- Capital increase consisting of offers to qualified

investors, categories of investors and individual investors via the

PrimaryBid platform

- Mediolanum Farmaceutici, European industrial specialist in

healthcare and historical reference shareholder, reasserts its

confidence by committing to a subscription of €7.1 million (of

which €2.1 million by offsetting receivables) out of a total of

€9.3 million in subscription commitments from historical

shareholders and members of the Board of Directors (of which €4.1

million by offsetting receivables)

- Issue price of the new shares of €6.80 per share

- Closing of the PrimaryBid Offering on March 8, 2022 at 10:00

p.m. and of the Global Offering on March 9, 2023 before market

opening at the latest

- The funds raised will be used to pursue the development

towards registration of glenzocimab for the treatment of

stroke

Regulatory News:

ACTICOR BIOTECH (FR0014005OJ5 – ALACT - the "Company")

(Paris:ALACT), a clinical-stage biotechnology company focused on

the development of innovative drugs for the treatment of

cardiovascular emergencies, in particular stroke, announces today

the launch of a fundraising of c. 10 million euros via the issuance

of new ordinary shares to institutional and individual investors

(via the PrimaryBid platform) (the "Offering").

A fundraising supported by a historical shareholder and

dedicated to the treatment of stroke

ACTICOR BIOTECH will use the proceeds of this capital increase

to pursue its development plan towards the registration of

glenzocimab in emergency treatment of stroke, which will mainly

be achieved through:

- continued recruitment of patients in the ACTISAVE clinical

trial (pivotal registration phase 2/3) rolled out in 7 European

countries, the UK, Israel, and the USA until the first futility

analysis, and

- the preparation of a new batch of glenzocimab and the

pharmaceutical registration plan.

In addition, as part of its ongoing activities, the Company will

continue its consultations with regulatory agencies and the

work necessary for the registration of glenzocimab in Europe and

the United States and is targeting a launch of patient

recruitment in the LIBERATE phase 2b study (sponsored by the

University of Birmingham) in the treatment of myocardial infarction

and continued enrolment in the GREEN study (sponsored by

APHP) in the treatment of stroke in combination with mechanical

thrombectomy.

The funds raised are intended to enable the Company to finance

its operations at least until the end of the Q3 2023.

Gilles AVENARD, Chief Executive Officer of Acticor

Biotech said: "The capital increase we are launching today will

allow us to continue the development of glenzocimab towards

registration in stroke. By 2022, we have fully met our recruitment

target of 200 patients in ACTISAVE. We also achieved positive

results in our ACTIMIS study, which not only confirmed the

favourable safety profile of glenzocimab, but more importantly

shown a reduction in intracerebral haemorrhage and mortality in the

glenzocimab group. We are now looking forward to involving new

countries and hospitals in Actisave as well as developing

glenzocimab in myocardial infarction (LIBERATE) in partnership with

the University of Birmingham in the UK.

The funds raised through this transaction will primarily support

the ongoing Phase 2/3 clinical trial, ACTISAVE, in the U.S. and

Europe, a pivotal study which, if successful, should support the

registration of glenzocimab in stroke. To date, more than 230

patients have been enrolled out of the planned 1,000 patients in

the study. In addition, these funds will allow us to pursue the

pharmaceutical development of glenzocimab with a view to its

marketing and our consultations with the European (EMA) and

American (FDA) regulatory agencies.

We would like to thank in particular our historical reference

shareholder, Mediolanum Farmaceutici S.p.a. for its support in this

fundraising. In case of the signature of an industrial partnership

between Acticor and a third party, Mediolanum will benefit from a

right of first negotiation in the European Union. We are

particularly pleased to grant this right to Mediolanum

Farmaceutici, which has accompanied and supported Acticor with

conviction and determination since 2016. We are also pleased to be

able to offer the possibility to new investors, both institutional

and individual, to join us in our fight for the treatment of

cardiovascular emergencies."

