ARGAN: Exceptional Half-year results

Half-year results –

Wednesday 20

July

2022 –

17h45

Half-year results 2022:

-

Further increase of +5% of Net Recurring

Income

-

NAV NTA per share up +12%

to €103

-

2022 dividend expected to be €3.0 per

share, up +15% vs 2021

Key figures for the first half of 2022:

|

Consolidated income statement |

June 30,

2022 |

June 30,

2021 |

Change |

|

Rental income |

€81.7m |

€76.2m |

+7% |

|

Net Recurring Income – group share |

€58.2m |

€55.4m |

+5% |

|

Net Recurring Income per share |

€2.56 |

€2.47 |

+4% |

|

|

|

|

|

|

Valuation indicators |

June 30,

2022 |

Dec. 31, 2021 |

Change |

|

Value of the portfolio

(excl.

duties) |

€4.03

Bn |

€3.75

Bn |

+ 8% |

|

NAV EPRA NTA per

share |

€103.1

** |

€91.8 |

+12% |

|

NAV EPRA NRV per share |

€114.7 ** |

€102.5 |

+12% |

| |

|

|

|

|

|

|

Debt indicators |

June 30,

2022 |

Dec. 31, 2021 |

Change |

|

LTV (excl.

duties) |

41% |

43% |

-200 bps |

|

LTV (incl. duties) |

39% |

41% |

-200 bps |

|

Cost of debt |

1.35% |

1.50% |

-15 bps |

* Calculated on the weighted average number of

shares of 22,713,067** Calculated on the number of shares at the

end of June 2022 of 22,951,290On 12 July 2022, the Executive Board

of ARGAN approved the half-year consolidated financial statement at

end-June 2022. The audit procedures performed by our statutory

auditors on these consolidated financial statements have been

completed. The certification report will be issued after

finalization of the specific verifications.

Upgrade of the 2022 targets:

Given the exceptional half-year results and the ongoing

acquisition of a warehouse of 153,000

sq.m, Argan has raised its 2022

targets.

|

Indicators |

2022

targetsupdated |

2022

targetsinitial |

Changevs 2021 |

|

Rental income |

€165m |

€163m |

+5% |

|

Net Recurring Income |

€118m |

€117m |

+5% |

|

Dividend per share |

3.0

€* |

2.75 € |

+15% |

* Subject to approval during the Shareholders Annual Meeting

KPI are increasing

Recurring net income up

+5%

Recurring net income

group share was up

+5% to €58.2

million at end-June

2022, representing 71% of rental income. The

exceptional net income, group share, of €321.7 million was mainly

due to the very significant positive change in the fair value of

the portfolio of €265 million in the first half of 2022.

Premium

portfolio at €4.03 billion, up

+8% in

six months

The delivered

portfolio (excluding properties under development)

amounts to 3,300,000

sq.m at

end-June 2022. Its valuation amounts to

€4.03 billion excluding transfer duties (€4.24 billion including

transfer duties), an increase of 8% compared to December 31,

2021.

The valuation of the assets delivered at €4.03

billion shows a capitalization rate of 4.10% excluding

transfer duties (3.9% including transfer duties), down

from 4.3% excluding transfer duties as at December 31, 2021.

The average remaining

fixed length of leases remains

stable at 5.8 years compared to 5.9 years as at December

31, 2021.The weighted average age is 10 years

old.

An occupancy rate back to 100%

in 2023

The occupancy rate of the portfolio is

99%, stable compared to the end of December 2021. However,

the ongoing letting of the Ferrières warehouse should enable the

Group to return to an occupancy rate of 100% by early 2023.

Net LTV down to 41% and cost of debt

down to 1.35%

Gross financial debt relating to the portfolio delivered

amounted to €1.9 billion. After taking into account residual cash,

the net LTV (net financial debt/appraised value excluding transfer

duties) fell to 41% at end-June 2022.

The debt is composed of 33% fixed-rate bonds, 31% fixed-rate

amortizing loans, 29% hedged variable-rate amortizing loans and 7%

variable-rate amortizing loans. The average rate of the

debt as at June

30, 2022 was down 15 bps to 1.35% and its maturity is 6.5

years.

+12%

increase of the

continuation EPRA NAV (NTA) to € 103.1 per

share

The NRV (reconstitution NAV) was €114.7 per

share as at June 30, 2022 (+12% over 6 months). The NTA

(continuation NAV) was € 103.1 per share

as at June 30, 2022

(+12% over 6 months).

The NDV (liquidation NAV) was € 103.6 per share as at June 30, 2022

(+13% over 6 months).

