NET AND OPERATIONAL PROFITABILITY FROM CONTINUING

OPERATIONS POSITIVE OPERATING CASH FLOW FROM CONTINUING

OPERATIONS AT +0.8 MILLION EUROS HIGH LEVEL OF ACTIVITY OF

THE AVIONICS BUSINESS FINALISATION OF THE FABLITE PROGRAM

EXPECTED IN THE 4TH QUARTER OF 2022 Half-year revenue from

continuing operations at 4.6 million euros (5.7 million euros

including sales from discontinued operations) Half-year net

profit from continuing operations at 0.1 million euros

Half-year EBITDA from continuing operations at 0.7 million

euros

Regulatory News:

MEMSCAP (NYSE Euronext: MEMS), the leading provider of

innovative solutions based on MEMS (micro-electro-mechanical

systems) technology, today announced its earnings for the first

half of 2022 ending June 30, 2022.

Restructuring of the US operations / Revenue and consolidated

earnings for the first half of 2022

As previously announced, the MEMSCAP Group has initiated the

restructuring phase of its US operations as part of the progress of

the FABLITE program. This program is progressing according to the

management's plans and should be completed before the end of the

4th quarter of 2022.

In accordance with IFRS 5 “Non-current assets held for sale and

discontinued operations”, revenue from the US operations was

excluded from revenue from continuing operations and included in

the consolidated income statement via the loss after tax from

discontinued operations.

In accordance with the previous quarterly press releases,

consolidated revenue for the first half of 2022, excluding US

operations, amounted to 4.6 million euros (5.0 million US dollars)

compared to 4.2 million euros (5.1 million US dollars) for the

restated first half of 2021. Including sales from discontinued

operations, consolidated revenue amounted to 5.7 million euros (6.2

million US dollars) over the first half of 2022.

Consolidated revenue distribution by market segment, over the

first half of 2022, is as follows:

Market segments / Revenue

(M€)

For the 6 months ended 30 June

2022

%

For the 6 months ended 30 June

2021 (Restated)

%

Var. 1er sem. (M€)

2022 / 2021 (%)

Aerospace

3.5

77%

2.3

56%

+1.2

+49%

Medical

1.0

22%

1.8

43%

-0.8

-44%

Others

0.1

1%

0.1

1%

-0.0

-13%

Total revenue from continuing

operations

4.6

100%

4.2

100%

+0.4

+9%

Revenue from discontinued

operations – IFRS 5

(US operations)

1.2

--

1.2

--

-0.0

-3%

(Any apparent discrepancies in totals are due to rounding. In

accordance with IFRS 5, items related to the 2021 financial year

were restated in order to present comparative information for

discontinued operations.)

Sales from continuing operations for the first half of 2022

confirmed the strong recovery of the avionics business, up +1.2

million euros (+49%) compared to the first half of 2021. The

evolution of business volumes related to the medical business (-0.8

million euros) resulted from the annual delivery schedules marked

by particularly high delivery levels from one client in the first

half of 2021. The avionics business thus represented 77% of sales

from continuing operations for the first half of 2022 compared to

56% for the restated first half of 2021.

Sales of the US operations, classified as discontinued

operations, amounted to 1.2 million euros (1.3 million US dollars)

for the first half of 2022 compared to 1.2 million euros (1.4

million US dollars) for the first half of 2021.

* * *

MEMSCAP’s consolidated earnings for the first half of 2022 are

given within the following table:

In million euros

Q1 2021 (Restated)

Q2 2021 (Restated)

H1 2021 (Restated)

Q1 2022

Q2 2022

H1 2022

Revenue from continuing

operations

2.2

2.0

4.2

2.3

2.3

4.6

Cost of revenue

(1.1)

(1.2)

(2.4)

(1.4)

(1.4)

2.8

Gross margin

1.0

0.8

1.8

0.8

0.9

1.7

% of revenue

49%

39%

44%

37%

38%

38%

Operating expenses*

(0.8)

(0.7)

(1.5)

(0.8)

(0.9)

(1.7)

Operating profit /

(loss)

0.3

0.1

0.3

0.0

(0.0)

0.0

Financial profit / (loss)

(0.0)

(0.0)

(0.0)

(0.1)

0.2

0.1

Income tax expense

(0.0)

(0.0)

(0.0)

0.0

(0.0)

(0.0)

Net profit / (loss) from

continuing operations

0.3

0.0

0.3

(0.0)

0.1

0.1

Profit / (loss) after tax from

discontinued operations

(0.4)

(0.1)

(0.5)

(0.4)

(0.3)

(0.7)

Net profit / (loss)

(0.1)

(0.1)

(0.2)

(0.4)

(0.1)

(0.6)

(Any apparent discrepancies in totals are due to rounding. In

accordance with IFRS 5, items related to the 2021 financial year

were restated in order to present comparative information for

discontinued operations.) * Net of research & development

grants.

