Regulatory News:

TheraVet (ISIN: BE0974387194 - ticker: ALVET) (Paris:ALVET)

(Brussels:ALVET), a pioneering company in the management of

osteoarticular diseases in pets, today announces its financial

results ended June 30, 2022 and provides an update on the

development of its activities. The Company announces also the

publication of its half-year financial report.

Recent operational highlights

- Partnership agreement with Industrie Biomediche Insubri SA

(IBI, Switzerland) broadening BIOCERA-VET® product line with a

biological bone graft, BIOCERA-VET® SmartGraft

- Distribution agreement in France, United Kingdom, Ireland and

Spain with leading companies in the distribution of veterinary

products

- Commercial launch of the whole BIOCERA-VET® line in Belgium,

France, The Netherlands, Spain, UK & Ireland

- Commercial launch of BIOCERA-VET® RTU and Granules in the

United States of America with a focus of its marketing and

commercial efforts on the states of Texas, Florida and the

Carolinas

- Positive efficacy and safety results of BIOCERA-VET® - Bone

Surgery in arthrodesis1 confirmed and awarded in international

congress VOS/WVOC2 2022

- Available cash of €3.50 million on June 30, 2022 covering

operational activities until the second quarter 2024

2022 half-year financial results

Financial information at June 30, 2022

en € (Belgian GAAP) (1)

30.06.2022

6 months

31.12.2021

12 months

30.06.2021

6 months

Turnover

42,753

12,348

1,943

Other operating income

1,158,057

2,181,390

1,065,438

Variation of stocks of finished

goods and work and contracts in progress

142,359

54,843

36,585

Produced fixed assets

870,044

1,930,219

913,805

Operating Grants

46,665

54,199

39,090

Other operating income

98,989

142,129

75,958

Total Operating products

1,200,810

2,193,738

1,067,381

Operating charges

-2,223,199

-3,364,356

-1,709,367

Goods for resale, raw materials

and consumables

-259,344

-63,972

-25,862

R&D Expenses

-342,316

-1,152,580

-628,092

Expenses related to IPO

-130,103

-174,932

-170,491

Marketing and commercial

expenses

-130,309

-199,622

-97,899

General & administrative

expenses

-325,291

-492,072

-207,187

Consultants & Temporary

staff

-422,776

-517,790

-233,753

Staff

-611,756

-762,085

-345,615

Other operating charges

-1,304

-1,303

-468

Brutto Operation result

-1,022,389

-1,170,618

-641,986

Amortization & Depreciation

-193,509

-558,294

-336,472

-1,215,898

-1,728,912

-978,458

37,337

261,088

208,176

-1,178,561

-1,467,824

-770,282

126,974

-1,178,561

-1,340,850

-770,282

- Net Cash & Cash equivalents at the

end of the period

3,498,856

5,631,418

7,246,645

(1) The accounts presented have not been reviewed by the

Statutory Auditors

During the first half of 2022, TheraVet generated €42,753 of

revenues representing an increase of €30,405 as compared to

December 31, 2021.

The revenues of the first half of 2021, during which the sales

of the BIOCERA-VET® product had started on the Belgian market, then

represented an amount of €1,943. During the second half of 2021,

the French and Dutch markets were approached, allowing Theravet to

reach a turnover of €12,348 as of December 31, 2021. At the end of

the first half of 2022, the commercialization of the range

BIOCERA-VET® in the United Kingdom, Ireland and Spain enable the

company to significantly increase sales.

The Company also generated €870,044 of “capitalised production”

as a result of the activation of development expenses related to

the BIOCERA-VET® and VISCO-VET® programs during the first half of

2022, representing a decrease of €43,761 as compared to the first

half of 2021.

The inventory change of finished products and work in progress

increases by €142,359 during the first half of 2022, bringing the

inventory from €54,843 at December 31, 2021 to €197,202 as of June

30, 2022. This increase is resulting of the constitution of

inventories in marge of the commercial expansion in new market and

the expected increased demand.

