Press release Biocartis Group NV: BIOCARTIS ANNOUNCES H1 2022

RESULTS

PRESS RELEASE: REGULATED INFORMATION1 September 2022, 07:02

CEST

BIOCARTIS

ANNOUNCES H1

2022 RESULTSAffirms 2022

Outlook 35% growth

in oncology cartridge

revenues Gross Margin on Products

of 32%Refinancing

underway

Company will host a conference call with live

webcast presentation today at 14:30 CEST / 13:30 BST (UK) / 08:30

EDT (US) to discuss H1 2022 results

Mechelen, Belgium,

1 September 2022

– Biocartis Group NV (the ‘Company’ or ‘Biocartis’), an innovative

molecular diagnostics company (Euronext Brussels: BCART), today

announces its business highlights and financial results for the

first half of 2022, prepared in accordance with IAS 34 ‘Interim

Financial Reporting’ as adopted by the European Union.

Commenting on the H1

2022 results and post-reporting period events,

Herman Verrelst, Chief Executive Officer of Biocartis,

said: “Our operational

performance in H1 2022 marked a pivotal moment on our journey

towards profitability: continued strong growth of our core oncology

business translated into significantly higher gross margins.

Cartridge revenue in our core oncology business grew by 35%

year-on-year, and the gross margin on products increased to 32%.

Despite the expected decrease of Idylla™ SARS-CoV-2 product sales,

we almost quadrupled gross profit to EUR 6.6m during the first half

of the year, fueled by increased average selling prices of

cartridges in oncology and economies of scale in our cartridge

manufacturing. We are on track to deliver on our objectives for the

entire year, and also made important progress in securing future

growth. We are particularly proud of the extended partnership with

AstraZeneca for the development of a companion diagnostic for its

blockbuster Tagrisso®. Furthermore, we were very pleased to

announce that we entered into several financing arrangements with

the support of certain holders of our convertible bonds. These

will, upon successful completion, strengthen our cash position with

approximately EUR 66m and fundamentally improve our financing

structure."

KEY MESSAGES

H1 2022

- Product revenue of

EUR 20.3m (H1 2021: EUR 18.5m), of which EUR 16.5m from 153k

cartridges sold and EUR 3.8m from instrument rentals and sales:

- EUR 14.4m cartridge revenue in

oncology (+35% year-on-year), double-digit growth across all

regions, led by the US, both in cartridge volumes as in Average

Selling price (ASP)

- The contribution of COVID-19

testing to cartridge revenues decreased to EUR 1.7m as both volumes

and pricing continued to reduce. Revenues are evenly split between

Europe and the US

- ASP per commercial cartridge of EUR

113 in oncology and EUR 103 overall

- EUR 3.8m revenue from a global

Idylla™ installed base of 2,014 instruments, with 102 net new

instruments placed

- Gross

profit on product sales increased

by 370% from EUR 1.4m to EUR 6.6m, reflecting a gross margin of

32%, compared to 8% for H1 2021 and 16% for the full year 2021

- Operating cash

burn1 of EUR -19.2m, EUR 9.4m lower than in H1 2021;

Company cash position of EUR 19.7m (unaudited figure) end of H1

2022. The available credit facilities of EUR 15.0m remained fully

undrawn as of 30 June 2022

- New partnership

with AstraZeneca to develop a companion

diagnostic2 (CDx) for use with Tagrisso® (osimertinib),

AstraZeneca’s third-generation EGFR-TKI (tyrosine kinase inhibitor)

treatment

- Post the reporting period, start of

Biocartis’ commercialization in Europe of

SkylineDx’s Merlin Assay as a CE-IVD marked kit,

ahead of the launch of an Idylla™ version of the Assay

REFINANCINGToday the Company

announced a comprehensive recapitalization transaction (the

‘Transactions’) that will provide adequate capital to support the

Company’s growth for the foreseeable future. The Transactions,

which are supported by key existing investors, is a significant

milestone for the Company and will provide for the following:

- Deleveraging via a partial

equitization of the 4.00% convertible bonds due 2024 (“Existing

Convertible Bonds”) equal to 10% of notional amounts outstanding,

and maturity extension by 3.5 years to November 2027.

