- Partial exercise of the Over-Allotment Option with the final

amount of the Offer increased to €20.5 million

- Signing & implementation of a liquidity contract with

Portzamparc BNP Paribas

Regulatory News:

OKwind Group, the renewable energy self-consumption

specialist announces the end of the stabilization period and the

partial exercise by Portzamparc of the Over-Allotment Option for

83.3% in the context of its IPO on the Euronext Growth® market in

Paris (ISIN code : FR0013439627 – Ticker symbol : ALOKW).

This transaction results in the issuance of 30,810 new ordinary

shares at the Offer Price of €10.81, representing a total amount of

€ 0.3 million, bringing the size of the Offer to €20.5 million.

As a result, the free float now represents approximately 21.34%

of OKwind Group’s share capital. The total number of shares offered

in the initial public offering amounts to 1,897,345 shares, of

which 1,757,466 new shares and 139,879 shares sold.

End of the stabilization period

The Company has received notification that Portzamparc, acting

as Stabilization Agent in the context of the first admission to

trading of ordinary shares of OKwind Group on Euronext Growth

Paris, has carried out stabilization activities (as defined in

Article 3.2(d) of Regulation (EU) No 596/2014 (the "Market Abuse

Regulation")) on the following securities:

Issuer:

OKwind Group

Securities:

Ordinary shares with a par value of EUR

1.00 (ISIN : FR0013439627)

Offering size:

1,866,535 ordinary shares (excluding the

Over-Allotment Option)

Offer price:

EUR 10.81 per ordinary shares

Market:

Euronext Growth Paris

Stabilization Agent :

Portzamparc BNP Paribas

The stabilization period, which started on 8 July 2022, ended on

4 August 2022. Pursuant to Article 6, paragraph 2, of the

Commission Delegated Regulation (EU) 2016/1052 supplementing the

Market Abuse Regulation with regard to technical regulatory

standards concerning the conditions applicable to buyback programs

and stabilization measures, OKwind Group, on the basis of the

information provided by Portzamparc, is publishing in this press

release the information relating to the stabilization activities

carried out by Portzamparc as Stabilization Agent:

Execution date

Intermediary

Buy / Sell

Number of shares

Average transaction price (in

€)

Lowest / highest price (in

€)

Aggregate amount (in

€)

Market

08/07/2022

Portzamparc

Buy

3,096

10.7295

10.00 / 10.81

33,218.53

Euronext Growth

11/07/2022

Portzamparc

Buy

1,000

10.8099

10.79 / 10.81

10,809.90

Euronext Growth

12/07/2022

Portzamparc

Buy

0

0

0

0

Euronext Growth

13/07/2022

Portzamparc

Buy

200

10.8099

10.8/10.81

2,161.98

Euronext Growth

14/07/2022

Portzamparc

Buy

24

10.81

10.81 / 10.81

259.44

Euronext Growth

15/07/2022

Portzamparc

Buy

25

10.81

10.81 / 10.81

270.25

Euronext Growth

18/07/2022

Portzamparc

Buy

250

10.6188

10.61 / 10.81

2,654.70

Euronext Growth

19/07/2022

Portzamparc

Buy

85

10.7535

10.69 / 10.81

914.05

Euronext Growth

20/07/2022

Portzamparc

Buy

0

0

0

0

Euronext Growth

21/07/2022

Portzamparc

Buy

87

10.6785

10.60 / 10.81

929.03

Euronext Growth

22/07/2022

Portzamparc

Buy

0

0

0

0

Euronext Growth

25/07/2022

Portzamparc

Buy

0

0

0

0

Euronext Growth

26/07/2022

Portzamparc

Buy

0

0

0

0

Euronext Growth

27/07/2022

Portzamparc

Buy

1,147

10.81

10.81 / 10.81

12,399.07

Euronext Growth

28/07/2022

Portzamparc

Buy

0

0

0

0

Euronext Growth

29/07/2022

Portzamparc

Buy

0

0

0

0

Euronext Growth

01/08/2022

Portzamparc

Buy

0

0

0

0

Euronext Growth

02/08/2022

Portzamparc

Buy

86

10.77

10.77/10.77

926.22

Euronext Growth

03/08/2022

Portzamparc

Buy

190

10.80

10.80 / 10.80

2,052.00

Euronext Growth

04/08/2022

Portzamparc

Buy

0

0

0

0

Euronext Growth

The detailed list of transactions is available on OKwind Group’s

website (https://www.okwind-finance.com).

This press release is issued also on behalf of Portzamparc

pursuant to Article 6, paragraph 2, of Commission Delegated

Regulation (EU) 2016/1052.