(Financial data were subject to a limited review by the Group’s

statutory auditors. On August 31, 2022, MEMSCAP’s board of

directors authorized the release of the interim condensed

consolidated financial statements on June 30, 2022.)

The evolution of the sales mix led to a consolidated gross

margin of 1.7 million euros for the first half of 2022, 38% of

consolidated sales, compared to 1.8 million euros for the restated

first half of 2021, representing 44% of consolidated sales.

The amount of operating expenses at 1.7 million euros for the

first half of 2022 was up compared to the restated first half of

2021 (+0.2 million euros). This evolution resulted from an

increasing R&D activity for the period.

The Group therefore reported consolidated operating earnings

from continuing operations at the breakeven point for the first

half of 2022 compared to an operating profit of 0.3 million euros

for the restated first half of 2021. It should be noted that the

net foreign exchange gain related to operating activities, recorded

in financial income, amounted to 0.2 million euros over this

half-year period. The Group thus posted a half-year net profit from

continuing operations of 0.1 million euros compared to a net profit

from continuing operations of 0.3 million euros for the restated

first half of 2021.

The net loss from discontinued operations related to the Group's

US operations amounted to 0.7 million euros for the first half of

2022 compared to 0.5 million euros for the restated first half of

2021. It is recalled that the Group's US subsidiary benefited in

the first half of 2021 from a PPP (Paycheck protection program)

state subsidy of 0.2 million euros.

Considering the net loss from discontinued operations related to

the Group's US operations, the net consolidated loss amounted to

0.6 million euros for the first half of 2022 compared to a net loss

of 0.2 million euros for the restated first half of 2021.

* * *

Evolution of the Group’s cash / Consolidated shareholders’

equity

For the first half of 2022, the Group posted a positive EBITDA

from continuing operations of 0.7 million euros compared to 0.9

million euros for the restated first half of 2021. Operating cash

flows from continuing operations amounted to +0.8 million euros for

the first half of 2022 compared to +1.2 million euros for the

restated first half of 2021.

In addition, net cash used by operating activities from

discontinued operations (the Group’s US operations) amounted to 0.6

million euros for the first half of 2022 compared to 0.3 million

euros for the restated first half of 2021.

Taking into account cash flows used by investing activities (0.1

million euros) and cash flows used by financing activities (0.4

million euros), the Group's net cash was down 0.3 million euros for

the first half of 2022 compared to an increase of 0.4 million euros

for the restated first half of 2021.

As of June 30, 2022, the Group reported available liquidities at

4.4 million euros (5.3 million euros as of December 31, 2021)

including investment securities recorded under non-current

financial assets for an amount of 1.0 million euros. In addition to

this amount, the Group had unused available credit lines for an

amount of 0.4 million euros on the same date.

Current financial debt, including lease liabilities under IFRS

16, was 0.7 million euros as of June 30, 2022 compared to 1.0

million euros as of December 31, 2021. MEMSCAP shareholders’ equity

totalled 14.8 million euros as of June 30, 2022 compared to 15.8

million euros as of December 31, 2021.

* * *

Analysis and perspectives

As previously mentioned, the Norwegian entity, including the

avionics and medical businesses of the Group, will become the

operational core of the MEMSCAP Group at the end of the

restructuring phase of the US operations. These activities over the

first half of 2022 posted historically high levels of sales thanks

to the renewed momentum of the avionics business.

The ongoing FABLITE program should lead to a significant

improvement in the Group's operating profitability.

* * *

Q3 2022 Earnings: October 20, 2022

About MEMSCAP MEMSCAP is the leading provider of

innovative micro-electro-mechanical systems (MEMS)-based solutions.

MEMSCAP’s products and solutions include components, component

designs (IP), manufacturing and related services.

MEMSCAP is listed on Euronext Paris ™ - Segment C - ISIN:

FR0010298620 - MEMS.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

Interim condensed consolidated financial statements at 30

June 2022

30 June 2022

31 December 2021

€000

€000

Assets

Non-current assets

Property, plant and

equipment.....................................................................................

953

1 662

Goodwill and intangible

assets......................................................................................

7 128

7 238

Right-of-use

assets........................................................................................................

5 131

5 224

Other non-current financial

assets................................................................................

1 041

1 385

Employee benefit net

asset...........................................................................................

34

35

Deferred tax

asset........................................................................................................

