Bonduelle - Quarter 3 FY 2021-2022 Revenue: Activity growth in line

with annual guidance

BONDUELLE

A French SCA (Partnership Limited by Shares)

with a capital of 57 102 699,50 EurosHead Office: La

Woestyne 59173 Renescure, FranceRegistered under

number: 447 250 044 (Dunkerque Commercial and Companies

Register)

Quarter 3 FY 2021-2022

Revenue(January 1 - March 31, 2022)

Activity growth in line with annual

guidance

Growth in the group's various activities

and geographies driven by the dynamism of the food service sector

and by favorable comparison bases

The Bonduelle Group's revenue stands for the 3rd

quarter of FY 2021-2022 at € 725.9 million, a change from the

previous financial year of +7.6% based on reported figures and

+4.-% on like for like basis* after taking into account currency

fluctuations, mainly the strengthening of the US and Canadian

dollars. No change in the group's scope of consolidation occurred

over the period. Over the 9 first months, the revenue stands at €

2,168.7 million, up +2.5% on reported figures and +1.-% on like for

like basis*.

Activity by Geographic

Region

|

Total Consolidated Revenue(in €

millions) |

9 months2021-2022 |

9 months2020-2021 |

Variation Reported figures |

Variation Like for like

basis* |

3rd

quarter2021-2022 |

3rd

quarter2020-2021 |

Variation Reported figures |

Variation Like for like

basis* |

|

Europe Zone |

999.8 |

955.5 |

4.6% |

4.7% |

336.- |

307.4 |

9.3% |

9.4% |

|

Non-Europe Zone |

1,168.9 |

1,160.6 |

0.7% |

-2.1% |

389.9 |

367.1 |

6.2% |

-0.5% |

|

Total |

2,168.7 |

2,116.1 |

2.5% |

1.-% |

725.9 |

674.6 |

7.6% |

4.-% |

Activity by Operating

Segments

|

Total Consolidated Revenue(in €

millions) |

9 months2021-2022 |

9 months2020-2021 |

Variation Reported figures |

Variation Like for like

basis* |

3rd

quarter2021-2022 |

3rd

quarter2020-2021 |

Variation Reported figures |

Variation Like for like

basis* |

|

Canned |

873.6 |

840.1 |

4.-% |

2.8% |

280.1 |

251.1 |

11.6% |

9.7% |

|

Frozen |

561.7 |

505.1 |

11.2% |

8.6% |

198.7 |

173.1 |

14.8% |

9.6% |

|

Fresh processed |

733.5 |

770.9 |

-4.9% |

-6.-% |

247.1 |

250.4 |

-1.3% |

-5.6% |

|

Total |

2,168.7 |

2,116.1 |

2.5% |

1.-% |

725.9 |

674.6 |

7.6% |

4.-% |

As in the first six months of the financial

year, the activity is returning to a more normal growth rate,

characterized by a slower demand in the retail sector and a

sustained growth in food service, driven by favorable comparisons

basis over the quarter.

Europe Zone

The revenue of the Europe Zone, representing 46.1% of the group's

revenues over the first 9 months, recorded an overall aggregated

growth of +4.6% on reported figures and +4.7% on like for like

basis* and over quarter 3 revenue rose +9.3% and +9.4%

respectively.Both for the first nine months of the year and for the

third quarter, the canned, frozen, and fresh prepared food

operating segments are on the increase.The long-life operating

segment in the retail sector enjoyed solid growth during the

quarter, particularly for brands (Bonduelle and Cassegrain),

boosted in large part by the preparation of the Easter holidays.

The food service business activity continued its strong growth,

helped by a favorable comparison base (2nd wave Covid the previous

year). Similarly, the fresh food business activity also benefited

from the recovery of the food service sector during the quarter.

Overall, the third quarter saw a normalization of the activities by

distribution channel in Europe.

Non-Europe

Zone The revenue of the non-Europe zone,

representing 53.9% of the group's revenues over the first 9 months

of this financial, was up +0.7% on reported figures and -2.1% on

like for like basis*. In North America, the long-life operating

segment (canned and frozen) benefited from the acceleration of the

food service sector on a favorable basis of comparison, while the

retail activity declined slightly on like for like basis* as

expected.Unsurprisingly, the fresh segment activities in this zone

showed a decline in volume linked to the strategy to improve the

profitability of this activity. Price increases negotiated with the

business clients to offset inflation confirmed the positive trend

in profitability over the second half of the financial year.In the

Eurasia region, the business activities continued to grow in line

with previous quarters in both canned and frozen products. In

Ukraine, the activity, representing a very limited part of the

group's revenue, and totally stopped following the invasion of the

country, is experiencing a slight recovery.

