KBC Group: Third-quarter result of 776 million euros

09 November 2022 - 7:00AM

KBC Group: Third-quarter result of 776 million euros

Press Release

Outside trading hours - Regulated information*

Brussels, 9 November 2022 (07.00 a.m. CET)

KBC Group: Third-quarter result of 776 million

euros

‘Almost nine months have now passed since Russia

invaded Ukraine and, unfortunately, there is no sign of an end to

the war. The tragedy in Ukraine is causing immense human suffering

and our heartfelt solidarity goes out to all victims of this

conflict. We sincerely hope that a respectful, peaceful and lasting

solution can be achieved as soon as possible. The war in Ukraine,

alongside other geopolitical uncertainties, is also sending

shockwaves throughout the global economy, resulting in high

inflation and weighing on economic growth. Given those

uncertainties, we have further increased our dedicated reserve for

geopolitical and emerging risks, bringing it close to 0.4 billion

euros at the end of the quarter under review.

The tragedy unfolding in Ukraine comes on top of

other pressing issues such as the climate crisis, as evidenced by

the extreme weather events of the past year. In that respect,

sustainability and ESG in general also remain high on our agenda.

In August, for example, we became the first Belgian financial

institution to issue a social bond, for an amount of 750 million

euros. The money raised will be used for investments in the health

care sector. What’s more, having already achieved or even surpassed

almost all our previously set sustainability objectives ahead of

schedule, we have – in accordance with our climate commitments –

now set new climate-related targets for a number of key sectors and

activities. You can read all about them in our first ever Climate

Report on www.kbc.com.

In early July, we finalised the acquisition of

Raiffeisenbank Bulgaria. This entity and our existing Bulgarian

subsidiary UBB will merge their operations, allowing us to

significantly expand our share of our Bulgarian core market to an

estimated 19% in terms of assets. Raiffeisenbank Bulgaria has now

been included in our consolidated results for the first time.

As regards our financial results, we posted an

excellent net profit of 776 million euros in the quarter under

review. Quarter-on-quarter total income was more or less stable,

with higher net interest income, technical insurance income and net

fee and commission income being offset by lower trading & fair

value income and net other income. Costs were also more or less at

the previous quarter’s level, though that quarter did include a

one-off 78-million euro charge in the form of a new additional bank

and insurance tax in Hungary. We recorded a net impairment release

on our loan book, which was more than offset by an increase in the

reserve for geopolitical and emerging risks. Our solvency position

remained very solid with a common equity ratio of 15% on a fully

loaded basis, and our liquidity position was excellent, as

illustrated by an NSFR of 140% and an LCR of 155%. As announced

earlier, we will – in line with our general dividend policy – pay

out an interim dividend of 1 euro per share on 16 November 2022 as

an advance on the total dividend for financial year 2022.

In closing, a few words about our mobile app. A

few weeks ago, independent international research agency Sia

Partners again named KBC Mobile one of the top performing mobile

banking apps worldwide. KBC Mobile is also the best mobile banking

and insurance app in Belgium where it has further consolidated the

leading position it already occupied. This is not only recognition

of the quality of service we provide, it’s also a clear sign that

we remain committed to innovation and ensuring maximum convenience

for our customers, who continue to put their trust in us. I would

like to thank our customers, our employees, our shareholders and

all our other stakeholders for their continuing trust and

support.’

Johan ThijsChief Executive Officer

Full press release attached

- 3q2022-pb-en

- 3q2022-quarterly-report-en

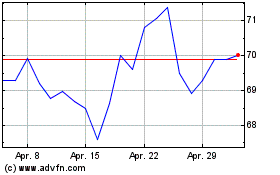

KBC Groep NV (EU:KBC)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

KBC Groep NV (EU:KBC)

Historical Stock Chart

Von Apr 2023 bis Apr 2024