Semi-Annual Statement of Liquidity Agreement

12 Juli 2022 - 5:53PM

Semi-Annual Statement of Liquidity Agreement

REGULATED RELEASE

SEMI-ANNUAL STATEMENTOF LIQUIDITY AGREEMENT

Paris – July 12, 2022

In accordance with the provisions of the French

Financial Markets Authority’s decision no. 2018-01 of

July 2, 2018 establishing liquidity contracts as an

accepted market practice, Klépierre informs the public of the

implementation of the liquidity contract for the first half of

2022:

- Available resources on June 30,

2022: 30,000 Klépierre shares and

10,151,342.79 euros;

- Number of transactions on buy side

over the first half of 2022: 5,727;

- Number of transactions on sell side

the first half of 2022: 6,838;

- Traded volume on buy side over the

first half of 2022: 1,549,656 shares for

34,462,443.42 euros;

- Traded volume on sell side over the

first half of 2022: 1,519,656 shares for 33,950,786.62 euros.

As a reminder,

- At December 31, 2021,

available resources were 0 Klépierre share and

10,663,000.00 euros.

- At the date of signature of the

liquidity contract with Rothschild Martin Maurel,

February 1, 2019, the available resources were

307,923 Klépierre shares and 1,768,835.76 euros.

TRANSACTIONS DETAILS

|

Date |

Buy sideNumber of transactions |

Sell sideNumber of transactions |

Buy sideNumber of shares |

Sell sideNumber of shares |

Buy sideTraded volume in EUR |

Sell sideTraded volume in EUR |

|

3-Jan-22 |

6 |

11 |

1,800 |

1,500 |

37,692.00 |

31,575.00 |

|

4-Jan-22 |

9 |

14 |

3,500 |

3,300 |

75,740.00 |

71,544.00 |

|

5-Jan-22 |

16 |

20 |

4,500 |

4,500 |

99,225.00 |

99,405.00 |

|

6-Jan-22 |

36 |

80 |

13,500 |

13,500 |

295,785.00 |

296,325.00 |

|

7-Jan-22 |

12 |

15 |

3,500 |

3,700 |

76,895.00 |

81,511.00 |

|

10-Jan-22 |

22 |

27 |

6,000 |

6,000 |

135,780.00 |

136,080.00 |

|

11-Jan-22 |

25 |

32 |

7,500 |

7,500 |

171,825.00 |

172,125.00 |

|

12-Jan-22 |

37 |

4 |

15,450 |

2,000 |

349,324.50 |

45,060.00 |

|

13-Jan-22 |

19 |

23 |

3,250 |

4,500 |

72,475.00 |

100,620.00 |

|

14-Jan-22 |

20 |

60 |

7,500 |

15,000 |

168,450.00 |

337,650.00 |

|

17-Jan-22 |

26 |

48 |

5,250 |

8,250 |

118,387.50 |

186,367.50 |

|

18-Jan-22 |

13 |

39 |

3,100 |

4,800 |

69,843.00 |

108,432.00 |

|

19-Jan-22 |

16 |

27 |

5,000 |

5,000 |

116,250.00 |

116,650.00 |

|

20-Jan-22 |

44 |

50 |

12,000 |

12,000 |

282,000.00 |

283,320.00 |

|

21-Jan-22 |

21 |

18 |

6,000 |

6,000 |

141,240.00 |

141,600.00 |

|

24-Jan-22 |

73 |

32 |

