Kering: Very solid revenue growth in the third quarter of 2022

|

PRESS RELEASE |

|

October 20, 2022 |

VERY SOLID REVENUE GROWTH

IN THE THIRD QUARTER OF 2022

Group revenue: €5,137

millionUp 23% as reported and up 14% on a

comparable basis

Download the Press Release in PDF format

“Kering’s solid performances in the third

quarter underscore the strength of the Group and the pertinence of

our strategy. We delivered sharp top-line growth, both versus last

year and from pre-pandemic levels. Our ongoing focus on the

exclusivity of our brands and on the quality of their distribution

are yielding very positive results and reinforce their positioning

in their key markets. In an increasingly complex environment, we

maintain the required flexibility to support our profitability and

sustain our investments in the long-term outlook of all our Houses,

Gucci first and foremost. We are as confident as ever in the

potential and prospects of the Group.”François-Henri

Pinault, Chairman and Chief Executive Officer

- Group revenue in

the third quarter of 2022 was up 23% as reported and up 14% on a

comparable basis compared to the third quarter of 2021.Versus the

third quarter of 2019, comparable revenue was up 28%.

- Revenue in the

directly operated store network continued to grow at a rapid pace,

up 19% on a comparable basis. All regions posted growth. Western

Europe (+74%) and Japan (+31%) achieved particularly outstanding

performances. In North America (+1%), steady activity reflects the

high comparison base together with the hefty contribution from

American tourists to European sales momentum. Growth in

Asia-Pacific (+7%) was robust, despite the impact of Covid

restrictions in Mainland China.

|

Revenue (in € millions) |

|

Q3 2022 |

Q3 2021 |

Reported change |

Comparable change(1) |

|

|

|

|

|

|

|

|

Gucci |

|

2,581 |

2,182 |

+18% |

+9% |

|

Yves Saint Laurent |

|

916 |

652 |

+40% |

+30% |

|

Bottega Veneta |

|

437 |

363 |

+20% |

+14% |

|

Other Houses |

|

995 |

849 |

+17% |

+13% |

|

Kering Eyewear and Corporate |

|

253 |

173 |

+47% |

+21% |

|

|

|

|

|

|

|

|

Eliminations |

|

(45) |

(31) |

- |

- |

|

|

|

|

|

|

|

|

KERING |

|

5,137 |

4,188 |

+23% |

+14% |

| (1) On a

comparable scope and exchange rate basis. |

|

Gucci: continuing healthy

growth

In the third quarter, Gucci’s revenue totaled

€2,581 million, up 18% as reported and 9% on a comparable

basis.Sales generated in directly operated stores grew 9% on a

comparable basis. Momentum remained very strong in Western Europe,

supported by both local customers and tourists, particularly from

the US. Conversely, this factor weighed activity in North America

itself. In Japan, revenue rose sharply. Performance in Mainland

China was mixed, impacting sales in Asia-Pacific, where overall

trends posted a notable improvement. Wholesale revenue rose 2%. The

rationalization of this channel is now complete.

Yves Saint Laurent: another

stellar quarter

Yves Saint Laurent achieved an outstanding third

quarter with revenue of €916 million, up 40% as reported and

up 30% on a comparable basis.Sales in directly operated stores rose

sharply, up 38% on a comparable basis, driven by all product

categories. Revenue in Western Europe more than doubled relative to

the third quarter of 2021 due to the resumption of tourism and the

House’s desirability with local customers. All other geographical

zones saw strong growth.Wholesale revenue rose 13% on a comparable

basis.

Bottega Veneta: very healthy growth

trajectory

Bottega Veneta’s revenue totaled

€437 billion in the third quarter, up 20% as reported and up

14% on a comparable basis. Growth was driven by sales in directly

operated stores, up 20% on a comparable basis, reflecting the

excellent reception of Matthieu Blazy’s first collection.

Performance was particularly remarkable in Western Europe and

Japan. Wholesale revenue fell 5%, in line with the House’s strategy

of streamlining this channel.

Other Houses: further excellent performance

In the third quarter, revenue from Kering’s

Other Houses totaled €995 million, an increase of 17% as

reported and 13% on a comparable basis.Revenue from directly

operated stores grew sharply, up 43% on a comparable basis. Sales

at Balenciaga and Alexander McQueen were particularly buoyant

across all product categories. Brioni continued its rebound.

Boucheron and Pomellato once again posted very good performances.

