Regulatory News:

Mercialys (Paris:MERY):

- Major refinancing operation carried out during the first

quarter. The maturity of debt, liquidity and financing costs

were significantly optimized, with the latter reduced from 2.0% at

end-2021 to 1.7% at end-June 2022. The Company’s short-term debt

maturities are very clearly covered by the cash position and

confirmed bank lines, with the next bond maturities not due until

2026.

- The divestment of two hypermarkets enables the Company to

further reduce its loan to value ratio (LTV), down to 36.6%

excluding transfer taxes and 34.3% including transfer taxes at

end-June 2022. The portfolio value is Euro 3,122.8 million

including transfer taxes, up +1.7% over six months like-for-like.

The average appraisal yield rate came to 5.71%, stable compared

with end-December 2021. EPRA NDV climbed +11.6% over six months to

Euro 19.65 per share, reflecting the positive trend for asset

values, as well as a significant impact for the change in the fair

value of debt.

- Following a first quarter marked by significant health,

political, economic and geopolitical disruptions, retailer

sales for the half-year show a trend that is very close to

the normalized 2019 level, with footfall representing 88.7% of

the 2019 baseline. This trend reflects the appetite among French

consumers to return to physical retail. Alongside this, the

attractive positioning of Mercialys’ sites was illustrated by the

combination of two factors during the first half of the year. On

the one hand, the sustainability of rents for retailers, with an

occupancy cost ratio of 10.7% at end-June 2022 (vs. 10.4% at end

2019), despite an indexation effect of +1.9% and a rental reversion

rate of +1.7%. On the other hand, a further reduction in the

current financial vacancy rate, from 3.2% at end-2021 to 2.9% at

end-June 2022.

- Invoiced rents are up +3.2%, with +5.3%

like-for-like. The EBITDA margin is still high, with

87.0% for the first half of 2022, highlighting the robust trend

for rents and the effective control over costs, despite the costs

resulting from the completion of the process to bring back in-house

the last support functions that were previously outsourced to the

Casino group.

- Funds from operations (FFO) at end-June 2022 are up

+3.2%.

- 2022 objectives: Considering the satisfactory

performance levels achieved over the first half of the year,

Mercialys is able to confirm its objectives, excluding the health

situation’s potential impacts on its operations. These objectives

are based on growth in funds from operations (FFO) per share to

reach at least +2% vs. 2021 and a dividend to range from 85% to 95%

of 2022 FFO.

Jun 30, 2021

Jun 30, 2022

Change %

Organic growth in invoiced rents including

indexation

-4.0%

+5.3%

-

EBITDA (€m)

76.3

75.3

-1.4%

EBITDA margin

90.1%

87.0%

-

Funds from operations, FFO (€m)

55.7

57.5

+3.2%

ICR (EBITDA / net finance costs)

5.6x

6.1x

-

LTV (excluding transfer taxes)

38.3%

36.6%

-

LTV (including transfer taxes)

36.0%

34.3%

-

Portfolio value including transfer taxes

(€m)

3,185.6

3,122.8

+1.1% (+1.7% H1) 1

EPRA NRV (€/share)

20.32

20.35

+0.2%

EPRA NDV (€/share)

17.17

19.65

+14.4%

I. 2022 first-half business and

results

During the first half of 2022, business continued to be widely

marked by various elements linked to the general health environment

at the start of the year, then the outbreak of the crisis in

Ukraine and an inflationary macroeconomic context. These

disruptions negatively affected retail trends in France during the

first quarter. However, the performance figures in terms of

shopping center footfall and retailer sales 2 picked up again

significantly in the second quarter.

Footfall reached 88.7% of the normalized level for 2019,

while noting that the bases for comparison are not relevant in

relation to 2020 and 2021 as a result of the government-ordered

store closures.

Based on the same parameters, the national panel (Quantaflow)

shows a footfall figure for the first half of 2022 representing

86.3% of the level from 2019.

Across Mercialys’ portfolio, retailer sales at end-June

2022 represented 98.1% of the normalized level from 2019, including

102.3% just for the month of June. At end May 2022, the national

panel (CNCC) shows retailer sales at 91.5% of their normalized

level from 2019.