18,450 |

8,000 |

429,516.00 |

187,600.00 |

|

25-Jan-22 |

142 |

228 |

15,750 |

24,000 |

368,865.00 |

563,040.00 |

|

26-Jan-22 |

52 |

78 |

15,000 |

17,200 |

360,750.00 |

413,660.00 |

|

27-Jan-22 |

31 |

23 |

4,726 |

4,026 |

113,140.44 |

96,704.52 |

|

28-Jan-22 |

71 |

95 |

20,000 |

20,700 |

465,200.00 |

483,552.00 |

|

31-Jan-22 |

56 |

62 |

12,950 |

12,950 |

299,922.00 |

301,864.50 |

|

January 2022 |

747 |

986 |

184,726 |

184,426 |

4,248,305.44 |

4,254,685.52 |

|

1-Feb-22 |

41 |

36 |

10,500 |

10,500 |

245,910.00 |

246,645.00 |

|

2-Feb-22 |

49 |

35 |

12,200 |

7,500 |

286,334.00 |

176,250.00 |

|

3-Feb-22 |

55 |

2 |

17,500 |

10,000 |

397,250.00 |

228,100.00 |

|

4-Feb-22 |

78 |

55 |

11,171 |

9,671 |

251,570.92 |

218,758.02 |

|

7-Feb-22 |

20 |

14 |

2,484 |

1,984 |

55,666.44 |

44,580.48 |

|

8-Feb-22 |

14 |

11 |

3,750 |

4,250 |

84,787.50 |

96,177.50 |

|

9-Feb-22 |

21 |

74 |

6,000 |

19,700 |

139,440.00 |

457,237.00 |

|

10-Feb-22 |

53 |

59 |

13,500 |

13,500 |

326,025.00 |

326,430.00 |

|

11-Feb-22 |

55 |

25 |

14,700 |

5,000 |

352,359.00 |

120,450.00 |

|

14-Feb-22 |

7 |

1 |

5,000 |

2,500 |

117,400.00 |

59,150.00 |

|

15-Feb-22 |

24 |

88 |

6,000 |

18,200 |

142,920.00 |

434,980.00 |

|

16-Feb-22 |

57 |

60 |

13,287 |

13,287 |

329,251.86 |

330,049.08 |

|

17-Feb-22 |

16 |

24 |

4,500 |

4,500 |

116,325.00 |

116,460.00 |

|

18-Feb-22 |

29 |

37 |

9,650 |

9,650 |

256,593.50 |

256,497.00 |

|

21-Feb-22 |

62 |

4 |

11,678 |

978 |

303,861.56 |

25,858.32 |

|

22-Feb-22 |

5 |

28 |

2,000 |

4,000 |

51,280.00 |

104,000.00 |

|

23-Feb-22 |

47 |

80 |

11,254 |

17,254 |

293,504.32 |

450,329.40 |

|

24-Feb-22 |

56 |

47 |

7,488 |

6,488 |

188,023.68 |

163,757.12 |

|

25-Feb-22 |

19 |

43 |

5,250 |

8,950 |

133,035.00 |

228,135.50 |

|

28-Feb-22 |

59 |

97 |

25,700 |

25,700 |

650,724.00 |

653,037.00 |

|

February 2022 |

767 |

820 |

193,612 |

193,612 |

4,722,261.78 |

4,736,881.42 |

|

1-Mar-22 |

25 |

26 |

8,500 |

8,500 |

217,260.00 |

213,690.00 |

|

2-Mar-22 |

10 |

10 |

1,750 |

1,750 |

43,260.00 |

42,542.50 |

|

4-Mar-22 |

26 |

2 |

6,200 |

1,500 |

140,492.00 |

32,955.00 |

|

7-Mar-22 |

7 |

0 |

2,500 |

0 |

50,975.00 |

0 |

|

8-Mar-22 |

45 |

39 |

7,750 |

6,250 |

165,307.50 |

134,187.50 |

|

9-Mar-22 |

128 |

180 |

39,000 |

47,700 |

868,530.00 |

1,062,279.00 |

|

10-Mar-22 |

58 |

72 |

17,000 |

17,000 |

383,520.00 |

384,030.00 |

|

