Total Gabon: First Half 2021 Financial Statements

24 August 2021 - 8:36PM

Business Wire

Regulatory News:

Total Gabon (Paris:EC):

Main Financial Indicators

Q2 21

Q1 21

Q2 21

vs.

Q1 21

H1 21

H1 20

H1 21

vs.

H1 20

Average Brent price

$/b

69.0

61.1

+13%

65.0

40.1

+62%

Average Total Gabon crude price (1)

$/b

65.1

54.4

+20%

61.5

30.7

+100%

Crude oil production

from fields operated by Total Gabon

kb/d (2)

14.4

18.5

-22%

16.4

20.3

-19%.

Crude oil production

from Total Gabon interests (3)

kb/d

22.6

26.8

-16%

24.7

26.6

-7%

Sales volumes (1)

Mb (4)

2.34

2.08

+13%

4.40

5.18

-15%

Revenues (5)

M$

172

139

+24%

311

187

+66%

Funds generated from operations (6)

M$

34

88

-61%.

122

85

+44%.

Capital expenditure

M$

18

18

0%

36

16

+125%

Net income

M$

13

-1

n.a

12

-59

n.a

- Excluding profit oil reverting to the Gabonese Republic as per

production sharing contracts.

- kb/d: Thousand barrels per day

- Including profit oil reverting to the Gabonese Republic as per

production sharing contracts.

- Mb: Million barrels.

- Revenue from hydrocarbon sales and services (transportation,

processing and storage), including profit oil reverting to the

Gabonese Republic as per production sharing contracts.

- Funds generated from operations are comprised of the operating

cash flow, the gains or losses on disposals of assets and the

working capital changes.

Second quarter and first half 2020 statements

Selling Price

The selling price of the crude oil grade marketed by Total Gabon

averaged $65.1 per barrel, during the second quarter 2021, up 20%

compared to first quarter 2021.

The selling price for the first half 2021 averaged 61,5 $/b, up

100% compared to the first semester 2020, reflecting the increase

in the average Brent price as well as a the significant improvement

in crude oil differentials from fields operated by Total Gabon.

Production

Total Gabon’s equity share of operated and non-operated oil

production(1) amounted to 22,600 barrels per day during the second

quarter 2021 up 16% compared to the first quarter 2021, mainly due

to:

- the five-year shutdown of the Torpille field in May.

Total Gabon’s equity share of operated and non-operated oil

production(1) amounted to 24,700 barrels per day during the first

half 2021 up 7% compared to the first half 2020, mainly due to:

- the five-year shutdown of the Torpille field in May;

- a partial production unavailability on the Baudroie operated

field due to damage to an evacuation line;

- the natural decline of the fields.

This was partly offset by:

- the gains on the non-operated Grondin sector, from the

conversion campaign of well activation from gas-lift to electrical

submersible pumps.

The five-year shutdown of the Torpille field took place in May

in line with the planned program and schedule. During this

shutdown, regulatory inspections and maintenance activities were

carried out, as well as efficiency improvement works on the main

compressor reliability and performance.

Revenues

Despite the production drop during Torpille field planned

shutdown, average selling price improvement allows second quarter

2021 revenues to increase by 24% to $172 million compared to the

first quarter 2021.

Revenues amounted to $311 million in the first half 2021.

Although impacted by less favorable lifting program, they increased

by 66% compared to the first half 2020 due to average selling price

strong improvement.

Funds generated from Operations

Cash flow from operations amounted to $34 million in the second

quarter 2021, down 61% compared to the first quarter 2021. The

variance is mainly explained by the higher need in working capital,

notably driven by the increase in receivables driven by the

increase of prices during the period.

Cash flow from operations amounted to $122 million in the first

half 2021, up 44% compared to the first half 2020.

Capital Expenditure

Capital expenditure amounted to $36 million during the first

half 2021, up 125% compared to the first half 2020. This includes,

mainly five-year shutdown of Torpille field and integrity works on

the operated sector; mainly the completion of the conversion

campaign of well activation from gas-lift to electrical submersible

pumps and the installation of a gas pipeline on Grondin

non-operated sector.

Net Income

Net income for the second quarter 2021 amounted to $13 million

and $12 million for the first half 2021, sharp increase compared to

the first quarter 2021 and the first half 2020. The increase is

mainly explained by the average selling price improvement.

Highlights since the beginning of second quarter 2021

Corporate governance

Total Gabon's ordinary Shareholders' Meeting was held on May 27,

2021 in Libreville and approved the payment of a net dividend of

$4.50 per share related to the financial year 2020, representing

$20.25 million.

This dividend was paid on June 10, 2021 in an equivalent amount

of €3.69 per share based on the European Central Bank’s rate of

$1.2198 for one euro on May 27, 2021.

Société anonyme incorporated in Gabon with a

Board of Directors and share capital of $76,500,000 Headquarters:

Boulevard Hourcq, Port-Gentil, BP 525, Gabonese Republic

www.total.ga Registered in Port-Gentil: 2000 B 00011

(1) Including profit oil reverting to the Gabonese Republic as

per production sharing contracts.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210824005776/en/

actionnariat-totalgabon@total.com

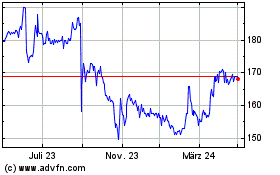

TotalEnergies EP Gabon (EU:EC)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

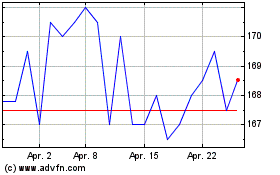

TotalEnergies EP Gabon (EU:EC)

Historical Stock Chart

Von Apr 2023 bis Apr 2024