Winfarm : First-Half 2021 Results.

PRESS RELEASE Loudéac, 13 October

2021

FIRST-HALF 2021 RESULTS

Solid sales growth

Improving the profitability of Farming

Supplies

Structuring the Group to embark on a new

phase of growth

WINFARM (ISIN: FR0014000P11 - ticker:

ALWF), No. 1 French distance-seller for the farming

industry, announced its consolidated results today for the

first half of 2021.

On 13 October 2021, the Board of Directors

approved the consolidated financial statements for the financial

year ended 30 June 2021. These financial statements have been

subject to a limited review by the statutory auditors, and the

certification reports are currently being prepared.

WINFARM recalls that

the Group has sponsored a professional cycling team under a 3-year

contract. In 2020, WINFARM reported on adjusted EBITDA, restated

for these costs, for the purpose of presenting the Group’s economic

performance without taking these specific expenses into account.

From 2021, the sponsorship agreement will become a partnership

agreement (€400k/year). The Group has decided to return to an

EBITDA without restatement for the sake of readability of its

financial statements from now on to ensure comparability with

respect to the EBITDA target it has set for 2025.

|

Consolidated data, French accounting standards, Limited review, in

€k |

H1 2021 |

H1 2020 |

|

Revenue |

51 996 |

49 402 |

|

Sponsorship and image rights expenses1 |

(200) |

(1 483) |

|

EBITDA |

2 221 |

1 018 |

|

EBTIDA margin |

4.3% |

2.1% |

|

Depreciation, amortisation and provisions |

(1 318) |

(1 052) |

|

Operating income/loss |

1 023 |

50 |

|

Financial income/loss |

(91) |

(42) |

|

Non-recurring profit (loss) |

92 |

188 |

|

Corporate tax |

(461) |

(190) |

|

Share of net profits of entities accounted for by the equity

method |

60 |

191 |

|

Net income (Group share) |

660 |

111 |

GROWTH IN SALES IN HISTORICAL ACTIVITY,

ACCELERATION IN GROWTH DRIVERS

|

In millions of euros, Limited review |

H1 2021 |

H1 2020 |

Change |

|

Farming Supplies |

46.5 |

42.8 |

+9% |

|

Farming Nutrition |

4.8 |

6,0 |

-20% |

|

Other |

0.7 |

0.6 |

+15% |

|

Total |

52.0 |

49.4 |

+5% |

FARMING SUPPLIESAcceleration in

the high-potential horse and landscape markets (+41% and +85%,

respectively)

The Farming Supplies business (89% of H1 2021

revenue), under the Vital Concept brand, recorded sales growth of

+8.7% year-on-year.

WINFARM benefited from the impacts of its

diversification in the horse and landscape markets, where sales

continued to gather pace over the first six months of the year,

generating growth of +40.6% and +84.6%, respectively. These

performances are all the more noteworthy for coming on the heels of

sharp respective gains of +23% and +42% in 2019, and +33% and +88%

in 2020, underscoring the impressive potential of these markets to

contribute to the Group’s future growth.

The Group also benefited from strong growth in

the Farm Gates segment, single-handedly accounting for more than

one-third of total H1 2021 revenue growth.

Drawing on its well-established reputation,

Vital Concept has become a key brand and a leading partner in these

two markets.

The Group is also expanding in its historical

scope of operations, aided by successful diversification in

high-demand categories such as the Tubular range in livestock

equipment, wear parts with the development of the STEROK brand, and

the Clothing & Footwear range.

FARMING NUTRITIONFarming

Nutrition: Change of Management and cyclical downturn in exports

due to the health crisis

At the beginning of the year, the Group’s

Management decided to review the Operational Management of Farming

Nutrition, under the Alphatech brand, to enable it to be able to

follow the strategic roadmap. In addition, business was temporarily

penalised due to the temporary impacts of the rise in bird flu

cases in Southeast Asian countries combined with the conditions

brought on by the COVID-19 health crisis, which continued to

adversely affect export trade given that Alphatech earns more than

50% of its revenue outside France.

IMPROVEMENT IN PROFITABILITY CARRIED BY THE

FARMING SUPPLIES DIVISION

The Group’s gross margin grew faster than business

growth. Up +8% to €17.1m, it now accounts for 32.8% of revenue vs.

32.1% in H1 2020. Against a backdrop of generalised increases in

commodities prices, this control of the gross margin illustrates

the Group’s ability to effectively pass on purchase price

increases.

The increase in business and the continuation of

work to optimise logistics flows as well as the reduction in the

use of subcontracting continued to favour the increase in EBITDA

for the farming supplies division, which amounted to €2.2 million,

representing 6.1% of revenue compared with 4.2% in H1 2020.

