ASSYSTEM: First-half 2022 results

First-half

2022 results

- Revenue: €241.7 million, representing strong year-on-year

growth (12.3% in total and 4.6% like for like)

- Operating profit before non-recurring items (EBITA)(1): €16.4

million (up 17.3%)

- EBITA margin: 6.8% (up 0.3 pts)

- Full-year 2022 targets: €490 million in revenue (versus

the previous guidance of €480 million) and EBITA margin of

6.8% (target unchanged)

Paris La

Défense,

14 September

2022, 5.35

p.m. (CEST) – At its meeting held today, the Board

of Directors of Assystem S.A. (ASY – ISIN: FR0000074148), an

international engineering group, reviewed the Group’s financial

statements for the first half of 2022 (i.e. the six months ended 30

June 2022).

Dominique Louis, Assystem’s Chairman

and Chief Executive Officer, said:

“Our sustained revenue growth and earnings

performance once again show the strength of our business model and

how we have got our strategy right. The nuclear engineering market

is on a fast growth trajectory and we have positioned ourselves to

leverage the benefits of this thanks to our constant investment in

our managerial, commercial and technical assets. Our other

activities – which have synergies with the nuclear sector in terms

of where they are conducted, and the expertise required to carry

them out – have seen a marked return to growth.”

KEY

FIGURES

|

In millions of euros (€m) |

H1

2021restated* |

H1 2022 |

Year-on-year change |

|

Revenue |

215.3 |

241.7 |

+12.3% |

|

Operating profit before non-recurring

items –

EBITA(1) |

13.9 |

16.4 |

+17.3% |

|

% of revenue |

6.5% |

6.8% |

+0.3 pts |

|

Consolidated profit for the

period(2) |

11.2 |

32.7 |

- |

|

|

|

|

|

|

In millions of euros (€m) |

31 Dec.

2021 |

30 June

2022 |

|

|

Net

debt(3) |

64.7 |

52.1 |

|

* The published figures for first-half 2022

include the impacts on revenue and profit of applying IFRS 5 with

regard to (i) the sale of Assystem’s life sciences and general

industry technical assistance activities to Expleo Group in January

2022, and (ii) the agreement entered into by Assystem to sell, by

the end of the year, 51% of the shares and voting rights of MPH –

the company that heads up the Staffing business – to MPH’s

management. The figures for first-half 2021 have been restated

accordingly to enable meaningful comparisons with the first half of

2022.

ANALYSIS OF THE FIRST-HALF 2022 INCOME

STATEMENT

Assystem’s consolidated revenue totalled €241.7

million in the first half of 2022, up 12.3% on first-half 2021. The

year-on-year increase included 4.6% in like-for-like growth and a

positive 6.5% impact from changes in the scope of

consolidation.

Revenue from Nuclear activities amounted to

€171.7 million (representing 71% of the consolidated total), up

4.9% from €163.8 million in first-half 2021, with 4.2%

like-for-like growth (including a negative 2.3% impact from the end

of the Kacare contract). The year-on-year growth was once again

fuelled by the Group’s activities in France and the United

Kingdom.

ET&I revenue advanced 35.7% to €69.9 million

from €51.5 million in first-half 2021. This increase was led by (i)

the impact of the business’s return to like-for-like growth (6.0%

in first-half 2022) thanks to the ramp-up of a major contract in

Saudi Arabia, and (ii) the consolidation of STUP in India and

Schofield Lothian in the United Kingdom (changes in the scope of

consolidation had a 26.9% positive effect).

- Operating profit before

non-recurring items

(EBITA)

and

EBITDA(4)

Consolidated EBITA totalled

€16.4 million in the first six months of 2022, up 17.3% on the

€13.9 million recorded for first-half 2021. EBITA margin widened to

6.8% from 6.5%.

EBITA for Assystem

Operations (all of the

Group’s operations except for Holding company activities) totalled

€19.0 million, representing 7.9% of revenue, versus €16.8 million

and 7.8% respectively in first-half 2021.

The Group’s “Holding company” expenses had a

€2.6 million negative impact on consolidated EBITA in first-half

2022 versus a €2.9 million negative impact in the same period of

2021.

Excluding the impact of IFRS 16,

consolidated

EBITDA(4)

amounted to €19.3 million in first-half 2022, representing 8.0% of

revenue, compared with €15.9 million and 7.4% respectively in

first-half 2021.