- Allow holders of the Existing

Convertible Bonds to exchange into new second lien secured

convertible bonds (“New Convertible Notes”), subject to their

commitment to participate pro-rata in a fully backstopped EUR 25

million investment into additional New Convertible Notes.

- Allow existing shareholders to

participate in the growth of the Company by taking part in a fully

covered rights issue of EUR 25 million, which is backstopped in

full by certain new investors and KBC Securities (subject to a

number of customary and transaction specific conditions).

- Certain existing holders of New

Convertible Notes will provide a new senior secured term loan (“New

Convertible Term Loans”) that will provide the Company with

approximately EUR 16 million of additional cash liquidity.

More information can be found in the press

release here.

2022 OUTLOOK

As a result of a fading demand for COVID-19 testing, the product

revenues for 2022 are projected to be around the lower end of the

initial EUR 50-55m range, without any impact however on the

previously stated expectations for gross margin on product sales

and operating cash burn, which are maintained at:

- Increase gross margins on product sales to 25% - 30%

- Reduce the operating cash burn (EBITDA plus capital

expenditure) by EUR 9.5m-13.5m, to be between EUR 43m - 47m for

FY22

Biocartis will host a

conference call with live webcast presentation today at 14:30 CEST

/ 13:30 BST (UK) / 08:30 EDT (US) to discuss the H1 2022 results.

Participants that want to follow the webcast presentation live, are

invited to click on this link on the day of the event. Participants

that also want to ask a question and/or attend the event over the

phone, are required to register here in advance of the conference.

After registration, each participant will be provided with dial-in

numbers and a personal PIN. The conference call and webcast will be

conducted in English. A replay of the webcast will be available on

the Biocartis investors’ website shortly after.

Commercial highlights

- 153k commercial cartridges sold in H1 2022, compared to 156k in

H1 2021: oncology cartridge volumes grew by 21% while infectious

disease cartridge volumes almost halved as COVID-19 testing

continued to reduce

- Double-digit growth of oncology cartridge volumes in all

regions combined with pricing discipline, delivered 35% growth in

oncology cartridge revenue:

- Sustained growth across Europe with growing contribution of the

Idylla™ GeneFusion that is now increasingly used in clinical

routine

- The US remains the fastest growing market in oncology, fueled

by an increasing ASP as the proportion of free-of-charge cartridge

volumes for market seeding and the initial validation of assays by

customers declines

- Strong performance of the distributor markets3 and good

traction from the commercial partnership with AstraZeneca

- Total revenue from Idylla™ instruments increased by 4% to EUR

3.8m in H1 2022, including instruments sold to content partners4:

- Revenue generated from instrument placements at end customers

increased by 24% year-on-year, against a 12% increase of the

installed base of Idylla™ instruments, and evenly split between

revenue from capital sales and reagent rentals

- The US recorded the strongest growth of instrument revenue,

driven by a high proportion of capital sales, representing more

than 90% of total US instrument revenue and nearly half of total

revenue from sold instruments

- Continued double-digit growth of instrument revenue in Europe,

mostly from rental income that accounts for nearly 90% of total

instrument rental income

Idylla™ test menu,

partnerships & publications

- Test menu:

- Launch of the fully automated,

CE-marked IVD Idylla™ GeneFusion Panel on 20 June 2022

- Launch of new SeptiCyte RAPID®

EDTA5 (CE-IVD) blood compatible cartridges6 by Biocartis’ partner

Immunexpress on 23 August 2022, post the reporting period

- Product registrations:

- Russia – Additional registrations

have been completed in June 2022 for the Idylla™ NRAS-BRAF Mutation

Test, the Idylla™ KRAS Mutation Test and the Idylla™ MSI Test in

Russia. More information on the impact of the war in Ukraine and

Russia can be found in the disclaimer at the bottom of this press

release.

- Japan – On 29 August 2022, Nichirei

Biosciences, Biocartis’ distribution partner in Japan, received

approval by the Japanese regulatory authorities (Ministry of

Health, Labor and Welfare) for the commercialization of the Idylla™

MSI Test in Japan. Nichirei Biosciences plans the commercial launch

of the Idylla™ MSI Test in Japan in November 2022.

