Bekaert - Update on the Share Buyback Program and the Liquidity Agreement

30 September 2022 - 8:15AM

Bekaert - Update on the Share Buyback Program and the Liquidity

Agreement

Update on the Share Buyback Program and the Liquidity

AgreementPeriod from 22 September 2022 to 28 September

2022

Share Buyback Program

In the context of the share buyback program of Bekaert,

announced on 25 February 2022, the third tranche

of € 30 million started on 29 July 2022.

Bekaert announces today that during the period from

22 September 2022 to 28 September 2022, Kepler Cheuvreux

on behalf of Bekaert has bought 114 785 shares.

The table below provides an overview of the transactions under

the third tranche of the share buyback program during the period

from 22 September 2022 to 28 September 2022:

|

|

Repurchase of shares |

|

Date |

Market |

Number of Shares |

Average Price paid (€) |

Highest Price paid (€) |

Lowest Price paid (€) |

Total Amount (€) |

|

22 September 2022 |

Euronext Brussels |

10 600 |

26.82 |

27.06 |

26.56 |

284 292 |

| |

MTF CBOE |

8 700 |

26.77 |

26.94 |

26.54 |

232 899 |

| |

MTF Turquoise |

1 500 |

26.87 |

26.90 |

26.84 |

40 305 |

|

|

MTF Aquis |

1 800 |

26.89 |

26.90 |

26.84 |

48 402 |

|

23 September 2022 |

Euronext Brussels |

10 497 |

25.99 |

26.56 |

25.72 |

272 817 |

| |

MTF CBOE |

8 885 |

25.97 |

26.54 |

25.72 |

230 743 |

| |

MTF Turquoise |

1 440 |

25.98 |

26.80 |

25.74 |

37 411 |

|

|

MTF Aquis |

1 950 |

25.97 |

26.54 |

25.74 |

50 642 |

|

26 September 2022 |

Euronext Brussels |

10 900 |

25.90 |

26.18 |

25.50 |

282 310 |

| |

MTF CBOE |

9 400 |

25.88 |

26.18 |

25.48 |

243 272 |

| |

MTF Turquoise |

1 475 |

25.91 |

26.18 |

25.58 |

38 217 |

|

|

MTF Aquis |

1 986 |

25.91 |

26.22 |

25.50 |

51 457 |

|

27 September 2022 |

Euronext Brussels |

11 017 |

26.02 |

26.36 |

25.68 |

286 662 |

| |

MTF CBOE |

9 850 |

26.02 |

26.34 |

25.68 |

256 297 |

| |

MTF Turquoise |

1 399 |

26.02 |

26.42 |

25.76 |

36 402 |

|

|

MTF Aquis |

2 043 |

26.01 |

26.42 |

25.72 |

53 138 |

|

28 September 2022 |

Euronext Brussels |

9 748 |

25.55 |

25.90 |

24.88 |

249 061 |

| |

MTF CBOE |

8 576 |

25.52 |

25.86 |

24.90 |

218 860 |

| |

MTF Turquoise |

1 339 |

25.51 |

25.90 |

25.02 |

34 158 |

|

|

MTF Aquis |

1 680 |

25.51 |

25.92 |

24.92 |

42 857 |

|

Total |

|

114 785 |

26.05 |

27.06 |

24.88 |

2 990 202 |

As announced on 25 February 2022 and 29 July 2022, the purpose

of the program is to reduce the issued share capital of the

company. All shares repurchased as part of the program will be

cancelled.

Liquidity agreement

In the context of the renewed liquidity agreement with Kepler

Cheuvreux, Bekaert announces today that Kepler Cheuvreux on behalf

of Bekaert has bought 9 900 shares during the period from

22 September 2022 to 28 September 2022 on Euronext

Brussels. During the same period, Kepler Cheuvreux on behalf of

Bekaert has sold 4 500 shares on Euronext Brussels.

The tables below provide an overview of the transactions under

the liquidity agreement during the period from 22 September

2022 to 28 September 2022:

|

|

Purchase of shares |

|

Date |

Number of Shares |

Average Price (€) |

Highest Price (€) |

Lowest Price (€) |

Total Amount (€) |

|

22 September 2022 |

3 400 |

26.74 |

26.90 |

26.50 |

90 916 |

|

23 September 2022 |

1 200 |

26.07 |

26.30 |

25.80 |

31 284 |

|

26 September 2022 |

1 600 |

25.59 |

25.62 |

25.50 |

40 944 |

|

27 September 2022 |

1 700 |

25.86 |

25.94 |

25.70 |

43 962 |

|

28 September 2022 |

2 000 |

25.42 |

25.80 |

25.00 |

50 840 |

|

Total |

9 900 |

— |

— |

— |

257 946 |

|

|

Sale of shares |

|

Date |

Number of Shares |

Average Price (€) |

Highest Price (€) |

Lowest Price (€) |

Total Amount (€) |

|

22 September 2022 |

1 000 |

27.10 |

27.10 |

27.10 |

27 100 |

|

23 September 2022 |

0 |

0.00 |

0.00 |

0.00 |

0 |

|

26 September 2022 |

700 |

26.09 |

26.20 |

2 600.00 |

18 263 |

|

27 September 2022 |

2 800 |

26.13 |

26.20 |

2 600.00 |

73 164 |

|

28 September 2022 |

0 |

0.00 |

0.00 |

0.00 |

0 |

|

Total |

4 500 |

— |

— |

— |

118 527 |

The balance held by Bekaert under the liquidity agreement at the

end of the period is 105 267 shares.

On 28 September 2022 after closing of the market, Bekaert

holds 3 704 895 own shares, or 6.28% of the total number

of the outstanding shares.

Related press release: 2 September 2022: Bekaert renews existing

liquidity contract

This information is also made available on the investor

relations pages of our website.

- p220930E - Bekaert - Update on the Share Buyback Program and

the Liquidity Agreement

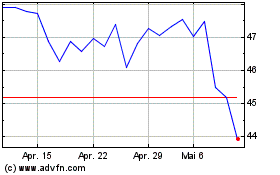

NV Bekaert (EU:BEKB)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

NV Bekaert (EU:BEKB)

Historical Stock Chart

Von Apr 2023 bis Apr 2024