- Confirmation of financial objectives announced during the

IPO:

- 2022: revenues of €35 million and consolidated EBITDA rate

of c.10%

- 2026: revenues of €175 million and consolidated EBITDA rate

of c.20%

- Strong growth outlook in the second half of 2022, given the

very favorable market environment and the greater seasonality of

the business

- Revenues as of September 30, 2022 to €22.5 million, +70% vs.

2021

- Substantial growth in order backlog1 with €30.6

million as of September 30, 2022, vs. €6.4 million as of September

30, 2021 driven by accelerating demand and commercial

momentum

- Strengthening of financial resources through the completion

of the €20.5 million capital increase in July 2022

Regulatory News:

Groupe OKwind (FR0013439627 - ALOKW), which is

specialized in the design, manufacture and sale of smart energy

generation and management systems dedicated to self-consumption,

today announces its results for the first half of 2022, ended June

30, and approved by the Board of Directors on October 17, 2022.

Simplified income statement as of June

30, 2022

in €k

06/2022

06/2021

Change in %

Revenues

13,500

9,519

+41.8%

of which BtoB

11,561

8,664

+33.4%

of which BtoC

1,939

855

+126.8%

Other operating income

1,186

630

Purchases consumed

(6,675)

(4,379)

Personnel costs

(4,202)

(3,330)

Other operating expenses

(3,783)

(2,539)

Taxes

(129)

(108)

EBITDA

(102)

(208)

+50.9%

Net changes in depreciation and

amortization

(626)

(412)

Operating profit

(729)

(620)

Financial expenses

(285)

(137)

Extraordinary expenses

(7)

(4)

Income tax

167

166

Net income (group share)

(854)

(595)

Half-year revenues for 2022 set at €13.5 million, up 42%

compared to H1 2021, and break down as follows: - 86% of revenues

from the BtoB segment: €11.6 million, up +33%, - 14% of revenues

from the BtoC segment: €1.9 million, a significant increase by

+127%.

The acceleration of activity in OKwind's three business segments

(farms, local authorities/industrial sites and individuals) is

benefiting from a favorable market context. The rising price

environment of energy combined with the growing awareness of the

need for more environmentally friendly solutions have supported the

Company's sales momentum.

The order backlog has significantly increased and stood at €18.5

million at June 30, 2022, compared to €5.4 million at June 30,

2021.

During the first half of 2022, the Group recorded a 52% increase

in purchases (raw materials, supplies and other materials), in line

with the business growth. Personnel costs also increased following

the recruitment of new staff in order to structure the teams (139

employees as at June 30, 2022 vs. 113 as at June 30, 2021), in

accordance with the development plan.

Other operating expenses amounted to €3.8 million and include

subcontracting costs related to the on-site installation of

trackers by specialized service providers, the opening of new

branches and the relocation of the headquarter in Torcé.

After taking these items into account at June 30, 2022, EBITDA2

is close to breakeven at -€0.1 million. The EBITDA rate (-0.8%) has

significantly improved compared to the first half of 2021 (-2.2%),

while integrating the implementation of a controlled stock policy

in order to anticipate the historically higher level of activity in

the second half of the year, a seasonality which should however

lessen in 2023.

Cash and cash equivalents as of June

30, 2022

As of June 30, 2022, the Group's cash position amounted to €6.4

million, compared to €1.3 million as of June 30, 2021. Since then,

the Company's financial resources have been strengthened to €20.5

million thanks to the success of the initial public offering in

July 2022 and the issue of a €3.0 million convertible bond in favor

of Sofiprotéol.

Commercial activity for the 3rd quarter

of 2022

Firm orders booked since January 1st of the current fiscal year,

consolidated at the end of September 2022, have significantly

increased to €47.3 million, compared to €17.6 million in September

2021 (+145%). As a result, the backlog as of September 30, 2022

stood at €30.6 million compared to €6.4 million as of September 30,

2021. As of September 30, 2022 revenues increased by 70% to €22.5

million, compared to €13.2 million the previous year.

Post-closing highlights

On July 5, the Company announced the success of its initial

public offering on Euronext Growth with a capital increase of €20.5

million. This operation was a great success with both institutional

and retail investors.

At the end of August, Groupe OKwind signed a strategic

partnership with the investment fund Sofiprotéol to accelerate its

development through the issue of €3 million in bonds convertible

into shares.

The Company has also been pursuing its commercial development by

participating in leading professional trade fairs for local

authorities and industrial sites (Carrefour des Gestions Locales de

l'Eau, FNCCR Congress) and for farms (SPACE – The International

Exhibition for Animal Breeding - and the “Sommet de l'Élevage”). At

the same time, Groupe OKwind has continued to market its trackers

through its third business line dedicated to individuals

(Lumioo).

Development strategy and

outlook

Relying on a robust business model and a both solid and

high-quality order book, Groupe OKwind confirms its short- and

medium-term objectives, with revenues of €35 million and a

consolidated EBITDA rate of around 10% for the year 2022, and

revenues of €175 million and a consolidated EBITDA rate of around

20% for the year 2026.

Louis MAURICE, Founder and Chairman of Groupe OKwind,

said: “This first financial release since our listing on the

stock exchange is characterized by the ongoing strong commercial

momentum confirming the relevance of our value proposition. The

current geopolitical and inflationary context, which is

particularly reflected in the soaring energy bills, highlights the

need to offer reliable alternatives in terms of renewable energy

production. Given the environmental and economic challenges that

both professionals and individuals are facing, our solution, which

is immediately available, competitive and sustainable thanks to the

lowest carbon footprint on the French photovoltaic market, is

highly acclaimed and has become the reference for self-consumption.

