Heineken Holding N.V. reports 2021 full year results

Amsterdam, 16 February 2022 – Heineken Holding N.V.

(EURONEXT: HEIO; OTCQX: HKHHY) announces:

- The net result of

Heineken Holding N.V.'s participating interest in Heineken N.V. for

2021 amounts to €1.663 million

- Net revenue (beia)

organic growth 12.2%; per hectolitre 8.3%

- Consolidated beer

volume 4.6% organic growth

- Heineken® volume

growth 17.4%, well ahead of 2019

- Gross savings close

to €1.3 billion, on-track to deliver €2 billion by 2023

- Operating profit

(beia) organic growth 43.8%, margin 15.6% (+331 bps)

- Net profit (beia)

€2,041 million, 80.2% organic growth

- Diluted EPS (beia) €3.54 (2020:

€2.00)

|

IFRS Measures |

€ million |

Total growth |

|

BEIA Measures |

€ million |

Organic growth2 |

|

Revenue |

26,583 |

11.8% |

|

Revenue (beia) |

26,583 |

11.4% |

| Net revenue |

21,941 |

11.3% |

|

Net revenue

(beia) |

21,901 |

12.2% |

| Operating

profit |

4,483 |

476.2% |

|

Operating profit

(beia) |

3,414 |

43.8% |

| |

|

|

|

Operating profit

(beia) margin (%) |

15.6% |

|

| Net profit of

Heineken Holding N.V. |

1,663 |

|

|

Net profit

(beia) |

2,041 |

80.2% |

| Diluted EPS (in

€) |

5.77 |

|

|

Diluted EPS

(beia) (in €) |

3.54 |

76.8% |

| |

|

|

|

Free operating

cash flow |

2,514 |

|

|

|

|

|

|

Net debt / EBITDA (beia)3 |

2.6x |

|

1 Consolidated figures are used throughout this report, unless

otherwise stated. Please refer to the Glossary for an explanation

of non-GAAP measures and other terms. Page 13 includes a

reconciliation versus IFRS metrics. These non-GAAP measures are

included in internal management reports that are reviewed by the

Executive Board of Heineken N.V., as they believe that this

measurement is the most relevant in evaluating the results.2

Organic growth shown, except for Diluted EPS (beia), which is total

growth. 3 Includes acquisitions and excludes disposals on a

12-month pro-forma basis

Heineken Holding N.V. engages in no activities other than its

participating interest in Heineken N.V. and the management or

supervision of and provision of services to that company.

During 2021, HEINEKEN deployed its EverGreen strategy across the

business, designed to emerge stronger from the COVID-19 crisis and

adapt to new external dynamics for superior and balanced growth

with enhanced profitability, whilst simultaneously raising the bar

on sustainability and responsibility.

HEINEKEN's superior growth ambition is grounded in building a

favourable geographic footprint, its strong premium beer brands,

including non-alcoholic variants and developing winning beverage

propositions in fast-growing segments.

Net revenue (beia) for the full year 2021

increased by 12.2% organically, with total consolidated volume

growing by 3.6% and net revenue (beia) per hectolitre up 8.3%. The

underlying price-mix on a constant geographic basis was up 7.1%,

driven by assertive pricing and premiumisation, with the regions

Americas and Africa, Middle East and Eastern Europe (AMEE) growing

double-digits. Currency translation negatively impacted net revenue

(beia) by €515 million or 2.6%, mainly driven by the Brazilian Real

and the Nigerian Naira. The consolidation of United Breweries

Limited (UBL) in India positively impacted net revenue (beia) by

€280 million or 1.4%.

In the second half of the year, net revenue (beia) grew 10.6%

organically. HEINEKEN took further pricing actions and accelerated

net revenue (beia) per hectolitre growth to 11.0%. Underlying

price-mix in the second half was up 8.8% primarily driven by

Nigeria, Brazil, Mexico and Europe, the latter benefiting from an

improved channel mix. Total consolidated volume declined slightly

by 0.3%, mainly impacted by the restrictions in the Asia Pacific

region.