Other operating income of €98,989 as of June 30, 2022, compared

to the amount of €75,958 as of June 30, 2021, represents an

increase of €23,031 as a result of the increase in payroll and the

financial contributions received in this context.

In accordance with the roadmap presented at the time of the IPO,

the increase in “Purchases and expenses" reflects the development

of preclinical and clinical programs, the commercialization of

BIOCERA-VET® products and the structuring of the Company:

- COGS are significantly increased due to the

commercialization of the BIOCERA-VET® products in Belgium, France

and the Netherlands as well as the launch of the commercialization

in new countries in March 2022 (United Kingdom, Ireland and Spain).

A stock of products from the new BIOCERA-VET® products (BIOCERA-VET

RTU, Granules and SmartGraft has also been constituted. -

R&D expenses of €342,316 as from June 30, 2022 decreased

by €285,776 compared to the first half of 2021.

This diminution is explained by the particularly important

R&D activities made in 2021:

- The expenses linked to the development of VISCO-VET® reached

€453,099 as of June 30, 2021 (to reach €841,757 at the end of 2021)

and covered preclinical studies (on the mechanism of action),

clinical developments and the validation of the GMP manufacturing

process.

- The expenses linked to the development of BIOCERA-VET® reached

€135,831 as of June 30, 2021 (to reach €298,822 at the end of 2021)

and covered the validation of the manufacturing process, the

development of analytical methods and the clinical case collection

in order to gather safety and efficacy results on the

products.

In 2022, activities related to the development of VISCO-VET®

represent €241,043 and cover mainly the activities related to the

pivotal European clinical study and the manufacturing process

validation whereas the activities related to the BIOCERA-VET®

product range represent €99,034 mainly covering the clinical case

collection.

- Listed company expenses are amounting to €130,103 which

represents a decrease of €40,388 compared to the first half of 2021

and resulting from the stock market communication activities. -

Marketing & Sales expenses amount to €130,309

representing an increase of €32,410 as compared to first half of

2021, resulting from the effort of the Company to prepare the

commercial launch of the BIOCERA-VET® products on the European and

American markets. - G&A expenses increased by €118,104

as compared to the first half of 2021 and represent €325,291 mainly

as a result of

- the lawyers support in the preparation of the different

partnership agreements negotiated and signed over 2021 and early

2022,

- the fixed structural expenses related to the employees

(increase of its staff from 7 to 12 employees between June 2021 and

2022).

- The costs of consultants and interims are to be

analyzed in parallel with the staff expenses since they are

operational consultants to structure and strengthen the Company.

These costs, representing an amount of €422,776 as of June 30,

2022, increased by €189,023, or 81%, compared to the amount of

€233,753 in June 2021. This increase is linked to the increase of

the expert consultants as well as a punctual strengthened of the

team to prepare the commercial launches and add the new products in

the BIOCERA-VET range - Staff expenses reached €611,756 in

June 2022, compared to €345,615 in June 2021. This increase of

€266,141 is explained by the hiring of 5 new employees as part of

the structuring and development of the Company and represent an

increase of the payroll of 77%.

Finally, the amortization of development expenses related to the

BIOCERA-VET® Bone Surgery and VISCO-VET® programs represents

€193,509 in June 2022 and resulted in an operating loss of €1.2

million compared to €978,458 as of 30 June 2021 and a net loss of

€1.1 million compared to €770,282 at June 30, 2021.

The Company’s cash and cash equivalents at June 30, 2022

amounted to €3,498,856 allowing to fund operation until second

quarter of 2024.

Post-closing event as of June 30, 2022

In July 2022, the Company received approval from the Walloon

Region on 2 development projects submitted for assessment during

the period.

The first project, supported for a total amount of €1,070,650

(including €599,922 in the form of a subsidies and €470,728 in the

form of a recoverable advance), concerns the development of new

proprietary cements with improved properties as well as the

development of BIOCERA-VET® combined with an antibiotic.