Amid this buoyant environment, the strong visibility provided by

our order intake and backlog will enable us to achieve our 2022

objectives while continuing to deploy our development plan with

confidence in order to reach our objectives by 2026.”

Availability of the 2022 half-year financial report

The half-year financial statements have been approved by the

Board of Directors and reviewed on October 17, 2022. The 2022

half-year financial report will be available before October 31,

2022 on the Investor website (www.okwind-finance.com), in the

Documentation section.

About Groupe OKwind

Founded in 2009 by Louis Maurice, Chairman and CEO, Groupe

OKwind develops solutions for the production and consumption of

green energy in short supply chains. Our comprehensive approach,

combining energy generation and management, aims to strengthen

energy autonomy and thus accelerate the ecological transition.

Thanks to its unique technological ecosystem, Groupe OKwind enables

self-consumption to assert itself as a new avenue for energy. A

solution that can be quickly deployed, managed in real time and at

a competitive price, without subsidies. Every day, we work to

deploy local, low-carbon, fixed-cost energy for professionals and

individuals. In 2021, Groupe OKwind generated consolidated revenues

of €25 million and today has 160 employees, with more than 2,000

installations throughout France.

For more information: www.okwind.fr

APPENDICES

Consolidated income statement by

nature

in €k

06/2022

06/2021

Revenues

13,500

9,519

Other operating income

1,186

630

Purchases consumed

(6,675)

(4,379)

Personnel costs

(4,202)

(3,330)

Other operating expenses

(3,783)

(2,539)

Taxes

(129)

(108)

EBITDA

(102)

(208)

Net changes in depreciation and

amortization

(626)

(412)

Operating profit before amortization and

impairment of goodwill

(729)

(620)

Amortization of goodwill

-

-

Operating profit after amortization and

impairment of goodwill

(729)

(620)

Financial expenses

(285)

(137)

Extraordinary expenses

(7)

(4)

Income tax

167

166

Net income of consolidated companies

(854)

(595)

Share of profit of associates

-

-

Net income of the consolidated group

(854)

(595)

Minority interests

-

-

Net income (Group share)

(854)

(595)

Earnings per share (in €)

(0.13)

(0.09)

Diluted earnings per share (in €)

(0.13)

(0.08)

Cash-flow statement

in €k

06/2022

12/2021

06/2021

Net income of the consolidated

group

(854)

1,283

(595)

Depreciation and provisions

507

897

438

Change in deferred taxes

(4)

163

(3)

Capital gains or losses on disposals

2

114

4

Share of profit of associates

-

(16)

-

Total cash-flow

(349)

2,441

(156)

Changes in inventories related to

operations

(1,550)

374

(496)

Change in receivables related to the

activity

(368)

(4,906)

(767)

Change in operating liabilities

2,584

1,403

123

Net cash flow from operating

activities

317

(688)

(1,296)

Acquisition of fixed assets

(1,728)

(2,705)

(1,644)

Disposal of fixed assets

12

82

61

Impact of changes in the scope of

consolidation

-

-

-

Net cash flow from investing

activities

(1,716)

(2,622)

(1,584)

Borrowing issues

5,341

2,127

1

Loan repayments

(2,104)

(1,930)

(1,151)

Net change in bank overdrafts

1,850

1,150

650

Total net cash flow from

financing

5,088

1,347

(501)

Change in cash and cash

equivalents

3,689

(1,963)

(3,380)

Opening cash position

2,726

4,690

4,690

Closing cash position

6,415

2,726

1,309

Consolidated balance sheet

Assets (in €k)

06/2022

12/2021

Uncalled capital

-

-

Intangible assets

9,605

8,497

of which goodwill

4,955

4,955

Property, plant and equipment

1,314

1,128

Financial assets

1,011

773

Investments in associates

195

195

Total fixed assets

12,125

10,593

Inventory and work in progress

3,325

1,775

Trade receivables and related accounts

11,673

12,443

Other receivables and accruals

2,229

1,080

Marketable securities

-

-

Cash and cash equivalents

6,415

2,726

Total Assets

35,766

28,617

Liabilities (in €k)

06/2022

12/2021

Equity

6,475

6,458

Premiums related to capital

-

-

Retained earnings and consolidated

income

2,324

3,195

Total shareholders' equity

8,799

9,653

Minority interests

-

-

Provisions

243

262

Borrowings and financial liabilities

17,298

11,859

Accounts payable and related accounts

4,266

2,942

Other liabilities and accruals

5,160

3,901

Total Liabilities

35,766

28,617

1 The backlog corresponds to orders for which a purchase order

has been signed, some of which are invoiced on delivery and the

remainder on commissioning of the trackers. 2 Using the subtractive

method, EBITDA is obtained by adding depreciation and provisions,

net of write-backs, to operating income.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221017005743/en/

Groupe OKwind Investor Relations investors@okwind.com

NewCap Mathilde Bohin / Thomas Grojean Investor Relations

okwind@newcap.eu T.: +33 (0)1 44 71 94 94

NewCap Nicolas Merigeau Media Relations okwind@newcap.eu

T.: +33 (0)1 44 71 94 98

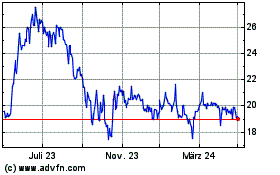

Groupe Okwind (EU:ALOKW)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

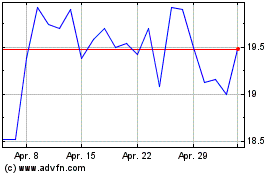

Groupe Okwind (EU:ALOKW)

Historical Stock Chart

Von Apr 2023 bis Apr 2024