190

229

14 477

15 773

Current assets

Inventories...................................................................................................................

1 972

2 493

Trade and other

receivables..........................................................................................

2 286

2 824

Prepayments................................................................................................................

253

426

Cash and short-term

deposits.......................................................................................

3 343

3 919

7 854

9 662

Assets held for

sale.......................................................................................................

1 743

--

9 597

9 662

Total assets

24 074

25 435

Equity and liabilities

Equity

Issued

capital................................................................................................................

1 869

1 869

Share

premium.............................................................................................................

17 972

17 972

Treasury

shares............................................................................................................

(150)

(144)

Retained

earnings.........................................................................................................

(1 842)

(1 130)

Foreign currency

translation.........................................................................................

(3 052)

(2 779)

14 797

15 788

Non-current liabilities

Lease

liabilities.............................................................................................................

4 838

4 989

Interest-bearing loans and

borrowings..........................................................................

178

229

Employee benefit

liability..............................................................................................

69

67

5 085

5 285

Current liabilities

Trade and other

payables.............................................................................................

1 494

3 375

Lease

liabilities.............................................................................................................

582

577

Interest-bearing loans and

borrowings..........................................................................

100

390

Provisions.....................................................................................................................

19

20

2 195

4 362

Liabilities directly associated with the

assets held for

sale..............................................

1 997

--

4 192

4 362

Total liabilities

9 277

9 647

Total equity and liabilities

24 074

25 435

CONSOLIDATED STATEMENT OF INCOME

Interim condensed consolidated financial statements at 30

June 2022

For the six months ended 30

June

2022

(Restated)

2021

(Published)

2021

Continuing operations

€000

€000

€000

Sales of goods and

services.................................................................................

4 555

4 191

5 382

Revenue............................................................................................................

4 555

4 191

5 382

Cost of

sales.......................................................................................................

(2 841)

(2 351)

(3 811)

Gross

profit.......................................................................................................

1 714

1 840

1 571

Other

income.....................................................................................................

204

174

174

Research and development

expenses.................................................................

(945)

(725)

(755)

Selling and distribution

costs..............................................................................

(306)

(299)

(312)

Administrative

expenses.....................................................................................

(638)

(646)

(816)

Operating profit /

(loss).....................................................................................

29

344

(138)

Finance

costs.....................................................................................................

(87)

(75)

(75)

Finance

income..................................................................................................

182

50

50

Profit / (loss) for the period from

continuing operations before tax..................

124

319

(163)

Income tax

expense...........................................................................................

(38)

(47)

(47)

Profit / (loss) for the period from

continuing operations...................................

86

272

(210)

Discontinued operations

Profit/(loss) after tax for the period

from discontinued operations......................

(657)

(482)

--

Profit / (loss) for the

period...............................................................................

(571)

(210)

(210)

Earnings per share:

- Basic, for profit / (loss) for the

period attributable to ordinary equity holders of the parent (in

euros)................................................................................

€ (0,077)

€ (0,028)

€ (0,028)

- Diluted, for profit / (loss) for the

period attributable to ordinary equity holders of the parent (in

euros)....................................................................

€ (0,077)

€ (0,028)

€ (0,028)

- Basic, profit / (loss) for the period

from continuing operations attributable to ordinary equity holders

of the parent (in euros)....................................

€ 0,012

€ 0,037

€ (0,028)

- Diluted, profit / (loss) for the period

from continuing operations attributable to ordinary equity holders

of the parent (in euros)................................

€ 0,012

€ 0,037

€ (0,028)

In accordance with IFRS 5, items related to the 2021 financial

year were restated in order to present comparative information for

discontinued operations.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Interim condensed consolidated financial statements at 30

June 2022

For the six months ended 30

June

2022

2021

€000

€000

Profit / (loss) for the

period........................................................................................

(571)

(210)

Items that will not be reclassified

subsequently to profit or loss

Remeasurement gain/(loss) on defined

benefit plans..................................................

--

--

Income tax on items that will not be

reclassified to profit or loss.................................

--

--

Total items that will not be

reclassified to profit or

loss.............................................

--

--

Items that may be reclassified

subsequently to profit or loss

Net gain / (loss) on other non-current

financial

assets.................................................

(141)

114

Exchange differences on translation of

foreign operations...........................................

(273)

229

Income tax on items that may be

reclassified to profit or

loss......................................

--

--

Total items that may be reclassified to

profit or

loss..................................................

(414)

343

Other comprehensive income for the

period, net of

tax.............................................

(414)

343

Total comprehensive income for the

period, net of

tax..............................................

