- Consolidated sales of €48.1 million, +3.9% at constant exchange

rates

- EBITDA down 9.0% to €9.9 million with a margin of 20.5%

- Recurring Operating Profit of €1.9 million

- Cash and cash equivalents of €24.6 million at December 31,

2021

Regulatory news:

Amplitude Surgical (ISIN: FR0012789667, Ticker: AMPLI, eligible

for PEA-PME plans) (Paris:AMPLI), leading French player on the

surgical technology market for lower-limb orthopedics, announces

its results for the first half of its 2021-22 financial year to

December 31, 2021.

Olivier Jallabert, Amplitude Surgical’s CEO, said:

“During the first half of our 2021-22 financial year, Amplitude

Surgical recorded a 3.9% increase in sales at constant exchange

rates. The decrease in the gross margin was a consequence of a

weaker level of industrial activity than in the first half of

2020-2021 combined with an increase in Sales & Marketing

expenses in foot and ankle activities, leading to a 9.0% fall in

EBITDA to €9.9 million. The Recurring Operating Profit was €1.9

million, a slight decrease on the previous year”.

Financial summary – actual exchange rates:

€m - IFRS

H1 2021-22

H1 2020-21

Δ

Sales

48,099

45,909

4.8%

Gross margin

35,455

34,939

1.5%

as a % of sales

73.7%

76.1%

-240 bps

Sales & Marketing costs

18,629

16,413

+13.5%

General & Administrative costs

5,508

6,225

-11.5%

Research & Development costs

1,466

1,469

-0.2%

EBITDA

9,852

10,832

-9.0%

as a % of sales

20.5%

23.6%

-310 bps

Recurring Operating Profit

1,879

2,042

Non-recurring operating

income/expenses

-326

-887

Operating profit/loss

1,553

1,156

Financial profit/loss

-4,321

-6,220

Net profit/loss – Group share

-2,833

-4,984

Net financial debt

119,482

114,521

Cash position at end of period

24,628

36,497

EBITDA down 9.0% with a gross margin of 20.5%

In the first half of its 2021-22 financial year (from July to

December 2021), Amplitude generated sales of €48.1 million, up 4.8%

in actual terms and 3.9% at constant exchange rates compared with

the previous year. Despite this improvement, activity continued to

be negatively affected by the public health situation associated

with the COVID-19 pandemic, notably knee and hip activity.

- Knee and hip activity was stable, with sales up 0.3% in

actual terms and down 0.3% at constant exchange rates. Following a

first quarter that was down on the previous year, notably impacted

by lower operating room availability in France, the beginning of

the second quarter (from mid-October to mid-November) saw an upturn

in the sales momentum with fewer restrictions associated with the

public health situation than the previous year. However, this

rebound was slowed down again from the beginning of December

following the increase in COVID-19 contaminations. Overall, during

the first half, the health situation and reduced availability of

operating rooms and medical personnel are continuing to have a

considerable negative impact on activity.

- Novastep, innovative solutions for foot and ankle

surgery, generated strong growth over the half with sales totaling

€7.9 million (+33.1% at constant exchange rates), driven by the

United States. Novastep’s activity now accounts for 16.4% of total

Group sales.

Amplitude Surgical recorded a gross margin of 73.7% over the

half, down 240 bps, impacted by the weaker dynamism of its

industrial activities compared with first half of 2020-2021 and a

negative change in the euro compared to the currencies of the

Group’s international distribution subsidiaries.

The Group’s operating expenses totaled €25.6 million, up 6.2%

compared with end-December 2020.

Sales & Marketing costs increased by 13.5% due to the growth

in Novastep’s foot and ankle activities.

General & Administrative costs decreased by 11.5% to €5.5

million, with the Group continuing its efforts to control costs in

a commercial environment that has been significantly disrupted by

the public health situation.

In the first half of 2021/2022, Research & Development

expenses represented 3.0% of sales and were stable, in absolute

value, compared with the first half of the previous year.

Amplitude Surgical had a workforce of 453 staff at the end of

December 2021, versus 443 at end-June 2021 and 442 at end-December

2020. Personnel costs were up 5.9% compared with H1 2020-2021.

EBITDA was thus €9.9 million, down 9.0%, with a margin of 20.5%,

down 310 bps compared with the first half of 2020-21.

The Group generated a Recurring Operating Profit of €1.9 million

over the half, versus €2.0 million in the first half of 2020/2021,

the positive sales trend being offset by a lower margin and the

increase in Sales & Marketing expenses. The Operating Profit

was €1.6 million, versus €1.2 million in H1 2020/2021.

The Financial Result was -€4.3 million and consisted primarily

of an interest expense of €4.8 million and the booking of a net

currency gain of €0.7 million at end-December 2021.

Financial structure: cash of €24.6 million at the end of

2021

The net cash flow generated by operating activity was a positive

€1.7 million over the half, versus a negative €1.0 million in the

first half of 2020-21.