- Partnerships:

- Announcement of a new partnership

on 8 February 2022 between Biocartis and Ophiomics, a Lisbon

(Portugal) based biotech company with an initial focus on the

commercialization of HepatoPredict7.

- Announcement of a new agreement

with AstraZeneca on 22 June 2022 highlighting the development and

planned premarket submission to the US FDA of a novel CDx test on

the Idylla™ platform for AstraZeneca’s third-generation EGFR-TKI

(tyrosine kinase inhibitor) treatment.

- Announcement of Biocartis’ start of

the commercialization in Europe of SkylineDx’s innovative Merlin

Assay as a CE-IVD marked manual kit, ahead of the launch of an

Idylla™ version of the Assay, on 1 September 2022 and post the

reporting period.

- Publications - During H1 2022,

excellent data was published from several new Idylla™ studies,

including a study (announced 4 May 2022) by Memorial Sloan

Kettering Cancer Center (NY, US), in the Journal of Molecular

Diagnostics on the Idylla™ GeneFusion Assay (RUO8).

Organizational and operational

highlights

- Commercial milestones – Double

milestone announced on 15 June 2022 with the selling of the

one-millionth commercial Idylla™ cartridge and the placement of the

2,000th Idylla™ instrument since commercial launch.

- Shareholders’ Meetings – All agenda

items were approved during the ordinary shareholders’ meeting held

13 May 2022.

- Cartridge manufacturing – Transfer

of the Idylla™ SARS-CoV-2 Test (CE-IVD) and the Idylla™

SARS-CoV-2/Flu/RSV Panel (CE-IVD) to the second cartridge

manufacturing line (‘ML2’) was completed during H1 2022. Plans are

under development to complete all current assay transfers in the

course of 2023. The gradual product transfers to the fully

automated ML2 line will further unlock economies of scale and

reduce manufacturing costs.

- ISO 27001 certification – Post the

reporting period, ISO 27001 certification achievement announced on

24 August 2022 for Biocartis for the design, development,

maintenance, service provision and support of the Idylla™ platform

and associated customer-facing software.

- Management team – Biocartis aligned

its organizational structure to deliver on its strategic priorities

and has appointed, effective as from 1 September 2022:

- Global Head of Partnering:

Madhushree (Madhu) Ghosh, PhD, MS, will join Biocartis as Global

Head of Partnering. Dr. Ghosh brings a wealth of experience to

successful commercial and strategic team leadership in global

strategic alliance management, P/L business unit leadership and IVD

and CDx product development for in excess of 20 years spent in

molecular diagnostics and clinical assay development with a focus

on Next Generation Sequencing, real-time PCR, multiplex PCR,

oncology and infectious disease diagnostics. Previously, Dr. Ghosh

held senior roles at Thermo Fisher Scientific, NeoGenomics

Laboratories Inc., QIAGEN, and AltheaDx.

- Global Head of Sales: David Dejans,

previously Head of Sales Europe and Distributor markets, will move

into the role of Global Head of Sales.

Financial highlights

- Total operating income – Total

operating income amounted to EUR 26.8m compared to EUR 23.1m last

year. Product revenues increased by 10% from EUR 18.5m in H1 2021

to EUR 20.3m in H1 2022. Within product sales, cartridge sales

revenues increased by 11.6%. Excluding the revenue from the sale of

Idylla™ SARS-CoV-2 tests9 that continue to trend downward,

cartridge revenues increased 38%. Revenues from Idylla™ instrument

sales amounted to EUR 3.8m (H1 2021: EUR 3.7m). The majority of the

102 net new instruments were placed under reagent rental agreements

as opposed to H1 2021 during which immediately recognized capital

sales accounted for most of the 189 net placements. Collaboration

revenues, almost entirely from R&D services provided to

partners, increased by EUR 2.6m to EUR 5.1m.

- Idylla™ cartridge average sales

price (ASP) – During H1 2022, Idylla™ oncology cartridge ASP

increased by 8% to EUR 113, resulting from a growing contribution

of the Idylla™ GeneFusion Assay10 (RUO) and from higher sales from

the US where pricing is generally higher than in Europe and other

parts of the world. The overall ASP in H1 2022 stood at EUR 103, up

from EUR 95 in H1 2021 because of the increased ASP in oncology and

a lower contribution of lower priced SARS-CoV-2 tests.