The occupancy cost ratio 3 came to a balanced level of

10.7% at end-June 2022. This ratio, which was not able to be

determined for 2020 and 2021 due to the government-ordered store

closures, was 10.4% at December 31, 2019.

The current financial vacancy rate 4 was 2.9% for the

first half of 2022, showing a further reduction compared with the

3.2% recorded at December 31, 2021 and 4.0% at end-June 2021.

The robust letting performance is illustrated by the 90 leases

signed for renewals or relettings during the first half of 2022.

The reversion rate associated with these negotiations was

+1.7%.

The combination of the three indicators, i.e. the higher

reversion rate, the positive organic rental income growth and the

contraction in the vacancy rate, appears to be particularly

satisfactory in an uncertain environment. Note that in June 2022,

the Bank of France reported that household purchasing power was

expected to contract only slightly in 2022 (-1% estimated), before

picking up again in 2023 and 2024 (+0.5% and +1.5% estimated

respectively). According to the Bank of France, the development of

inflation in France is expected to be cushioned through the

purchasing power support measures already put in place (e.g. energy

price caps, fuel rebates) or that could be determined through the

amended finance bill. These measures to mitigate the contraction in

purchasing power are also helping support retailers’ activity.

Alongside this, Mercialys has continued moving forward with its

efforts concerning its collection rate. This came to 94.7% at July

22, 2022 for 2021, highlighting the significant progress made

compared with the 88.8% recorded at December 31, 2021. The

collection rate for the first half of 2022 was 94.6% at July 22,

2022.

Organic growth 5 in rental income for the first half of

the year came to +5.3%, including a limited indexation

effect of +1.9%.

The positive trend recorded in the first quarter of 2022 is

continuing to ramp up. While the indexation effect was stable at

end-March and end-June 2022 (+1.9%), the deferred impact of the

rent relief granted for the lockdown during the first half of 2020

dropped from +2.4% at end-March to +1.4% at end-June 2022.

Organic growth, excluding base effects linked to the health

crisis, therefore came to +3.9% at the end of the first half of

2022, compared with +2.4% at end-March 2022.

As a result of the indexation mechanisms and the lease

anniversary dates, the indexation effect for Mercialys’ rental

income is linked primarily to the French Commercial Rent Index

(ILC) published for the second and third quarters of 2021, and will

therefore remain limited, with an estimated impact of less than +2%

for the full year in 2022.

Invoiced rents came to Euro 86.1 million, up +3.2% on a

current basis and +5.3% like-for-like. These changes reflect the

following elements:

Year to end-June 2021

Year to end-June 2022

Indexation

+0.3 pp

+€0.2m

+1.9 pp

+€1.6m

Contribution by Casual Leasing

-0.4 pp

-€0.4m

+1.6 pp

+€1.3m

Contribution by variable rents

-0.8 pp

-€0.8m

+0.1 pp

+€0.1m

Actions carried out on the portfolio

-2.3 pp

-€2.1m

+0.3 pp

+€0.2m

Accounting impact of “Covid-19 rent

relief” granted to retailers for the 2020 lockdowns

-0.8 pp

-€0.7m

+1.4 pp

+€1.1m

Like-for-like growth

-4.0 pp

-€3.7m

+5.3 pp

+€4.4m

Asset acquisition and sales

-4.0 pp

-€3.6m

-2.0 pp

-€1.6m

Other effects

-0.1 pp

-€0.0m

-0.1 pp

-€0.1m

Growth on a current basis

-8.1 pp

-€7.3m

+3.2 pp

+€2.7m

Rental revenues came to Euro 86.5 million, up +2.1% from

the first half of 2021, reflecting the growth in invoiced rents and

the contraction in lease rights and despecialization

indemnities.

Net rental income is up +1.2% to Euro 85.0 million. It

includes a significant upturn in management fee-related costs

compared with the first half of 2021, factoring in the catch-up

achieved on collection levels for 2020 and 2021, as well as the

normalization of collection during the first half of 2022. This

catch-up has also had an impact on the provisions recorded for

these years.

