- An exceptional fiscal year 2021, marked by positive phase 2a

results for AEF0117, the recognition of the first sub-licensing

revenues thanks to the signature of an industrial partnership with

Indivior PLC, and securing major grants for AEF0217 (EU’s Horizon

2020 program) and AEF0117 (NIH-NIDA USA).

- A solid financial structure, with a closing cash position of

€24.7 million, strengthened by the success of the IPO carried out

at the beginning of 2022, which raised €25.3 million.

Regulatory News:

Aelis Farma (ISIN: FR0014007ZB4 - ticker: AELIS, PEA-PME

eligible) (Paris: AELIS), a clinical-stage biopharmaceutical

company specialized in the development of treatments for brain

diseases, today announced its annual results for the year ended

December 31, 2021.

Pier Vincenzo Piazza, CEO of Aelis Farma, said: "On

behalf of Aelis Farma, I would like to thank once again all our

shareholders, both long-standing and new, as well as our partner

Indivior, for their contribution to the success of our initial

public offering in February. The fundraising of more than €25

million realized on this occasion gives us the necessary means to

accelerate the development of Aelis Farma and deploy its strategic

plan presented to the financial community. The success of this

transaction is based on the solid foundations put in place in

particular during the 2021 financial year with the signature of our

first industrial partnership with Indivior PLC, through an

option-license agreement for AEF0117 to treat the adverse effects

of excessive cannabis use. This asset, which is the most advanced

of our pipeline and is on the verge of a phase 2b clinical study,

also received a new grant of $4.5 million from the U.S. National

Institute of Health (NIH) at the end of 2021. Our second drug

candidate, AEF0217, has received a European grant of €6 million for

the ICOD program which support the clinical program aiming to

confirm its potential to treat cognitive deficits of Down syndrome

(Trisomy 21). These different programs make Aelis Farma a company

on the forefront of the brain diseases space, a position that, with

the support of our investors, we are convinced to be able to

consolidate and eventually become one of the leading players in

this sector that has significant unmet medical needs.”

Annual results 2021 (IFRS)

Simplified income statement1 (in

€k)

2021

2020

Revenue from ordinary activities

10,762

1,137

Research and development costs

(6,870)

(3,388)

General and administrative expenses and

other operating expenses and income

(1,340)

(589)

Operating income

2,552

(2,840)

Financial result

(794)

(202)

Income taxes

(1,185)

956

Net income (loss)

574

(2,086)

In June 2021, the Company entered into a sub-license option

agreement with Indivior PLC, the leading addiction treatment group,

for AEF0117 to treat cannabis related disorders, addictions, and

other compulsive behaviors. Aelis Farma's revenues from this

contract are as follows:

- upon signing the contract, the Company received an upfront

payment of $30 million;

- if the option is exercised by Indivior PLC, the Company will

receive a lump sum payment of $100 million;

- depending on the achievement of technical, regulatory and

commercial milestones supplementary payments of up to $340

million;

- royalties on net sales between 12% and 20%.

The accounting principles applied to the revenues from this

contract, resulting from IFRS 15, have led to the recognition of

revenues of €9,075,000 for the year 2021. The balance of the

upfront payment received, i.e., €15,541,000, will be recognized

over the remaining term of the option.

Other income from ordinary activities (€1,687,000) consists of

the Research Tax Credit (€1,089,000) and operating grants

(€598,000) related to the research programs led by the Company.

Their increase compared to the previous year is correlated to the

increase in research and development expenses incurred during the

year.

Research and development costs

In €k

31/12/21

31/12/20

Raw materials, other purchases and

external expenses

(3,143)

(1,741)

Personnel costs

(1,808)

(1,351)

Intellectual Property

(1,919)

(296)

Research and development costs

(6,870)

(3,388)

The increase in research and development expenses (+103%)

reflects the ramp-up of the development program for drug candidates

AEF0117 and AEF0217, the strengthening of research teams, and the

increase in intellectual property expenses related to the payment

of royalties to patent owners following the signature of the

sub-licensing option agreement with Indivior PLC (€1,683,000).

The operating result at December 31, 2021 was a profit of

€2,552,000 compared to a loss of €2,840,000 at December 31, 2020.