Breakdown of Capital and Voting Rights

Following the Offering and the partial exercise of the

Over-Allotment Option, the share capital and the voting rights of

the Company are distributed as follows:

Shareholders

Numbers of shares % of capital Voting rights % of voting rights

Maurice Family

1,557,295

18.92%

3,084,703

21.20%

Sallé Family

1,818,021

22.08%

3,594,524

24.70%

Heulot Family

1,156,399

14.05%

2,286,789

15.72%

Subtotal

4,531,715

55.05%

8,966,016

61.62%

Christian Blais

534,596

6.49%

1,068,465

7.34%

Frédéric Bellanger

449,904

5.47%

898,354

6.17%

Thierry Bernard

413,318

5.02%

817,185

5.62%

Others

546,257

6.64%

1,043,891

7.17%

Public

1,756,636

21.34%

1,756,636

12.07%

Total

8,232,426

100%

14,550,547

100%

Liquidity contract

OKwind Group also announces that it has entrusted Portzamparc

with the implementation of a liquidity contract, in accordance with

the legal framework in force, and in particular with the provisions

of the French Financial Markets Authority's (AMF) decision n°

2021-01 of 22 June 2021. It complies with the AMAFI Charter of

Ethics. This liquidity contract is concluded for a period of one

year, automatically renewable, taking effect as of 5 August 2022. A

sum of €200,000 in cash has been allocated to the liquidity

account.

Execution of the liquidity contract may be suspended:

- under the conditions referred to in Article 5 of the AMF

decision n° 2021-01 of 22 June 2021;

- if the share is listed outside the thresholds authorized by the

Group’s Shareholders’ Meeting; and

- at any time upon OKwind Group’s request, under its

responsibility.

The liquidity contract may be terminated at any time and without

prior notice by OKwind Group at any time by Portzamparc subject to

a one month notice.

About Groupe OKwind

Founded in 2009 by Louis Maurice, Chairman and Chief Executive

Officer, Groupe OKwind develops solutions for the production and

consumption of green energy in short supply chains. Our

comprehensive approach, combining energy generation and management,

aims to strengthen energy autonomy and thus accelerate the

ecological transition. Thanks to its unique technological

ecosystem, Groupe OKwind enables self-consumption to assert itself

as a new avenue for energy. A solution that can be quickly

deployed, managed in real time and at a competitive price, without

subsidies. Every day, we work to deploy local, low-carbon,

fixed-cost energy for professionals and individuals. In 2021,

Groupe OKwind generated consolidated revenue of €25.2 million and

had 131 employees, with more than 2,000 installations throughout

France.

For further information: https://www.okwind.fr/en/

Disclaimer

This announcement is not being made in and copies of it may not

be distributed or sent, directly or indirectly, into the United

States of America, Canada, Australia or Japan.

The distribution of this document may be restricted by law in

certain jurisdictions. Persons into whose possession this document

comes are required to inform themselves about and to observe any

such restrictions.

This press release is provided for information purposes only. It

does not constitute and should not be deemed to constitute an offer

to the public of securities, nor a solicitation of the public

relating to an offer of any kind whatsoever in any country,

including France. Potential investors are advised to read the

prospectus before making an investment decision in order to fully

understand the potential risks and rewards associated with the

decision to invest in the securities.

This announcement is an advertisement and not a prospectus

within the meaning of Regulation (EU) 2017/1129 of the European

Parliament and of the Council of 14 June 2017 on the prospectus to

be published when securities are offered to the public or admitted

to trading on a regulated market, as amended (the “Prospectus

Regulation”), also forming part of the domestic law in the United

Kingdom by virtue of the European Union (Withdrawal) Act 2018 (the

“EUWA”).

With respect to the member States of the European Economic Area

and to the United Kingdom, no action has been undertaken or will be

undertaken to make an offer to the public of the securities

referred to herein requiring a publication of a prospectus in any

relevant member State other than France or the United Kingdom. As a

result, the securities may not and will not be offered in any

relevant member State other than France or the United Kingdom

except in accordance with the exemptions set forth in Article 1(4)

of the Prospectus Regulation, also forming part of the domestic law

in the United Kingdom by virtue of EUWA, or under any other

circumstances which do not require the publication by OKwind Group

of a prospectus pursuant to Article 3(2) of the Prospectus

Regulation, also forming part of the domestic law in the United

Kingdom by virtue of EUWA, and/or to applicable regulations of that

relevant member State or the United Kingdom. In France, an offer to

the public of securities may not be made except pursuant to a

prospectus that has been approved by the French Financial Markets

Authority (the “AMF”). The approval of the prospectus by the AMF

should not be understood as an endorsement of the securities

offered or admitted to trading on a regulated market.

It does not constitute an offer to purchase or to subscribe for

securities in the United States or in any other jurisdiction.

Not for distribution, directly or indirectly,

in the United States of America, Canada, Australia or Japan

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220804005881/en/

Groupe OKwind Investor Relations investors@okwind.com

NewCap Mathilde Bohin / Thomas Grojean Investor Relations

okwind@newcap.eu T.: +33 (0)1 44 71 94 94

NewCap Nicolas Merigeau Media Relations okwind@newcap.eu

T.: +33 (0)1 44 71 94 98

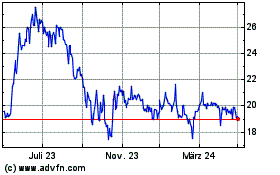

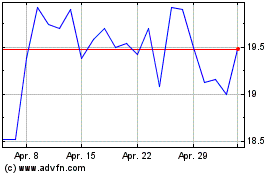

Groupe Okwind (EU:ALOKW)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Groupe Okwind (EU:ALOKW)

Historical Stock Chart

Von Apr 2023 bis Apr 2024