EBITDA totaled Euro 75.3 million, down -1.4% compared

with June 30, 2021. The EBITDA margin came to a high level of 87.0%

(vs. 84.0% at December 31, 2021 and 90.1% at June 30, 2021).

The net financial expenses used to calculate FFO 6

totaled Euro 14.2 million at June 30, 2022, significantly lower

than end-June 2021 (Euro 16.1 million). Specifically, this

improvement reflects the impact of the refinancing operation

carried out during the first quarter of 2022, based on a Euro 500

million bond issue with a 2.5% coupon, the partial redemption of

Euro 100 million of the bond issue with a maturity of July 2027 and

4.625% coupon, and lastly, the exercising of the make-whole early

redemption option on the bond issue scheduled to mature in March

2023 for a nominal total of Euro 469.5 million with a 1.787%

coupon. The positive impact of this refinancing is also reflected

in the real average cost of drawn debt of 1.7%, compared

with the 2.0% recorded for the full year in 2021.

Other operating income and expenses (excluding capital

gains on disposals and impairment) came to Euro +0.8 million and

primarily include the impact of the ramping up of activities for

Ocitô and Cap Cowork, as well as the reversals or allowances for

provisions recorded.0

Tax represents a Euro -0.3 million expense at end-June

2022 (Euro -0.4 million for the first half of 2021). This amount

corresponds primarily to a CVAE corporate value-added tax

expense.

The share of net income from associates and joint

ventures (excluding capital gains, amortization and impairment)

came to Euro 1.8 million at June 30, 2022, compared with Euro 1.7

million at June 30, 2021.

Non-controlling interests (excluding capital gains,

amortization and impairment) came to Euro -5.4 million at June 30,

2022, virtually stable compared with the first half of 2021 (Euro

-5.3 million).

In view of these elements, funds from operations (FFO

6) are up +3.2% from June 30, 2021 to Euro 57.5 million,

with Euro 0.61 per share 7.

(In thousands of euros)

Jun 30, 2021

Jun 30, 2022

Change %

Invoiced rents

83,419

86,087

+3.2%

Lease rights and despecialization

indemnities

1,246

364

-

Rental revenues

84,665

86,450

+2.1%

Non-recovered building service charges and

property taxes and other net property operating expenses

(699)

(1,441)

-

Net rental income

83,966

85,009

+1.2%

Management, administrative and other

activities income

1,292

1,208

-6.6%

Other income and expenses

(2,042)

(1,620)

-20.7%

Personnel expenses

(6,900)

(9,346)

+35.5%

EBITDA

76,317

75,251

-1.4%

EBITDA margin (% of rental revenues)

90.1%

87.0%

-

Net financial items (excluding

non-recurring items8)

(16,101)

(14,162)

-12.0%

Reversals of / (Allowances for)

provisions

(346)

(522)

+51.1%

Other operating income and expenses

(excluding capital gains on disposals and

impairment)

(199)

766

-

Tax expense

(423)

(339)

-19.6%

Share of net income from associates and

joint ventures (excluding capital gains, amortization and

impairment)

1,745

1,836

+5.2%

Non-controlling interests

(excluding capital gains, amortization and

impairment)

(5,300)

(5,367)

+1.3%

FFO

55,694

57,461

+3.2%

Funds from operations (FFO) per share

7(in euros)

0.60

0.61

+1.6%

II. Deep changes in the shareholding and

governance structure launched in 2012 and completed in 2022

Mercialys’ history has been closely linked to the Casino group,

which listed the Company on the stock market in 2005. While

Mercialys has not been a Casino subsidiary since 2012, Casino

continued to be a shareholder with around 40% of the Company’s

capital from 2012 to 2018. Casino’s contribution as a shareholder

and the various real estate agreements in place between the two

companies contributed to drive Mercialys’ economic performance.

From July 2018, Casino gradually divested its interest,

completing its exit from the shareholding structure in April 2022.

The governance structure has been adapted in line with this change

in the shareholder base. Since April 28, 2022, the Board of

Directors has no longer included any representatives of Casino. It

is aligned with the best governance standards and includes 63%

independent directors, with five women and three men, with the

difference between the number of members of each gender limited to

two9.

