Press release Biocartis Group NV: Biocartis Announces Entry into

Comprehensive Recapitalization Arrangements to Strengthen Cash

Position and Support Growth

PRESS RELEASE: REGULATED INFORMATION/INSIDE

INFORMATION

1 September 2022, 07:00 CEST

Biocartis Announces

Entry

into Comprehensive

Recapitalization

Arrangements to

Strengthen Cash Position and Support Growth

Mechelen, Belgium, 1

September 2022 – Biocartis Group NV (the

"Company" or "Biocartis"), an

innovative molecular diagnostics company (Euronext Brussels:

BCART), is pleased to announce a comprehensive recapitalisation

transaction (the “Transactions”) that will provide

adequate capital to support the Company’s growth for the

foreseeable future. The Transactions are supported by key existing

investors, and are a significant milestone for the Company. The

Transactions will provide for the following:

- Deleveraging via a partial

equitization of the 4.00% convertible bonds due 2024

(“Existing Convertible Bonds”) equal to 10% of

notional amounts outstanding, and maturity extension by 3.5 years

to November 2027.

- Allow holders of the Existing

Convertible Bonds to exchange into new second lien secured

convertible bonds (“New Convertible Notes”),

subject to their commitment to participate pro-rata in a fully

backstopped EUR 25 million investment into additional New

Convertible Notes.

- Allow existing shareholders to

participate in the growth of the Company by taking part in a fully

covered rights issue of EUR 25 million, which is backstopped in

full by certain new investors and KBC Securities (subject to a

number of customary and transaction specific conditions).

- Certain existing holders of New

Convertible Notes will provide a new senior secured term loan

(“New Convertible Term Loans”) that will provide

the Company with approximately EUR 16 million of additional cash

liquidity.

The Transactions are intended to provide the

Company with approximately EUR 66 million of new money to help

manage liquidity until the Company reaches operating breakeven.

Herman Verrelst, Chief Executive Officer

of Biocartis, said: “These financing

arrangements represent a significant milestone for Biocartis. They

provide us with an opportunity to strengthen our cash position by

approximately EUR 66 million and fundamentally improve our

financial structure by pushing out the maturity date on our

convertible debt. Given the recent challenging conditions in

the financing markets, we believe these arrangements represent an

important validation of the Biocartis value proposition. Subject to

the successful completion, and upon approval by our bondholders and

shareholders, these agreements will provide the resources necessary

to continue and execute our growth strategy towards

profitability."

The Transactions are subject to the consent of

the requisite majority of the holders of the Existing Convertible

Bonds and existing shareholders of the Company, and conditional

upon equity proceeds in the fully backstopped rights offering of at

least EUR 25 million. The Company has already received binding

agreements from (i) certain holders of Existing Convertible Bonds

to fully backstop approximately EUR 41 million of capital in the

New Convertible Notes and New Convertible Term Loans, and (ii)

certain new investors and KBC Securities to backstop (subject to a

number of customary and transaction specific conditions) all of the

EUR 25 million rights issue.

The Company will call an extraordinary

shareholders' meeting and a meeting of Existing Convertible Bond to

request the necessary consents to effect the Transactions. The

Company has already received commitment from 65% of holders of

Existing Convertible Bonds. The Company believes that the

Transactions are an important milestone for the Company to secure

the financing necessary for its future growth which benefits all of

its stakeholders and therefore encourages both shareholders and

bondholders to grant the necessary consents to implement it. The

Company intends to complete the Transactions by the end of the

year.

Amendments to Existing Convertible

Bonds: The terms and conditions of the Existing

Convertible Bonds are expected to be amended to provide for, among

others, the following changes:

- 10.0% of the aggregate principal

amount will be converted into shares of the Company at the existing

conversion price of the Existing Convertible Bonds (i.e., EUR

12.8913) (the "Equitization") at (and subject to

completion of) the completion of the Transactions1.