11-Mar-22 |

18 |

13 |

4,500 |

4,500 |

100,755.00 |

101,025.00 |

|

14-Mar-22 |

36 |

55 |

9,500 |

9,500 |

218,500.00 |

219,355.00 |

|

15-Mar-22 |

30 |

31 |

10,000 |

10,000 |

229,300.00 |

230,100.00 |

|

16-Mar-22 |

77 |

78 |

20,250 |

20,250 |

489,240.00 |

490,050.00 |

|

17-Mar-22 |

30 |

2 |

10,450 |

750 |

244,948.00 |

17,940.00 |

|

18-Mar-22 |

7 |

0 |

5,000 |

0 |

114,150.00 |

0 |

|

21-Mar-22 |

44 |

0 |

6,000 |

0 |

136,500.00 |

0 |

|

22-Mar-22 |

52 |

152 |

13,250 |

33,950 |

309,387.50 |

791,714.00 |

|

23-Mar-22 |

58 |

19 |

14,500 |

4,800 |

337,995.00 |

112,176.00 |

|

24-Mar-22 |

38 |

7 |

9,000 |

2,000 |

204,660.00 |

45,600.00 |

|

25-Mar-22 |

38 |

126 |

8,750 |

25,450 |

202,125.00 |

589,167.50 |

|

28-Mar-22 |

53 |

27 |

15,500 |

6,800 |

366,110.00 |

160,548.00 |

|

29-Mar-22 |

36 |

108 |

10,250 |

18,950 |

244,667.50 |

453,094.50 |

|

30-Mar-22 |

78 |

126 |

20,500 |

20,500 |

508,605.00 |

510,245.00 |

|

31-Mar-22 |

41 |

5 |

11,700 |

2,000 |

287,235.00 |

49,400.00 |

|

March 2022 |

935 |

1,078 |

251,850 |

242,150 |

5,863,522.50 |

5,640,099.00 |

|

1-Apr-22 |

38 |

25 |

5,000 |

7,500 |

120,050.00 |

180,825.00 |

|

4-Apr-22 |

51 |

0 |

10,000 |

0 |

234,500.00 |

0 |

|

5-Apr-22 |

36 |

3 |

8,250 |

750 |

191,400.00 |

17,572.50 |

|

6-Apr-22 |

7 |

0 |

2,500 |

0 |

55,550.00 |

0 |

|

7-Apr-22 |

8 |

0 |

1,250 |

0 |

27,350.00 |

0 |

|

8-Apr-22 |

29 |

50 |

7,156 |

13,406 |

159,364.12 |

300,428.46 |

|

11-Apr-22 |

48 |

164 |

13,500 |

33,500 |

313,875.00 |

781,890.00 |

|

12-Apr-22 |

17 |

0 |

3,500 |

0 |

80,045.00 |

0 |

|

13-Apr-22 |

24 |

58 |

6,750 |

10,250 |

154,777.50 |

236,570.00 |

|

14-Apr-22 |

55 |

66 |

14,650 |

12,150 |

340,319.50 |

283,216.50 |

|

19-Apr-22 |

66 |

66 |

25,000 |

12,600 |

582,750.00 |

294,966.00 |

|

20-Apr-22 |

41 |

113 |

9,850 |

22,250 |

229,209.50 |

519,315.00 |

|

21-Apr-22 |

56 |

55 |

13,500 |

13,500 |

319,680.00 |

320,085.00 |

|

22-Apr-22 |

45 |

0 |

12,500 |

0 |

289,875.00 |

0 |

|

25-Apr-22 |

53 |

44 |

14,250 |

9,500 |

327,180.00 |

218,690.00 |

|

26-Apr-22 |

57 |

152 |

11,500 |

31,250 |

270,710.00 |

735,312.50 |

|

27-Apr-22 |

51 |

59 |

8,750 |

10,950 |

205,362.50 |

257,215.50 |

|

28-Apr-22 |

54 |

52 |

19,700 |

17,000 |

468,663.00 |

402,050.00 |

|

29-Apr-22 |

55 |

88 |

21,500 |

16,000 |

494,285.00 |

369,440.00 |

|

April 2022 |

791 |

995 |

209,106 |

210,606 |

4,864,946.12 |