Terms and Conditions of the Offer

The Offer will be made at the same price, i.e. 6.80 euros per

new share, in three separate and concurrent parts and under the

same price conditions, together constituting the "Offering”:

- A global placement, via the issuance of new ordinary shares

with cancellation of preferential subscription right, for the

benefit of qualified investors, in France and abroad on the basis

of Article L. 411-2, 1° of the French Monetary and Financial Code

in accordance with the 27th resolution of the General Meeting of

October 4, 2021 (the "Global Placement");

- A public offering without a designated beneficiary, of new

ordinary shares with cancellation of the preferential subscription

right, intended for private individuals of French nationality or

nationals of Member States of the European Economic Area, via the

PrimaryBid platform, which will be carried out according to an

allocation proportional to the requests within the limit of the

amount allocated to this public offering, with a reduction of the

allocations in the event of excess requests, if any, on the basis

of Article L. 225-136 of the French Commercial Code, and of Article

L. 411-2, 1° of the French Monetary and Financial Code in

accordance with the 26th resolution of the combined general meeting

of October 4, 2021 (the "PrimaryBid"); and

- An offer, via the issuance of new ordinary shares with

cancellation of the preferential subscription right in favour of

categories of beneficiaries, on the basis of the 13th Resolution of

the General Meeting of May 12, 2022, in accordance with Article L.

225-138 of the French Commercial Code (the "Restricted Share

Offer"), restricted to (i) Mediolanum Farmaceutici and two

other natural persons who have undertaken to subscribe to it, for a

total amount of 5.2 million euros; and (ii) holders of the

Company's outstanding Convertible Bonds who will subscribe to the

capital increase by way of set-off against claims due under the

Convertible Bonds, plus accrued interest (in accordance with the

terms and conditions of the Convertible Bonds) for a total amount

of approximately 4.1 million euros;

The total amount of the operation would be approximately 10

million euros, including issue premium, with a possibility to

increase this total amount in case of high demand.

The size of the Offer will depend exclusively on the orders

received for each of the operations detailed above without the

possibility of reallocating the sums allocated from one to the

other. It is specified that the PrimaryBid Offer intended for

individual investors is incidental to the Global Offering and that

it will represent a maximum of 20% of the amount of the Offer. In

any event, the PrimaryBid Offer and the corresponding capital

increase will not be carried out if the capital increase taking

place as a result of the Global Offering is not carried out.

The Global Offering will be carried out by accelerated

bookbuilding, at the end of which the number and price of the new

shares to be issued will be determined, in accordance with the

resolutions of the general meetings of October 4, 2021 and May 12,

2022 (the "Meetings").

The subscription price of the new shares will be equal to €6.80,

representing a discount of 18% to the closing price of the ACTICOR

BIOTECH share on March 7, 2023, in accordance with the resolutions

of the General Meeting. The subscription price of the new ordinary

shares issued under the Primary Bid will be equal to the price of

the new ordinary shares issued under the Global Offering and the

Reserved Offering.

The final number of shares to be issued will be decided by the

Chief Executive Officer of the Company, pursuant to and within the

limits of the sub-delegations of authority granted by the Board of

Directors of the Company as of the date of this press release and

in accordance with the resolutions of the Meetings.

It should be noted that all of the directors of the Company, or

whose legal entities of which they are directors, who have

themselves undertaken to subscribe to the Offer (including 2022 CB

Holders), did not participate in the vote which gave the Chief

Executive Officer the authority to launch the Offer and to set the

final terms.

The final number of shares to be issued will be the subject of a

subsequent press release relating to the completion, if any, of the

contemplated issue.

The accelerated bookbuilding procedure for the Global Offering

will be initiated immediately after the publication of this press

release and is expected to close before the opening of the markets

tomorrow (March 9, 2023), subject to any early closing or

extension. The PrimaryBid Offer also starts immediately and will

close at 10:00 p.m. today, subject to any early closing. The

Company will announce the results of the Offer as soon as possible

after the closing of the order book by way of a press release.

The settlement-delivery of the new ordinary shares to be issued

as a result of the Offer and their admission to trading on the

Euronext Growth® Paris multilateral trading facility are scheduled

for March 13, 2023. The new shares will be subject to all the

provisions of the by-laws and will be assimilated to the existing

shares as from the final realization of the capital increase, they

will carry current dividend rights and will be admitted to trading

on the Euronext Growth Paris market on the same quotation line as

the shares of the Company already listed under the same ISIN code

FR0014005OJ5 – ALACT.

