Baikowski: 2021 Annual Results

14 April 2022 - 6:00PM

Business Wire

Strong growth in results after an atypical

year Good start to 2022

Regulatory News:

Baikowski (Paris:ALBKK):

"The year 2021 once again demonstrated the strength of the

Baikowski model with solid annual results in a still turbulent

environment. The Group remains vigilant and mobilized with regard

to the economic situation and its global macroeconomic

consequences, but confirms its growth trajectory.”

Benoît GRENOT - CEO

Consolidated figures (in millions of

euro)

2021*

2020

Revenue

44.9

35.6

EBITDA1

As a % of revenue

11.8

26.2%

6.9

17.1%

EBIT (Operating income)

7.0

1.7

Group share of net income

6.8

1.3

* Audit Status of the 2021 consolidated financial statements:

the audit procedures on the financial statements have been

completed and the statutory auditors' report is being prepared.

The Baikowski® Group's consolidated annual revenues for fiscal

year 2021 amounted to €44.9M, up sharply by +26% compared to 2020,

and by +11% compared to 2019. The Group has confirmed its solid

international momentum with 97% of its sales coming from exports,

including 20% in Europe and 77% worldwide.

Business is growing in all the Group's major international

markets. It continues to be driven by strong demand from the

electronics, automotive and polishing markets, which performed well

throughout the year. The semiconductor market continued to grow

strongly with sales linked to the needs of new technologies.

In line with its strategy of deployment by added value,

Baikowski® continued to invest in innovation with a

customer-oriented approach.

All results are fully in line with this growth in activity. EBIT

was €7.0M, representing a margin of 15.6% of revenues.

EBITDA1 amounted to €11.8M, representing 26.2% of

revenues.

The financial result for the year 2021 is an income of €0.4M

compared to €- 0.2M in 2020, and the corporate tax charge is €

-0.7M (€-0.2M in 2020).

The Group's share of net income is €6.8M, up sharply from €1.3M

in 2020, or 15.1% of revenues. The Board of Directors will propose

a dividend of €0.85 per share to the General Meeting of

Shareholders.

The Group enjoys a very solid financial situation with a closing

cash position of € 9.4M. With shareholders' equity of €40.8M and

net financial debt of €4.6M, decrease of €10.0M compared to 2020,

the Group's gearing (net financial debt/net equity) is 11% at the

end of 2021.

1 EBITDA = Earnings before interest, taxes, depreciation and

amortization and including profits from consolidated companies

using the equity method.

After a strong start to year, the Group

remains confident in the execution of its roadmap.

Next important date : June 8, 2022 - Annual

General Shareholders ’Meeting

About Baikowski® : Baikowski® has existed for a hundred

years and is a leading manufacturer of specialist industrial

minerals and, more particularly, of ultra-pure alumina powders and

formulations, as well as of other high-quality oxides and

composites such as spinel, ZTA, YAG and cerium for technical

ceramic applications, precision polishing, crystals and additives

or coverings. The quality of Baikowski®’s products is appreciated

by a variety of high-tech markets including the lighting,

watchmaking, mobile phone, microelectronic, automotive, defense and

medical industries.

Complete information on the company may be

found at: www.baikowski.com - finance@baikowski.com Euronext

: ALBKK - ISIN : FR0013384369

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220414005424/en/

Aelium Financial communication Valentine Boivin +33 (0)1

75 77 54 65 finance@baikowski.com

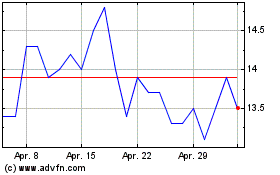

Baikowski (EU:ALBKK)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Baikowski (EU:ALBKK)

Historical Stock Chart

Von Apr 2023 bis Apr 2024