- Gross margin – Gross margin on

products significantly increased, from 8% in H1 2021 to 32% in H1

2022. Last year, the gross margin was impacted by a higher

cartridge COGS (Costs of Goods Sold) because production volumes

were lower than expected as the pandemic caused a global shortage

of reagent supplies. Moreover, the lower revenues from SARS-CoV-2

tests that have a significantly lower ASP than the other assays,

also contributes to an improved gross margin. The total gross

profit amounted to EUR 6.6m, or EUR 5.2m more than in H1 2021.

- OPEX – Total operating expenses

(excluding cost of sales) of EUR 37.7m in H1 2022 decreased by EUR

1.4m from EUR 39.1m in H1 2021. EUR 4.1m lower spending in R&D

was partly offset by the post-pandemic normalization of commercial

activities, the impact of the 2021 restructuring of the US

commercial operations and by global inflation.

- Net cash flow and cash position –

The operating cash burn of EUR 19.2m (H1 2021: EUR 28.8m) was

complemented by working capital investments of EUR 0.6m and a

scheduled investment of EUR 1.0m to fund the operations of the

Chinese joint venture WondfoCartis. Financial cash flows included

EUR 3.1m interest payments and the repayment of EUR 8.6m

borrowings, including EUR 6.0m drawn on working capital facilities

at the end of 2021. The net cash outflow amounted to EUR 35.5m and

resulted in a net cash position of EUR 19.7m. EUR 15m of credit

facilities were undrawn and remain fully available awaiting the

closing of the refinancing.

KEY FIGURES H1

2022 The tables below show an overview of the key

figures and a breakdown of operating income for H1 2022 and H1

2021. Consolidated financial statements and accompanying notes are

included in Biocartis’ half-year 2022 report available here on the

Company’s website.

|

Key figures (EUR 1,000) |

H1 2022 |

H1 2021 |

% Change |

|

Total operating income |

26,771 |

23,057 |

16% |

|

Cost of goods sold |

-13,720 |

-17,059 |

-20% |

|

Research and development expenses |

-19,251 |

-23,389 |

-18% |

|

Sales and marketing expenses |

-10,050 |

-7,740 |

30% |

|

General and administrative expenses |

-8,376 |

-7,935 |

6% |

|

Operating expenses |

-51,397 |

-56,132 |

-8% |

|

Operating result |

-24,626 |

-33,075 |

-26% |

|

Net financial result |

-3,805 |

-4,249 |

-10% |

|

Share in the result of associated companies |

-432 |

-101 |

328% |

|

Income tax |

96 |

149 |

-36% |

|

Net result |

-28,767 |

-37,276 |

-23% |

|

Cash flow from operating activities |

-24,154 |

-33,752 |

-28% |

|

Cash flow from investing activities |

-1,594 |

-2,087 |

-24% |

|

Cash flow from financing activities |

-9,542 |

-3,518 |

171% |

|

Net cash flow 1 |

-35,290 |

-39,357 |

-10% |

|

Cash and cash equivalents2 |

19,724 |

84,905 |

-77% |

|

Financial debt |

147,166 |

149,412 |

-2% |

1 Excludes the effect of exchange rate

differences on the cash balances held in foreign currencies2

Including EUR 1,2m of restricted cash in H1 2022 and H1 2021

|

Operating income (EUR 1,000) |

H1 2022 |

H1 2021 |

% Change |

|

Collaboration revenue |

5,082 |

2,640 |

93% |

|

Idylla™ system sales |

3,824 |

3,715 |

3% |

|

Idylla™ cartridge sales |

16,477 |

14,749 |

12% |

|

Product sales revenue |

20,301 |

18,463 |

10% |

|

Service revenue |

977 |

748 |

31% |

|

Total revenue |

26,360 |

21,851 |

21% |

|

Grants and other income |

411 |

1,206 |

-66% |

|

Total operating income |

26,771 |

23,057 |

16% |

|

Product sales revenue (EUR 1,000) |

H1 2022 |

H1 2021 |

% Change |

|

Commercial revenue |

19,899 |

18,441 |

8% |

|

Research & development revenue |

401 |

22 |

1724% |

|

Total product sales revenue |

20,301 |

18,463 |

10% |

IDYLLA™ TEST MENU

OUTLOOK

- Idylla™ MSI Test US FDA submission – Biocartis continues to

interact with the US FDA on the 510(k) that was previously

submitted for its Idylla™ MSI Test.