- The maturity date will be extended

by approximately 3.5 years (to 9November 2027) if the Transactions

occur. The maturity date will remain 9 May 2024 if the Transactions

do not occur.

- Certain covenants, including the

negative pledge, will be removed to permit the refinancing.

- Remaining coupons will be paid as

Payment-In-Kind to preserve cash.

- The outstanding value of the

Existing Convertible Bonds (including principal, capitalised

interest, and accrued but uncapitalised interest) will be written

down to zero if a change of control has occurred but the

outstanding principal amount of secured debt is not paid in full in

connection with that transaction.

The Company will launch a consent solicitation

to Holders of the Existing Convertible Bonds to amend the terms of

the Existing Convertible Bonds (including the partial Equitization

of the Existing Convertible Bonds) as described above. To date,

holders of 65% of the Existing Convertible Bonds have committed to

vote in favour of such amendments. Holders of the Existing

Convertible Bonds should contact their brokers or the Company if

they have not received the relevant documentation in the coming

days.

New Convertible Term Loans:

Certain funds and accounts managed or advised by Highbridge Capital

Management LLC and funds managed or advised by Whitebox Advisors

LLC (together, the "Backstoppers") have committed

to provide New Convertible Term Loans in an amount of EUR 30.0

million, comprised of EUR 15.7 million of cash to the Company plus

EUR 13.7 million to fund the repurchase of Existing Convertible

Bonds held by the Backstoppers, plus the amount required to fund

the original issue discount of the New Convertible Term Loans. The

New Convertible Term Loans pay a coupon equal to EURIBOR plus 8.75%

(with a 1.5% floor). The New Convertible Term Loans benefit from

(a) guarantees from the Company’s wholly-owned subsidiaries

Biocartis N.V. and Biocartis US, Inc. and (b) security in the form

of senior all asset security from the Company, Biocartis N.V. and

Biocartis US, Inc. and over the shares of Biocartis N.V. and

Biocartis US, Inc. The loan is not callable by the borrower during

the first year. Thereafter, the borrower may repay in cash or force

equitize (in lieu of cash) the New Convertible Term Loans, subject

to certain conditions as described below. The New Convertible Term

Loans contain customary anti-dilution protection. If the

Transactions occur, the New Convertible Term Loans will mature on 9

August 2026. If such transactions do not occur, the New Convertible

Term Loans will mature on 15 March 2023, and the Backstoppers’ cash

commitments will be downsized to EUR 12.5 million; the Backstoppers

will automatically exchange all of their holdings in the Existing

Convertible Bonds and/or New Convertible Bonds for loans under the

New Convertible Term Loan, with such debt remaining outstanding

under and pursuant to the terms of the New Convertible Term

Loan.

Lender Equitization: At any time and at the

option of a lender, the lender may equitize the term loans at par

plus accrued interest plus option redemption payment, and converted

into freely tradable shares of the Company at a discount of 10% to

a relevant volume weighted average trading price of the Company’s

shares prior to conversion, subject to a floor set at 20% above the

price at which shares are issued in the proposed equity raise (the

"floor price"), subject to specified

adjustments.

Company Equitization: After the first year, and

to the extent the Company's share price is greater than 150% of the

floor price for five consecutive trading days, the Company may

force an equitization of certain amounts of the New Convertible

Term Loans, subject to various maximum conversion amounts.

Exchange of Existing Convertible

Bonds: Holders of the Existing Convertible Bonds will be

offered the right to participate in an exchange of Existing

Convertible Bonds for New Convertible Bonds on the following terms

and conditions:

- To be eligible for the exchange, a

holder must commit to make a pro-rata investment in the Company by

purchasing for cash its pro rata share of EUR 25 million of

additional newly issued New Convertible Bonds that are offered by

the Company (the "New Money Amount") and support

the amendment to the terms of the Existing Convertible Bonds

described above. Holders that exchange will be entitled to exchange

their Existing Convertible Bonds holdings at EUR 1.00 / EUR 1.00 of

current par value into the New Convertible Bonds (after the

Equitization, which shall only occur if the Transactions are

successful). Existing holders that do not provide additional

funding pursuant to these terms will not be permitted to exchange,

and their Existing Convertible Bonds will remain outstanding with

the amended terms (subject to the approval of the amendment of the

Existing Convertible Bonds as set out above).