Qeelin held out well against the complex operating environment in

China.Wholesale revenue was down 25% reflecting the Houses’

strategy to reduce the contribution of this channel, as well as

calendar phasing effects.

Kering Eyewear and Corporate*

Third-quarter revenue from Kering Eyewear and

Corporate amounted to €253 million. Kering Eyewear achieved

total sales of €246 million, up 23% on a comparable basis.

Growth was sustained across all regions and distribution channels,

with significant contributions from Gucci and Cartier and sharp

growth in all brands. Following the successful integration of

Lindberg, the acquisition of Maui Jim has recently been

completed.

* In the first quarter of 2022, the “Corporate

and other” segment was renamed “Kering Eyewear and Corporate”.

Intragroup eliminations are now reported on a separate line.

***

Stock Repurchase Program: launch of the fourth

and final tranche

Pursuant to the Stock Repurchase Program

announced on August 25, 2021, covering up to 2.0% of Kering’s share

capital over a 24-month period, the Group signed a new stock

repurchase agreement with an investment service provider.

This agreement corresponds to a fourth and final

tranche of the program, covering a maximum volume of 650,000

shares, i.e., approximately 0.5% of Kering’s share capital as of

October 15, 2022. The maximum price per share was set at €1,000 by

the fifteenth resolution adopted in the Annual General Meeting of

April 28, 2022. The purchase period provided for in the agreement

started on October 24, 2022, and is scheduled to last until

December 21, 2022 at the latest.

Part of the shares acquired under this fourth

tranche are to be canceled. The remaining repurchased shares will

be allocated to plans to grant bonus shares to certain Kering

employees. The respective volumes will be determined at the end of

the repurchase period.

The table below summarizes the tranches of the

program that have already been completed:

|

|

Tranche 1 |

Tranche 2 |

Tranche 3 |

|

Repurchase period |

From August 25 to November 3, 2021 |

From February 23 to April 6, 2022 |

From May 18 to July 19, 2022 |

|

Number of shares repurchased |

650,000 shares, representing around 0.5% of the share capital |

650,000 shares, representing around 0.5% of the share capital |

650,000 shares, representing around 0.5% of the share capital |

|

Average price of the repurchased shares |

€643.70 per share |

€578.71 per share |

€485.53 per share |

|

Use of the repurchased shares |

325,000 shares were canceled on December 10, 2021, pursuant to a

decision by the Board of Directors at its meeting on December 9,

2021. |

The Board of Directors decided in its meeting of April 28, 2022, to

cancel 325,000 shares by the end of 2022. |

The Board of Directors decided in its meeting of July 27, 2022, to

cancel 400,000 shares by the end of 2022. |

ANNOUNCEMENTS SINCE JULY 1,

2022

Capital increase as part of the employee

share ownership programJuly 7, 2022 - The Group Managing

Director, pursuant to decisions taken by the Board of Directors on

December 9, 2021, and May 23, 2022, approved a €411,448 increase in

Kering SA’s share capital through the issue of 102,862 new ordinary

shares with par value of €4 each, taking the total share capital to

€499,183,112, divided into 124,795,778 shares with par value of €4

each.

Changes in the membership of

Kering’s Board of

DirectorsJuly 27, 2022 - Jean Liu resigned from her role

as Director on Kering’s Board of Directors, which the Board duly

noted. Jean Liu had been an independent director since June 16,

2020.Vincent Schaal was also appointed as a Director representing

employees by the Social and Economic Committee, replacing Clare

Lacaze, whose term of office ended on July 31, 2022.As a result,

Kering’s Board of Directors is now made up of 13 members,

including:

- six independent Directors (55% of

Board members excluding Directors representing employees in

accordance with the AFEP-MEDEF code);

- five women (45% of Board members

excluding directors representing employees in accordance with the

AFEP-MEDEF code);

- five different nationalities

(British, French, Italian, Ivorian and Turkish).

Completion of the third tranche of the

Stock Repurchase ProgramJuly 27, 2022 - The third tranche

of the Stock Repurchase Program (announced on August 25, 2021, with

the aim of repurchasing up to 2.0% of the Group’s share capital

over a 24-month period) was completed on July 19, 2022. Between May

18 and July 19, 2022, 650,000 shares were repurchased at an average

price of €485.53 per share, representing around 0.5% of the share

capital. The Board of Directors decided in its meeting of July 27,

2022, that the 400,000 shares repurchased in this tranche would be

canceled by the- end of 2022.Kering publishes the fifth

edition of its Standards for sustainabilitySeptember 30,

2022 - In 2018, Kering published its first set of Standards for Raw

Materials and Manufacturing Processes. Year after year, the Group

has continually developed this document, which serves to guide its

sustainability strategy. In this endeavor, following its focus on

synthetics and silk in 2019, packaging, visual marketing and

innovation in 2020 and circularity and faux fur in 2021, Kering has

added two new chapters to the 2022 version: “Cut, Make, Trim” and

“Sustainability claims”. These updates address growing interests

and emerging concerns such as regenerative agriculture and the

product end-of-life phase with a further focus on innovation.