Beer volume grew 4.6% organically for the full

year. In the fourth quarter, beer volume grew 6.2%, benefiting from

fewer restrictions in Europe relative to last year, continued

momentum in the Americas and AMEE, and a sequential recovery in

Asia Pacific (APAC) relative to the third quarter.

| Beer

volume1 |

|

4Q21 |

|

4Q20 |

|

Organic growth |

|

FY21 |

|

FY20 |

|

Organic growth |

|

(in mhl) |

|

|

|

|

|

|

|

Heineken N.V. |

|

61.1 |

|

56.2 |

|

6.2% |

|

231.2 |

|

221.6 |

|

4.6% |

1 2021 volume reflects the shift of malt-based, unfermented,

non-alcoholic drinks from Beer to Non-Beer Volume. Organic growth

has been corrected.

Premium beer volume grew 10.0%, outperforming

the portfolio in the majority of HEINEKEN's markets, and accounts

for more than 60% of the total organic growth in beer volume in

2021. HEINEKEN's growth in premium is led by

Heineken®, up 17.4%, significantly outperforming

the total beer market and well ahead of 2019. The growth was

broad-based with more than 60 markets growing double-digits in

2021.

The outstanding growth of Heineken® Original was further

supported by the strong performance of its line extensions.

Heineken® Silver more than doubled its volume,

driven by excellent performances in China and Vietnam. Building on

this success, HEINEKEN will roll-out Heineken® Silver

internationally to reach more than 20 markets in 2022.

| Heineken®

volume |

|

4Q21 |

|

Organic growth |

|

FY21 |

|

Organic growth |

|

(in mhl) |

|

|

|

|

|

Total Heineken N.V. |

|

13.3 |

|

24.1% |

|

48.8 |

|

17.4% |

HEINEKEN launched its EverGreen strategy in February 2021 to

future-proof its business and deliver superior, balanced growth for

sustainable, long-term value creation. It requires HEINEKEN to

constantly navigate the long-term transformation with the

short-term financial delivery under fast-changing external

circumstances. HEINEKEN is encouraged by the progress made,

witnessed by the strong performance of its business in 2021 and how

EverGreen is taking shape.

In 2022, HEINEKEN will continue to navigate an uncertain

environment and expect COVID-19 to still have an impact on

revenues. HEINEKEN's plans assume markets in APAC to progressively

bounce back during the year, yet full recovery of the on-trade in

Europe may take longer.

HEINEKEN also expects to be significantly impacted by inflation

and supply chain resilience pressures. More specifically, HEINEKEN

expects its input cost per hectolitre (beia) to increase in the

mid-teens, given its hedged positions and the sharp increase in the

prices of commodities, energy and freight. HEINEKEN will offset

these input cost increases through pricing in absolute terms, which

may lead to softer beer consumption.

Reflecting HEINEKEN's confidence in the long-term, it intends to

reverse the cost mitigation actions undertaken in 2021 and to

further step up its investments in brand support and its digital

and sustainability initiatives. This investment will be partially

offset by further delivery of gross savings from our productivity

programme. These changes are expected to have a greater impact in

the first half of the year.

Overall, HEINEKEN expects a stable to modest sequential

improvement in operating profit margin (beia) in 2022. Whilst

continuing to target 17% operating margin (beia) in 2023 and

operating leverage beyond, there is increased uncertainty given

current and evolving economic and input cost circumstances.

Therefore, HEINEKEN will update the 2023 guidance later in the

year.

HEINEKEN also anticipates:

- An average effective

interest rate (beia) broadly in line with 2021 (2021: 2.7%)

- Capital expenditure

related to property, plant and equipment and intangible assets of

around €2 billion (2021: €1.6 billion)

- An effective tax rate (beia) of around

28% (2021: 29.9%), back to the level of 2019

The Heineken N.V. dividend policy is to pay a ratio of 30% to

40% of full year net profit (beia). For 2021, a total cash dividend

of €1.24 per share, representing an increase of 77.1% (2020:

€0.70), and a payout ratio of 35.0%, in the middle of the range of

the policy, will be proposed to the Annual General Meeting of

Shareholders of Heineken N.V. on 21 April 2022 ("2022 AGM"). If

approved, a final dividend of €0.96 per share will be paid on 3 May

2022, as an interim dividend of €0.28 per share was paid on 11

August 2021.

If Heineken N.V. shareholders approve the proposed dividend,

Heineken Holding N.V. will, according to its Articles of

Association, pay an identical dividend per share. A final dividend

of €0.96 per share of €1.60 nominal value will be payable as of 3

May 2022.