This change is mainly due to the recognition of revenues from the

license option contract signed in 2021 with Indivior PLC.

The financial result shows a loss of -€794,000 at December 31,

2021 compared to a loss of -€202,000 at December 31, 2020 in

particular due to the application of the IFRS standard on financial

instruments applied to the convertible bonds contracted by the

company in 2019.

The net result for the year 2021 is a profit of €574,000

compared to a loss of -€2,086,000 for the previous year.

Cash flow

In €k

31/12/21 31/12/20

Cash flow from operating

activities

18,970

(2,478)

Net cash flow from investing

activities

(212)

(34)

Net cash flow from financing

activities

180

1,277

Effect of exchange rate

changes

1,235

-

Change in cash and cash

equivalents

20,172

(1,235)

Opening cash position

4,538

5,771

Closing cash position

24,710

4,538

The fiscal year 2021 was characterized by the strengthening of

the company's financial structure thanks to the revenues from

operating activities resulting from the signing of the license

option agreement with Indivior PLC, and the payment of $30 million

upon signing of the agreement. The positive evolution of this cash

flow in dollars allowed the recognition of a foreign exchange gain

of €1.2 million. The cash position at December 31, 2021 of

€24,710,000 thus reflects an improvement of €20,172,000 in cash

compared to the previous year.

Financial structure

In €k

31/12/21

31/12/20

Liquid assets

a

24,710

4,538

Gross financial debt

b

7,917

6,336

Total net financial

debt

b-a

(16,793)

1,798

Aelis Farma's financial structure was strengthened in February

2022 by:

- the net proceeds of €22.1 million from the capital increase

carried out at the time of the Company's listing on compartment B

of Euronext Paris;

- the conversion into capital of the convertible bonds held by

Inserm Transfert Initiative and the Nouvelle-Aquitaine Region,

resulting in a decrease of €3,591,000 in gross indebtedness, from

€7,917,000 to €4,326,000.

The Company's current cash position allows it to finance the

development of Aelis Farma in accordance with the strategy

presented during the IPO.

Strategy & outlook

In 2022, with a financial position strengthened by the funds

raised during the IPO in February of €25.3 million, the Company

intends to pursue the development of its various assets and

accelerate the ramp-up of CB1-SSi development:

1. Development of AEF117 to treat the

adverse effects of excessive cannabis use

A phase 2b clinical trial, including approximately 330 patients

and whose protocol has been discussed with the FDA, will start in

the second quarter of 2022 in the United States, in accordance with

expectations, to evaluate the efficacy of AEF0117 for the treatment

of cannabis addiction. The study will be coordinated by its

principal investigator, Prof. Frances Levin of Columbia University.

The new development phases of AEF0117 have received a grant of $4.5

million from NIH, which had already provided funding for phases 1

and phase 2a of $3.3 million.

2. Development of AEF0217 to treat various

cognitive deficits, including those of Down syndrome (Trisomy

21)

AEF0217 is currently being evaluated in phase 1 clinical studies

in healthy volunteers, with no significant adverse events reported

to date in the first five cohorts of subject. Results from these

studies will be available in the second quarter of 2022.

A phase 1/2 clinical study of AEF0217 in Down syndrome subjects

is planned to start in the fourth quarter of 2022. These studies

could provide initial efficacy results in the first half of 2023.

This clinical program is being conducted in the framework of the

"Improving Cognition in Down syndrome" ("ICOD") consortium in

collaboration with the Institut Hospital del Mar d'Investigacions

Mèdiques ("IMIM") in Barcelona and other European clinical centers.

The European Union's Horizon 2020 program has awarded the ICOD

project a grant of €6 million (H2020 Program N° 899986).

Aelis Farma also plans to finalize in 2022 the preparation of

the phase 2 research program for AEF0217, which will expand the

study of the compound's efficacy to other indications, such as

cognitive disorders associated with Fragile X syndrome or aging, in

which AEF0217 has demonstrated efficacy in preclinical models.

3. Development of new drug candidates via

the proprietary platform

Given the involvement of the CB1 receptor in numerous

pathologies and with its diversified and proprietary library of

CB1-SSi, Aelis Farma plans to pursue the characterization of new

CB1-SSi that may address other CB1 receptor-dependent brain

diseases.