Reviewed annually, these major developments reflect the Group’s

commitment to transparency and its open-source approach.

Kering Eyewear completes the acquisition

of Maui JimOctober 3, 2022 - Kering Eyewear currently

holds a stake of more than 90% in iconic sunglass brand Maui Jim,

in line with the terms announced on March 14, 2022, and after

obtaining approval from the antitrust authorities. The acquisition

of the remaining shares should take place by the end of 2022. Maui

Jim will be consolidated in the Kering group’s financial statements

from October 1, 2022.

AUDIOCAST

An

audiocast for analysts and investors will be held

at 6:00 pm

(CEST) on Thursday, October 20, 2022. It may be

accessed here. The slides (PDF) will be available

ahead of the audiocast at https://www.kering.com/en/finance/

A replay of the

webcast will also be available at

https://www.kering.com/en/finance/

About Kering

Kering is a global Luxury group that manages the

development of a series of renowned Houses in Fashion, Leather

Goods and Jewelry: Gucci, Saint Laurent, Bottega Veneta,

Balenciaga, Alexander McQueen, Brioni, Boucheron, Pomellato, Dodo

and Qeelin, as well as Kering Eyewear. By placing creativity at the

heart of its strategy, Kering enables its Houses to set new limits

in terms of their creative expression while crafting tomorrow’s

Luxury in a sustainable and responsible way. We capture these

beliefs in our signature: Empowering Imagination. In 2021, Kering

had more than 42,000 staff members and generated revenue of

€17.6 billion.

Contacts

|

Press |

|

|

| Emilie

Gargatte |

+33 (0)1 45 64 61

20 |

emilie.gargatte@kering.com |

| Marie de

Montreynaud |

+33 (0)1 45 64 62

53 |

marie.demontreynaud@kering.com |

| |

|

|

|

Analysts/investors |

|

|

| Claire

Roblet |

+33 (0)1 45 64 61

49 |

claire.roblet@kering.com |

| Aurélie

Jolion |

+33 (0)1 45 64 60

45 |

aurelie.jolion@kering.com |

Appendix: Revenue for the third quarter

and first nine months of 2022

|

Revenue (in € millions) |

|

Q3 2022 |

Q3 2021 |

Reportedchange |

Comparable

change(1) |

First nine

months 2022

|

First nine

months 2021

|

Reportedchange |

Comparable

change(1) |

|

Gucci |

|

2,581 |

2,182 |

+18% |

+9% |

7,754 |

6,661 |

+16% |

+8% |

|

Yves Saint Laurent |

|

916 |

652 |

+40% |

+30% |

2,397 |

1,698 |

+41% |

+33% |

|

Bottega Veneta |

|

437 |

363 |

+20% |

+14% |

1,271 |

1,071 |

+19% |

+13% |

|

Other Houses |

|

995 |

849 |

+17% |

+13% |

2,950 |

2,334 |

+26% |

+23% |

|

Kering Eyewear and Corporate |

|

253 |

173 |

+47% |

+21% |

844 |

569 |

+48% |

+24% |

|

|

|

|

|

|

|

|

|

|

|

|

Eliminations |

|

(45) |

(31) |

- |

- |

(149) |

(98) |

- |

- |

|

KERING |

|

5,137 |

4,188 |

+23% |

+14% |

15,067 |

12,235 |

+23% |

+15% |

(1) On a comparable scope and exchange rate basis.

- Kering Press Release_22_Third quarter revenue_ 22_20 10 22

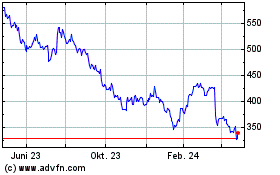

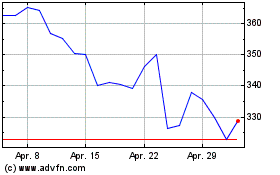

Kering (EU:KER)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Kering (EU:KER)

Historical Stock Chart

Von Apr 2023 bis Apr 2024