- Highlights for 2021:

- Listing of shares on Euronext Growth® Paris in April

2021

- Investment in Exos Financial and in Miami International

Holdings

- Completion of a second round of private placement financing

in January 2022 (post-closing)

- Investment in Israeli company Gauzy, a world leader in smart

glass and ADAS technologies (post-closing)

- Financial elements:

- Net assets of €8.9m as at December 30, 2021

- Total return of 16.7% over the year 2021 due to the increase

in the share price since the listing in April 2021

Regulatory News:

Hamilton Global Opportunities plc (GB00BMDXQ672 - ALHGO)

publishes its annual results for 2021, approved by the Board of

Directors on April 29, 2022, and its annual financial report, which

is available on the company's website in the Investors section

(hamiltongo.eu) and on the AMF website.

Gustavo Perrotta, Founder and Managing Director of Hamilton

Global Opportunities, said: "We are pleased with this first

year marked by the admission of HGO shares on Euronext Growth Paris

and the favorable evolution of the share price which underlines our

investment dynamics. As announced at the time of the listing, our

objective is to provide investors with a permanent vehicle to

capture and maximize the value creation generated by investment

opportunities in international tech companies. In line with our

strategy, we have completed two high-profile investments: Exos

Financial and Miami International Holdings. We look forward to the

continued development of the Hamilton Global Opportunities

portfolio in 2022, following the investment in Gauzy in the first

half of 2022, with several similar targets already identified to

date.”

PERFORMANCE

Assets as at 30 December 2021 (in

€)

December 31, 2021

December 31, 2020

Tangible assets

2 297

3 888

Investments

5 592 071

292 194

Trade and other receivables

57 100

57 100

Fixed Assets

5 651 468

353 182

Debtors: amounts falling due

within one year

143 041

109 418

Cash at bank and in hand

3 429 902

22 745

Current assets

3 572 943

132 163

Net current

assets/(liabilities)

9 224 411

485 345

Creditors: amounts falling due

within one year

(362 830)

(402 011)

Net assets

8 861 581

83 334

Details of the main changes in the financial

statements

Net assets amounted to 8.9 M€, compared to 0.09 M€ on December

31, 2020. This increase in the second half of the year is due to

the capital increase carried out during the period for an amount of

9.6 M€.

At December 31, 2021, the cash position was €3.5 million.

Financial key performance

indicators

2021

2020

NAV per share

27.82

N/A

Cash realisations

N/A

N/A

Capital investment as a

percentage of net assets

61%

N/A

Operating loss

(261 650)

(49 097)

Cash generated from

operations

(590 515)

23 472

Total shareholder return

16.67%

N/A

The share price as at 31 December 2021, has increased by 16.67%

to €49 (vs €42 in April 2021). The Financial year ended December

31, 2021 was the first year of operation of the Company in its

current form. These indicators will become more relevant in fiscal

year 2022 as the investments are very recent and have an investment

horizon of up to 48 months.

Highlights of the year 2021

Hamilton Global Opportunities shares admitted to Euronext

Growth® Paris

On April 26, 2021, Hamilton Global Opportunities plc announced

the direct listing of its shares on Euronext Growth® Paris.

Hamilton Global Opportunities plc gives to investors the

opportunity to access private equity capital returns through a

listed investment vehicle which focuses on investments in Tech,

Fintech and MedTech principally in the United States and

Israel.

First major investment as a listed company in Exos

Financial

On July 6, 2021, Hamilton Global Opportunities plc announced its

first major deal with a $3 million investment in Exos Financial, as

part of a Series B funding round which will be used to accelerate

growth both organically and through acquisitions. Exos builds a

data-enabled institutional finance platform designed to deliver the

full suite of investment banking services in a modern and

interconnected way.

Investment in Miami International Holdings, the first private

multi-market platform operator in the U.S.

On October 7, 2021, Hamilton Global Opportunities plc announced

a USD $3 million investment in Miami International Holdings, Inc.

one of the leading exchange players in the U.S. options market.

Miami International Holdings, Inc. (MIH) is the parent company of

multiple securities exchanges, based on the MIAX platform,

developed in-house and designed for derivatives trading.

Post-closing events

Completion of a second private placement financing

On January 27, Hamilton Global Opportunities plc announced that

it had successfully raised €4.5 million from European investors at

a price of €49 per share, in line with the closing price on January

26, 2022. These new resources allow Hamilton Global Opportunities

plc to accelerate the deployment of strategic investments in mature

growth companies in the US and Israel.

Completion of investment in Israeli company Gauzy

On April 11, 2022, Hamilton Global Opportunities plc announced

that it had successfully completed an initial investment of $2

million in Israel's Gauzy, a global leader in smart glass and ADAS

technologies, in a Series D financing round. This investment was

made as part of Hamilton Global Opportunities plc's momentum in

line with its strategy of focusing on technology companies with

strong potential for profitable and responsible growth. Gauzy is a

true pioneer in nanotechnology applied to light control, and is the

only materials science company in the world developing, producing

and commercializing two of the three technologies applied to smart

glass, Suspended Particle Devices and liquid crystals for use in a

variety of industries, as well as a number of ADAS (Advanced Driver

Assistance Systems) for vehicles in the automotive industry.

About Hamilton Global Opportunities:

Hamilton Global Opportunities PLC (“HGO”) is an investment

company listed on the Euronext Growth Market in Paris

(ALHGO) focusing on investments in Tech, Fintech and MedTech

principally in the United States and Israel. The HGO management

team has significant relevant experience in structuring direct

investments in the areas above mentioned. For more information,

please visit: hamiltongo.eu

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220429005594/en/

Hamilton Global Opportunities Gustavo Perrotta

Founder & CEO gp@hamiltongo.eu Gavin Alexander Partner

ga@hamiltongo.eu Andrew Wynn Partner aw@hamiltongo.eu

NewCap Louis-Victor Delouvrier Investor Relations

hamilton@newcap.eu +33 (0)1 44 71 98 53

NewCap Nicolas Merigeau Media Relations

hamilton@newcap.eu +33 (0)1 44 71 94 98

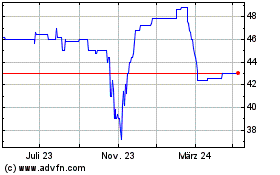

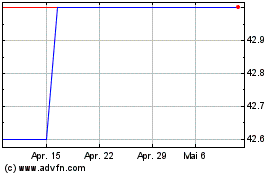

Hamilton Global Opportun... (EU:ALHGO)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Hamilton Global Opportun... (EU:ALHGO)

Historical Stock Chart

Von Apr 2023 bis Apr 2024