Since 2019, with a phased approach, Mercialys has brought

various support functions that were previously outsourced to Casino

back in-house. This process will be completed in August 2022, with

the Company also bringing back in-house its rental, technical and

administrative management activities, which were previously

entrusted to a Casino subsidiary, which is still responsible for

facilities management for the shopping centers owned by Mercialys.

The agreements between Mercialys and Casino concerning real estate

projects or financing have also been gradually phased out since

2020.

Alongside this, Casino continues to be a tenant, primarily for

hypermarkets, and represents 20.9% of Mercialys’ total rental

income at end-June 2022 (vs. 22.6% at end-June 2021 and 22.4% at

end-December 2021). Mercialys’ rental exposure is distributed

across:

- 5 food stores (including one Monoprix store) operated by Casino

and 100% owned by Mercialys

- 5 food stores operated by Casino and 60% owned by

Mercialys

- 10 food stores operated by Casino and 51% owned by

Mercialys

Mercialys’ portfolio also includes diverse food operators. On

the one hand, the Company owns a food store operated by Aldi. On

the other hand, at the sites where Mercialys does not own the food

anchors, they are are owned and operated by either Casino, or

Carrefour (3 sites), Système U (3 sites) and Intermarché (1

site).

In addition, through SCI AMR, created in partnership with Amundi

Immobilier, Mercialys has a 25% interest in 3 Monoprix sites and 2

hypermarkets operated by Casino.

In total, taking into consideration the share in rental income

based on the stakes held in assets through these various entities,

Mercialys’ economic exposure to rent from retailers operated by the

Casino group is 17.8% at end-June 2022.

While Mercialys is gradually scaling back its exposure to Casino

as its primary tenant, thanks in particular to asset rotations, it

is still relevant to own hypermarkets. First of all, as a factor

driving recurrent visits within the retail mix of these sites, in

addition to, as demonstrated since 2015, through the capacity for

these assets to evolve in line with the adjacent shopping

center.

III. Maintaining the attractiveness of

everyday retail: Mercialys’ robust approach to building client

knowledge to support retailers

One of the major operational challenges for Mercialys in an

uncertain consumption environment is to develop the attractiveness

of its sites and their footfall levels, while offering the best

tools for retailers to maximize the potential for sales across

their stores.

Thus, Mercialys is leveraging the capabilities making it

possible to communicate with visitors across its shopping centers,

and particularly the 1.3 million qualified contacts who are

registered in the Company’s bases. The relevance of this targeted

communication is illustrated by a 41% opening rate for the

communications sent by the Company.

Mercialys is continuing to further strengthen its client

knowledge with a view to qualifying their needs even more

effectively. In 2022, a new feature was introduced with the loyalty

program, offering the possibility for clients to scan their

receipts. The analysis of these data makes it possible to more

effectively determine on-site events, communications and retailers

or products to be showcased. Mercialys aims to analyze the data

from receipts representing 1% of the sales generated by retailers

in its shopping centers.

These client knowledge tools aim to carry out two types of

actions that will generate traffic and therefore sales for

retailers.

On the one hand, setting up cashback operations financed with

the sites’ marketing funds. The cashback balance is built up

through purchases made in the center and then converted into

vouchers that clients can use exclusively in their shopping center.

The effectiveness of this type of operation was demonstrated once

again during the first half of 2022 across Mercialys’ portfolio:

every Euro 1 of vouchers awarded has generated Euro 4.0 of

purchases.

On the other hand, thanks to the improvement in the health

conditions, Mercialys’ teams were able to start organizing special

events and activities again, either for different celebrations

(Valentine’s Day, Father’s Day, etc.) or with retailers. These

actions on the ground are particularly well suited to local retail,

renewing clients’ interest in their shopping center, focusing on

human contact and promoting retailers and products.

Once again, these special events and activities, supported by

the Prim Prim loyalty program, have achieved results that can be

measured with various indicators, as illustrated by the following

examples: a +25% increase in footfall over one week in June at Le

Port (Reunion Island) thanks to a cashback operation on dedicated

timeslots; a +44% increase in the average basket at an Yves Rocher

store in Niort in connection with a specific event; and a 67%

voucher usage rate in stores at the Brest shopping center in

May.

