Spineway : 2022 Half-year results and overall growth strategy

Press release

Ecully,

September 7,

2022 – 8 pm

Half-year results 2022

Initial benefits of

redeployment

- Acceleration of

activity driven by Distimp sales and contributions

- Good operating performance orientation

- Strong cash position of €15.3 million allowing

- No additional

issuance of Convertible Bonds until the end of

2022

- The

continuation of the Group's growth

strategy

Growth ambition and strategy

confirmed

- Following the acquisition of

Distimp in June 2021, acquisition of Spine Innovations in

July 2022

- Continued construction of a

European player in spine care

|

In thousands of eurosConsolidated financial statements* |

HY1 2022 |

HY1 2021 |

Variation2022/2021In

% |

|

Revenue |

3 113 |

1 885 |

+ 65% |

|

Cost of sales |

- 1 036 |

- 505 |

|

|

Gross margin**% of Revenue |

2 07767% |

1 38073% |

+ 51% |

|

Operating costsOf which operating costs |

- 2 948- 1 329 |

- 1 863- 995 |

+ 58%+ 34% |

|

Of which personnel expenses |

- 1 874 |

- 1 091 |

+ 72% |

|

Operating income |

- 871 |

- 483 |

- 80% |

|

Financial result |

125 |

70 |

+ 79% |

|

Exceptional result |

- 56 |

- 203 |

+ 72% |

|

Net result |

- 803 |

- 617 |

- 30% |

* Unaudited figures** Accounting gross margin

including inventory adjustments. Adjusted from this impact, the

gross margin related to pure sales is of 2,244 k€, i.e. a rate of

72% at the end of June 2022, stable compared to the end of June

2021 (1,339 k€ and 71%). The margin on sales thus increased

in value by 68%.

The Board of Directors of Spineway, at a meeting

held on September 7, 2022, chaired by Stéphane Le Roux, approved

the half-year results as of June 30, 2022.

In the context of a still fragile and

non-homogenous recovery in its areas of operation, Spineway

achieved revenues of €3.1 million in the first half of 2022, up 65%

compared to the first half of 2021. This increase is driven by the

strong performance of sales in Latin America (+72% to €1.5M), the

synergies implemented with Distimp, notably in France, which

brought the turnover of the European zone to €0.9M (+106% compared

to HF1 2021) and the solid results in the Middle East (€0.4M, up

96%)

Improved gross margin on sales by 68%

and controlled expenses

This growth in activity is accompanied

by a 68% increase in gross margin on sales** to €2.2 million at the

end of June 2022 compared to €1.3 million last year.

During the period, operating costs were

kept under control despite the reinforcement of the teams

necessary for the development and transformation of R&D

projects and the growth of the Group. Thus, the number of employees

has increased by 29% since June 2021. The management team has been

reinforced by four new top-level experts: a Director of Sales for

France and French-speaking Africa, a Scientific Director, an

R&D Director and a Marketing and International Sales

Director.

Operating costs amounted to €1.3 million, i.e.

43% of sales compared to 53% last year, even though the Group

continued to incur regulatory expenses, particularly in studies and

clinical tests to prepare the changeover linked to the new CE/MDR

regulations.

The operating

profit for the first half of 2022 is thus

- 0.9 M€ compared to - 0.5 M€ at the end of June 2021.

Also benefiting from the improvement in the

financial profit (+ 78%) and the exceptional result (+72%),

the net result was -0.8

M€ versus -0.6 M€ last year. It now represents 26% of the

turnover compared with 33% last year and has thus increased by 7

points.

The Group remains committed to an objective of

revenue growth and reorganization aimed at a return to operating

profitability while going on with costs’ control.

Strengthened equity and solid cash

position of €15.3 million at the end of June

In the first half of 2022, the conversion of

convertible or exchangeable bonds into new or existing ordinary

shares linked to the contract with Negma GROUP LTD generated a

capital increase of €0.6 million through the creation of

6,213,624,332 shares and an issue premium of €1.1 million. The

purpose of this contract is to finance the Group's acquisition and

partnership plan, to support its strategy and also to support cash

requirements related to current operations, particularly in

connection with the current pandemic. As of June 30, 2022, €11.5

million of additional financing remained under this contract, which

has provided €22.6 million in cash since its conclusion.