This significant increase of

€11.3 in EPRA NTA NAV per share

compared to December 31, 2021

comes from net earnings per share

(+€2.2), the change in asset

value (+€11.5), the payment of the dividend in cash

(-€0.9) and in shares

(-€1.5)

Further growth

ofgroup’s

rental income

An anticipated

indexation of

+4% in 2023

The period of high inflation will have a

direct impact on rent increases through the ILAT, the index of

rents for tertiary activities. For the record, this index

is composed of 50% consumer price index, 25% construction cost

index and 25% annual average French GDP. Argan anticipates

that its rental

indexation will increase

by c.4% in

2023. In this period of

strong inflation, ILAT will support our

rental growth in the coming years.

A strong rental

demand combined with a limited

immediate supply will increase market

rents

Market rents are expected to rise over

the next few years due to an imbalance between sustained

take-up (2.9 million square meters let in H1-2022, up +14% compared

to the 10-year average) and an increasingly constrained immediate

supply (down -25% over 1 year) and also, higher cost of

construction.In France, the vacancy rate is now 3.6%, which is a

historic low. In the most attractive regions, such

as Paris region (Ile-de-France),

the vacancy rate is now around 3%.

Embedded growth for 2022 and

2023

Argan has a pipeline of projects to be delivered

by end-2023 of 170,000 sq.m, fully pre-let. In addition,

the acquisition in progress, with a 12-year firm lease,

which is expected to take place in October 2022, will also

support the growth of the group's rental

income.

|

Operational indicators |

|

|

Operating Portfolio at end-June 2022 |

3,300,000 sq.m |

|

Projects to be delivered in H2-2022 |

50,000

sq.m |

|

Acquisition under premises |

150,000 sq.m |

|

Portfolio at end-2022 |

3,500,000

sq.m |

|

|

|

|

Projects to be delivered

in 2023 |

120,000

sq.m |

Future developments with a yield of 300 bps above

borrowing costs

Construction cost inflation in the first half of

the year is between 15 to 20%, but this only concerns the costs of

new program. As a result, Argan target to maintain at

least 300 bps spread between the rental

yield and the cost of the mortgage debt backed by each program.

Rising rents will support group's

portfolio valuations

Rental growth from indexation, rising

market rents and our developments will support the group's

valuations, offsetting a potential

increase in capitalization rates

A controlled impact of the rise in

interest rates,thanks to a controlled level of the

debt

Debt protected against rising interest

ratesInterest rates have risen sharply

during the second quarter of 2022. However, this increase has no

significant impact because our debt is made up of:

- 62% fixed-rate

debt

- 31% of our debt is at

variable rates, hedged by instruments that are activated

as soon as the Euribor reaches 1.5%.

- Only 7% variable rate debt

A cost of debt that cannot exceed

2%, even if

Euribor reach

3%

|

Euribor |

2022 |

2023 |

2024 |

|

0.0% |

1.40% |

1.25% |

1.25% |

|

1.0% |

1.70% |

1.60% |

1.55% |

|

2.0% |

1.95% |

1.85% |

1.80% |

|

3.0% |

2.10% |

2.00% |

1.95% |

No need to refinance

our debt by 2026

Our mortgage debt (67% of our debt in

H1-2022) has the advantage of amortizing every year and does

not need refinancing in the

markets.Only our bond debt issued in 2021 will need to be

refinanced in 2026, as our €130 million bond debt issued in 2017 is

already provisioned for repayment in July

2023, without

refinancing.

Controlled debt, far from our

covenants

|

Cap rate |

2022 |

2023 |

2024 |

|

4.1% |

42.6% |

42.5% |

41.6% |

|

4.5% |

46.8% |

46.6% |

45.7% |

|

5.0% |

51.9% |

51.7% |

50.7% |

The LTV ratio at end June-2022 is down by 200 bps to 41%, but it

should be noted that this decline is transitory given the

acquisition in progress. Argan

expects the LTV ratio at the end of 2022 to be close to the

43% LTV ratio, published at the

end of 2021.

About Argan

ARGAN is the only French real estate company

specialising in the DEVELOPMENT & RENTAL OF PREMIUM WAREHOUSES

listed on EURONEXT.As at 30 June 2022, ARGAN’s portfolio amounted

to 3.3 million sq.m, comprising approximately 100 warehouses

located exclusively in France, valued at €4.0 billion. ARGAN is

listed on Compartment A of Euronext Paris (ISIN FR0010481960 - ARG)

and is included in the CAC All-Share and IEIF SIIC France indices.