IV. Resumption of investments: arbitrage to

be carried out between making acquisitions and rolling out the

development pipeline

Mercialys weathered the health crisis in 2020 and 2021, while

once again demonstrating the liquidity and value of its assets. The

characteristics of this arbitrage policy also marked the sales

completed during the first half of 2022.

They represented a total of Euro 71.7 million including transfer

taxes, primarily concerning two Géant hypermarkets in Annecy and

Saint-Etienne. Overall, these sales were based on transactions

values that were slightly higher than the appraisal values. These

disposals also helped reduce Mercialys’ exposure to its primary

tenant, the Casino group.

These divestments and the major refinancing operation carried

out during the first quarter of 2022 (see section V of this press

release) are enabling Mercialys to resume an investment

strategy.

Mercialys has made far-reaching changes to the make-up of its

development pipeline since the end of the Partnership Agreement

signed with the Casino group. At end-June 2022, only 30% of

Mercialys’ projects are dependent on reaching an agreement with

Casino as a co-owner or co-volumist.

The characteristics of the projects also illustrate the

Company’s multifunctionality approach and its drive to capitalize

on all of its spaces. Around 40% of the investments planned concern

dining, leisure and tertiary activities (e.g. coworking or

logistics).

Recent inflationary pressures, concerning labor and building

material costs, have also led to changes in the investments to be

made in terms of these developments and their yields. The

sustainability of rent levels is still a decisive factor for

projects to be launched.

At end-June 2022, Mercialys’ development pipeline represented

Euro 540 million with around

Euro 36.6 million of potential additional rental income.

Mercialys has already rolled out various projects linked primarily

to relaunching sites.

(In million euros)

Total investment

Investment still to be

committed

Target net rental

income

Target net yield on cost

(%)

Completion date

COMMITTED PROJECTS

20.7

18.4

0.2

na

2022 / 2026

Dining and leisure

1.1

1.1

0.1

6.0%

2022

Tertiary activities

19.6

17.3

0.2

na 10

2022 / 2026

CONTROLLED PROJECTS

134.8

130.1

9.4

7.0%

2023 / >2027

Retail

89.9

85.4

6.3

7.0%

2023 / 2025

Dining and leisure

1.2

1.2

0.1

7.0%

2024 / 2025

Tertiary activities

43.7

43.5

3.1

7.0%

2023 / >2027

IDENTIFIED PROJECTS

385.0

384.9

26.9

7.0%

2024 / >2027

Retail

236.9

236.8

16.6

7.0%

2025 / >2027

Dining and leisure

111.9

111.9

7.8

7.0%

2025 / 2026

Tertiary activities

36.2

36.2

2.5

7.0%

2024 / >2027

TOTAL PROJECTS 10

540.4

533.4

36.6

na

2022 / >2027

- Committed projects: projects fully secured in terms of land

management, planning and related development permits

- Controlled projects: projects effectively under control in

terms of land management, with various points to be finalized for

regulatory urban planning (constructability), planning or

administrative permits

- Identified projects: projects currently being structured, in

emergence phase

V. Portfolio and financial structure

Strong EPRA NDV (Net Disposal Value) growth, up +11.6% over

six months and +14.4% over 12 months

Mercialys’ portfolio value came to Euro 3,122.8 million

including transfer taxes, down -0.5% over six months and -2.0% over

12 months. Like-for-like 11, it is up +1.7% over six months and

+1.1% over 12 months.

Excluding transfer taxes, the portfolio value came to Euro

2,930.2 million, down -0.5% over six months and -2.2% over 12

months. Like-for-like 11, it is up +1.7% over six months and +0.8%

over 12 months.

At end-June 2022, Mercialys’ portfolio mainly comprised 50

shopping centers 12, with 25 large regional shopping centers and 25

leading local retail sites.

The average appraisal yield rate was 5.71% at June 30,

2022, unchanged compared with the end of December 2021 and

consistent with the 5.74% recorded at June 30, 2021.