The second project, supported for a total amount of €1,421,095

(including €429,132 euros in the form of a subsidies and €991,963

in the form of a recoverable advance), concerns the VISCO-VET®

product and aims to finalize its characterization and

development.

These subsidies granted cover activities that started during the

period and were therefore taken into account in the closing of the

period.

Next key milestones of the next half-year 2022

- Continue with the commercialization of BIOCERA-VET®;

- Finalize the new formulation of BIOCERA-VET® combined with

antibiotics and prepare for the commercial launch;

- Pursue the operational efforts on the pivotal European clinical

study evaluating VISCO-VET® in dogs suffering from osteoarthritis

to improve recruitment and limit delays;

- Increase the visibility of the Company and of its products

among the orthopedic veterinarians community with commercial and

scientific participation in international congresses.

Half-year Report 2022

The 2022 half-year financial report ending June 30, 2022 will be

published September 09, 2022 and will be available on the Company’s

website, www.theravet-finances.com.

Financial calendar 2023

Full year financial results: April, 25, 2023 Ordinary

General Assembly: June 01, 2023 Half-year business

update: July 11, 2023 Half-year financial results:

September 06, 2023

About TheraVet SA TheraVet is a veterinary biotechnology

company specialising in osteoarticular treatments for companion

animals. The Company develops targeted, safe and effective

treatments to improve the quality of life of pets suffering from

joint and bone diseases. For pet owners, the health of their pets

is a major concern and TheraVet’s mission is to address the need

for innovative and curative treatments. TheraVet works closely with

international opinion leaders in order to provide a more effective

response to ever-growing needs in the field of veterinary medicine.

TheraVet is listed on Euronext Growth® Paris and Brussels, has its

head office in Belgium (Gosselies) with a US subsidiary in Texas.

For more information, visit the TheraVet website Or follow us on

LinkedIn / Facebook / Twitter

Forward-looking statements This release may contain

forward-looking statements. Forward-looking statements may include

statements regarding the Company's plans, objectives, goals,

strategies, future events, the safety and clinical activity of

TheraVet’s pipelines and financial condition, results of operation

and business outlook. By their nature, forward-looking statements

involve inherent risks and uncertainties, both general and

specific, and there are risks that predictions, forecasts,

projections and other forward-looking statements will not be

achieved. These risks, uncertainties and other factors include,

among others, those listed and fully described in the “Risk

Factors” section in the Annual Report. TheraVet expressly disclaims

any obligation to update any such forward-looking statements in

this document to reflect any change in its expectations with regard

thereto or any change in events, conditions or circumstances on

which any such statement is based, unless required by law or

regulation.

1 Surgical procedure to restore function and alleviate

pain in carpal and tarsal joints with ligamentous injuries, bone

fractures, joint luxation or subluxations 2 VOS: Veterinary

Orthopedic Society ; WVOC: World Veterinary Orthopaedic

Congress

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220908005678/en/

TheraVet Chief Operating Officer Sabrina Ena

investors@thera.vet Tel: +32 (0) 71 96 00 43

Chief Corporate Officer Julie Winand investors@thera.vet

NewCap Investor Relations and Financial Communications

Théo Martin / Hugo Willefert theravet@newcap.eu Tel: +33 (0)1 44 71

94 94

Press Relations Arthur Rouillé theravet@newcap.eu Tel: +33 (0)1

44 71 00 15

NewCap Belgique Press Relations Laure-Eve Monfort

lemonfort@newcap.fr Tel: + 32 (0) 489 57 76 52

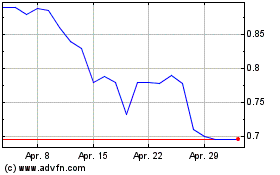

TheraVet (EU:ALVET)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

TheraVet (EU:ALVET)

Historical Stock Chart

Von Apr 2023 bis Apr 2024