- Half-year revenues up 34% to €49.7 million

- Commercial momentum accelerated in Q2 2022, +52% vs. Q2

2021

- Strong rebound in heavy vehicle activity: +56% vs. Q2 2021

- Sustained growth in light vehicles: +40% vs. Q2 2021

- Continued roll-out of the strategic plan

- Establishment of North American headquarters and gigafactory in

Columbus, Ohio

- Signature of commercial partnerships with global transportation

players

- Expansion of product range and service offering

- Adjusted EBITDA growth of 21%, solid financial structure and

cash position of €46.5 million at the end of June 2022

- Expected annual revenues of more than 100 M€

- Confirmation of financial objectives for 2027

Regulatory News:

Forsee Power (FR0014005SB3 – FORSE – the « Company

») (Paris:FORSE), the expert in smart battery systems for

sustainable electromobility, announces today its 2022 half-year

results, approved by the Board of Directors on September 14,

2022.

Christophe Gurtner, Chairman and Chief Executive Officer of

Forsee Power comments:

« Forsee Power's sales momentum increased throughout the first

half of 2022 despite a tense supply chain environment. The second

quarter of 2022 was marked by a recovery in sales in the heavy

vehicle segment, while the growth of the activity in the light

vehicle market remained strong. In parallel with this good

commercial performance, we also improved our adjusted EBITDA by 21%

and intend to continue improving our financial performance.

Semester after semester, electromobility is establishing as the new

standard for the transportation of people and goods. To meet this

booming demand, we are continuing to deploy our strategic plan,

which was marked during the first half of the year by our expansion

into the US market and the extension of our range of innovative

products and services. Finally, the Company has solid financial

resources to pursue its growth as of the second half of 2022 and

thus consolidates its position as the leader in intelligent battery

systems ».

Key figures from the consolidated half-year statement

In €m - IFRS standards

H1 2021

H1 2022

Change

Change %

Sales

37.2

49.7

+12.6

+34%

Heavy vehicles

29.6

38.5

+8.9

+30%

Light vehicles

7.6

11.2

+3.6

+48%

EBITDA1

(8.1)

(8.2)

-0.1

-1%

EBITDA margin

(22)%

(16)%

Adjusted EBITDA2

(7.9)

(6.2)

+1.7

+21%

Adjusted EBITDA margin

(21)%

(12)%

Underlying operating income

(10.2)

(12.2)

-2.0

-20%

Operating income

(10.2)

(12.2)

-2.0

-20%

Financial result

(6.4)

2.5

+8.9

+139%

Net consolidated income

(16.8)

(9.8)

+6.9

+41%

The audit on the consolidated accounts have been carried

out.

2022 Half-year results

In the first half of 2022, the Company reported revenues of

€49.7 million, up 34% compared with 2021. This good commercial

performance benefited in the second quarter from the recovery of

activity in the heavy vehicle market (+30%) and continued strong

activity in the light vehicle segment (+48%). In a context of

tensions on the supply of certain electronic components, the

Company has maintained its efforts in terms of flexibility in order

to satisfy the strong demand of the electromobility market.

In terms of geographical breakdown of revenues, the French

market is the main contributor to half-year revenues, while the

rest of Europe is growing strongly, now representing 36% of sales

(vs. 10% in H1 2021).

The Group posted an adjusted EBITDA margin of (12)% compared to

(21)% a year ago. This positive development is mainly due to:

- the improvement in gross margin (+€3.3m) resulting from

improved productivity and higher volume; - the integration of the

net operating costs of the new Holiwatt activity taken over by the

Group in July 2021 (-€1.5m).

On a like-for-like basis (excluding Holiwatt integration costs),

adjusted EBITDA for the first half of 2022 would have amounted to

(-€4.7m), or 10% of the Group's revenues.

As a result, operating profit for the first half of 2022

amounted to (-€12.2m), down from the operating profit recorded in

the first half of 2021 (-€10.2m).

During the past six months, financial income was positive at

€2.5 million, compared with (-€6.4 million) in H1 2021.

In total and after taking into account a tax charge of €0.2

million, the net loss for the first half of 2022 improved

significantly and amounted to (-€9.8 million) compared to (-€16.8

million).

Group consolidated cash flow

In €m

H1 2021

H1 2022

Change

Free cash flow from operations

1.0

(15.2)

-16.2

Free cash flow from investing

(4.5)

(5.7)

-1.2

Free cash flow from financing

(3.6)

(3.5)

+0.1

Change in cash

(7.1)

(24.4)

-17.3

A solid balance sheet position

During the first half of 2022, the Group's working capital

balance represented 62% of half-year revenues, compared with 50% a

year earlier. This increase is the direct consequence of the

increase in inventory levels (+11.1 M€) in a tense supply

context.

In addition, CAPEX (excluding the IFRS 16 impact) during the

past six months amounted to €2.0 million, or 4% of sales, a lower

level than last year (6%) and in line with the announced objective

(less than 10% of sales).

As of June 30, 2022, the Company had a strong balance sheet;

shareholders' equity of €61.3 million, compared to €69.2 million as

of December 31, 2021.

The increase in cash flow from operating activities is due to

the deterioration in the change in working capital.