Underwriting commitments for a total amount of €9.3 million -

Renewal of confidence in Mediolanum Farmaceutici S.p.a. -

Redemption of the Convertible Bonds by way of debt compensation in

the context of the Reserved Offer

On October 17, 2022, the Company issued 78,000 Convertible Bonds

for a total amount of €3,9 million, subscribed by Mediolanum

Farmaceutici S.p.A for €2 million, ARMESA for €1 million and other

individuals for 0.9 million euros (the "Noteholders").

The terms and conditions of the Convertible Bonds provide for

their automatic redemption by way of debt compensation in the event

of the completion of a fund raising for a minimum total amount of

€3 million. Consequently, the Bondholders will subscribe in the

framework of the Offer to an amount corresponding to the nominal

value of the Convertible Bonds plus a capitalised interest of 12%

per annum until the redemption date, i.e. an amount of €4.1

million.

Mediolanum Farmaceutici S.p.a., an existing shareholder, has

also committed to subscribe to the Reserved Share Offer for an

additional cash amount of €5 million, for a total subscription

commitment of €7.1 million.

In return for its commitment, Mediolanum will enter into a

“Right of First Negotiation Agreement” with the Company, whereby

Acticor grants Mediolanum a right of first negotiation for the

licensing of glenzocimab in the European Union.

The Chairman of the Board of Directors and another historical

individual shareholder have also each committed to subscribe to the

Restricted Share Offer for an amount of 100,000 euros each.

Capital increase open to individuals via the PrimaryBid

platform

Investors can subscribe to the PrimaryBid Offer only via the

PrimaryBid partners mentioned on the PrimaryBid website

(www.PrimaryBid.fr). The PrimaryBid Offer is not subject to a

placement and guarantee agreement.

Undertaking to abstain from trading

In the context of the Fundraising, the Company has undertaken to

abstain for a period of 90 days from the date of

settlement-delivery of the Offer, subject to customary

exceptions.

Financial Intermediaries

GILBERT DUPONT acts as Global Coordinator, Lead Manager and

Bookrunner.

Within the framework of the PrimaryBid Offer, investors will be

able to subscribe only via the PrimaryBid platform

(https://primarybid.fr/) or via the PrimaryBid partners mentioned

on the PrimaryBid website.

Guarantee of the Offer

The Offer is not subject to a guarantee. However, the Global

Offering realized with qualified investors pursuant to the 27th

resolution of the Ordinary and Extraordinary General Meeting of

October 4, 2021 is subject to a placement agreement between the

Company and the Global Coordinator, Lead Manager and

Bookrunner.

Prospectus

The Offer does not give rise to a prospectus subject to the visa

of the Autorité des marchés financiers.

This press release does not constitute a prospectus under

Regulation (EU) 2017/1129 of the European Parliament and of the

Council of 14 June 2017, as amended, or an offer to the public.

Risk factors

The public's attention is drawn to the risk factors relating to

the Company and its business, presented in chapter 3 of the 2021

universal registration document approved by the Autorité des

marchés financiers on April 26, 2022 under number R. 22 - 011,

which is available free of charge on the Company's website

(www.acticor-biotech.com) and the website of the Autorité des

marchés financiers (www.amf-france.org). The occurrence of some or

all of these risks could have an adverse effect on the Company's

business, financial condition, results, development or

prospects.

In addition, investors are invited to take into consideration

the following risks specific to the offering: (i) the market price

of the Company's shares could fluctuate and fall below the

subscription price of the shares issued in the framework of the

Offer, (ii) the volatility and liquidity of the Company's shares

could fluctuate significantly, (iii) sales of the Company's shares

could take place on the market and have an unfavorable impact on

the Company's share price (iv) the Company's shareholders could

suffer potentially significant dilution from any future capital

increases required by the Company's search for financing, and (v)

as the securities to be issued will not be listed on a regulated

market, investors will not benefit from the guarantees associated

with such a market.