***

About AELIS FARMA

Founded in 2013, Aelis Farma is a biopharmaceutical company that

is developing a new class of drugs, the Signaling Specific

inhibitors of the CB1 receptor of the endocannabinoid system

(CB1-SSi). These new molecules hold great potential in the

treatment of many brain diseases. CB1-SSi were developed by Aelis

Farma on the basis of the discovery of a new natural defense

mechanism of the brain made by the team of Dr. Pier Vincenzo

Piazza, CEO of the Company, when he was Director of the Inserm

Magendie Neurocenter in Bordeaux. For these discoveries, Dr. Piazza

was awarded the Inserm Grand Prix and the Grand Prix of Neurology

of the French Academy of Sciences, which are among the most

prestigious French prizes in medicine and neurology.

Aelis Farma is developing two first-in-class drug candidates

that are at the clinical stage, AEF0117 and AEF0217, and has a

portfolio of innovative CB1-SSi for the treatment of other diseases

associated with dysregulation of CB1 receptor activity.

AEF0117, which targets the disorders due to excessive cannabis

use (addiction and psychosis), has demonstrated efficacy in a phase

2a clinical trial and will enter a phase 2b clinical trial in the

United States in 2022. Aelis Farma has an exclusive license option

agreement with Indivior PLC, a leading pharmaceutical group in the

treatment of addiction, for the development and commercialization

of AEF0117 to treat disorders linked to excessive cannabis use. As

part of this agreement, Aelis Farma received $30 million (option

payment). If Indivior exercises the license option at the end of

the phase 2b, Aelis Farma will receive a $100 million license fee

(potentially in 2024) and up to $340 million in additional payments

contingent upon the achievement of development, regulatory and

commercial milestones, as well as royalties on net sales of AEF0117

ranging between 12% and 20%.

AEF0217, which targets various cognitive disorders including

those associated with Down syndrome, is successfully progressing in

its phase 1/2 program and could provide the first evidence of

efficacy in the first half of 2023. This compound has undergone an

extensive preclinical proof-of-concept program using highly

innovative and highly predictive tests to assess cognitive

functions. In this context, AEF0217 has demonstrated its ability to

completely reverse cognitive deficits observed in several models of

neurodevelopmental disorders, such as Down syndrome and Fragile X

syndrome, as well as in models of certain cognitive deficits

associated with aging.

Based in Bordeaux, within the Magendie Neurocenter, Aelis Farma

has a team of 24 highly qualified employees and has benefited from

investments from the Nouvelle-Aquitaine Region, Inserm Transfert

Initiative, Bpifrance, regional funds ACI, NACO and Aqui-invest and

IRDI Capital Investissement.

For more information: www.aelisfarma.com

ISIN: FR0014007ZB4 Ticker: AELIS B Compartment

of Euronext Paris

Disclaimer

This press release contains statements that are not factual,

including, but not limited to, certain statements regarding future

results and other future events. These statements are based on the

current views and assumptions of the Company's management. They

involve known and unknown risks and uncertainties that could cause

actual results, profitability and events to differ materially from

expectations. In addition, Aelis Farma, its shareholders and its

respective affiliates, directors, executives, consultants and

employees have not verified the accuracy of, and make no

representations or warranties with respect to, any statistical

information or forward-looking information contained in this press

release that is derived from third-party sources or industry

publications. Such statistical data and forward-looking information

are used in this release for informational purposes only.

1 The annual accounts were approved by the Board of Directors on

April 1, 2022. The audit of these accounts has been completed. The

certified auditors’ report is in the process of being issued.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220403005039/en/

AELIS FARMA Pier Vincenzo Piazza Co-founder and CEO

contact@aelisfarma.com

NewCap Dusan Oresansky/Marine de Fages Investor Relations

aelis@newcap.eu +33 1 44 71 94 92

NewCap Nicolas Merigeau Media Relations

nmerigeau@newcap.fr +33 1 44 71 94 98

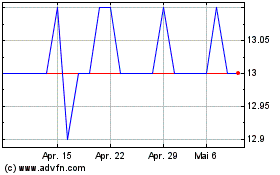

Aelis Farma (EU:AELIS)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Aelis Farma (EU:AELIS)

Historical Stock Chart

Von Apr 2023 bis Apr 2024