With a strong cash position of more than €15

million as of June 30, 2022, the Group has decided to

suspend the issuance of new tranches of convertible bonds until the

end of 20221. The Group's financial

structure remains sound with a net cash position of €10.9 million

and shareholders' equity of €21.5 million as of June 30, 2022.

The company is studying financing solutions that

are more favorable to its development, its shareholders, and the

support of its future projects.

Shares Consolidating to

reduce volatility

In order to support its growth and value

creation strategy, since August 16, Spineway has initiated a

reverse stock split based on 1 new share for 40,000 shares. This

consolidation, which will be effective on September 15, has the

dual objective of limiting share price volatility and reducing

speculation on the share price.

| Share

exchange period |

| 16

August 2022 |

Start of exchange

operations |

| 14

September 2022 |

End of exchange

operations |

|

Consolidation operations |

| 14

September 2022 |

Last listing of old shares on

Euronext Growth (ISIN code: FR0011398874) |

| 15

September 2022 |

First listing of the new

shares on Euronext Growth (ISIN code: FR001400BVK2) |

| 19

September 2022 |

Allocation of new shares |

| Breakage

management |

| 14

September 2022 |

Start of compensation of

fractional shares by financial intermediaries |

| 14

October 2022 |

Deadline for compensation of

fractional shares by financial intermediaries |

Ambition confirmed

The strengthening of the Group's cash position

and shareholders' equity will enable it to pursue its growth

plan.

As such, in July 2022, Spineway acquired Spine

Innovations, a French company specializing in intervertebral disc

prostheses for the cervical and lumbar spine. Spine Innovations has

a team of 13 people and markets its products mainly in France,

Europe, and Australia. For the fiscal year 2020/2021, the company

generated sales of €4.2 million, 76% of which were generated

internationally. In line with its growth strategy, this new

acquisition will enable Spineway to add a new segment to its

product offering, strengthen its positions in France and

internationally, and expand its teams. This acquisition will

contribute to the Group's revenues from the second half of

2022.

This new acquisition confirms the

Group's strategy of positioning itself as a leading European player

in the field of spinal implants, in particular by expanding its

range of innovative Premium products, through targeted external

growth.

Upcoming:

September 28, 2022: Lyon Pôle Bourse Forum at the Palais du

Commerce in LyonSeptember 20, 2022: Closing of the

Consolidation TransactionOctober 14, 2022: Third

quarter revenues

SPINEWAY IS ELIGIBLE FOR THE PEA-PME

(EQUITY SAVINGS PLANS FOR SMES)Find out all about Spineway

at www.spineway.com

This press release has been prepared in both

English and French. In case of discrepancies, the French version

shall prevail.

Spineway

designs, manufactures and markets

innovative implants and surgical instruments for treating severe

disorders of the spinal column.Spineway has an

international network of over 50 independent distributors and 90%

of its revenue comes from exports.Spineway, which

is eligible for investment through FCPIs (French unit trusts

specializing in innovation), has received the OSEO Excellence award

since 2011 and has won the Deloitte Fast 50 award (2011). Rhône

Alpes INPI Patent Innovation award (2013) – INPI Talent award

(2015). ISIN: FR0011398874 -

ALSPW

Contacts:

|

SPINEWAYShareholder-services lineAvailable Tuesday

through Thursday+33 (0)806 706 060 |

Eligible PEA / PMEALSPWEURONEXT GROWTH |

AELIUM Finance & CommunicationInvestor

relationsSolène Kennisspineway@aelium.fr |

1 To date, 760 bonds remain to be converted on the previously

raised tranches

- CPSPW-CA 2022 09 07_2022 half-year results_UK.

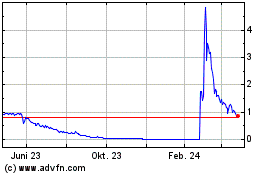

Spineway (EU:ALSPW)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

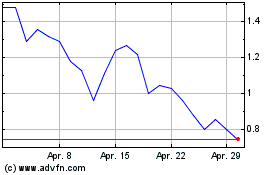

Spineway (EU:ALSPW)

Historical Stock Chart

Von Apr 2023 bis Apr 2024