- Operating profit and other

income statement items

After taking into account €1.1 million in net

non-recurring expense for the period and €0.9 million in

share-based payments, consolidated operating

profit totalled €14.4 million, compared with €12.6 million

in the first six months of 2021.

Expleo Group –

in which Assystem holds 38.05% of the capital and 38.94% of the

quasi-equity instruments issued by that company (convertible bonds

with capitalised interest) – contributed €3.1 million to

consolidated profit, breaking down as €5.8 million in coupons on

the convertible bonds less Assystem’s €2.7 million share of

Expleo Group’s loss for the period.

Assystem recorded net financial

income of €5.0 million for first-half 2022. This includes

a €4.1 million dividend receivable from Framatome and €3.7 million

in income recognised as a result of applying IAS 29 (Financial

Reporting in Hyperinflationary Economies) to items in the

consolidated statement of financial position that relate to the

Group’s Turkish subsidiary.

After deducting an income tax expense of €3.5

million (versus €3.2 million in first-half 2021),

consolidated profit from continuing operations

totalled €19.0 million, versus €8.8 million in the same period of

2021.

Profit from discontinued

operations came to €13.7 million (€2.4 million in

first-half 2021), including an €18.0 million disposal gain on the

sale of the Group’s life sciences and general industry technical

assistance activities, and a €4.3 million net loss from other

items, primarily reflecting the terms of the agreement to sell 51%

of MPH to its management.

Consolidated profit for

the period totalled €32.7 million, versus €11.2 million in

the first half of 2021.

- Information

about Expleo Group

Revenue generated by Expleo

Group amounted to €617.8 million in the first six months

of 2022 compared with €482.8 million in first-half 2021. This 28.0%

year-on-year increase includes a 4.2% rise due to the consolidation

of activities acquired from Assystem.

Expleo Group’s

EBITDA (including the impact of IFRS 16) totalled €45.0

million.

Expleo Group’s

consolidated profit before recognition of the

capitalised interest on its quasi-equity instruments was €7.8

million.

FREE CASH

FLOW(5)

AND NET DEBT

Free cash flow (excluding the

impact of IFRS 16 and taking into account the seasonal pattern of

the Group’s working capital requirement) represented a negative

€7.0 million in first-half 2022 (including a €5.6 million net

outflow for continuing operations), compared with a negative €9.2

million in first-half 2021 (including an €11.2 million net outflow

for continuing operations).

The Group had net debt of

€52.1

million at 30 June

2022, versus €64.7 million at 31 December

2021. The €12.6 million decrease breaks down as follows:

- a €5.6 million impact from the

negative free cash flow from continuing operations (including

€20.2 million resulting from the change in working capital

requirement);

- a €1.4 million impact from the

negative free cash flow from discontinued operations;

- a €26.0 million net-of-tax cash

inflow from sales of shares and businesses;

- a €4.8 million negative impact on

consolidated cash and cash equivalents resulting from the

deconsolidation of MPH;

- a €1.6 million net cash outflow

from other movements.

PAYMENT OF THE

2021

DIVIDEND

At the Annual General Meeting held on 3 June

2022, Assystem’s shareholders approved a dividend of €1.0 per

outstanding share. This dividend was paid on 8 July 2022 and

represented a total payout of €14.8 million.

FULL-YEAR

2022 TARGETS

Assystem’s targets for full-year 2022 – based on

its scope of consolidation at end-June – are as follows:

- consolidated revenue of €490

million (versus the previous guidance of €480 million);

- a stable EBITA margin, at

6.8%.

AVAILABILITY OF THE FIRST-HALF 2022 INTERIM FINANCIAL

REPORT

Assystem’s first-half 2022 interim financial

report has been published and filed with the Autorité des Marchés

Financiers (AMF) today. This report, as well as the presentation of

the Group’s first-half 2022 results, can be viewed and downloaded

on Assystem’s website (www.assystem.com) in the “Finance/Regulated

Information” section.

2022 FINANCIAL

CALENDAR

-

15

September: First-half

2022 results – Presentation

meeting at 8.30 a.m. (CEST)

- 27 October:

Third-quarter 2022 revenue release

ABOUT

ASSYSTEMAs one of the world’s leading independent

nuclear engineering companies, Assystem’s main mission is to help

accelerate energy transition. In the 10 countries where the Group

operates, the skills of its 6,000 experts are being put to the

service of developing the production and use of carbon-free

electricity (nuclear and renewables) as well as green hydrogen.

