SFL: Colonial Group Successfully Completes the Requalification of all its Outstanding Bonds Into “Green Bonds”

17 Februar 2022 - 2:47PM

Business Wire

The first and only Ibex company with 100%

“green bonds”

- All of the Group’s bondholders’ meetings have approved the

requalification of its outstanding bonds into “green bonds”, which

will not entail any changes to their terms and conditions, interest

rates or maturities.

- The Group has reached this milestone thanks to its portfolio of

environmentally sustainable investments, which has a value of more

than the €4.6 billion of its outstanding bonds.

- Colonial is Europe’s leader in the GRESB (Global Real Estate

Sustainability Benchmark) index, the main benchmark for ESG in the

real estate sector.

Regulatory News:

Today, Colonial and its French subsidiary Société Foncière

Lyonnaise (SFL) (Paris:FLY) completed the requalification of all of

the Group's outstanding bonds with an aggregated outstanding

principal amount of €4.6 billion into "green bonds", following the

approval of their bondholders.

The Group has reached this milestone thanks to its portfolio of

environmentally sustainable investments with a value equal to or

greater than the outstanding nominal of its outstanding bonds. As a

result of this transaction, Colonial becomes the first Ibex-35

company to have all its bonds qualified as "green". Green bonds

constitute an alternative to corporate financing in an environment

in which the awareness of companies on sustainability issues has

become more relevant than ever. This type of debt is intended to

finance "green assets" that would have a positive impact on the

environment. The Group’s intention is that any bonds it proposes to

issue in the future will be issued under the Group’s Green

Financing Framework as “green bonds” (subject to the availability

of green assets at the time of any such issue).

The bondholders have approved the modification of the “Use of

Proceeds” of such bonds from “General Corporate Purposes” to “the

financing or refinancing of a portfolio of eligible green assets”.

Crédit Agricole Corporate and Investment Bank and Freshfields

Bruckhaus Deringer have advised the Colonial Group in this process.

The requalification of the outstanding bonds into “green bonds”

will not entail any changes to their characteristics, terms and

conditions, interest rates or maturities.

“We are very satisfied with the willingness shown by the market

to join us in our commitment to sustainability”, explains Carmina

Ganyet, Colonial’s Corporate General Manager. According to Ganyet,

the requalification of the outstanding bonds into "green" and the

issuance of new bonds under this category represent” a competitive

advantage and an attractive investment for the capital markets,

whose interest in this type of investment is increasing”.

The Group actively manages its indebtedness and during the first

nine months of 2021, Colonial refinanced more than €1 billion,

optimising its average cost of financing, improving its diversified

debt profile and the maturities of its borrowings. This “liability

management” has enabled the Group to bring the cost of its debt

below 1.5%. At the end of September 2021, the Group had a net debt

of €4,645 million, of which €2,812 million corresponded to bonds

issued by Colonial and €1,290 million to bonds issued by SFL, in

addition to the €500 million bonds issued by SFL in October 2021.

The Group’s Loan to Value at 30 September 2021 stood at around

37%.

A Leading ESG real estate company in Europe

Colonial’s ESG strategy has been recognised over the last few

years by the main entities in this field in Europe. Moody’s

recently highlighted the Group’s excellent ESG policy in its latest

report on Colonial, noting the high governance standards and strong

environmental credentials of its high quality office buildings and

upgraded the company’s credit outlook from Baa2 “stable” to

“positive”. Currently, 93% of Colonial’s office portfolio benefits

from sustainability certifications, a percentage well above the

sector average in Europe, and has set itself the challenge of being

emissions neutral by 2050.

Moody’s recognition of Colonial’s ESG policy is added to

Colonial’s recent performance in the main ESG indices. The

international organisation CDP (Carbon Disclosure Project) has

awarded Colonial its highest rating ("A") for its decarbonisation

policy. It should be noted that worldwide only 12 companies in the

real estate sector have this rating, 5 of them in Europe. GRESB

(Global Real Estate Sustainability Benchmark), the main ESG index

for the real estate sector, has ranked Colonial as the leading

office company in Europe, awarding it 94 out of a possible 100

points. Likewise, V.E. has placed Colonial in the top 3% of more

than 4,800 companies analysed each year. In addition, Colonial has

been recognised with the EPRA Sustainability Best Practices in 2021

for the sixth consecutive year.

About Colonial

The Colonial Group is a leader in the European prime office

market, present in the main business areas of Barcelona, Madrid and

Paris with a prime office portfolio of approximately 1.6m square

meters and an asset value under management of more than €12,000

million. Colonial is a SOCIMI and forms part of the Ibex 35 share

index.

About SFL

Leader in the prime segment of the Parisian commercial real

estate market, Société Foncière Lyonnaise stands out for the

quality of its property portfolio, which is valued at €7,300

million and is focused on the Central Business District of Paris

(#cloud.paris, Edouard VII, Washington Plaza, etc.), and for the

quality of its client portfolio, which is composed of prestigious

companies in the consulting, media, digital, luxury, finance and

insurance sectors. As France’s oldest real estate company, SFL

demonstrates year after year an unwavering commitment to its

strategy focused on creating added value for clients and,

ultimately, substantial valuation levels for its properties. SFL is

listed in Euronext París (Compartment A) and is rated BBB+ with a

“stable” outlook by S&P.

“The information included in this document should be read

together with all available public information, in particular the

information available on Colonial's website

www.inmocolonial.com.”

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220217005568/en/

Roman 93 414 23 40 Xavier Ribó – x.ribo@romanrm.com +34

669 486 003 Víctor Palacio – v.palacio@romanrm.com 34 677 782 370

Marina Huete – m.huete@romanrm.com

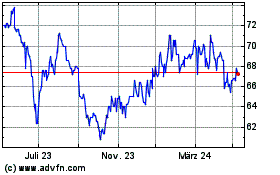

Fonciere Lyonnaise (EU:FLY)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Fonciere Lyonnaise (EU:FLY)

Historical Stock Chart

Von Apr 2023 bis Apr 2024