2021 targets have been exceeded with rental income of €157m (+10%) and a portfolio valued at €3.75bn (excluding transfer taxes)

03 Januar 2022 - 5:45PM

2021 targets have been exceeded with rental income of €157m (+10%)

and a portfolio valued at €3.75bn (excluding transfer taxes)

Annual revenue – Monday 03

January

2022

– 5:45 pm.

2021 targets have been

exceeded with rental income of

€157m

(+10%)

and a portfolio valued at

€3.75bn (excluding transfer

taxes)

Rental income (IFRS) as at 31 December 2021

(unaudited figures)

|

€m |

Financial year

2021 |

Financial year

2020 |

Change |

|

9-month total cumulated (Jan.-Sept.) |

117.0 |

106.0 |

+10% |

|

4th quarter (Oct.-Dec.) |

39.8 |

36.4 |

+9% |

|

Year total |

156.8 |

142.4 |

+10% |

RENTAL INCOME GROWTH TARGET EXCEEDED

In the 4th quarter of 2021, ARGAN, the French

real estate company specialising in the development and rental of

PREMIUM warehouses, recorded rental income of €39.8m, a strong

growth of over +9% compared with the same period last year, due

mainly to the full-year effect of the units delivered throughout

the year 2020 as well as rents generated by developments and

acquisitions made throughout 2021.For the financial year

2021, rental income thus stands

at €156.8m, up

+10% compared with the financial

year 2020 (€142.4m), thus exceeding the

initial target of €154m.

€240 MILLION OF

INVESTMENTS IN 2021

In 2021, ARGAN has invested

€240m, representing more than 325.000 sq. meters

and generating, at a rate of

return of 5.65%,

€13.5m

of rental income:

- In March,

delivery of a logistics platform of 14,200

sqm located in Gondreville, leased to

COLRUYT, a local supermarket brand, for a fixed

term of 9 years. The implementation of a rooftop

photovoltaic power plant producing 150 MWh per year dedicated to

COLRUYT’s own use saves 10 tons of CO² emissions per

year;

- In May,

delivery of the 12,000 sqm

extension consisting of two new units on the site of

Decathlon in Ferrières-en-Brie. One unit is leased to

DECATHLON under a firm 6-year lease. The second

cell is rented to XEFI, a leading IT services company for very

small / very small businesses, for a fixed term of 6 years;

-

In May, acquisition from Carrefour of 3 warehouses located

in Lens, Marseille and Plessis-Pâté for a total surface area of

70,000 sqm in the context of the creation of a joint

property company (SCI – Société Civile Immobilière) held at 60% by

ARGAN and 40% by the Carrefour Group. The warehouse of Plessis-Pâté

is fully leased to CARREFOUR and the refurbishment

of the warehouses of Lens and Marseille, which will be leased to

identified third parties, is ongoing;

-

In June, delivery of a new warehouse of

22,000 sqm in Escrennes, leased to FDG

Group, leader in the non-food retail market, for a

fixed term of 9 years

-

in August, delivery of the 185,000 sqm logistics platform

on 4 levels located near Metz and leased to AMAZON

France for a fixed term of 15 years. The rooftop

photovoltaic power plant, the rainwater collecting system, the

vegetalisation of the site and the other environmental advances

integrated into the project have enabled it to obtain a BREEAM Very

Good certification. Self-consumption saves 36 tons of

CO² emissions per year.

-

In November, delivery of the

18,000 sqm extension of the

logistics platform located in

Meung-sur-Loire to a total of

32,000

sqm. Two units with a total surface area of 13,000

sqm are leased to ASTR'IN, an operator of land

transport and logistics.

At the same time, ARGAN sold a portfolio of four

logistics hubs with a total area of more than 53,000 sqm to OPPCI

GROUPAMA GAN REIM in October 2021.

A PREMIUM PORTFOLIO OF

3.3 MILLION SQ. METERS VALUED AT

€3.75 BILLION EXCLUDING TRANSFER

TAXES AT THE END OF DECEMBER 2021

As at 31 December 2021, the built portfolio

amounts to 3,265,000 sqm. Its valuation is thus increasing by +24%,

from €3,012m at the end of 2020 to €3,745m excluding transfer taxes

(€3,934m including

transfer taxes), resulting in a capitalisation rate of

4.30% excluding transfer

taxes (4.10% including transfer taxes), down sharply

compared to 5.05% excluding transfer taxes as at 31 December

2020.

The weighted average remaining fixed

length of the leases, calculated as at 1st January 2022,

is 5.9 years (up

vs. 5.7 years as at 1st January 2021).The occupancy rate

for the portfolio is 99% and its weighted average

age is 9.6

years (vs. 9.2 years as at 31 December 2020).

Given the current health context, the

annual results presentation will be broadcast live as a video

webcast.

Financial calendar

2022

(Publication of the press release after closing of the stock

exchange)

- 19 January: Annual results

2021 (by

video webcast)

- 24 March: General Shareholders’ Meeting

- 4 April: 1st quarter sales 2022

- 4 July: 2nd quarter sales 2022

- 20 July: Half-year results 2022

- 3 October: 3rd quarter sales 2022

About

Argan

ARGAN is the only French real estate company

specialising in the DEVELOPMENT & RENTAL OF PREMIUM WAREHOUSES

listed on Euronext.As at 31 December 2021, ARGAN’s portfolio

amounted to 3.3 million sq. meters, comprising approximately 100

warehouses located exclusively in France, valued at €3.75 billion

and generating annual rental income of €162 million. ARGAN is

listed on Compartment A of Euronext Paris (ISIN FR0010481960 - ARG)

and is included in the CAC All-Share and IEIF SIIC France indices.

The company opted for the listed real estate investment companies

(SIICs) tax regime on 01 July 2007.www.argan.fr

|

Francis Albertinelli – Chief Financial and Administrative

OfficerMarie-Caroline Schwartz – General CounselTel: +33 1 47 47 05

46 E-mail: contact@argan.frwww.argan.fr |

Aude Vayre – Media relationsTel: +33 6 14 64

15 65E-mail: argan@citigatedewerogerson.com |

|

|

- 20220103 - Annual Revenue 2021 - English version

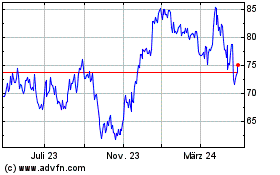

Argan (EU:ARG)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Argan (EU:ARG)

Historical Stock Chart

Von Apr 2023 bis Apr 2024