Forward-looking statements

This press release contains certain forward-looking statements

concerning Acticor Biotech and its business. Such forward-looking

statements are based on assumptions that Acticor Biotech considers

to be reasonable. However, there can be no assurance that such

forward-looking statements will be verified, which statements are

subject to numerous risks, including the risks set forth in the

Document de référence registration document as approved by the

Autorité des marchés financiers under number R. 22-011 on 26 April

2022 and to the development of economic conditions, financial

markets and the markets in which Acticor Biotech operates. The

forward-looking statements contained in this press release are also

subject to risks not yet known to Acticor Biotech or not currently

considered material by Acticor Biotech. The occurrence of all or

part of such risks could cause actual results, financial

conditions, performance or achievements of Acticor Biotech to be

materially different from such forward-looking statements.

About ACTICOR BIOTECH

Acticor Biotech is a clinical stage biopharmaceutical company, a

spin-off from INSERM (the French National Institute of Health and

Medical Research), which is aiming to develop an innovative

treatment for cardiovascular emergencies, including ischemic

stroke.

Acticor Biotech is developing glenzocimab (ACT017), a humanized

monoclonal antibody (mAb) fragment directed against a novel target

of major interest, platelet glycoprotein VI (GPVI). Glenzocimab

inhibits platelet binding to the thrombus without affecting

physiological hemostasis, thereby limiting the bleeding risk,

particularly in the brain.

In May 2022, Acticor Biotech presented positive results from its

Phase 1b/2a study, ACTIMIS, at the ESOC, confirming the safety

profile and showing a reduction in mortality and intracerebral

hemorrhage in the glenzocimab-treated group in patients with

stroke. The efficacy of glenzocimab is now being evaluated in an

international Phase 2/3 study, ACTISAVE, which will include 1,000

patients. In July 2022, Acticor Biotech was granted "PRIME" status

by the European Medicines Agency (EMA) for glenzocimab in the

treatment of stroke. This designation will allow the company to

strengthen its interactions and obtain early dialogues with

regulatory authorities.

Acticor Biotech is supported by a panel of European and

international investors (Karista, Go Capital, Newton Biocapital,

CMS Medical Venture Investment (HK) Limited, A&B (HK) Limited,

Mirae Asset Capital, Anaxago, Primer Capital, Mediolanum

Farmaceutici and the Armesa foundation). Acticor Biotech is listed

on Euronext Growth Paris since November 2021 (ISIN: FR0014005OJ5 –

ALACT).

For more information, visit: www.acticor-biotech.com

Disclaimer

This press release does not constitute an offer to sell or the

solicitation of an offer to buy ordinary shares of the Company, and

shall not constitute an offer, solicitation or sale in any

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of that jurisdiction.

This announcement is an advertisement and not a prospectus

within the meaning of Regulation (EU) 2017/1129 of the European

Parliament and of the Council of 14 June 2017, as amended (the

“Prospectus Regulation”).

In France, the Offering described above will take place solely

as (i) a global placement to qualified investors or a limited

number of investors, pursuant to Article L. 411-2, 1° of the French

Monetary and Financial Code and applicable regulations, and (ii) a

global placement to qualified investors or a limited number of

investors, pursuant to Article L. 411-2, 1° of the French Monetary

and Financial Code and applicable regulations and (ii) a public

offering of securities without a named beneficiary, pursuant to

Article L. 225-136 of the French Commercial Code, Article

L.411.2-1,1° of the Monetary and Financial Code and applicable

regulations.

With respect to Member States of the European Economic Area

(including France), no action has been taken or will be taken to

permit a public offering of the securities referred to in this

press release which would require the publication of a prospectus

(pursuant to article 3 of the Prospectus Regulation) in any Member

State.

This press release and the information it contains is not an

offer to sell, nor the solicitation of an offer to subscribe for or

buy, new ordinary shares in the United States or any other

jurisdiction where restrictions may apply including notably Canada,

Australia or Japan. Securities may not be offered or sold in the

United States absent registration under the Securities Act or an

exemption from registration thereunder. Acticor Biotech does not

intend to conduct a public offering of the new ordinary shares in

the United States, or in any other jurisdiction.