4,917,576.46 |

|

2-May-22 |

34 |

41 |

10,348 |

8,848 |

232,209.12 |

201,911.36 |

|

3-May-22 |

14 |

38 |

4,000 |

13,500 |

90,720.00 |

307,800.00 |

|

4-May-22 |

34 |

20 |

10,000 |

5,500 |

230,000.00 |

126,995.00 |

|

5-May-22 |

9 |

20 |

2,500 |

7,000 |

57,950.00 |

162,540.00 |

|

6-May-22 |

35 |

0 |

9,000 |

0 |

200,070.00 |

0 |

|

9-May-22 |

21 |

26 |

7,500 |

7,000 |

162,975.00 |

152,600.00 |

|

10-May-22 |

20 |

52 |

6,500 |

11,500 |

141,310.00 |

251,160.00 |

|

11-May-22 |

39 |

66 |

8,821 |

13,821 |

196,531.88 |

308,070.09 |

|

12-May-22 |

71 |

126 |

28,750 |

28,450 |

584,775.00 |

579,811.00 |

|

13-May-22 |

62 |

85 |

19,700 |

20,000 |

418,625.00 |

426,400.00 |

|

16-May-22 |

29 |

31 |

6,300 |

6,000 |

136,899.00 |

130,680.00 |

|

17-May-22 |

43 |

57 |

13,050 |

13,000 |

291,928.50 |

291,590.00 |

|

18-May-22 |

38 |

28 |

8,750 |

8,800 |

201,337.50 |

202,488.00 |

|

19-May-22 |

85 |

1 |

17,800 |

100 |

380,564.00 |

2,152.00 |

|

20-May-22 |

38 |

180 |

15,750 |

33,450 |

336,892.50 |

716,833.50 |

|

23-May-22 |

43 |

49 |

11,200 |

11,000 |

241,584.00 |

238,040.00 |

|

24-May-22 |

55 |

56 |

14,000 |

12,500 |

306,320.00 |

273,625.00 |

|

25-May-22 |

63 |

103 |

25,500 |

27,200 |

557,175.00 |

594,864.00 |

|

26-May-22 |

79 |

156 |

32,200 |

32,100 |

713,552.00 |

712,620.00 |

|

27-May-22 |

70 |

77 |

22,850 |

20,750 |

494,017.00 |

448,615.00 |

|

30-May-22 |

75 |

59 |

17,500 |

15,000 |

382,725.00 |

328,050.00 |

|

31-May-22 |

21 |

23 |

6,500 |

5,500 |

137,150.00 |

116,160.00 |

|

May 2022 |

978 |

1,294 |

298,519 |

301,019 |

6,495,310.50 |

6,573,004.95 |

|

1-Jun-22 |

76 |

158 |

30,000 |

35,000 |

642,300.00 |

749,700.00 |

|

2-Jun-22 |

61 |

0 |

19,000 |

0 |

397,860.00 |

0 |

|

3-Jun-22 |

34 |

169 |

11,295 |

30,995 |

235,613.70 |

650,585.05 |

|

6-Jun-22 |

13 |

14 |

3,025 |

3,000 |

64,069.50 |

63,720.00 |

|

7-Jun-22 |

33 |

48 |

9,425 |

9,450 |

200,281.25 |

201,379.50 |

|

8-Jun-22 |

31 |

35 |

8,217 |

8,267 |

175,515.12 |

176,996.47 |

|

9-Jun-22 |

81 |

35 |

19,250 |

9,500 |

408,485.00 |

203,015.00 |

|

10-Jun-22 |

72 |

49 |

14,250 |

12,500 |

289,417.50 |

254,250.00 |

|

13-Jun-22 |

106 |

66 |

22,750 |

12,000 |

440,667.50 |

232,560.00 |

|

14-Jun-22 |

149 |

102 |

43,000 |

33,500 |

816,140.00 |

637,170.00 |

|

15-Jun-22 |

101 |

152 |

27,000 |

44,000 |

521,370.00 |

853,600.00 |

|

16-Jun-22 |

83 |

68 |

24,500 |