The negative change in cash flow from investing activities is

due to the acquisition of NEoT Capital shares from Mitsubishi

Corporation.

Lastly, cash flow from financing activities was stable.

In total, as of June 30, 2022, the Group's cash position

amounted to €46.5 million compared to €70.8 million as of December

31, 2021.

Gross financial debt was stable at €54.4 million at June 30,

2022, compared with €53.7 million at December 31, 2021.

Recent and post closing events

Business Development

- Order to equip 420 Wrightbus buses with ZEN SLIM battery

systems;

- Ballard Motive Solutions chooses Forsee Power high-power

battery systems to equip fuel cell Refuse Collection Vehicles

- Started deliveries of 5,000 GO 10 batteries to Omega Seiki

Mobility in India for their RAGE+ electric 3-wheelers.

Development of new products and services

- Signing of a partnership with EDF Store & Forecast for the

development of mobile and intelligent electricity storage systems

with second life batteries

Industrial development

- Establishment of the North American headquarters and a

gigafactory in Columbus, Ohio.

Acquisition

- Acquisition of shares in NEoT Capital from Mitsubishi

Corporation, a company dedicated to financing in the renewable

energy and electric mobility sectors to strengthen the Group's

service offering.

Impact of Covid-19 and the conflict in Ukraine

- The first half of 2022 was affected by the increase in cases of

Covid-19 in China, particularly in Shanghai, which exposes the

Group to pandemic risk due to the presence in China of one of its

production sites and some of its suppliers.

- The Group is not exposed to the restrictions imposed on Russia,

as Forsee Power has no employees, customers or suppliers in that

country. However, the Group is exposed to indirect logistical

impacts, impacts linked to increases in the cost of materials, and

impacts linked to the geopolitical situation in Ukraine and the

energy sector.

Strategy and outlook

In the second half of 2022, Forsee Power will focus on the

development of its production unit in the United States with the

objective of reaching a production capacity of 3 GWh by 2027 and

will continue to develop its commercial partnerships as well as its

R&D work in order to expand its product and service

offering.

The Group announces a sales target of over €100 million in 2022

and also confirms its financial objectives for 2027, namely to

achieve revenues of around €600 million and EBITDA and adjusted

EBITDA margins both above 15%.

Forsee Power remains cautious about the uncertainties linked to

the Covid-19 crisis, particularly in China where the Group operates

one of its 4 production sites, and also the impact of the conflict

in Ukraine, the logistical impact between Asia and Europe, the rise

in raw material prices and the tense supply situation for certain

electronic components.

Next financial communication: Q3 2022 sales on November

9, 2022 before market opening.

The half-year financial report will be available on the

Company's website, in the investor section:

https://www,forseepower-finance,com/index,php/en/documentation

Forsee Power joins the CAC® Small Index

Following the annual review of the Euronext Paris indices on

September 8, 2022, the Scientific Council of the Indices has

decided to admit Forsee Power in the sample of the CAC Small

index.

The effective date is Friday, September 16, 2022 after market

close.

About Forsee Power

Forsee Power is a French industrial group specializing in smart

battery systems for sustainable electric transport (light vehicles,

off-highway vehicles, buses, trains and ships), A major player in

Europe, Asia and North America, the Group designs, assembles, and

supplies energy management systems based on cells that are among

the most robust in the market and provides installation,

commissioning, and maintenance on site and remotely, Forsee Power

also offers financing solutions (battery leasing) and second-life

solutions for transport batteries, The Group recorded revenue from

sales of EUR 72,4 million in 2021 and has more than 600 employees,

For more information: www,forseepower,com | @ForseePower

1The EBITDA metric corresponds to operating income before

amortization and impairment of intangible assets, amortization of

rights of use on property, plant and equipment, depreciation and

impairment of property, plant and equipment and net impairment of

assets. This indicator is detailed in paragraph 2.1 of the

half-year financial report.

2 In addition to EBITDA, the Group also monitors adjusted

EBITDA. This alternative performance metric corresponds to EBITDA

adjusted for share-based compensation expenses. The Group considers

that these expenses do not reflect its current operating

performance, in particular for equity-settled compensation plans,

as they do not have a direct impact on cash. This indicator is

detailed in paragraph 2.1 of the half-year financial report.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220914005659/en/

Forsee Power Sophie Tricaud VP Corporate affairs and

Sustainability investors@forseepower.com

NewCap Thomas Grojean Quentin Massé Investor Relations

forseepower@newcap.eu +33 (0)1 44 71 94 94

NewCap Nicolas Merigeau Media Relations

forseepower@newcap.eu +33 (0)1 44 71 94 98

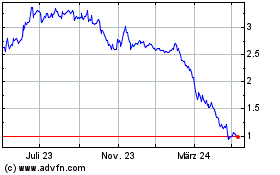

Forsee Power (EU:FORSE)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

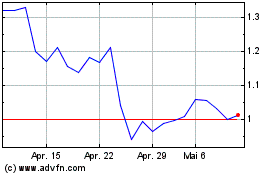

Forsee Power (EU:FORSE)

Historical Stock Chart

Von Apr 2023 bis Apr 2024