The EPRA net asset value indicators are as follows:

EPRA NRV

EPRA NTA

EPRA NDV

Jun 30, 2021

Dec 31, 2021

Jun 30, 2022

Jun 30, 2021

Dec 31, 2021

Jun 30, 2022

Jun 30, 2021

Dec 31, 2021

Jun 30, 2022

€/share

20.32

20.51

20.35

18.26

18.39

18.24

17.17

17.60

19.65

Change over 6 months

-0.8%

-0.8%

+11.6%

Change over 12 months

+0.2%

-0.1%

+14.4%

The EPRA Net Disposal Value (NDV) came to Euro 1,834.6

million at end-June 2022 vs. Euro 1,608.1 million at end-June 2021.

Per share, it represents Euro 19.65 13, with a significant increase

of +11.6% over six months and +14.4% over 12 months.

The Euro +2.04 per share change13 for the first half of this

year takes into account the following impacts:

- dividend payment: Euro -0.92;

- Funds from operations (FFO): Euro +0.62 14;

- Change in unrealized capital gains (i.e. difference between the

net book value of assets on the balance sheet and their appraisal

value excluding transfer taxes): Euro +0.44, including a yield

effect for Euro +0.03, a rent effect for Euro +0.50 and other

effects 15 for Euro -0.08;

- Change in fair value of fixed-rate debt: Euro +2.02;

- Change in fair value of derivatives and other items: Euro

-0.12.

Major refinancing operation carried out during the first

quarter of 2022, consolidating liquidity levels and helping

optimize the cost of debt

During the first quarter of 2022, Mercialys rolled out a

three-pronged refinancing operation. The Company carried out a bond

issue for a nominal total of Euro 500 million, with a 7-year

maturity and 2.5% coupon. Alongside this, Mercialys completed the

early redemption of Euro 100 million of the bond issue due to

mature in July 2027, with a 4.625% coupon and an initial nominal

total of Euro 300 million. The Company also fully exercised its

make-whole call option for the early redemption of its bond

maturing in March 2023 with a nominal total of Euro 469.5

million.

This operation enabled Mercialys to significantly extend the

average maturity of its bond debt from

3.6 years at end-2021 to 5.4 years at end-June 2022. The average

maturity of drawn debt was 4.7 years at end-June 2022, compared

with 3.2 years at end-December 2021.

This has significantly strengthened the Company’s liquidity, as

the next bond maturity will be due in February 2026. Between now

and this date, only various commercial paper programs are still to

be renewed or redeemed, for a combined total of Euro 182 million.

These short-term financing facilities are very largely covered by

the Euro 242.3 million of free cash flow at end-June 2022

and by the undrawn confirmed bank facilities in place for a

combined total of Euro 430 million.

Thanks to this refinancing in particular, the real average

cost of drawn debt16 for the first half of 2022 came to 1.7%,

which represents a significant improvement compared with the 2.0%

recorded for the full year in 2021.

In a context of high interest rate volatility, Mercialys has

maintained a high level of hedging for its debt, with a

hedged or fixed-rate debt position (including commercial paper) of

87% at end-June 2022, compared with 86% at end-December 2021 and

87% at end-June 2021.

Mercialys continues to benefit from a very healthy financial

structure, with an LTV ratio excluding transfer taxes 17 of

36.6% at June 30, 2022 (compared with 36.7% at December 31, 2021

and 38.3% at June 30, 2021) and an LTV ratio including transfer

taxes of 34.3% on the same date (versus 34.4% at December 31,

2021 and 36.0% at June 30, 2021).

The ICR was 6.1x 18 at June 30, 2022, compared with 5.1x

at December 31, 2021 and 5.6x at June 30, 2021, reflecting both the

operational performance and the optimization of the financing

structure.

On June 8, 2022, Standard & Poor’s confirmed its BBB /

stable outlook rating for Mercialys.

VI. 2022 outlook confirmed

Considering the satisfactory performance levels achieved over

the first half of the year, Mercialys is able to confirm its

full-year objectives for 2022, excluding the health situation’s

potential impacts on its operations:

- Growth in funds from operations (FFO) per share to reach at

least +2% vs. 2021;

- Dividend to range from 85% to 95% of 2022 FFO.