Both the Heineken Holding N.V. shares and the Heineken N.V.

shares will trade ex-dividend on 25 April 2022. The dividend

payment will be subject to a 15% Dutch withholding tax.

| |

|

Translational Calculated Currency Impact |

|

| |

|

|

|

The translational currency impact for 2021 was negative,

amounting to €515 million on net revenue (beia), €98 million

at operating profit (beia) and €43 million at net profit

(beia).

Applying spot rates as of 14 February 2022 to the 2021 financial

results as a base, the calculated currency translational impact

would be positive, approximately €465 million in net revenue

(beia), €65 million at operating profit (beia), and €45 million at

net profit (beia).

| |

|

Board of

Directors Composition |

|

| |

|

|

|

Mr J.A. Fernández Carbajal will have completed his four-year

appointment term upon conclusion of the Annual General Meeting of

Shareholders of Heineken Holding N.V. on 21 April 2022 ('2022

AGM'). A non-binding nomination for the reappointment of Mr

Fernández Carbajal shall be submitted to the 2022 AGM. He is a

representative of FEMSA (that (in)directly holds a 14.76% economic

interest in the HEINEKEN group), and his (re)appointment is based

on the Corporate Governance Agreement, which was concluded between

(among others) the Company and FEMSA on 30 April 2010 and which was

approved by the Annual General Meeting of Shareholders on 22 April

2010 (in connection with the acquisition by Heineken N.V. of

FEMSA’s beer activities). Mr Fernández Carbajal has been a member

of the Board of Directors since 2010. The proposed reappointment is

a deviation of the maximum number of terms for reappointment set

out in the Dutch Corporate Governance Code, but is in accordance

with the Articles of Association of the Company.

Mrs A.M. Fentener van Vlissingen and Mrs L.L.H. Brassey will

have completed their four-year appointment term upon conclusion of

the 2022 AGM. Mrs A.M. Fentener van Vlissingen and Mrs L.L.H.

Brassey are eligible for reappointment as non-executive member of

the Board of Directors of Heineken Holding N.V. for a period of

four years and a non-binding recommendation shall be submitted to

the 2022 AGM in this respect.

A non-binding recommendation, drawn up by the Board of

Directors, will be submitted to the 2022 AGM to appoint Mr C.A.G.

de Carvalho as non-executive member of the Board of Directors, for

the maximum period of four years (i.e. until the end of the Annual

General Meeting of Shareholders to be held in 2026). The proposed

appointment of Mr C.A.G. de Carvalho, the youngest son of Mrs C.L.

de Carvalho-Heineken, would continue the tradition of personal

involvement in HEINEKEN by successive generations of the Heineken

family. Mr C.A.G. de Carvalho (1991) is a national of the

Netherlands and the United Kingdom. After graduating from Princeton

University, Mr C.A.G. de Carvalho lived and worked in Asia. He

worked in e-commerce for Lazada Group and gained experience with

the beer sector while working for Schmatz Beer Dining, a German

restaurant chain and beer brand. Mr C.A.G. de Carvalho is currently

completing his Master of Business Administration at the Wharton

School of the University of Pennsylvania.

|

Media Heineken Holding N.V. |

|

|

|

Kees Jongsma |

|

|

| tel. +31 6 54 79

82 53 |

|

|

| E-mail:

cjongsma@spj.nl |

|

|

| |

|

|

|

Media |

|

Investors |

|

Sarah Backhouse |

|

José Federico Castillo Martinez |

| Director of

Global Communication |

|

Investor

Relations Director |

| Michael

Fuchs |

|

Robin

Achten / Anna Nawrocka |

| Corporate &

Financial Communications Manager |

|

Investor

Relations Senior Analysts |

| E-mail:

pressoffice@heineken.com |

|

E-mail:

investors@heineken.com |

| Tel:

+31-20-5239355 |

|

Tel:

+31-20-5239590 |

| |

|

Investor

Calendar Heineken N.V. |

|

| |

|

|

|

(events also accessible for Heineken Holding N.V.

