Sidetrade: Double-digit growth in revenue to 12% for Q1 2022

First Quarter Revenue for 2022

Record-breaking new bookings surge in Q1

2022

- Growth of +132%

- 81% of bookings were international, with 62% from the

United States

Increase in Order-to-Cash SaaS revenue

to +21%Double-digit growth in revenue to

12%Sidetrade recognized as one of three Leaders in

the first Gartner® Magic Quadrant™ for Integrated Invoice-to-Cash

Applications

Sidetrade

(Euronext Growth: ALBFR.PA), the global

AI-powered Order-to-Cash SaaS platform, today announces new record

bookings with an increase of +132% up from Q1 2022, a +21% increase

in its Order-to-Cash SaaS revenue, and a +12% increase in its total

revenue.

Olivier Novasque, CEO of Sidetrade

commented:“We have just delivered the best quarter in our

history in terms of new bookings, including a major contract in the

United States, where we were selected over our three direct US

competitors. In addition to this unprecedented success, this

performance once again demonstrates the technological edge of our

Order-to-Cash solution, our real commercial delivery capacity and

the strength of our SaaS model. The return of inflation and the

multiple hikes in interest rates will only increase appetite among

businesses for solutions that secure and accelerate cash flow

generation.

“This market performance will be further

strengthened by the recognition of Sidetrade as a Leader in the

first Gartner® Magic Quadrant™ for Integrated Invoice-to-Cash

Applications. This provides tremendous potential for growth in our

business in the United States and in our enterprise accounts in

Europe. We are now, more than ever, in the best possible position

to consolidate our initial success in the United States, accelerate

our growth in all regions and take Sidetrade to the next

level.”

Sidetrade hits quarterly new bookings record, with a

surge of +132% in Q1 2022

In Q1 2022, Sidetrade set a new record

for Order-to-Cash SaaS bookings, which will

generate an additional €2.17 million in annual recurring

revenue ("ARR"), compared with €0.94 million in Q1 2021;

a 132% increase. The former record for bookings

(ARR of €1.67 million) had been set in the previous quarter

(Q4 2021). The total value of these new subscription contracts

over their initial contract periods (excluding renewals) represents

€6.91 million of total contract value

("TCV").

To these SaaS bookings should be added

€1.09 million of services on an annual basis

(implementation, configuration, training, recurring services,

etc.), compared with €0.81 million in Q1 2021. As a result, the

annual contract value (ACV) of these orders in Q1

2022 was €3.27 million, compared with

€1.75 million in Q1 2021, an 87%

increase.

The initial contract period for new customers

(excluding renewals) rose to 40.8 months, compared

with 36.2 months in the same quarter of the previous fiscal

year.

81% of bookings were international, with 62% from the

United States

In Q1 2022, international orders

represented more than 81% of all bookings, driven by

unprecedented momentum in sales with world-leading organizations.

As a result of inflation and recruitment difficulties, businesses

have been driven to invest in Order-to-Cash solutions to accelerate

their cash flow generation in an environment of rising interest

rates, thereby increasing their productivity.

Less than a year after operations were

officially launched in North America, Sidetrade signed the largest

contract in its history with a major Information Technology

consultancy firm (see the press release issued on February 21,

2022). This contract, awarded to Sidetrade in preference over its

three direct US competitors, provides it with an additional

ARR of €1.36 million in this region, i.e.,

62% of all bookings in Q1 2022.

As a reminder, Sidetrade had set itself the goal

of achieving more than one-third of its bookings in the United

States by the second half of 2022. Buoyed by this initial success

and its recognition as a Leader in the first Gartner® Magic

Quadrant™ for Integrated Invoice-to-Cash Applications, Sidetrade

intends to ramp up its presence in North America by doubling its

sales force in 2022.

In this quarter, New Business includes the

record-breaking contract signed in the United States, representing

69% of total bookings.

Cross-selling represents 15% of total new

bookings, with the remaining 16% of

bookings accounting for Upselling of

additional modules to existing customers.

Growth in Order-to-Cash SaaS revenue, up

+21%

|

Sidetrade(€m) |

2022 Q1 |

2021

Q1 |

Change |

|

‘Order-to-Cash’ Activities |

8.1 |

6.8 |

+19% |

|

of which SaaS Subscriptions |

6.7 |

5.5 |

+21% |

|

‘Sales & Marketing’ Activities |

0.3 |

0.7 |

-57% |

|

Revenue |

8.4 |

7.5 |

+12% |

2022 Q1 accounts have been audited and will be certified after

the finalization of procedures required for the annual financial

report.