* * *

This press release is available on

www.mercialys.com. A presentation of these results is also

available online, in the following section: Investors / News and

Press Releases / Presentations and Investor Days

About Mercialys

Mercialys is one of France’s leading real estate companies. It

is specialized in the holding, management and transformation of

retail spaces, anticipating consumer trends, on its own behalf and

for third parties. At June 30, 2022, Mercialys had a real estate

portfolio valued at Euro 3.1 billion (including transfer taxes).

Its portfolio of 2,130 leases represents an annualized rental base

of Euro 168.8 million. Mercialys has been listed on the stock

market since October 12, 2005 (ticker: MERY) and has “SIIC” real

estate investment trust (REIT) tax status. Part of the SBF 120 and

Euronext Paris Compartment B, it had 93,886,501 shares outstanding

at June 30, 2022.

IMPORTANT INFORMATION

This press release contains certain forward-looking statements

regarding future events, trends, projects or targets. These

forward-looking statements are subject to identified and

unidentified risks and uncertainties that could cause actual

results to differ materially from the results anticipated in the

forward-looking statements. Please refer to Mercialys’ Universal

Registration Document available at www.mercialys.com for the year

ended December 31, 2021 for more details regarding certain factors,

risks and uncertainties that could affect Mercialys’ business.

Mercialys makes no undertaking in any form to publish updates or

adjustments to these forward-looking statements, nor to report new

information, new future events or any other circumstances that

might cause these statements to be revised.

APPENDIX TO THE PRESS RELEASE FINANCIAL

STATEMENTS

Consolidated income statement

(In thousands of euros)

Jun 30, 2021

Jun 30, 2022

Rental revenues

84,665

86,450

Service charges and property tax

(30,148)

(29,765)

Charges and taxes billed to tenants

25,929

25,389

Net property operating expenses

3,520

2,935

Net rental income

83,966

85,009

Management, administrative and other

activities income

1,292

1,208

Other income

221

424

Other expenses

(2,263)

(2,044)

Personnel expenses

(6,900)

(9,346)

Depreciation and amortization

(19,557)

(18,622)

Reversals of / (Allowances for)

provisions

(346)

(522)

Other operating income

790

74,212

Other operating expenses

(6,568)

(73,878)

Operating income

50,637

56,440

Income from cash and cash equivalents

162

19

Gross finance costs

(14,115)

(38,644)

(Expenses) / Income from net financial

debt

(13,953)

(38,625)

Other financial income

153

132

Other financial expenses

(1,619)

(1,628)

Net financial items

(15,419)

(40,121)

Tax expense

(423)

(339)

Share of net income from associates and

joint ventures

1,091

1,185

Consolidated net income

35,886

17,165

Attributable to non-controlling

interests

4,498

4,570

Attributable to owners of the

parent

31,388

12,595

Earnings per share 19

Net income attributable to owners

of the parent (in euros)

0.34

0.13

Diluted net income attributable

to owners of the parent (in euros)

0.34

0.13

Consolidated statement of financial position

ASSETS (in thousands of euros)

Dec 31, 2021

Jun 30, 2022

Intangible assets

5,028

4,214

Property, plant and equipment

6,922

4,189

Investment property

1,935,117

1,921,342

Right-of-use assets

8,590

10,032

Investments in associates

37,907

37,368

Other non-current assets

50,733

37,392

Deferred tax assets

1,346

1,013

Non-current assets

2,045,642

2,015,551

Trade receivables

36,865

29,944

Other current assets

34,595

38,265

Cash and cash equivalents

257,178

242,306

Investment properties held for sale

60,086

405

Current assets

388,724

310,919

Total assets

2,434,366

2,326,471

EQUITY AND LIABILITIES (in thousands of

euros)