The company opted for the listed real estate investment companies

(SIICs) tax regime on 01 July 2007.www.argan.fr

| Francis

Albertinelli – CFOStéphane Saatdjian – Investors

RelationsTél : 01 47 47 05 46 E-mail :

contact@argan.frwww.argan.fr |

Aude Vayre – Press relationsTél : 06 14 64 15

65E-mail : argan@citigatedewerogerson.com |

|

|

Consolidated income statement

(IFRS)

|

In €m |

June 30,

2021(6

months) |

December 31,

2021(12

months) |

June 30,

2022(6

months) |

|

Rental income |

76.2 |

156.8 |

81.7 |

|

Rebilling of rental charges and taxes |

25.8 |

25.7 |

24.2 |

|

Rental charges and taxes |

-26.9 |

-27.7 |

-25.5 |

|

Other property income (IFRS 16) |

1,5 |

3,1 |

1,6 |

|

Other property expenses |

-0,1 |

-0,3 |

-0,3 |

|

Net property

income |

76,5 |

157,7 |

81,7 |

|

EBITDA (Current Operating Income) |

72.4 |

147.1 |

73.0 |

|

Including impact of IFRS 16 |

1.4 |

3.1 |

1.3 |

|

Change in fair value of the portfolio Change in fair

value IFRS 16 |

286.2-1.0 |

544.6 -2.1 |

265.9 -1.1 |

|

Other operating expenses |

- |

- |

-0.5 |

|

Income from disposals |

- |

18.5 |

-0.1 |

|

EBITDA. after value

adjustments (FV) |

357.6 |

708.2 |

337.1 |

|

Income from cash and equivalents Cost of gross

financial debt Interest on IFRS 16 lease liabilities Borrowing

costs Change in fair value of hedging instruments |

0.0- 14.2-0.8- 1.3- 0.5 |

0.2-29.5-1.6- 2.8- 1.7 |

0.1

-13.0-0.8 - 2.1-

0.5 |

|

Early repayment penalties |

|

|

-6.5 |

|

Income before tax |

340.7 |

672.7 |

314.4 |

|

Other financial expenses |

2.0 |

3.6 |

8.7 |

|

Tax |

- |

- |

- |

|

Share of profit of equity-accounted companies |

- |

- |

- |

|

Consolidated net incomeNet income

- group share |

342.7338.3 |

676.3668.1 |

323.1321.7 |

|

Diluted earnings per share (€) |

15.1 |

29.7 |

14.2 |

Recurring net income

|

In €m |

June 30,

2021(6

months) |

December 31,

2021(12

months) |

June 30,

2022(6

months) |

|

Consolidated net income |

342.7 |

676.3 |

323.1 |

|

Change in fair value of hedging instruments |

0.5 |

1.7 |

0.5 |

|

Change in fair value of the portfolio |

- 286.2 |

- 544.6 |

- 265.9 |

|

Income from disposals |

- |

- 18.5 |

0.1 |

|

Other financial expenses |

-2.0 |

- 3.6 |

- 8.7 |

|

Tax |

- |

- |

- |

|

Share of profit of equity-accounted companies |

- |

- |

- |

|

Early repayment penalties |

- |

- |

6.5 |

|

Allocation of free shares |

- |

- |

1.8 |

|

Other operating expenses non-recurring |

- |

- |

0.5 |

|

Impact of IFRS 16 |

0.4 |

0.6 |

0.5 |

|

Recurring net

Income |

55.4 |

111.9 |

58.4 |

|

Recurring net Income - group

share |

55.4 |

111.7 |

58.2 |

|

Recurring net income per share (€) |

2.5 |

5.0 |

2.6 |

NAV EPRA

|

|

Dec 31, 2021 |

June 30,

2022 |

|

|

NRV |

NTA |

NDV |

NRV |

NTA |

NDV |

|

Shareholders’ equity (in €m)Shareholders’

equity (in €/share) |

2,125.694.1 |

2,125.694.1 |

2,125.694.1 |

2,432.8106.0 |

2,432.8106.0 |

2,432.8106.0 |

|

|

|

|

|

|

|

|

|

+ Fair value of financial instruments (in €m) |

3.2 |

3.2 |

- |

-11.6 |

-11.6 |

- |

|

- Goodwill in the balance sheet (in €m) |

- |

-55.6 |

-55.6 |

- |

-55.6 |

-55.6 |

|

+ Transfer taxes (in €m) |

186.9 |

- |

- |

210.5 |

- |

- |

| |

|

|

|

|

|

|

|

= NAV (in €m) = NAV (in

€/share) |

2,315.7102.5 |

2,073.191.8 |

2,070.091.6 |

2,631.7114.7 |

2,365.5103.1 |

2,377.1103.6 |

- 20220720 - ARGAN-HY-results 2022 en

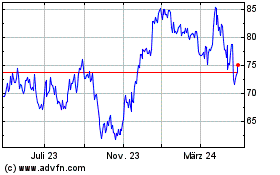

Argan (EU:ARG)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Argan (EU:ARG)

Historical Stock Chart

Von Apr 2023 bis Apr 2024