25,000 |

473,585.00 |

484,250.00 |

|

17-Jun-22 |

127 |

143 |

32,250 |

36,750 |

632,745.00 |

722,137.50 |

|

20-Jun-22 |

55 |

89 |

13,750 |

21,750 |

273,487.50 |

435,000.00 |

|

21-Jun-22 |

81 |

63 |

21,180 |

18,180 |

439,061.40 |

377,598.60 |

|

22-Jun-22 |

58 |

76 |

12,250 |

15,250 |

250,022.50 |

313,540.00 |

|

23-Jun-22 |

56 |

44 |

28,000 |

5,000 |

568,120.00 |

101,800.00 |

|

24-Jun-22 |

19 |

140 |

5,000 |

27,500 |

101,750.00 |

565,675.00 |

|

27-Jun-22 |

51 |

100 |

14,000 |

15,500 |

288,400.00 |

320,540.00 |

|

28-Jun-22 |

55 |

44 |

14,450 |

10,450 |

302,005.00 |

219,241.00 |

|

29-Jun-22 |

42 |

0 |

15,500 |

0 |

305,195.00 |

0 |

|

30-Jun-22 |

125 |

70 |

23,751 |

14,251 |

442,006.11 |

265,781.15 |

|

June 2022 |

1,509 |

1,665 |

411,843 |

387,843 |

8,268,097.08 |

7,828,539.27 |

|

FIRST HALF 2022 |

5,727 |

6,838 |

1,549,656 |

1,519,656 |

34,462,443.42 |

33,950,786.62 |

| INVESTOR

RELATIONS CONTACTS |

|

|

Arnaud Courtial, Group Head of IR and Financial

Communication+33 (0)6 74 57 35 12 —

arnaud.courtial@klepierre.comPaul Logerot, IR

Manager+33 (0)7 50 66 05 63 —

paul.logerot@klepierre.comJulia Croissant, IR

Officer+33 (0)7 88 77 40 37 — julia.croissant@klepierre.com |

|

ABOUT KLÉPIERRE

Klépierre is the European leader in shopping

malls, combining property development and asset management skills.

The Company’s portfolio is valued at €20.7 billion at

December 31, 2021, and comprises large shopping centers in more

than 10 countries in Continental Europe which together host

hundreds of millions of visitors per year. Klépierre holds a

controlling stake in Steen & Strøm (56.1%), Scandinavia’s

number one shopping center owner and manager. Klépierre is a French

REIT (SIIC) listed on Euronext Paris and is included in the CAC

Next 20 and EPRA Euro Zone Indexes. It is also included in ethical

indexes, such as Euronext CAC 40 ESG, MSCI Europe ESG Leaders,

FTSE4Good, Euronext Vigeo Europe 120, and features in CDP’s

“A-list”. These distinctions underscore the Group’s commitment to a

proactive sustainable development policy and its global leadership

in the fight against climate change. For more information, please

visit the newsroom on our website: www.klepierre.com

- PR_KLEPIERRE_LIQUIDITYCONTRACT_JUL 2022_ENG

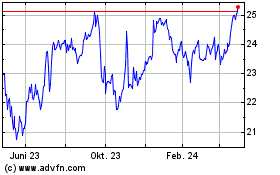

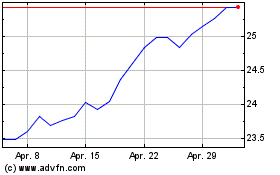

Klepierre (EU:LI)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Klepierre (EU:LI)

Historical Stock Chart

Von Apr 2023 bis Apr 2024