With over 50 years’ experience in highly

regulated sectors subject to stringent safety and security

constraints, the Group provides engineering and digital services

and solutions to optimise the cost and performance of its clients’

complex infrastructure assets throughout their life cycles.To find

out more visit www.assystem.com / Follow Assystem on Twitter:

@Assystem

CONTACTS

Philippe Chevallier – CFO & Deputy CEO –

Tel.: +33 (0)1 41 25 28 07 Anne-Charlotte Dagorn –

Communications Director – acdagorn@assystem.com - Tel.: +33 (0)6 83

03 70 29

Agnès Villeret – Komodo –

Investor relations – agnes.villeret@agence-komodo.com – Tel.: +33

(0)6 83 28 04 15

APPENDICES

1/ Revenue and EBITA

|

In millions of euros |

H1 2021 restated(1) |

H1 2022reported |

Total year-on-year change |

Like-for-like change(2) |

|

Group |

215.3 |

241.7 |

+12.3% |

+4.6% |

| Nuclear |

163.8 |

171.7 |

+4.9% |

+4.2% |

|

ET&I |

51.5 |

69.9 |

+35.7% |

+6.0% |

(1) The published figures for

first-half 2022 include the impacts on revenue and profit of

applying IFRS 5 with regard to (i) the sale of Assystem’s life

sciences and general industry technical assistance activities to

Expleo Group in January 2022, and (ii) the agreement entered into

by Assystem to sell, by the end of the year, 51% of the shares and

voting rights of MPH – the company that heads up the Staffing

business – to MPH’s management. The figures for first-half 2021

have been restated accordingly to enable meaningful comparisons

with the first half of 2022.(2) Based on a comparable

scope of consolidation and constant exchange rates

|

In millions of euros |

H1 2021 restated |

% of revenue |

H1 2022 |

% of revenue |

|

Group |

13.9 |

6.5% |

16.4 |

6.8% |

| Assystem

Operations |

16.8 |

7.8% |

19.0 |

7.9% |

|

Holding company |

(2.9) |

- |

(2.6) |

- |

(1) Operating profit before non-recurring items

(EBITA) including share of profit of equity-accounted investees

other than Expleo Group (€0.4 million in H1 2021 and €0.6 million

in H1 2022).