- Idylla™ ABC (Advanced Breast Cancer) Assay (collaboration

LifeArc) – The launch of the Idylla™ ABC Assay (RUO) is planned for

Q4 2022.

- Idylla™ Platform registration in China –Biocartis continues to

interact with the Chinese regulatory authority NMPA on the Idylla™

Platform registration that was completed 10 August 2022 after

addressing NMPA feedback.

POST-PERIOD EVENTS

- Announcement of Biocartis’ obtaining of ISO 27001 certification

on 24 August 2022 – see above.

- Announcement of Biocartis’ commercialization in Europe of

SkylineDx’s Merlin Assay as a CE-IVD marked manual kit on 1

September 2022 – see above.

- Announcement of refinancing on 1 September 2022 – see

above.

FINANCIAL CALENDAR

- 10 November 2022

Q3 2022 Business Update

- 23 February 2023

2022 full year results

- 30 March 2023

Publication 2022 annual report

AUDITOR STATEMENT

The condensed consolidated interim financial

statements for the six-months’ period ended 30 June 2022 have been

prepared in accordance with IAS 34 ‘Interim Financial Reporting’ as

adopted by the European Union. They do not include all the

information required for the full annual financial statements and

should therefore be read in conjunction with the financial

statements for the year ended 31 December 2021. The condensed

consolidated interim financial statements are presented in

thousands of Euros (unless stated otherwise). The condensed

consolidated interim financial statements have been approved for

issue by the Board of Directors. The statutory auditor, Deloitte

Bedrijfsrevisoren/Reviseurs d’Entreprises, represented by Nico

Houthaeve, has performed a review, which did not reveal any

significant adjustments to the condensed consolidated interim

financial statements. The interim financial report 2022 and the

review opinion of the auditor are available on

www.biocartis.com.

--- END ---

More information: Renate

DegraveHead of Corporate Communications & Investor Relations

Biocartise-mail rdegrave@biocartis.comtel

+32 15 631 729

mobile +32 471 53 60 64

About Biocartis

Biocartis (Euronext Brussels: BCART) is an

innovative molecular diagnostics (MDx) company providing next

generation diagnostic solutions aimed at improving clinical

practice for the benefit of patients, clinicians, payers and

industry. Biocartis' proprietary MDx Idylla™ platform is a fully

automated sample-to-result, real-time PCR (Polymerase Chain

Reaction) system that offers accurate, highly reliable molecular

information from virtually any biological sample in virtually any

setting. Biocartis is developing and marketing a continuously

expanding test menu addressing key unmet clinical needs, with a

focus in oncology, which represents the fastest growing segment of

the MDx market worldwide. Today, Biocartis offers tests supporting

melanoma, colorectal and lung cancer, as well as for COVID-19, Flu,

RSV and sepsis. More information: www.biocartis.com. Follow us

on Twitter: @Biocartis_.

Biocartis and Idylla™ are registered trademarks

in Europe, the United States and other countries. The Biocartis and

Idylla™ trademark and logo are used trademarks owned by Biocartis.

Please refer to the product labeling for applicable intended uses

for each individual Biocartis product.

This press release is not for distribution,

directly or indirectly, in any jurisdiction where to do so would be

unlawful. Any persons reading this press release should inform

themselves of and observe any such restrictions. Biocartis takes no

responsibility for any violation of any such restrictions by any

person. This press release does not constitute an offer or

invitation for the sale or purchase of securities in any

jurisdiction. No securities of Biocartis may be offered or sold in

the United States of America absent registration with the United

States Securities and Exchange Commission or an exemption from

registration under the U.S. Securities Act of 1933, as amended.