Highlights

Bonduelle's position on Ukraine and

RussiaThe Bonduelle Group considers that it is its duty to

ensure that people have access to essential foodstuffs and to do

all it can to avoid contributing to food shortages. As part of its

mission, the Bonduelle Group therefore ensures the continuity of

its activities in Russia to feed not only the 145 million Russians

but also the 90 million inhabitants in the surrounding countries

supplied by the group's Russian factories.Yet the current context

calls for exceptional measures.The Bonduelle Group therefore

decided on March 17, with the unanimous support of its controlling

shareholders, its Board of Directors, and its Supervisory Board, to

allocate all profits from sales in Russia during the period of

conflict to the future reconstruction of infrastructure and

agricultural and food ecosystems damaged by the conflict in

Ukraine.

2021-2022 Outlooks

Given the business activity trend observed over

the first nine months of the financial year, the necessary changes

in price negotiated or to be negotiated as a result of cost

inflation, and despite an uncertain health, geopolitical and

consumer environment, the group confirms its guidance of 3.-%

growth in business activity and targets a stable current operating

margin compared to the previous financial year, at 3.6% of revenue

at constant exchange rates and scope of consolidation.

* at constant currency exchange rate and scope

of consolidation basis. The revenues in foreign currency over the

given period are translated into the rate of exchange for the

comparable period. The impact of business acquisitions (or gain of

control) and divestments is restated as follows

- For businesses acquired (or gain of

control) during the current period, revenue generated since the

acquisition date is excluded from the organic growth

calculation;

- For businesses acquired (or gain of

control) during the prior fiscal year, revenue generated during the

current period up until the first anniversary date of the

acquisition is excluded;

- For businesses divested (or loss of

control) during the prior fiscal year, revenue generated in the

comparative period of the prior fiscal year until the divestment

date is excluded;

- For businesses divested (or loss of

control) during the current fiscal year, revenue generated in the

period commencing 12 months before the divestment date up to the

end of the comparative period of the prior fiscal year is

excluded.

Alternative performance indicators: the group

presents in its financial notices performance indicators not

defined by accounting standards. The main performance indicators

are detailed in the financial reports available on

www.bonduelle.com

Next financial events:

- 2021-2022 Financial Year Revenue:

August 1, 2022

(after stock exchange trading session)- 2021-2022 Annual Results:

October 3, 2022

(prior to stock exchange trading session)

About the

Bonduelle Group

We want to inspire the

transition toward a plant-based diet, to contribute to people’s

well-being and planet health. We are a French family business with

14,700 employees and we have been innovating with our farming

partners since 1853. Our products are cultivated on 124,000 acres

and marketed in 100 countries, with a revenue of € 2,779

million.Our 6 strong brands are Bonduelle, Cassegrain, Globus,

Arctic Gardens, Ready Pac Foods and Del Monte.

Bonduelle is listed on

Euronext compartment BEuronext indices: CAC MID & SMALL - CAC

FOOD PRODUCERS - CAC ALL SHARESBonduelle is part of the Gaïa

non-financial performance index and employee shareholder index

(I.A.S.)Code ISIN : FR0000063935 - Code Reuters : BOND.PA - Code

Bloomberg : BON FP

Find out about the

group’s current events and news on Twitter @Bonduelle_Group, and

its financial news on @BonduelleCFO

This document is a free translation into English

and has no other value than an informative one. Should there be any

difference between the French and the English version, only the

French-language version shall be deemed authentic and considered as

expressing the exact information published by Bonduelle.

- Bonduelle - Q3 FY 21-22 Revenue

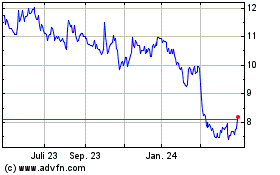

Bonduelle (EU:BON)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

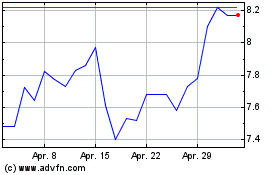

Bonduelle (EU:BON)

Historical Stock Chart

Von Apr 2023 bis Apr 2024