectives

other than exclusively climate change mitigation and adaptation

(environmental objectives currently covered by the EU taxonomy)

7 Based on Wendel’s share price of €105.4 as of

December 31, 2021

8 Cromology is classified as asset held for sale

in accordance with IFRS 5, consequently it is excluded from the

consolidation sales in both periods.

9 Adjusted operating margin at constant exchange

rates.

10 Net cash generated from operating

activities/Adjusted Operating Profit, on average over the

period.

11 TAR: Total Accident Rate (number of accidents

with and without lost time x 200,000/number of hours worked).

12 Proportion of women from the Executive

Committee to Band II (internal grade corresponding to a management

or executive management position) in the Group (number of women on

a full-time equivalent basis in a leadership position/total number

of full-time equivalents in leadership positions).

13 Greenhouse gas emissions from offices and

laboratories, tons of CO2 equivalent net emissions per employee and

per year corresponding to scopes 1, 2 and 3 (emissions related to

business travel).

14 EBITDA including the impact of IFRS 16.

EBITDA excluding the impact of IFRS 16 was €191.4m

15 Including IFRS 16 impacts. Excluding IFRS 16

net debt is €363.2m

16 EBITDA including the impact of IFRS 16.

EBITDA excluding the impact of IFRS 16 was $50.4m.

17 Excluding the impact of IFRS 16 due to data

availability in 2019

18 Adjusted EBITDA is a non-IFRS financial

measure. See “Use of Non-IFRS Financial Measures” from IHS

financial communication for additional information and a

reconciliation to the most comparable IFRS measures

19 Consolidated Net Leverage Ratio is calculated

based on a trailing 12 month adjusted EBITDA pro forma for

acquisitions

20 Adjusted EBITDA and RLFCF are non-IFRS

financial measures. See “Use of Non-IFRS Financial Measures” for

additional information and a reconciliation to the most comparable

IFRS measures in IHS financial communication. IHS is unable to

provide a reconciliation of Adjusted EBITDA and RLFCF to

(loss)/profit and cash from operations, respectively, for the

periods presented above without an unreasonable effort, due to the

uncertainty regarding, and the potential variability, of these

costs and expenses that may be incurred in the future, including,

in the case of Adjusted EBITDA, share-based payment expense,

finance costs, and insurance claims, and in the case of RLFCF net

movement in working capital, other non-operating expenses, and

impairment of inventory

21 EBITDA including IFRS 16 impacts, EBITDA

excluding IFRS 16 stands at €176.8m

22 Net debt including IFRS 16 impacts, Net debt

excluding IFRS 16 stood at €161.3m

23 Leverage ratio in accordance with financing

documentation

24 See page 332 of the 2020 Universal

Registration Document for the NAV methodology.

25 As of March 18, 2022

26 including c.€1bn of cash and a €750 million

committed credit facility (fully undrawn)

[27] Enterprise value exposure of Group companies,

according to the breakdown of 2021 revenues. Enterprise values are

based on NAV calculations as of December 31, 2021

28 GAV: Gross Asset Value, as computed in

Wendel’s NAV as of December 31, 2021

29 Based on Wendel’s share price of €105.4 as of

December 31, 2021

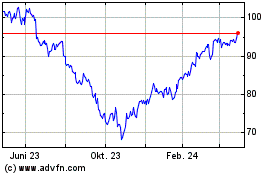

Wendel (EU:MF)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Wendel (EU:MF)

Historical Stock Chart

Von Apr 2023 bis Apr 2024