‘Order-to-Cash’ Activities grew

very sharply to 19% in Q1 2022, driven by 21% growth in

SaaS subscriptions. The growth in this recurring revenue

is the result of record bookings in the 2021 fiscal year, which

will continue to impact revenue growth throughout the 2022 fiscal

year. ‘Order-to-Cash’ Activities, a core business

within the Company’s strategy since 2019, now represent 96%

of total revenue.

In addition, ‘Sales & Marketing’

Activities, which were launched in 2017 and were mainly

focused on the French SME market, have become secondary to

Sidetrade’s activities and have not been technologically integrated

into the Order-to-Cash platform. They now account for only

4% of total revenue and will continue to play a

less prominent role commercially, with estimated revenue of

€0.9 million at end 2022.

Total revenue grew by 12% in Q1

2022, to €8.4 million. In addition to this performance,

international revenue continued to grow substantially, reaching

49% of revenue for the very first time,

with the United States representing 19% of the

total.

A resilient economic model against inflationary

pressures

Visibility of recurring revenue from

subscriptions in a period of economic

uncertaintySidetrade’s economic model provides its

business with significant resilience, as 90% of its revenue

is recurring, representing a significant advantage in the

current environment. The robustness of its model is based on

signing contracts that span multiple years. These comprise an

average initial commitment period of 36.25 months (increasing to

40.8 months for new customers acquired in Q1 2022), followed by

successive periods of the same length. With a controlled churn of

between 5% and 6% on average for Order-to-Cash solutions, the

average time a customer remains with Sidetrade is close to 20

years.

Resilience of the economic model in a

period of high inflationDue to the length of its

subscription periods, Sidetrade systematically reindexes all its

contracts to changes in consumer price indices (the Syntec for

Southern Europe, the UK CPI for Northern Europe, and the US CPI for

the United States), and alters the total price of subscriptions

each year by reference to changes in these price indices. In

addition to the fact that the rising cost of cash and salaries has

made Order-to-Cash solutions more attractive to financial

departments, the construction of Sidetrade’s economic model

demonstrates robust pricing power that protects the Company’s

future revenue against inflationary pressures.

Sidetrade recognized as a Leader in the

first Gartner® Magic Quadrant™ for Integrated Invoice-to-Cash

Applications, and unveils a global map of B2B payment

trends

On April 11, 2022, Sidetrade was recognized as

one of three Leaders in the Gartner® Magic Quadrant™ for

Invoice-to-Cash applications.

Following this recognition, for the first time

ever, Sidetrade made the move to reveal global B2B payment trends

in an industry-first predictive payment intelligence map. This is

extracted from its Data Lake, comprising of 593 million payment

experiences, worth a total value of more than $4.6 trillion

processed over the last three years from 20.7 million B2B buyers

worldwide. This map offers users (businesses, governments, and

analysts) unprecedented information on how buyers pay their

suppliers, an invaluable resource in a climate of global

uncertainty and inflationary pressures.

Next financial

announcementsAnnual Shareholder general meeting:

June 16, 2022 (11:00 am CEST, virtual)2022 First Half Year

Revenue: July 19, 2022, after the stock market closes

Investor

relationsChristelle Dhrif

+33 6 10 46 72

00

cdhrif@sidetrade.com

Media

relationsRebecca

Parlby

+44 7824

505 584

bparlby@sidetrade.com

About

Sidetrade

(www.sidetrade.com)Sidetrade

(Euronext Growth: ALBFR.PA) provides a SaaS platform dedicated to

securing and accelerating cash flow. Sidetrade’s next-generation

AI, nicknamed Aimie, analyzes $4,600 million worth of B2B payment

transactions daily in the Sidetrade Cloud to predict customer

payment behavior and attrition risk of more than 21 million

companies worldwide. Aimie recommends the best cash collection

strategies, intelligently automates actions on the Order-to-Cash

process, and dematerializes customer transactions to enhance

productivity, performance and working capital management. Sidetrade

has a global reach, with 250 talented employees based in Paris,

London, Birmingham, Dublin, Houston, and Calgary, serving global

businesses in more than 85 countries. Amongst them: Tech Data,

KPMG, Nespresso, Hearst, Expedia, Manpower, Securitas, Randstad,

Engie, Veolia, Inmarsat, and Bidfood.For further information, visit

us at www.sidetrade.com and follow us on Twitter @Sidetrade.

In the event of any

discrepancy between the French and English versions of this press

release, only the French version is to be taken into account.

- Growth in Order-to-Cash SaaS Revenue (+21%), Double-digit

increase in Revenue by +12%

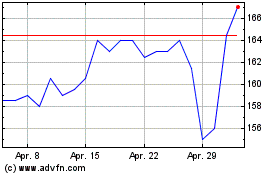

SideTrade (EU:ALBFR)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

SideTrade (EU:ALBFR)

Historical Stock Chart

Von Apr 2023 bis Apr 2024