- The Backstoppers have committed to

purchase any portion of the New Money Amount of additional New

Convertible Bonds that is not purchased by other holders of

Existing Convertible Bonds. In exchange for this backstop

commitment, the Backstoppers will receive a fee payable in freely

tradable shares of the Company.

Details regarding the process of the exchange of

Existing Convertible Bonds for New Convertible Bonds will be

provided to holders of Existing Convertible Bonds, and the exchange

is subject to various jurisdictional and securities-law related

limitations.

Issuance of New Convertible

Bonds: The Company will issue New Convertible Bonds which

will benefit from (a) security in the form of senior all asset

security from the Company, Biocartis N.V. and Biocartis US, Inc.

and over the shares of Biocartis N.V. and Biocartis US, Inc., and

rank junior to the New Convertible Term Loans and the existing

security, and (b) guarantees from the Company’s wholly-owned

subsidiaries Biocartis N.V. and Biocartis US, Inc. They will be

issued in an amount of up to EUR 131.5 million (depending on the

exchange participation and including the EUR 25 million upsize),

and mature in November 2026 if the Transactions herein occur and in

May 2024 if such Transactions do not occur. The New Convertible

Bonds will pay a 4.5% cash coupon semi-annually, and will be

subject to a make-whole provision. The New Convertible Bonds will

not be redeemable by the Company in the first year following their

issuance, and can only be redeemed thereafter prior to the maturity

date if the share price of the Company exceeds 150% of the

conversion price determined for the New Convertible Bonds, which

will be equal to 125% of the floor price of the New Convertible

Term Loans. The issuance of New Convertible Bonds is subject to

separate documentation and is subject to various jurisdictional and

securities-law related limitations.

Buyback of Existing Convertible Bonds

held by Backstoppers: As consideration for committing to

provide the New Convertible Term Loans the Company will repurchase

approximately 30% of the Backstoppers' holdings of Existing

Convertible Bonds (prior to the Equitization), which will be at a

discounted price of EUR82.50 per EUR100.00, if the Transactions

complete.

Advisers: Cowen and

KBC Securities are serving as financial advisors and Baker McKenzie

is serving as legal counsel to the Company.

Further implementation:

- The transactions described above

are subject to conditions and subject to finalizing additional

contractual agreements. The New Convertible Term Loans becoming

available on the terms described above are conditional on the

approval of the amendment of the terms and conditions of the

Existing Convertible Bonds, the exchange of Existing Convertible

Bonds and the issuance of New Convertible Bonds, the buyback of

Existing Convertible Bonds held by the Backstoppers, shareholder

approval and the Company’s equity raise. The Company intends to

complete the Transactions by the end of the year. The Company

intends to convene an extraordinary general shareholders' meeting

in order to approve (amongst others) (a) the conversion

feature of the New Convertible Term Loans and New Convertible

Bonds, the extended conversion of the Existing Convertible Bonds,

(b) the new equity raise, (c) the customary change of

control provisions in the New Convertible Term Loans and

instruments to be issued by the Company, and (d) the renewal

of the powers of the Company's board of directors to increase the

Company's capital pursuant to the authorised capital.

- In the event that shareholders do

not approve these requests at the shareholder's meeting, the

Transactions will not complete in full, the Company will not be

recapitalised, various fees and expenses will be paid to the

Backstoppers, certain terms of the New Convertible Terms Loans

become more restrictive, and the Company will need to consider

alternative arrangements, which may not be available on time or at

all.