In the Farming Nutrition division, EBITDA

increased to €0.6m compared to €0.2m in H1 2020, benefiting from

the increase in gross margin, which helped limit the impact of the

drop-in activity in the division due to the decline in export

sales.

Overall, consolidated EBITDA amounted to €2.2m

compared to €1.0m in H1 2020, representing an EBITDA margin of 4.3%

of revenue compared with 2.1% in H1 2020. After reintegrating

sponsorship and image rights expenses, the adjusted EBITDA rate was

4.5% vs. 5.1% in H1 2020.

After taking into account depreciation,

amortisation and provisions for €1.3m, operating income amounted to

€1.0m compared to €0.1m in H1 2020.

Net profit, Group share, amounted to €0.7m vs.

€0.1m in H1 2020

A SOLID FINANCIAL STRUCTURE

As at 30 June 2021, the company posted equity of

€22.9m for financial debt of €18.6m (including amounts due to

credit institutions, financial liabilities on financial leases,

current bank loans and contributions to current accounts), down

€5.5m compared to H1 2020. Cash was €16.2m, including the proceeds

from the exercise of the overallotment option related to the

fundraising carried out in December 2020 as part of the company’s

IPO.

2021 OUTLOOK Heading for a new

phase of growth

In the second half of 2021, the Group is

confident that the strong sales momentum will continue. WINFARM

will benefit in particular from the acquisition of BTN Haas last

July, an important new step in its European conquest strategy, by

establishing itself as a major player in the Netherlands, one of

the most important markets in the field of agriculture and

livestock in Europe, and establishing itself as a major

international player.

The next objectives will be focused primarily on

the success of the integration, with the aim of extending the scope

of BTN de Haas to the farming nutrition market, offering

significant potential for development.

The Group will also capitalise on the

strengthening of Alphatech’s managerial structure, whose mission

will be to increase the awareness of the Alphatech brand and

accelerate its sales once the health situation stabilises. This

business development plan will ultimately be linked to the

production of the food supplement plant, which is expected to begin

construction in the coming months.

On the Farming Supplies markets, the expansion

of the client base to new market segments such as grain producers,

the development of the web channel with the roll-out of a

purchasing recommendations algorithm and the realisation of new

partnerships will be all the levers that should enable the Group to

accelerate the growth of its Farming Supplies business. The Group

will also benefit from the strong potential of the horse and

landscape markets, a growth driver for the Group that offers solid

opportunities in terms of both organic growth and external growth

in markets that are still highly fragmented.

WINFARM is confident that the strong sales

momentum will continue in H2 2021. The rise in commodities prices

could, however, weigh slightly on the excellent margins. For 2021,

the Group anticipates continued growth in the first half of the

financial year. This growth in the business should be accompanied

by an improvement in EBITDA.

In the longer term, the Group reiterates its

targets, which, by 2025, aim to achieve revenue of around €200m and

an EBITDA margin of around 6.5%. Half of this acceleration in

growth would be achieved through organic growth and half through

external growth.

About WINFARM

Founded in Loudéac, in the heart of Brittany, in

the early 1990s, WINFARM is now the French leader in distance

selling for the agricultural world. WINFARM offers farmers and

breeders comprehensive, unique and integrated solutions to help

them meet the new technological, economic, environmental and social

challenges of the next generation of agriculture. With a vast

catalogue of more than 15,500 product references (seeds,

phytosanitary, harvesting products, etc.), two-thirds of which are

own brands, WINFARM has more than 44,500 customers in France and

Belgium.

In 2020, WINFARM recorded sales of €98.9m,

surpassing its target.

By 2025, WINFARM aims to double in size, with a

revenue target of around €200m and an EBITDA margin of about

6.5%.

For more information about the company:

www.winfarm-group.com

Contacts:

|

WINFARMinvestisseurs@winfarm-group.com |

|

|

ACTIFIN, financial communicationsBenjamin

LEHARI+33 (0) 1 56 88 11 11winfarm@actifin.fr |

ACTIFIN, financial press relationsJennifer

JULLIA+33 (0)1 56 88 11 19jjullia@actifin.fr |

1 From 2021, the title sponsor contract becomes

a partnership contract

- WINFARM_CP_RS_2021 vDEF UK

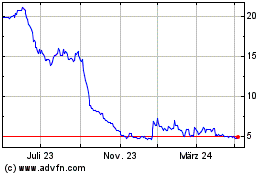

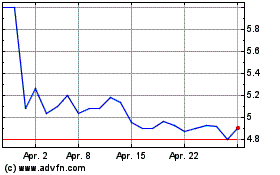

Winfarm (EU:ALWF)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Winfarm (EU:ALWF)

Historical Stock Chart

Von Apr 2023 bis Apr 2024