Impact of the war in UkraineBiocartis has no

sales in Ukraine. In Russia, Biocartis works through a local sales

distributor who realized first commercial sales in H1 2021

following completion of first product registrations in Russia in Q1

2021. The impact to expected revenue for 2022 from Russian

distributor sales that were projected prior to the start of the

war, is not material. Supplier exposure is limited to one indirect

supplier for Idylla™ instrument sub-parts who is based in Russia.

Based on the current level of inventory on-hand and on various

alternative sources of supply that were identified and are

currently being assessed, Biocartis does not expect any material

adverse impact on the continued supply of instruments.

Forward-looking statementsCertain statements,

beliefs and opinions in this press release are forward-looking,

which reflect the Company's or, as appropriate, the Company

directors' or managements' current expectations and projections

concerning future events such as the Company's results of

operations, financial condition, liquidity, performance, prospects,

growth, strategies and the industry in which the Company operates.

By their nature, forward-looking statements involve a number of

risks, uncertainties, assumptions and other factors that could

cause actual results or events to differ materially from those

expressed or implied by the forward-looking statements. These

risks, uncertainties, assumptions and factors could adversely

affect the outcome and financial effects of the plans and events

described herein. A multitude of factors including, but not limited

to, changes in demand, competition and technology, can cause actual

events, performance or results to differ significantly from any

anticipated development. Forward-looking statements contained in

this press release regarding past trends or activities are not

guarantees of future performance and should not be taken as a

representation that such trends or activities will continue in the

future. In addition, even if actual results or developments are

consistent with the forward-looking statements contained in this

press release, those results or developments may not be indicative

of results or developments in future periods. No representations

and warranties are made as to the accuracy or fairness of such

forward-looking statements. As a result, the Company expressly

disclaims any obligation or undertaking to release any updates or

revisions to any forward-looking statements in this press release

as a result of any change in expectations or any change in events,

conditions, assumptions or circumstances on which these

forward-looking statements are based, except if specifically

required to do so by law or regulation. Neither the Company nor its

advisers or representatives nor any of its subsidiary undertakings

or any such person's officers or employees guarantees that the

assumptions underlying such forward-looking statements are free

from errors nor does either accept any responsibility for the

future accuracy of the forward-looking statements contained in this

press release or the actual occurrence of the forecasted

developments. You should not place undue reliance on

forward-looking statements, which speak only as of the date of this

press release.

1 EBITDA plus capital expenditure2 A companion diagnostic (CDx)

test is a test used as a companion to a therapeutic drug that helps

predict if a patient is likely to respond to a treatment or not

3 Defined as the world excluding European direct

markets, US, China and Japan4 Partners providing test content so as

to develop an Idylla™ version of their assay or test on the Idylla™

platform5 EDTA represents Ethylenediaminetetraacetic acid, which is

the anticoagulant used for most hematology procedures (like

identifying and counting blood cells, blood typing, etc.). Source:

ksmedical.com, last consulted on 24 August 20226 In addition to

blood samples collected in PAXgene blood RNA tubes (per the

manufacturer’s instructions), this test is now also able to process

undiluted EDTA blood samples which are commonly used for most

hematology procedures, with results available in about one hour

7 HepatoPredict will be distributed by Biocartis

in Europe as a manual kit mainly addressing centralized expert

laboratories, and the test may later be translated into a version

on Biocartis’ rapid and easy-to-use molecular diagnostics platform

Idylla™. HepatoPredict is a prognostic gene expression signature

test to help identify which patients will benefit from

curative-intent surgery, in particular liver transplantation8

Research Use Only, not for use in diagnostic procedures

9 The Idylla™ SARS-CoV-2 Test (CE-IVD) and the

Idylla™ SARS-CoV-2/Flu/RSV Panel (CE-IVD)10 The contribution in H1

2022 mainly resulted from Idylla™ GeneFusion Assay (RUO) sales, as

the Idylla™ GeneFusion Panel (CE-IVD) was only launched late in H1

2022, on 20 June 2022

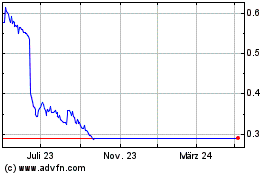

Biocartis Group NV (EU:BCART)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Biocartis Group NV (EU:BCART)

Historical Stock Chart

Von Apr 2023 bis Apr 2024