This communication is being distributed only to, and is directed

only at (a) persons outside the United Kingdom, (b) persons who

have professional experience in matters relating to investments

falling within Article 19(5) of the Financial Services and Markets

Act 2000 (Financial Promotion) Order 2005 (the "Order"), and

(c) high net worth entities, and other persons to whom it may

otherwise lawfully be communicated, falling within Article 49(2) of

the Order (all such persons together being referred to as

"Relevant Persons"). Any investment or investment activity

to which this communication relates is available only to Relevant

Persons and will be engaged in only with Relevant Persons. Any

person who is not a Relevant Person should not act or rely on this

communication or any of its contents.

Solely for the purposes of each manufacturer’s product approval

process, the target market assessment in respect of the new

ordinary shares has led to the conclusion in relation to the type

of clients criteria and only that: (i) the type of clients to whom

the new ordinary shares are targeted is eligible counterparties,

professional clients and retail clients, each as defined in

Directive 2014/65/EU, as amended (“MiFID II”); and (ii) all

channels for distribution of the new ordinary shares to eligible

counterparties, professional clients and retail clients are

appropriate. Any person subsequently offering, selling or

recommending the new ordinary shares (a “Distributor”)

should take into consideration the manufacturers’ type of clients

assessment; however, a Distributor subject to MiFID II is

responsible for undertaking its own target market assessment in

respect of the new ordinary shares (by either adopting or refining

the manufacturers’ type of clients assessment) and determining

appropriate distribution channels. For the avoidance of doubt, even

if the target market includes retail clients, the sole global

coordinator and bookrunner has decided it will only procure

investors for the new ordinary shares who meet the criteria of

eligible counterparties and professional clients.

This distribution of this press release may be subject to legal

or regulatory restrictions in certain jurisdictions. Any person who

comes into possession of this press release must inform him or

herself of and comply with any such restrictions.

This press release has not been independently verified and no

representation or warranty, express or implied, is made or given by

or on behalf of any of the sole global coordinator and bookrunner

or any of its parent or subsidiary undertakings, or the subsidiary

undertakings of any such parent undertakings, or any of such

person’s respective directors, officers, employees, agents,

affiliates or advisers, as to, and no reliance should be placed on,

the accuracy, completeness or fairness of the information or

opinions contained in this press release and no responsibility or

liability is assumed by any such persons for any such information

or opinions or for any errors or omissions. All information

presented or contained in this press release is subject to

verification, correction, completion and change without notice.

The sole global coordinator and bookrunner is acting exclusively

for the Company and no one else in connection with the Global

Placement and will not regard any other person (whether or not a

recipient of this press release) as its client in relation to the

Global Placement and will not be responsible to anyone other than

the Company for providing the protections afforded to its client

nor for providing advice in relation to the proposed Global

Placement.

Not for release, publication or distribution,

directly or indirectly, in the United States of America, Canada,

Australia or Japan. This press release does not constitute an

offering document and is for information purposes only

DO NOT DISTRIBUTE DIRECTLY OR INDIRECTLY TO THE

UNITED STATES OF AMERICA, CANADA, AUSTRALIA OR JAPAN

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230308005650/en/

ACTICOR BIOTECH Gilles AVENARD, MD CEO and founder

gilles.avenard@acticor-biotech.com T. : +33 (0)6 76 23 38 13

Sophie BINAY, PhD General Manager and CSO

Sophie.binay@acticor-biotech.com T. : +33 (0)6 76 23 38 13

NewCap Mathilde BOHIN / Quentin MASSÉ Investor Relations

acticor@newcap.eu T. : +33 (0)1 44 71 94 95

NewCap Arthur ROUILLÉ Media Relations acticor@newcap.eu

T. : +33 (0)1 44 71 00 15

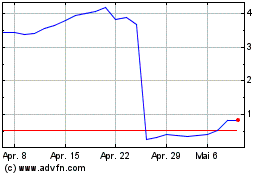

Acticor Biotech (EU:ALACT)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Acticor Biotech (EU:ALACT)

Historical Stock Chart

Von Apr 2023 bis Apr 2024