2/ Consolidated financial statements

- Consolidated statement of financial

position

| In millions of

euros |

31 Dec. 2021 |

30 June 2022 |

|

ASSETS |

|

|

|

Goodwill |

97.0 |

106.3 |

|

Intangible assets |

4.4 |

4.1 |

|

Property, plant and equipment |

12.9 |

12.1 |

|

Right-of-use assets |

33.2 |

33.9 |

|

Investment property |

1.3 |

1.3 |

|

Equity-accounted investees |

1.0 |

1.0 |

|

Expleo Group shares |

41.3 |

38.9 |

|

Expleo Group convertible bonds |

132.3 |

138.1 |

|

Expleo Group shares and convertible bonds |

173.6 |

177.0 |

|

Other non-current financial assets(1) |

147.7 |

143.0 |

|

Deferred tax assets |

8.8 |

5.9 |

|

Non-current assets |

479.9 |

484.6 |

|

Trade receivables |

169.3 |

174.1 |

|

Other receivables |

27.7 |

23.5 |

|

Income tax receivables |

3.4 |

4.6 |

|

Other current assets |

0.3 |

5.1 |

| Cash and cash

equivalents(2) |

25.7 |

21.7 |

|

Assets classified as held for sale |

18.3 |

16.9 |

|

Current assets |

244.7 |

245.9 |

|

TOTAL ASSETS |

724.6 |

730.5 |

|

|

|

|

|

EQUITY AND LIABILITIES |

31 Dec. 2021 |

30 June 2022 |

|

Share capital |

15.7 |

15.7 |

|

Consolidated reserves |

307.3 |

340.9 |

|

Profit for the period attributable to owners of the parent |

34.2 |

32.4 |

|

Equity attributable to owners of the parent |

357.2 |

389.0 |

|

Non-controlling interests |

1.3 |

1.7 |

|

Total equity |

358.5 |

390.7 |

|

Long-term debt and non-current financial liabilities(2) |

89.8 |

73.5 |

| Non-current

lease liabilities |

26.5 |

27.4 |

| Pension and

other employee benefit obligations |

22.4 |

18.9 |

| Long-term

provisions |

16.3 |

16.6 |

|

Deferred tax liabilities |

0.1 |

0.1 |

|

Non-current liabilities |

155.1 |

136.5 |

|

Short-term debt and current financial liabilities(2) |

0.5 |

0.3 |

| Current lease

liabilities |

8.2 |

8.2 |

| Trade

payables |

34.8 |

27.6 |

| Due to

suppliers of non-current assets |

0.2 |

0.1 |

| Accrued taxes

and payroll costs |

107.2 |

93.0 |

| Income tax

liabilities |

2.2 |

0.7 |

| Short-term

provisions |

2.6 |

3.6 |

| Other current

liabilities(3) |

46.3 |

60.9 |

|

Liabilities directly associated with assets classified as held for

sale |

9.0 |

8.9 |

|

Current liabilities |

211.0 |

203.3 |

|

TOTAL EQUITY AND LIABILITIES |

724.6 |

730.5 |

(1) Including Framatome shares, representing €136.7 million at

30 June 2022.(2) Net debt totalled €52.1 million at 30 June 2022,

breaking down as:

-

Short-and long-term debt and current and non-current financial

liabilities: €73.8 million

- Cash

and cash equivalents: €21.7 million

(3) O/w, at 30 June 2022, €14.8 million in dividends payable to

Assystem shareholders.

