Acceleration of revenue growth in Q3 2022

PRESS RELEASE

Loudéac, 10 November 2022

Acceleration of revenue growth in Q3

2022

Resilience of the model demonstrated in a

demanding environment

- Q3 2022 revenue: €33.9m, up 20% (+13% organic)

- Revenue at 30 September 2022: €95.4m, up 19% (+9%

organic)

- All business segments showed double-digit growth in Q3

2022

WINFARM (ISIN: FR0014000P11 - ticker: ALWF),

the number one French distance seller for the farming industry,

today reported its revenue for Q3 2022 and for the first nine

months of 2022.

|

|

Q3 |

|

9M |

| in €m,

unaudited |

2021 |

2022 |

Chg. |

Chg. organic1 |

|

2021 |

2022 |

Chg. |

Chg. organic1 |

|

Farming supplies |

25.1 |

29.8 |

+19% |

+11% |

|

71.6 |

85.0 |

+19% |

+8% |

|

Farming nutrition |

2.7 |

3.5 |

+29% |

+29% |

|

7.5 |

9.0 |

+20% |

+20% |

|

Other2 |

0.4 |

0.6 |

+30% |

+29% |

|

1.2 |

1.4 |

+15% |

+9% |

|

TOTAL |

28.3 |

33.9 |

+20% |

+13% |

|

80.3 |

95.4 |

+19% |

+9% |

Patrice Etienne, Chairman-Chief Executive

Officer and founder of WINFARM, said: "Our results are on track

again in the third quarter. The quality of the solutions we provide

to farmers is a key asset underpinning the resilience of our model.

Our food supplement products for livestock in particular helped

farmers to deal with the drought during the summer, which reduced

the amount of fodder available. Today, the breadth of our ranges

and their availability in a context where most other players have

been faced with shortages are key factors in structuring a lasting

relationship with our customers.”

At 30 September 2022, consolidated revenue rose

by 19% to €95.4m, representing organic growth of 9% excluding the

integration of the Kabelis companies acquired in July 2022. This

level of activity at 30 September 2022 represents 88% of the

revenue generated in full-year 2021, confirming positive sales

momentum in the third quarter, after a successful first half of the

year.

Consolidated Q3 2022 revenue came to €33.9m, up

20% versus Q3 2021. In organic terms, revenue grew by a strong 13%.

WINFARM benefited over the quarter from strong momentum across the

board, with all of its businesses recording double-digit growth

over the period.

The Farming Supplies business (88% of

revenue for the quarter), whose products are marketed under the

Vital Concept brand, made revenue of €29.8m, up 19% compared with

Q3 2021 (+11% organic). This performance is all the more remarkable

given the demanding environment caused by persistent inflation in

raw material prices, even if it has eased in recent months. In

order to minimise the impact on its business, WINFARM anticipated

this price pressure at an early stage by building stocks in certain

items and successfully passing on purchase price increases over the

months without losing customers.

The Farming Nutrition business (10% of

revenue for the quarter), whose products are marketed under the

Alphatech brand, made revenue of €3.5m, representing sharp organic

growth of 29%. The performance of export solutions continued to

drive the Group's results.

ACQUISITION OF KABELIS IN FRANCE

During Q3, WINFARM announced the acquisition of

the KABELIS companies specialised in landscaping and green space

development, creating a French champion on this market and the

largest player in the Grand Ouest region.

Founded in 2007, KABELIS specialised in

fertilisers, seeds, services for local authorities, horticulture,

golf courses, sports grounds, etc. and became the leading French

player in landscaping and green space development.

This second acquisition since the IPO, after

that of BTN de Haas in the Netherlands in 2021, sees WINFARM forge

ahead with the implementation of the roadmap it announced during

its IPO at the end of 2020, combining organic growth and

acquisitions to become a key player in the upstream agriculture

sector in Europe.

CONTINUED GROWTH EXPECTED IN Q4 2022

Having demonstrated its ability to continue

generating strong business growth during the first nine months of

the year, despite a demanding environment, by offering customers

solutions that contribute to operational performance and

competitiveness, WINFARM is confident that it will continue to grow

in Q4 2022.

In the longer term, the Group reiterates its

revenue target for 2025 of around €200m and an EBITDA margin of

around 6.5%. It expects to achieve half of this acceleration in

growth through organic growth and half through external growth.

About WINFARM

Founded in Loudéac, in the heart of Brittany, in

the early 1990s, WINFARM is now the French leader in distance

selling for the agricultural world. WINFARM offers farmers and

breeders comprehensive, unique and integrated solutions to help

them meet the new technological, economic, environmental and social

challenges of the next generation of agriculture. With a vast

catalogue of more than 15,500 product references (seeds,

phytosanitary, harvesting products, etc.), two-thirds of which are

own brands, WINFARM has more than 44,500 customers in France and

Belgium.

WINFARM generated revenue in 2021 of €108m. By

2025, WINFARM aims to achieve revenue of around €200m and an EBITDA

margin of about 6.5%.

The company is listed on Euronext Growth Paris

(ISIN: FR0014000P11 - ticker: ALWF) - Eligible for PEA PME equity

savings plans - Certified as an "Innovative Company" by

bpifrance.

For more information about the company:

www.winfarm-group.com

Contacts:

|

WINFARM investisseurs@winfarm-group.com |

|

|

ACTIFIN, financial communications Benjamin LEHARI+33 (0)1 56

88 11 11winfarm@actifin.fr |

ACTIFIN, financial press relations Jennifer JULLIA

+33 (0)1 56 88 11 19 jjullia@actifin.fr |

1 Like-for-like basis: excluding the

consolidation of Kabelis group companies in 2022 revenue

2 Revenue from farming advisory services (under

the Agritech brand) and experimental farm activities (under the Bel

Orient brand)

- WINFARM_PR_revenue_Q3_2022_final

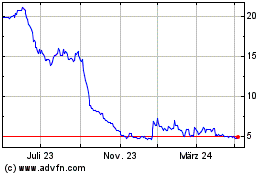

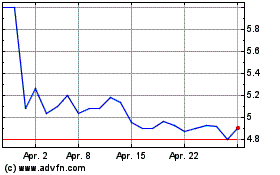

Winfarm (EU:ALWF)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Winfarm (EU:ALWF)

Historical Stock Chart

Von Apr 2023 bis Apr 2024