--- END ---

More information:Renate DegraveHead of

Corporate Communications & Investor Relations

Biocartise-mail rdegrave@biocartis.com

tel +32 15 631

729mobile +32 471 53 60 64

About BiocartisBiocartis

(Euronext Brussels: BCART) is an innovative molecular diagnostics

(MDx) company providing next generation diagnostic solutions aimed

at improving clinical practice for the benefit of patients,

clinicians, payers and industry. Biocartis' proprietary MDx Idylla™

platform is a fully automated sample-to-result, real-time PCR

(Polymerase Chain Reaction) system that offers accurate, highly

reliable molecular information from virtually any biological sample

in virtually any setting. Biocartis is developing and marketing a

continuously expanding test menu addressing key unmet clinical

needs, with a focus in oncology, which represents the fastest

growing segment of the MDx market worldwide. Today, Biocartis

offers tests supporting melanoma, colorectal and lung cancer, as

well as for SARS-CoV-2/flu/RSV and sepsis. More information:

www.biocartis.com. Follow us on Twitter: @Biocartis_.

Biocartis and Idylla™ are registered trademarks

in Europe, the United States and other countries. The Biocartis and

Idylla™ trademark and logo are used trademarks owned by Biocartis.

Please refer to the product labeling for applicable intended uses

for each individual Biocartis product. This press release is not

for distribution, directly or indirectly, in any jurisdiction where

to do so would be unlawful. Any persons reading this press release

should inform themselves of and observe any such restrictions.

Biocartis takes no responsibility for any violation of any such

restrictions by any person. This press release does not constitute

an offer or invitation for the sale or purchase of securities in

any jurisdiction. No securities of Biocartis may be offered or sold

in the United States of America absent registration with the United

States Securities and Exchange Commission or an exemption from

registration under the U.S. Securities Act of 1933, as amended.

Forward-looking

statementsCertain statements, beliefs and opinions in this

press release are forward-looking, which reflect the Company's or,

as appropriate, the Company directors' or managements' current

expectations and projections concerning future events such as the

Company's results of operations, financial condition, liquidity,

performance, prospects, growth, strategies and the industry in

which the Company operates. By their nature, forward-looking

statements involve a number of risks, uncertainties, assumptions

and other factors that could cause actual results or events to

differ materially from those expressed or implied by the

forward-looking statements. These risks, uncertainties, assumptions

and factors could adversely affect the outcome and financial

effects of the plans and events described herein. A multitude of

factors including, but not limited to, changes in demand,

competition and technology, can cause actual events, performance or

results to differ significantly from any anticipated development.

Forward- looking statements contained in this press release

regarding past trends or activities are not guarantees of future

performance and should not be taken as a representation that such

trends or activities will continue in the future. In addition, even

if actual results or developments are consistent with the

forward-looking statements contained in this press release, those

results or developments may not be indicative of results or

developments in future periods. No representations and warranties

are made as to the accuracy or fairness of such forward-looking

statements. As a result, the Company expressly disclaims any

obligation or undertaking to release any updates or revisions to

any forward-looking statements in this press release as a result of

any change in expectations or any change in events, conditions,

assumptions or circumstances on which these forward-looking

statements are based, except if specifically required to do so by

law or regulation. Neither the Company nor its advisers or

representatives nor any of its subsidiary undertakings or any such

person's officers or employees guarantees that the assumptions

underlying such forward-looking statements are free from errors nor

does either accept any responsibility for the future accuracy of

the forward-looking statements contained in this press release or

the actual occurrence of the forecasted developments. You should

not place undue reliance on forward-looking statements, which speak

only as of the date of this press release.

Important information

This announcement is not a prospectus for the

purposes of Regulation 2017/1129, as amended (together with any

applicable implementing measures in any Member State of the

European Economic Area, the “Prospectus Regulation”) or the

Prospectus Regulation as it forms part of UK domestic law by virtue

of the UK European Union (Withdrawal) Act 2018 and as amended by

The Prospectus (Amendment etc.) (EU Exit) Regulations 2019 (each as

amended) (the "UK Prospectus Regulation").