Investments totaled €4.9 million in the first half of 2021-22

versus €4.3 million in the first half of the previous year.

At end-December 2021, the Group had cash and cash equivalents of

€24.6 million. Its Net Financial Debt was €119.5 million, giving

gearing (Net Financial Debt over Shareholders’ Equity) of 2.19,

compared with 2.04 at the end of June 2021.

Key first-half events

- Divestment of two Group subsidiaries

- On July 23, 2021, the Group divested 100% of its Amplitude

Ortho SRL subsidiary (Romania) to GBG MLD SRL, the distributor of

the Group’s products in Moldova. The divested company will continue

to market the Group’s products on the Romanian market as a

distributor.

- With its growth failing to meet expectations, on August 13,

2021 the Group divested 80% of its Matsumoto Amplitude Inc.

subsidiary (Japan) to Mr. Takeshi Matsumoto, who already held 20%

of this subsidiary through his company Matsumoto Medical. Following

this divestment, the subsidiary’s new shareholders initiated it

winding up.

- URSSAF audits on tax on the promotion of medical

devices

- On January 27, 2022, the Grenoble Court of Appeal rejected

Amplitude SAS’ request to invalidate the adjustment with regard to

tax on the promotion of medical devices for the period from July 1,

2014 to June 30, 2017. The amount of this adjustment is €5.8

million. All these elements have been fully provisioned in the

Group’s accounts. Amplitude SAS will appeal this decision in the

Court of Cassation.

- On September 21, 2021, the Group received a letter of

adjustment from URSSAF following a fourth audit pertaining to tax

on the promotion of medical devices for the period from July 1,

2017 to June 30, 2020. This letter of adjustment would lead to the

repayment of social contribution arrears of €5.9 million, a sum

already provisioned in the Group’s accounts in previous financial

years. As with its previous disputes, the Group has formulated its

observations and will table a request with the URSSAF’s Amicable

Settlement Board.

Should this request be rejected, the Group will ask the Valence

Superior Court (Tribunal de Grande Instance) to invalidate the

adjustment.

- Dispute with Zimmer Biomet

- On November 4, 2021, the Grenoble Court of Appeal rejected the

case filed by Zimmer Biomet in the dispute pertaining to alleged

unfair competition and ordered the latter to pay €25,000 to

Amplitude SAS with respect to article 700 of the Code of Civil

Procedure. Zimmer Biomet has decided to lodge an appeal with the

Court of Cassation.

Outlook

- The Group has no commercial exposure in Ukraine or Russia. Its

exposure is limited to changes in energy costs and the price of raw

materials, notably titanium, that impact product manufacturing

costs.

- The improvement of the sanitary situation in France since

February has allowed since the beginning of March, a return of the

market closer to normal.

Availability of the financial report

Amplitude Surgical has made its half-year financial report to

December 31, 2021 available to the public and filed it with the AMF

French stock market authorities.

This half-year financial report can be found on Amplitude

Surgical’s website at www.amplitude-surgical.com/fr, in the

“Documentation / Financial Report” section.

Next financial press release:

Sales for the first 9 months of 2021-22, on Thursday April

21, 2022 (after market).

About Amplitude Surgical

Founded in 1997 in Valence, France, Amplitude Surgical is a

leading French player on the global surgical technology market for

lower-limb orthopedics. Amplitude Surgical develops and markets

high-end products for orthopedic surgery covering the main

disorders affecting the hip, knee and extremities, and notably foot

and ankle surgery. Amplitude Surgical develops, in close

collaboration with surgeons, numerous high value-added innovations

in order to best meet the needs of patients, surgeons and

healthcare facilities. A leading player in France, Amplitude

Surgical is developing abroad through its subsidiaries and a

network of exclusive distributors and agents distributing its

products in more than 30 countries. Amplitude Surgical operates on

the lower-limb market through the intermediary of its Novastep

subsidiaries in France and the United States. At June 30, 2021,

Amplitude Surgical had a workforce of 443 employees and recorded

sales of nearly 95.5 million euros.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220323005478/en/

Amplitude Surgical Dimitri Borchtch CFO finances@amplitude-surgical.com

+33 (0)4 75 41 87 41

NewCap Investor

Relations Mathilde

Bohin/Thomas Grojean amplitude@newcap.eu +33 (0)1 44 71 94

94

NewCap Media

Relations Nicolas

Merigeau amplitude@newcap.eu +33 (0)1 44 71 94 98

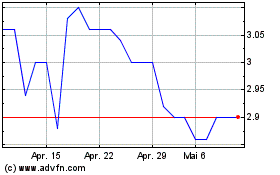

Amplitude Surgical (EU:AMPLI)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Amplitude Surgical (EU:AMPLI)

Historical Stock Chart

Von Apr 2023 bis Apr 2024