Dec 31, 2021

Jun 30, 2022

Share capital

93,887

93,887

Additional paid-in capital, treasury

shares and other reserves

649,231

591,857

Equity attributable to owners of the

parent

743,118

685,743

Non-controlling interests

202,011

201,144

Shareholders’ equity

945,129

886,887

Non-current provisions

1,008

811

Non-current financial liabilities

1,237,101

1,142,871

Deposits and guarantees

23,003

23,608

Non-current lease liabilities

8,353

9,530

Other non-current liabilities

5,716

354

Non-current liabilities

1,275,181

1,177,174

Trade payables

16,477

20,130

Current financial liabilities

150,144

197,815

Current lease liabilities

1,030

1,444

Current provisions

11,443

11,195

Other current liabilities

34,826

31,747

Current tax liabilities

136

79

Current liabilities

214,056

262,410

Total equity and liabilities

2,434,366

2,326,471

1 Like-for-like change 2 Mercialys’ large centers and main

convenience shopping centers based on a constant surface area,

representing over 80% of the value of the Company’s shopping

centers. The Rennes and Agen centers were included in the basis for

analysis at June 30, 2022, replacing the Clermont-Ferrand center,

held by a company in which Mercialys has a 51% interest, and the

Chartres center, which is subject to a repositioning project. 3

Ratio between rent, charges (including marketing funds) and

invoiced work (including tax) paid by retailers and their sales

revenue (including tax), excluding large food stores. 4 The

occupancy rate, as with Mercialys’ vacancy rate, does not include

agreements relating to the Casual Leasing business. 5 Assets enter

the like-for-like scope used to calculate organic growth after

being held for 12 months 6 FFO: Funds from operations = Net income

attributable to owners of the parent before amortization, gains or

losses on disposals net of associated fees, any asset impairment

and other non-recurring effects 7 Calculated based on the average

undiluted number of shares (basic), i.e. 93,570,578 shares 8pact of

hedging ineffectiveness, banking default risk, prices,

non-recurring amortization and costs relating to bond redemptions,

proceeds and costs from unwinding swaps in connection with these

redemptions 9 French law of January 27, 2011 concerning the

balanced representation of women and men within boards of directors

and supervisory boards and workplace equality: compliance for

boards of directors with eight members or less. 10 Excluding the

impact of mixed-use projects, which could also generate margins. 11

Sites on a constant scope and a constant surface area basis 12

Added to these are three geographically dispersed assets with a

total appraisal value including transfer taxes of Euro 8.5 million.

13 Calculation based on the diluted number of shares at the end of

the period, in accordance with the EPRA methodology regarding the

NDV 14 Calculation based on the diluted number of shares at the end

of the period, as this concerns the impact of FFO on the change in

NDV per share 15 Including impact of revaluation of assets outside

of organic scope, equity associates, maintenance capex and capital

gains on asset disposals. 16 This rate does not include the net

expense linked to the non-recurring bond redemption premiums, costs

and amortization, as well as the proceeds and costs from unwinding

swaps in connection with these redemptions. 17 LTV (Loan To Value):

Net financial debt / (market value of the portfolio excluding

transfer taxes + market value of investments in associates for Euro

56.5 million at June 30, 2022 and Euro 55.9 million at June 30,

2021, since the value of the portfolio held by associates is not

included in the appraisal value) 18 ICR (Interest Coverage Ratio):

EBITDA / net finance costs 19 Based on the weighted average number

of shares over the period adjusted for treasury shares: - Undiluted

weighted average number of shares for the first half of 2022 =

93,570,578 shares - Fully diluted weighted average number of shares

for the first half of 2022 = 93,570,578 shares

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220726005970/en/

Analysts / investors / media contact: Luce-Marie de

Fontaines Tel: +33 (0)1 82 82 75 63 Email:

ldefontaines@mercialys.com

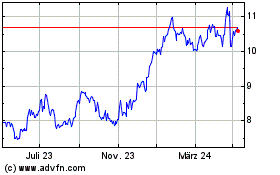

Mercialys (EU:MERY)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

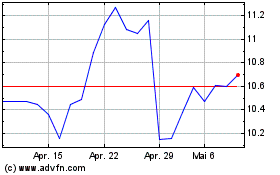

Mercialys (EU:MERY)

Historical Stock Chart

Von Apr 2023 bis Apr 2024