Consolidated income statement

|

In millions of euros |

Six months ended 30 June

2021restated |

Six months ended 30 June

2022 |

| |

|

|

|

Revenue |

215.3 |

241.7 |

| Payroll

costs |

(151.7) |

(169.2) |

| Other operating

income and expenses |

(42.7) |

(48.4) |

| Taxes other

than on income |

(0.5) |

(0.6) |

| Depreciation,

amortisation and provisions for recurring operating items, net |

(6.9) |

(7.7) |

|

|

|

|

|

Operating profit before non-recurring items

(EBITA) |

13.5 |

15.8 |

|

Share of profit of equity-accounted investees |

0.4 |

0.6 |

|

|

|

|

|

EBITA including share of profit of equity-accounted

investees |

13.9 |

16.4 |

|

Non-recurring income and expenses |

(0.6) |

(1.1) |

| Share-based

payments |

(0.7) |

(0.9) |

|

|

|

|

|

Operating profit |

12.6 |

14.4 |

|

Share of profit/(loss) of Expleo Group |

(6.6) |

(2.7) |

| Income from

Expleo Group convertible bonds |

5.3 |

5.8 |

| Net financial

expense on cash and debt |

(0.3) |

(0.3) |

| Other financial

income and expenses |

1.0 |

5.3 |

| |

|

|

|

Profit from continuing operations before tax |

12.0 |

22.5 |

| |

|

|

| Income tax

expense |

(3.2) |

(3.5) |

|

|

|

|

|

Profit from continuing operations |

8.8 |

19.0 |

| |

|

|

| Profit from

discontinued operations |

2.4 |

13.7 |

| |

|

|

|

Consolidated profit for the period |

11.2 |

32.7 |

| Attributable

to: |

|

|

| Owners of the

parent |

11.1 |

32.4 |

|

Non-controlling interests |

0.1 |

0.3 |

- Consolidated statement of cash flows

|

In millions of euros |

Six months ended 30 June

2021restated |

Six months ended 30 June

2022 |

|

CASH FLOWS FROM OPERATING ACTIVITIES |

|

|

|

| EBITA including

share of profit of equity-accounted investees |

13.9 |

16.4 |

|

| Depreciation,

amortisation and provisions for recurring operating items, net |

6.9 |

7.7 |

|

|

EBITDA |

20.8 |

24.1 |

|

| Change in

operating working capital requirement |

(19.1) |

(20.2) |

|

| Income tax

paid |

(1.5) |

(4.2) |

|

| Other cash

flows |

(3.7) |

1.1 |

|

| Net cash

generated from/(used in) operating activities of discontinued

operations |

2.3 |

(1.2) |

|

|

Net cash generated

from/(used in) operating

activities |

(1.2) |

(0.4) |

|

| |

|

|

|

| O/w: -

continuing operations |

(3.5) |

0.8 |

|

| - discontinued

operations |

2.3 |

(1.2) |

|

| CASH

FLOWS FROM INVESTING ACTIVITIES |

|

|

|

| Acquisitions of

property, plant and equipment and intangible assets, net of

disposals, o/w: |

(2.8) |

(1.8) |

|

| Acquisitions of

property, plant and equipment and intangible assets |

(2.8) |

(1.9) |

|

| Proceeds from

disposals of property, plant and equipment and intangible

assets |

- |

0.1 |

|

| |

|

|

|

| Free

cash flow |

(4.3) |

(2.2) |

|

| O/w: -

continuing operations |

(6.3) |

(0.9) |

|

| - discontinued

operations |

2.0 |

(1.3) |

|

| |

|

|

|

| Acquisitions of

shares, net of proceeds from sales |

(20.7) |

- |

|

| Net cash

generated from/(used in) investing activities – discontinued

operations |

(0.3) |

26.0 |

|

|

Net cash generated

from/(used in) investing

activities |

(23.8) |

24.2 |

|

| O/w: -

continuing operations |

(23.5) |

(1.8) |

|

| - discontinued

operations |

(0.3) |

26.0 |

|

| CASH

FLOWS FROM FINANCING ACTIVITIES |

|

|

|

| Net financial

income received/(expenses paid) |

(0.5) |

(2.3) |

|

| Proceeds from

new borrowings |

21.0 |

- |

|

| Repayments of

borrowings and movements in other financial liabilities |

- |

(17.0) |

|

| Repayments of

lease liabilities* |

(5.1) |

(4.8) |

|

|

Other movements in equity of the parent company |

(1.7) |

(0.1) |

|

|

Net cash generated

from/(used in) financing

activities |

13.7 |

(24.2) |

|

|

Net increase/(decrease) in cash and cash

equivalents |

(11.3) |

(0.4) |

|

| |

|

|

|

* Including interest expense

3/ Movements in net debt

|

In millions of euros |

|

|

|

Net debt at 31 Dec. 2021 |

64.7 |

|

|

Free cash flow from continuing operations |

5.6 |

Excluding IFRS 16

impact |

|

Free cash flow from discontinued operations |

1.4 |

|

| Sales of shares

and businesses, net of tax |

(26.0) |

|

|

Deconsolidation of MPH |

4.8 |

|

| Other

movements |

1.6 |

|

|

Net debt at 30 June

2022 |

52.1 |

|

4/ Information about the Company’s

capital

|

Number of shares |

At 31 Dec. 2021 |

At 31 Aug. 2022 |

|

Ordinary shares outstanding |

15,668,216 |

15,668,216 |

| Treasury

shares |

876,771 |

830,639 |

| Free shares and

performance shares outstanding |

216,300 |

211,025 |

| Weighted average

number of shares outstanding |

14,776,162 |

14,814,511 |

|

Weighted average number of diluted shares |

14,992,462 |

15,025,536 |

Ownership structure at 31 August

2022

|

In % |

Shares |

Exercisable voting rights |

|

HDL Development(1) |

57.93% |

74.76% |

| Free

float(2) |

36.77% |

25.24% |

|

Treasury shares |

5.30% |

- |

(1) HDL Development is a holding company that is

91,22%-controlled by Dominique Louis (Assystem’s Chairman &

Chief Executive Officer), notably through HDL, which itself holds

0.85% of Assystem’s capital. (2) Including 0.85% held by

HDL.

(1) Operating profit before non-recurring items

(EBITA) including share of profit of equity-accounted investees

other than Expleo Group (€0.4 million in H1 2021 and €0.6 million

in H1 2022). (2) Including profit attributable to non-controlling

interests, amounting to €0.1 million in H1 2021 and €0.3 million in

H1 2022. Profit for the period attributable to owners of the parent

therefore totalled €11.1 million in H1 2021 and €32.4 million in H1

2022. (3) Debt less cash and cash equivalents and after taking into

account the fair value of hedging instruments.(4) EBITA excluding

the impact of IFRS 16 (i.e.€16.1 million in first-half 2022) and

before depreciation and amortisation expense and net provisions for

recurring operating items.

(5) Corresponding to net cash generated from

operating activities less capital expenditure, net of disposals.

Free cash flow from continuing operations including the IFRS 16

impact represented a net outflow of €0.9 million.

- PR ASY_Résultatssemestriels 2022 ENG

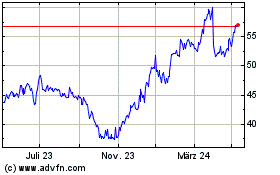

Assystem (EU:ASY)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Assystem (EU:ASY)

Historical Stock Chart

Von Apr 2023 bis Apr 2024