THIS ANNOUNCEMENT IS NOT FOR DISTRIBUTION,

DIRECTLY OR INDIRECTLY, IN THE UNITED STATES OF AMERICA, AUSTRALIA,

CANADA, JAPAN, SOUTH AFRICA OR ANY OTHER JURISDICTION WHERE TO DO

SO WOULD BE PROHIBITED BY APPLICABLE LAW.

THIS ANNOUNCEMENT IS FOR GENERAL INFORMATION

ONLY AND DOES NOT FORM PART OF ANY OFFER TO SELL OR PURCHASE, OR

THE SOLICITATION OF ANY OFFER TO SELL OR PURCHASE, ANY NEW BONDS,

OUTSTANDING BONDS OR OTHER SECURITIES. THE DISTRIBUTION OF THIS

ANNOUNCEMENT AND THE OFFER, SALE AND PURCHASE OF THE NEW BONDS, NEW

TERM LOANS OR THE OUTSTANDING BONDS DESCRIBED IN THIS ANNOUNCEMENT

IN CERTAIN JURISDICTIONS MAY BE RESTRICTED BY LAW. ANY PERSONS

READING THIS ANNOUNCEMENT SHOULD INFORM THEMSELVES OF AND OBSERVE

ANY SUCH RESTRICTIONS.

There shall be no offer, solicitation, sale or

purchase of the Existing Convertible Bonds, the New Convertible

Bonds, or the New Term Loans in any jurisdiction in which such

offer, solicitation, sale, or purchase would be unlawful prior to

registration, exemption from registration or qualification under

the securities laws of any such jurisdiction.

The securities referred to herein have not been

and will not be registered under the U.S. Securities Act of 1933,

as amended from time to time (the "U.S. Securities Act") or the

securities laws of any state of the United States, and may not be

offered or sold in the United States unless these securities are

registered under the U.S. Securities Act, or an exemption from the

registration requirements of the U.S. Securities Act is available.

Biocartis has not registered, and does not intend to register, any

portion of the offering of the securities concerned in the United

States, and does not intend to conduct a public offering of

securities in the United States.

This communication is only addressed to and

directed at persons in member states of the European Economic Area

(each a "Member States") and in the United Kingdom who are

"qualified investors" within the meaning of Article 2(e) of the

Prospectus Regulation and of the UK Prospectus Regulation,

respectively ("Qualified Investors").

This communication is only being distributed to

and is only directed at (i) persons who are outside the United

Kingdom or (ii) investment professionals falling within Article

19(5) of the Financial Services and Markets Act 2000 (Financial

Promotion) Order 2005 (the "Order") or (iii) high net worth

companies, and other persons to whom it may lawfully be

communicated, falling within Article 49(2)(a) to (d) of the Order

(all such persons together being referred to as "relevant

persons"). The securities referred to herein are only available to,

and any invitation, offer or agreement to subscribe, purchase or

otherwise acquire such securities will be engaged in only with,

relevant persons. Any person who is not a relevant person should

not act or rely on this document or any of its contents.

This announcement cannot be used as a basis for

any investment agreement or decision.

Biocartis is not liable if the aforementioned

restrictions are not complied with by any person.

1 The Backstoppers may reduce the minimum equity proceeds

required to complete the Transactions in their sole discretion

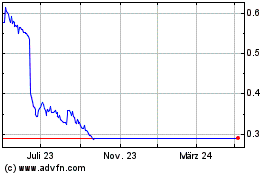

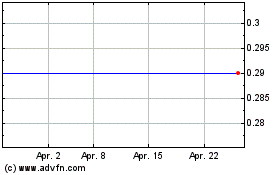

Biocartis Group NV (EU:BCART)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Biocartis Group NV (EU:BCART)

Historical Stock Chart

Von Apr 2023 bis Apr 2024