(985)

133

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Interim condensed consolidated financial statements at 30

June 2022

Number

Issued

Share

Treasury

Retained

Foreign

Total

(In thousands of euros, except for

number of shares)

of shares

capital

premium

shares

earnings

currency translation

shareholders’ equity

€000

€000

€000

€000

€000

€000

At 1 January

2021..........................................................................

7 476 902

1 869

18 783

(133)

(1 752)

(3 178)

15 589

Loss for the

period.........................................................................

--

--

--

--

(210)

--

(210)

Other comprehensive income for the period,

net of tax..................

--

--

--

--

114

229

343

Total comprehensive

income.........................................................

--

--

--

--

(96)

229

133

Retained earnings offset with share

premium................................

--

--

(811)

--

811

--

--

Treasury

shares.............................................................................

--

--

--

--

--

--

--

At 30 June

2021.............................................................................

7 476 902

1 869

17 972

(133)

(1 037)

(2 949)

15 722

At 1 January

2022..........................................................................

7 476 902

1 869

17 972

(144)

(1 130)

(2 779)

15 788

Loss for the

period.........................................................................

--

--

--

--

(571)

--

(571)

Other comprehensive income for the period,

net of tax..................

--

--

--

--

(141)

(273)

(414)

Total comprehensive

income.........................................................

--

--

--

--

(712)

(273)

(985)

Treasury

shares.............................................................................

--

--

--

(6)

--

--

(6)

At 30 June

2022.............................................................................

7 476 902

1 869

17 972

(150)

(1 842)

(3 052)

14 797

CONSOLIDATED CASH FLOW STATEMENT

Interim condensed consolidated financial statements at 30

June 2022

For the six months ended 30

June

2022

(Restated)

2021

(Published)

2021

€000

€000

€000

Operating activities:

Net profit / (loss) for the

period..............................................................................

(571)

(210)

(210)

Profit/(loss) after tax for the period

from discontinued operations..........................

(657)

(482)

--

Profit / (loss) for the period from

continuing operations..........................................

86

272

(210)

Non-cash items written back:

Amortization and

depreciation..........................................................................

499

476

591

Loss / (capital gain) on disposal of fixed

assets...................................................

35

31

31

Other non-financial

activities............................................................................

52

88

88

Accounts

receivable................................................................................................

212

403

212

Inventories.............................................................................................................

(202)

73

146

Other

debtors.........................................................................................................

(52)

(126)

(127)

Accounts

payable....................................................................................................

149

5

229

Other

liabilities.......................................................................................................

20

27

27

Net cash flows from operating

activities - continuing

operations...........................

799

1 249

987

Net cash flows used in operating

activities - discontinued operations......................

(614)

(262)

--

Total net cash flows from operating

activities........................................................

185

987

987

Investing activities:

Purchase of fixed

assets..........................................................................................

(223)

(15)

(56)

Proceeds from sale / (purchase) of other

non-current financial assets......................

155

(111)

(111)

Net cash flows used in investing

activities - continuing operations.........................

(68)

(126)

(167)

Net cash flows used in investing

activities - discontinued operations........................

(7)

(41)

--

Total net cash flows used in investing

activities.....................................................

(75)

(167)

(167)

Financing activities:

Repayment of

borrowings.......................................................................................

(70)

(104)

(104)

Payment of principal portion of lease

liabilities........................................................

(298)

(303)

(303)

Sale / (purchase) of treasury

shares........................................................................

(6)

--

--

Net cash flows used in financing

activities - continuing operations.........................

(374)

(407)

(407)

Net cash flows used in financing

activities - discontinued operations.......................

--

--

--

Total net cash flows used in financing

activities.....................................................

(374)

(407)

(407)

Net foreign exchange

difference.............................................................................

(41)

12

12

Increase / (decrease) in net cash and

cash equivalents...........................................

(305)

425

425

Opening cash and cash equivalents

balance...........................................................

3 648

2 928

2 928

Closing cash and cash equivalents

balance.............................................................

3 343

3 353

3 353

In accordance with IFRS 5, items related to the 2021 financial

year were restated in order to present comparative information for

discontinued operations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220831005643/en/

Yann Cousinet Chief Financial Officer Ph.: +33 (0) 4 76 92 85 00

yann.cousinet@memscap.com

For more information, visit our website at:

www.memscap.com.

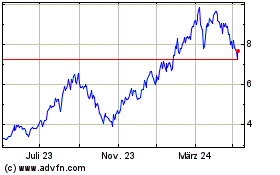

Memscap (EU:MEMS)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Memscap (EU:MEMS)

Historical Stock Chart

Von Apr 2023 bis Apr 2024