shareholders)

| Combined

financial and sustainability annual report publication |

25 February 2022 |

| Trading Update

for Q1 2022 |

20 April 2022 |

| Annual General

Meeting of Shareholders |

21 April 2022 |

| Quotation

ex-final dividend 2021 |

25 April 2022 |

| Final dividend

2021payable |

3 May 2022 |

| Half Year 2022

Results |

01 August 2022 |

| Quotation

ex-interim dividend 2022 |

03 August 2022 |

| Interim dividend

payable |

11 August 2022 |

| Trading Update

for Q3 2022 |

26 October 2022 |

HEINEKEN will host an analyst and investor video webcast about

its 2021 FY results combined with an update on the on-going

strategic review at 14:00 CET/ 13:00 GMT/ 08.00 EST. This call will

also be accessible for Heineken Holding N.V. shareholders. The

live video webcast will be accessible via the Heineken N.V.’s

website:

https://www.theheinekencompany.com/investors/results-reports-webcasts-and-presentations.

An audio replay service will also be made available after the

webcast at the above web address. Analysts and investors can

dial-in using the following telephone numbers:

| United Kingdom

(Local): 020 3936 2999 |

| Netherlands: 085

888 7233 |

| USA: 1 646 664

1960 |

| All other

locations: +44 20 3936 2999 |

| Participation

password for all countries: 589454 |

Editorial information:Heineken Holding N.V. engages in no

activities other than its participating interest in Heineken N.V.

and the management or supervision of and provision of services to

that company.

HEINEKEN is the world's most international brewer. It is the

leading developer and marketer of premium and non-alcoholic beer

and cider brands. Led by the Heineken® brand, the Group has a

portfolio of more than 300 international, regional, local and

specialty beers and ciders. HEINEKEN is committed to innovation,

long-term brand investment, disciplined sales execution and focused

cost management. Through "Brew a Better World", sustainability is

embedded in the business. HEINEKEN has a well-balanced geographic

footprint with leadership positions in both developed and

developing markets. HEINEKEN employs over 82,000 employees and

operates breweries, malteries, cider plants and other production

facilities in more than 70 countries. Heineken Holding N.V. and

Heineken N.V. shares trade on the Euronext in Amsterdam. Prices for

the ordinary shares may be accessed on Bloomberg under the symbols

HEIO NA and HEIA NA and on Reuters under HEIO.AS and HEIN.AS .

HEINEKEN has two sponsored level 1 American Depositary Receipt

(ADR) programmes: Heineken Holding N.V. (OTCQX: HKHHY) and Heineken

N.V. (OTCQX: HEINY). Most recent information is available on the

websites: www.heinekenholding.com and www.theHEINEKENcompany.com

and follow HEINEKEN on Twitter via @HEINEKENCorp.

Market Abuse Regulation:This press release may contain

price-sensitive information within the meaning of Article 7(1) of

the EU Market Abuse Regulation.

Disclaimer:This press release contains forward-looking

statements with regard to the financial position and results of

HEINEKEN’s activities. These forward-looking statements are subject

to risks and uncertainties that could cause actual results to

differ materially from those expressed in the forward-looking

statements. Many of these risks and uncertainties relate to factors

that are beyond HEINEKEN’s ability to control or estimate

precisely, such as future market and economic conditions,

developments in the ongoing COVID-19 pandemic and related

government measures, the behaviour of other market participants,

changes in consumer preferences, the ability to successfully

integrate acquired businesses and achieve anticipated synergies,

prices of commodities and other goods and services, interest-rate

and exchange-rate fluctuations, changes in tax rates, changes in

law, change in pension costs, the actions of government regulators

and weather conditions. These and other risk factors are detailed

in HEINEKEN’s publicly filed annual reports. You are cautioned not

to place undue reliance on these forward-looking statements, which

speak only of the date of this press release. HEINEKEN does not

undertake any obligation to update these forward-looking statements

contained in this press release. Market share estimates contained

in this press release are based on outside sources, such as

specialised research institutes, in combination with management

estimates.

- Heineken Holding NV 2021 Full Year results press release

(16_2_2022).pdf

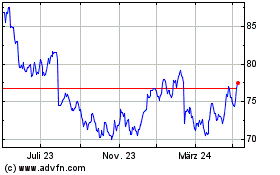

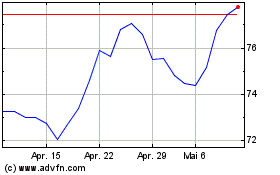

Heineken (EU:HEIO)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Heineken (EU:HEIO)

Historical Stock Chart

Von Apr 2023 bis Apr 2024